Hello Readers,

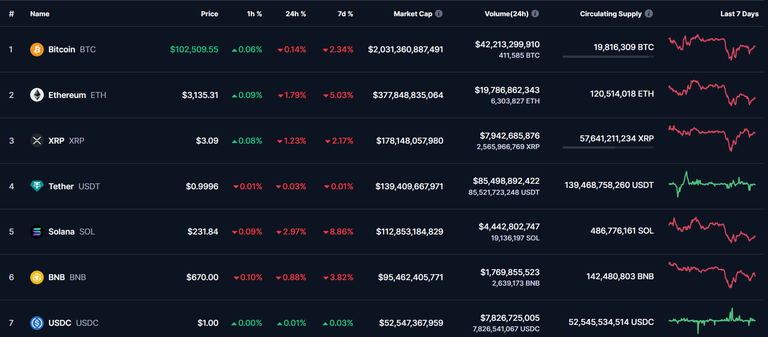

I hope all of you are doing fine and enjoying the day with your loved ones. The crypto market seems to have been sleeping since the last day as there is only a decline or flat movement seen today in the market, especially with $BTC price. Bitcoin, the world’s most famous cryptocurrency has dipped below $102,000 from its recent high of 109k$. The fall in price happened early today on Wednesday, as many investors waited for an important decision from the U.S. Federal Reserve. As of writing this post, Bitcoin was trading at $102,613, marking a 2% drop since last week. Ethereum, the second-largest cryptocurrency on the other hand has also fallen 2.8% and is currently being traded for $3,123. So if you are interested in what is causing this fall and about the upcoming US Fed’s rate cut policy, let’s take a dive with any further ado.

Why Bitcoin is Dropping?

Actually, the crypto market is in a cautious mode right now as shared by news, as traders are anticipating the Federal Open Market Committee (FOMC) meeting, which will determine the upcoming U.S. interest rate policy for 2025. Now not only the world economy but the crypto prices are also affected by the US Financial policies and as the inflation has eased a bit but still remains above the target, this is leading many market experts to believe that the Fed will keep its benchmark rate steady at around 4.25%-4.50% mark.

Alankar Saxena, Co-founder and CPO of Mudrex has stated, “Bitcoin is consolidating between $100,000 and $102,000 as markets await today’s FOMC meeting. If the Fed chair takes a more aggressive stance, Bitcoin could see temporary volatility.” As for the current price action of Bitcoin, the current important levels to watch are here around $102,200 as a resistance point and $99,330 as a support level. Now if Bitcoin drops below this support level of $99k, the analysts believe that it could trigger further declines in price.

Impact of Federal Reserve’s Decision

The Federal Reserve’s announcement which is about to be declared later today is expected to keep the interest rates steady, but traders will be closely analyzing the tone of its message for the upcoming time. The Fed’s upcoming outlook will play a very crucial role in leading the direction of global markets, including Bitcoin and other crypto tokens as well. Recently, U.S. President Donald Trump has asked the Fed to lower interest rates, the result of which could influence future monetary policy decisions and affect the world accordingly. When having higher interest rates, this condition generally makes traditional investments like bonds more attractive, thus pulling money away from riskier assets like shares or crypto. This is why Bitcoin and other crypto digital coins, NFTs and other assets tend to react sharply to such kind of announcements.

Global Market Trends

On a larger perspective of the financial markets, U.S. Treasury yields climbed overnight, and the dollar strengthened due to it. Meanwhile, tech-related stocks rebounded, helping Wall Street to recover from a sharp decline in prices earlier this week. Other major cryptocurrencies also faced declines in prices such as - Solana (-4.8%), BNB (-1%), Dogecoin (-3%), Cardano (-1.6%), Tron (-2%), Avalanche (-3.5%), Chainlink (-5.5%), Stellar (-2.7%), Hedera (-4.7%), Sui (-6%) and Shiba Inu (-5%) etc. The total cryptocurrency market capitalization after this announcement has dropped by 1.53% in the past 24 hours, settling right now at approximately $3.47 trillion. Stablecoins continue to dominate the trading market, accounting for 90.26% of the total crypto market volume, which is currently sitting at $101.94 billion, not to mention that Bitcoin’s market cap also took a hit, declining to $2.025 trillion.

What’s Next for Bitcoin?

Anyway, for now, all the lurking eyes are on the Federal upcoming Reserve’s decision and its possible long-term implications. If interest rates remain steady, in that case, Bitcoin may continue trading within its current range. However, any surprise announcements that I am somewhere expecting or a shift in economic outlook may have the potential to generate increased volatility in the crypto market.

However, this is not Financial advice and please DYOR before investing in Crypto. I would suggest that the investors should stay informed and be prepared for possible high-level price swings as the market starts acknowledging and digesting the Fed’s next policy stance. This decision will also dictate if Bitcoin rebounds or experiences further drops l, as it will depend largely on how the market interprets today’s announcement. So please stay safe and trade very cautiously when dealing in a volatile market.

Information Sources:

I hope you liked reading my post about Bitcoin’s price fall amid Fed’a upcoming Rate cut. Let me know your thoughts regarding this topic in the comment section below and I will ne seeing you all in my next post.

Posted Using INLEO