Hello Readers,

I hope all of you are doing well in life and also enjoying the chilling winter season with your family and friends. As you are already on Hive blockckchain, you already know about the cryptocurrency realm and how vibrating and volatile this world is in nature. It would be not wrong to say that the world of cryptocurrency thrives on change, but not all changes are welcomed equally. Just one week before we were all shouting about the crazy pump in Bitcoin and Crypto and today, we are witnessing a sharp downtrend already. While searching for what caused this sudden downtrend, I came across news today stating the decrease in basis-point rate in the US may be the biggest reason behind this reverse trend. So in this post, let us look into this cause and talk about the future of Bitcoin and Crypto and if are interested, let’s take a dive without any further ado.

Just recently, the U.S. Federal Reserve announced a 25-basis-point rate cut, which has sparked significant turbulence in the Bitcoin market. This decision, paired with the Fed’s cautious approach to future rate reductions, has left investors puzzled and scrambling to adjust their current strategies and this may be the main reason behind the sudden crypto downtrend.

What Happened to Bitcoin?

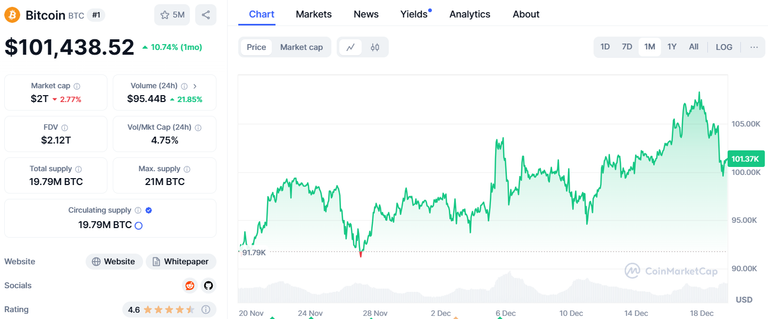

Following the rate cut news, Bitcoin’s value quickly dipped below the critical $100,000 mark. This drop was not just a blip, as it has projected further a wave of uncertainty among investors, producing a domino effect happening right now. After the rate-cur news, the crypto market sentiment took a bad hit, leading to immense selling pressure as traders worried about the Fed’s modest outlook for rate cuts in 2025 and beyond. Now to make things even worse, the Federal Reserve Chair Jerome Powell’s remarks did not do much to ease the tension. Powell recently clarified after the basis rate cut that the Fed is not interested in stockpiling Bitcoin, stating, “We are not allowed to own Bitcoin. That’s a matter for Congress to consider.” This neutral stance further affected crypto investors breaking their sentiment when we are literally in a long-awaited uptrend season.

The $860 Million Liquidation Shockwave

Being the first mover, Bitcoin was the first victim of this news and after Bitcoin’s decline, it then also triggered a domino effect across the cryptocurrency market. Altcoins, which are alternative cryptocurrencies like Ethereum, Dogecoin, Solana and Hive, etc faced even sharper losses than Bitcoin. Ethereum is currently struggling to maintain its $3,600 level, while XRP’s value dropped to $2.25 and Hive has also come down from its recent High point of 0.42$ to a current value of 0.248$ per unit while putting its support level at risk. In total, the crypto market saw a massive $860 million in liquidations. This mass sell-off highlighted the market’s high vulnerability to external influences, such as changes in monetary policy. Despite this, however, Bitcoin’s performance remained relatively steady compared to these cryptocurrencies and also traditional financial indices like the S&P 500. But I don't really think at this moment that the crypto market can correct this huge gap and maybe, it is the start of another long crypto winter and I just hope I am wrong.

Mixed Sentiments in the Market

Now even though it's high and panic time in Crypto, thankfully not all signs are pointing to Red danger. In my last post, I have already talked about BlackRock’s iShares ETH Trust has crossed a total of 1 million ETH holdings and today I came across another news stating that BlackRock’s IBIT Bitcoin ETF saw an inflow of $356 million, indicating that many investors still have faith in the cryptocurrency and its long-term potential. However, many other ETFs experienced net outflows and reflecting the mixed emotions surrounding the market. Meanwhile, the Altcoin Season Index also dropped to 55 now, suggesting that the altcoin market’s momentum may be fading. So right now it is time to play safe and especially for crypto traders, it would be safer to adopt a more cautious approach as they try to trade through this uncertain period.

The Future of Crypto?

The recent US rate cut and its aftermath have shown us once again how interconnected the crypto market is with global economic policies. As the Fed has given hints at only two rate cuts in 2025, lower than the three or four previously expected, investors need to stay informed, updated and adaptable to the situation. The crypto market is full of uncertainty and while this volatility can be literally breathtaking sometimes, it also presents opportunities for those who understand it and approach the market with a clearer strategy. So, whether you are a seasoned trader or just starting to explore this wild world of cryptocurrency, keeping an eye on both economic indicators and market trends is essential for navigating these waves of change. The crypto market’s resilience has always been its defining feature and being an old soul in this Crypto realm, I strongly believe that despite all these hurdles and trend-shifting, in the long term, the crypto world will only go upwards. What do you think?

Information Source

I hope you liked reading my post and let me know your thoughts regarding the rate cut and the future of crypto in the comment section below. That’s it for today and I will be seeing you all in my next post.

Posted Using InLeo Alpha