Hello and Namaste Everyone,

Recently I talked about my credit card renewal and it is my first ever credit card that I received three years back. Before this credit card, my thoughts about credit cards were completely different and I used to think that it is something that is not far from me. It is not for me because I was thinking that I don't want to get in the trap of credit instead it is better to use the cash or the money lying in the bank account for any payment. But I was wrong and today I admit that my thought process was not right before using the credit card and now after using the card for three years, I can say that having a credit card is a must. It is a necessity but we also need to understand that we need to use the credit card responsibly because it is not free money.

A credit card can be very helpful if it is used wisely we use the money for necessities but don't consider it as free money. In simple words, if we are using credit cards for the same expenses that we have to do through the bank account then it is the right use of credit card. When we use a credit card then we get a credit period along with some reward points which we don't get when we use money from a bank account. I understand it now and I try using my credit card as and when possible because I don't want to use the money that I have in the bank account but I'm happy to repay before couple of days before the due date. Now I have two cards from the same bank out of which is the traditional card and another one is a digital card which I can use online but I do not have the physical card with me.

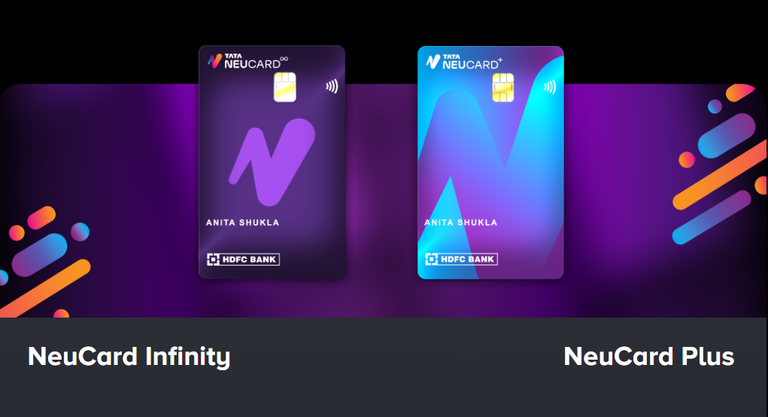

I got to know one of the cards through one of the reputed authors here but I don't want to tag him because I don't feel the need. He suggested me to cheque out the NEUCARD. It's a partner card issued by the HDFC Bank and my current card is also from the same bank but some benefits offered by these partner cards are better. I have gone through the details and now I will spend some time to see whether it is worth going for the upgrade because I don't want to have so many cards with me when I'm not able to use all of them. I'm sure there must be some option to upgrade the existing card to this one and if not then I will apply for this one and go for the closure for the one that I have had with me since the beginning of the new card offers better benefits.

We know that every card comes with certain benefits and according to our spending type and preference we need to choose the right card because individuals can have different requirements. Similarly, I also believe that I cannot go for any card blindly even if some benefits are good but I will do my thorough research before applying for this because ultimately I don't think a bank will provide more than two cards at any given time so because I already have two so one card closer will be required if the upgrade is not available with the existing card.

I'm not sure how is it going to work but I will figure out and spend some time to see what the available options and you will also connect with customer support if needed to get more clarity and information about it. It looks like the cards that I am exploring are pretty good and there are two categories both the cards come with some renewal charges and currently, the ones I have are not chargeable which means these cards are free for life. Paying annual charges can be good if the benefits are good so that is the part which I will go through and assess according to my requirement.

web- https://www.tatadigital.com/creditcard/

Thank you so much

Stay Safe

Posted Using InLeo Alpha