Hands of top Ministers behind India’s Stock Market crash on June 4th???

It is very overwhelming to think that powerful politicians have a grip on India’s financial ups and downs with this episode showing that Indian politicians can influence Indian Stock Market and possibly make gains out of it, at the cost of rekting retail investors of course!

I am alluding to the recent Exit Poll Stock Market Scam, that had India’s stock Market lose over 30 lakh crores of value on June 4th.

It was propagated that Stock Markets will go leaps and bounds if BJP under Modi comes to power with a thumping majority crossing beyond the simple majority mark of 272 seats bagging 300 plus seats!

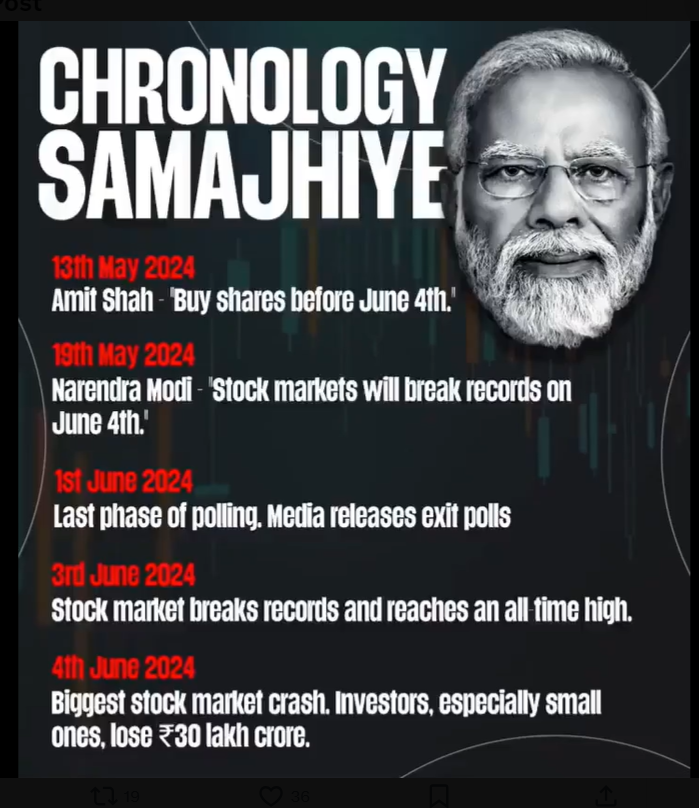

This theory sounded reasonable, but we had India’s Prime Minister, Narendra Modi,

Home Minister Amith Shah and India’s Finance Minister Nirmala Sitaraman say in separate interviews that BJP would definitely secure a thumping majority so stock markets on June 4th would experience a bull run.

Check their interviews out here - :

Stock Market Advice by Prime Minister Modi and Home Minister Amith Shah

Check this video on twitter >>

*Stock Market Advice by Finance Minister Nirmala Sitaraman *

Unfortunate, that retail investors heeded to misleading Stock Market Advise & lost money!

This entire investment suggestion given by these politicians was not based on fundamentals or proper reasoning of the Indian Economy, its only based on premise that BJP would win majority of seats and form a strong Indian Government.

Unfortunately, many retail investors were swayed by the inputs given by these 3 important Indian politicians who talked as if easy money can be made in Indian Stock Market if invested before June 4th, as on June 4th BJP would definitely form stable Government securing over 300 to 400 seats. This would have BJP form Government on its own strength without needing to make alliances with other political parties to form a joint coalition Government.

Well, on June 4th since BJP Government secured just 240 seats and did not have the strength to form Government on its own, the Indian Stock Market fell damn hard

Novice Retail investors get caught in the flood caused by investment moves of Big Wig investors

I will come to the numbers, but a mature suggestion for investors generally at these circumstances is – one should stay away from investing election result time because there is uncertainty on election outcome and there would be volatility.

During these periods, Stock Market Movements are defined by action of big investors (Corporate bigwigs) who will sell and buy according to the election outcome and this happens much before retail investors can respond.

Retail investors will get caught in the midst a sell off stampede, if election results have a outcome that would initiate sell off from Corporate bigwigs. This literally rips retailers apart (Rekting them) since they tend to be naïve investors not Smart investors.

Many novice investors do that classic mistake of selling off when price seems to be crashing fearing loss will be too big rather than wait till the prices rebound after the massive sell off period is over.

Buy low, sell high principle. If the asset is fundamentally good, its price would not collapse, there will be a recovery eventually.

It’s best for retail investors to invest based on fundamentals, research yes DYOR, not blindly invest listening to clips of politicians, be it even if they occupy top esteemed posts like in this case I am detailing about.

Cost of heeding to misleading Stock Market advise was heavy on retail investors

We had election result counting to happen on June 4th and these interviews of India’s top 3 politicians happened on May. So, it’s very possible these statements were given to have retailers pour money into Indian Stock Market before June 4th.

Now, I come to the numbers of the Indian Stock Market fall on June 4th.

India has two major Stock Indices which is monitored by the investing community to gauge the overall performance of the market – National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

NSE traces the performance of the top 50 companies from 13 main sectors of the economy based on their market capitalisation weight. NSE is referred to as Nifty 50. Nifty 50 index list of companies is reviewed and modified every 6 months.

BSE traces the performance of 30 largest companies that have largest liquidity. This is also a market capitalisation-based index.

On June 4th, Nifty 50 index fell by 8% from 23,363 points to 21,287 points losing over 2000 points.

BSE fell by over 8% losing over 6000 points falling from 76,739 points to 70,414 points.

The total amount of value lost is over 30 lakh crore.

Possible Linkage of Corporates having a hand along with the Government to play out this scam!

Right but the story does not end here, there is another part to this episode that further solidifies the possibility of Indian Stock Market being manipulated for select groups to make money from it.

The interviews so mentioned were on channels – NDTV and News 18, which are owned by India’s top industrialists with NDTV owed by Adani Group and News 18 by Reliance Ambani Group.

These industrialists have close connections with the Indian Government under Modi, and India’s Leader of Opposition(LOP) Rahul Gandhi has often said that the entire Indian economy is under hands of these businessman.

As entities owned by these industrialists always get to bag most of the business contracts and profit in India’s economy. Most of economic activity in India therefore enrich these select group of entities.

Since these entities get favours from Government under Modi, they also help Government by more ways than just providing bribes. One of the ways they helped Government is by purchasing and owning Media Houses so they propagate pro Modi Government news stories instead of providing unbiased news stories.

This nexus of Modi Government with Corporate forces, have them equipped to strategically execute these sorts of Stock Market Manipulations.

Rahul Gandhi has always said that Modi Government’s policies enrich only certain established big industrialists most -:

Watch video on twitter>>

Rahul Gandhi has been right in calling Modi Government 'Suit Boot ki Sarkar' as the Government's policies have helped only the economic progress of industrialists and Corporates.

Exit Polls substantiated reinforcing the investment advices of Prime Minister & his colleagues

As we saw on May we had India’s top politicians vouch that India’s Stock Markets would have bulls pull on June 4th because BJP’s resounding victory would activate the bulls energy.

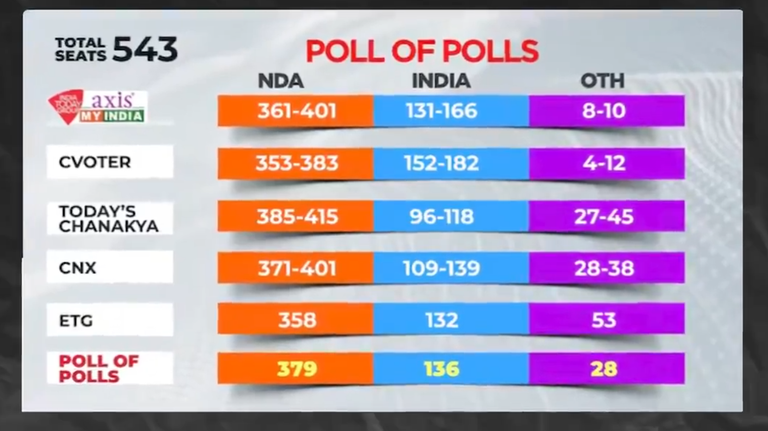

After this on June 1st elections concluded, we had TV news channels (mostly Godi Media) flash out exit poll survey findings which showed that BJP party leading NDA alliance would win by stamping out opposition as they are expected to get opposition tramping majority numbers beyond 350 near to 400 seats!

Exit Polls is a custom in Indian elections, that after elections have culminated Pollster companies would post their survey results on Media channels after which debates and talks would follow on these assumed Exit Poll results.

Poll companies conduct surveys on ground interviewing various voters to gauge who they voted for and tabulate their findings as Exit Poll Results. It’s all supposedly done interviewing large amounts of people covering all sections of Indian voters – women, men from different socio-economic backgrounds, age groups, demography (covering rural, urban and other remote areas), castes and religious groups too. Only if done methodically can most true and representative results be tabulated as India has the world’s largest and diverse population.

Well, on June 1st, Pollster companies publish their Exit poll that predicted a thumping majority for BJP party NDA alliance.

Now, join the dots… Exit Polls only further strengthened points made by India’s leading Ministers. Investors would have believed that easy money can be made in Stock Market if invested before June 4th.

Rahul Gandhi was sure that these Exit Polls were wrong and termed them as’ Modi Media and Modi Fantacy Polls’

Exit Poll Bull pull a force that attracted Retail investors' attention!

June 1st was a Saturday so Stock Markets were closed but when they opened on Monday June 3rd, Stock Markets rose because Exit Polls predicted NDA Government to emerge victorious with a thumping majority.

Sensex had risen by 3.75% gaining 2800 points from 73,856 to 76,867.

Nifty 50 had risen too by 3.7% gaining 800 points from 22,478 to 23,342.

It was a big bang news, as talk was on Stock Market indices breaching their all time highs and having one of their biggest one day gains etc.

There were talks also on the possibility of Stock Markets rising further on June 4th, as NDA is predicted to make a clean sweep and come to power with BJP itself winning 330 plus seats comfortably by its might!

Now add these two together – Misleading Exit Poll predictions + Misleading Statements by India’s top political leaders. They were enough to lure small investors to pour money in Stock Market expecting big gains on June 4th!

Yes – they instilled on small investors the feeling of FOMO,i.e, ‘The Fear of Missing Out’ (on possibility of making easy profits).

I already outlined the outcome that came about on June 4th – Indian Stock Markets bleeded losing over 30 lakh crores of value and lakhs of retail investors were on the losing end.

Loss & Profit journey for Retail investors based on their investment moves on June 3rd & beyond!

There may have been investors who were smart and booked profits on June 3rd, and they would provably be the more experienced group of investors.

There may have been investors who invested on June 3rd making the classic mistake of FOMO buying, that is buying when the Stock Markets have risen thinking that on June 4th they would rise further. This category of investors would have also sold out on June 4th, when Stock Market was falling slowly as election result outcomes were cropping up.

Making the classic mistake of buying high and selling low, instead of doing the opposite.

There may have been investors who invested in the Stock Market on May listening to the misleading advises given by India’s top political leaders, and then held on to the Stock Market post June 3rd when we had Stock Markets rally well.

They did not book profits on June 3rd believing that on June 4th, Stock Markets would climb up further. If these category of investors also sold out on June 4th, they were too in the red as on June 3rd we had Stock Markets rise by 3.7% and on June 4th they fell by 8%.

Well, but those investors who held on for a few more days would have made profits because Stock Markets rebounded, and on June 7th there was full recovery from the June 3rd crash and from June 8th Stock Markets rose up creating new all-time highs.

One of the reasons out around to support this Stock Market reaction was that Government formation happened immediately, as detailed in my previous articles with Modi retaining his Prime Ministerial seat by immediately contacting his alliance partners and forming the coalition NDA Government.

BJP got 240 seats but they formed Government combining strength with NDA partners together managing to get 290 seats. Therefore, since there were no hiccups in Government formation, Stock Markets rose, so goes the theory.

Personally, selling out on June 3rd and booking profits would be the smartest thing to do, because again there was uncertainity prevalent on Government formation. If INDIA Block formed Government by stitching alliances, one can never say markets would have gone up. They may have dipped further… well anyway!

One thing to realise that making profits or losses on paper is no guarantee as these are realised in actual only when investors book profits or incur losses when they sell their investment position

Behind the scenes, there looks to be the execution of India’s first Exit Poll Stock Market Scam…

*Now, there’s been demand from prominent opposition party members to investigate these Stock Market movements with India’s LOP, Rahul Gandhi talking about the possibility of Exit Poll being part of a larger evil scheme that got executed to become India’s first Exit Poll Stock Market Scam. *

Here is a press Conference where Rahul Gandhi says that there are reasons to believe that Prime Minister Modi and Home Minister Amth Shah have lent a hand in the execution of India’s biggest scam.

Let’s now understand what is this Exit Poll Stock Market Scam.

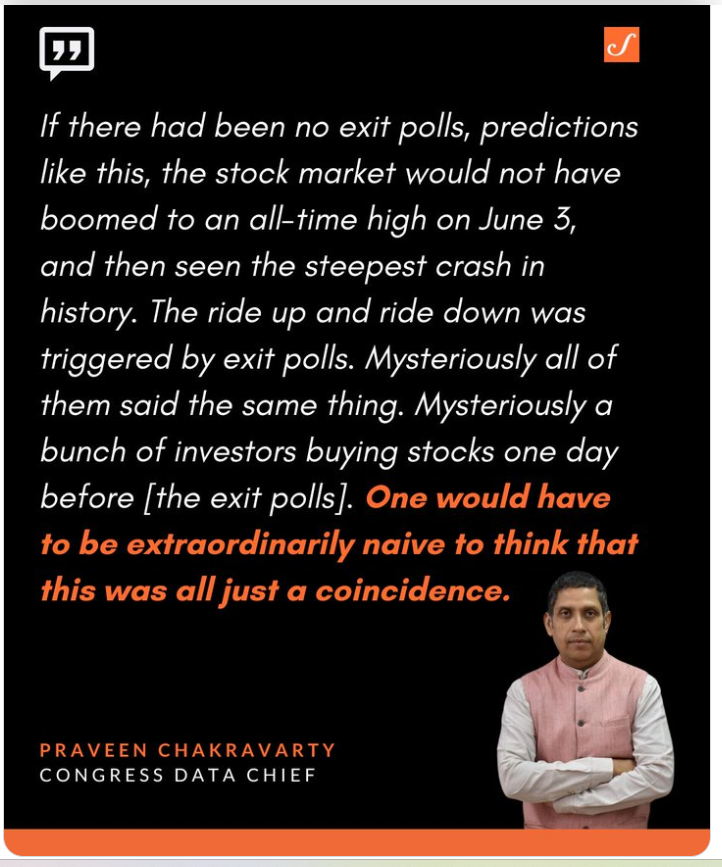

Chairman of the All India Professionals' Congress, Praveen Chakravarty who has been an angle investor, investment banker and is a well-recognised political economist helping Congress draft it’s economic policies outlines how Exit Polls could have been crafted to enable select groups make profits in Stock Market.

He explains about the Exit Poll Stock Market Scam in this interview with the Wire.

Strange & mysterious aspect of sudden increase of foreign investor trading activity on May 31st!

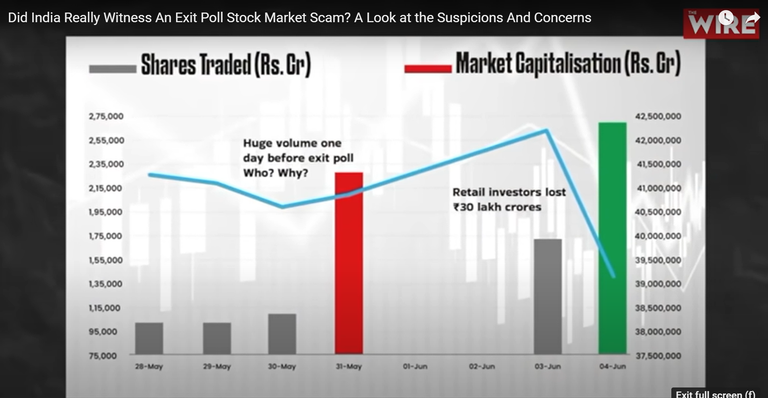

Praveen Chakravarty also leads the Data Analytics department of Congress and he looked into data relating to Stock Market activity. On May 31st, there was a abnormality in Indian Stock Market activity as there was a tremendous increase in trading activity.

According to data published by NSE, 58% of trading activity done that day was by Foreign Investors. There was no noticeable increase in activity from other categories of investors - Domestic institutional investors, retail investors and Indian Mutual funds.

This was strange because foreign investors in other days of the week did not indulge much in purchasing activity, they were generally Net sellers. Also, very importantly there was no reason for them to suddenly get bullish on Indian Stock Market that day.

Reasons to believe that a group of investors benefited indulging in insider trading!

The narrative that stock market rallied high on June 3rd is attributed to the Exit Poll outcomes which got published on TV media channels on June 1st but then why were these foreign investors engaging in Stock Market activity one day prior to June 1st, the day these Exit Poll outcomes got published in TV news channels?

So, were these Foreign Institutional investors having prior knowledge about the Exit Poll Outcome that predicted a landslide win for BJP lead NDA getting anywhere over 350 seats to 400 seats!

How can these category of investors alone get to know about the Exit Poll Outcomes before its revealed to the public through media Channels? This Exit Poll Outcome is presumed to be known only to Pollsters who conducted the polls and to their Media Organisations.

All these analysis points out to the possibility of insider trading where a group of investors registered as foreign investors benefited buying into the Indian Stock Market before June 3rd and selling to book profits on June 4th.

Something that was also noted is that there was increase in derivative trading that involved the usage of more advanced trading strategies such as shorting and going long etc. These group of traders made multiple amounts of profits by possibly going long on June 3rd and going short on June 4th.

This sort of trading practice is termed as insider trading which is an offense.

A probe is required to get into the bottom of this 2024 Exit Poll Stock Market episode!

So, India’s prominent opposition party leader, Rahul Gandhi, LOP is demanding a probe into this issue with formation of the Join Parliamentary Committee who will be coordinating with the Stock Exchange and investment regulatory body SEBI .

SEBI is the body that is in charge of investigating instances of Stock Exchange malpractices and there is demand for a probe into this episode to examine if there was a execution of India’s First Exit Poll Stock Market Scam.

What warrants investigating is –

i) The identity of these foreign investors

ii) Did they have inside information that was not disclosed to public, like the outcome of the Exit Polls

iii) Were the Pollster companies and media Organisations involved in this plot? And their connection with these foreign investors

iv) On whose behalf and using whose money was investing done by these group of foreign investors.

v) How much profits was made by these group of investors from those 2 days of trading June 3 and 4th.

Well Praveen Chakravarty details this best through his opinion piece on Deccan here -:

The world’s first ‘Exit Poll Stock Market Scam’

Hope you enjoyed reading my article! Thank you!

Posted Using InLeo Alpha

Posted Using InLeo Alpha