So Many Noobs, So Many Mistakes, So Much Easy Money

It's quite possible that 2017 marked the pinnacle of crypto irrationality. I can't back this up, but I wouldn't be surprised if more money was gained and lost that year than at any point since the beginning of all this.

I might be speaking from personal experience since 2017 was when I went all in. I divested most of my traditional stocks and plunged headfirst into Bitcoin and Ethereum. While I had begun accumulating Bitcoin a few years prior, it was in 2017 that I succumbed to the relentless FOMO (Fear Of Missing Out). I vividly recall Bitcoin soaring to $2000 and Ethereum reaching $200, and that's when the panic set in. It felt frustrating to see people I knew amassing wealth from a small investment while my stocks remained relatively stagnant for years.

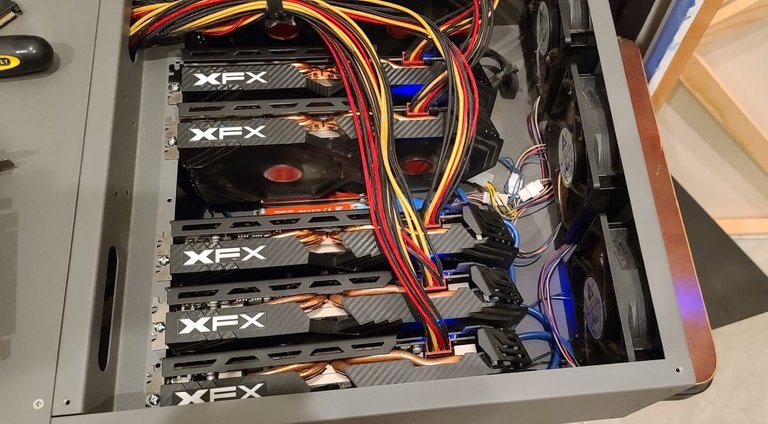

The bull run was wild, and I started seeing significant gains. In fact, I sold a fraction of my profits, allowing me to acquire the necessary equipment for two six-card mining rigs and two eight-card rigs. Additionally, I utilized a couple of extra video cards for mining whenever their host computers were idle, amassing a total of 30 cards for mining Ether, with an approximate hash rate of 960MH/s. Fortunately, a friend with a sizable warehouse let me use a portion of the space to operate my mining rigs.

I was riding the hype train, constantly pointing my mining farm to every Ethash POW coin I could solo-mine, aiming to secure a substantial number of coins before the crowd caught on. It seemed like all I could see were dollar signs, and the values of these altcoins continued to surge.

The Useless ICOs

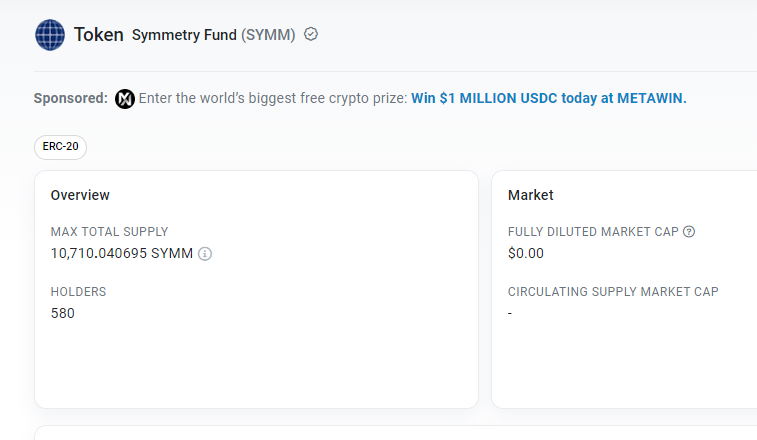

They say that hindsight is 20/20, and many people seemed to be going blind during the cryptocurrency craze. It was like a fever dream that's hard to comprehend unless you experienced it firsthand. One impractical idea after another, each with its own associated token and snazzy Bootstrap website with parallax effects. Some individuals even created coins with names like "IRipYouOff Coin," drafted a whitepaper, and initiated an ICO. Remarkably, a day later, the token would boast a multi-million dollar market capitalization. How anyone believed this was sustainable is beyond me.

Nevertheless, people kept buying into these schemes, and more of them kept cropping up. Regrettably, 99% of these ventures disappeared into thin air, taking everyone's Ethereum with them. My Ethereum wallet is filled with dead ERC-20 tokens, either airdropped to me or impulsively purchased during seemingly promising ICOs. If only I could retrieve all that Ethereum. It's some consolation that we were all in it together. Not that it's pleasant to witness others losing their investments, but at least no one was the lone fool in the group.

2018 Wipeout

By January 2018, the cryptocurrency market was in a rapid decline. I distinctly remember that uneasy feeling – "Whoa, this is a substantial dip, but it's just a bear market" I told myself.

However, if you were holding onto those useless ICO tokens, you were about to experience excruciating losses. Emotions ran high, causing many people to make poor decisions. I even lost faith in projects I once believed in, like Enjin, which later surged from a fraction of a penny to several dollars per coin. It was an absolute mess.

Fast Forward

Now, I can finally look back on the entire ordeal and chuckle at the absurdity of it all. It wasn't the least bit amusing for several years. I went through the most profound depression of my life, and I had no one to blame but myself.

The silver lining, at least for me, was that I managed to acquire a substantial stake in Steem, which I nearly doubled when Hive launched (by selling my Steem tokens and purchasing Hive). While I've had my ups and downs with Hive, it's the only crypto project I've never entirely abandoned, and I haven't lost faith in it. It's perplexing to me that it hasn't gained mainstream attention in the crypto community when you consider that Dogecoin occupies the 9th spot on CoinMarketCap.

In retrospect, having weathered the cryptocurrency landscape for so many years, it's safe to say that I've earned my stripes as a veteran in this domain. After the turbulent events of 2018, I came to terms with the notion that my initial investments had, for all intents and purposes, vanished. Anything I managed to accumulate beyond that point was a pleasant surprise. The lesson I've learned, and one I'd pass on to anyone else, is never to invest more than you can comfortably afford to lose. This advice remains as relevant today as it was in the midst of the frenzy of 2017.

I would really appreciate your support!