Photo by Pixabay on Pexels (modified)

Dear reader,

Unless you’ve been living under a rock the past few months (not a bad idea now that I think about it…), you’ve probably seen the news and it ain’t pretty. The markets are down big time and crypto in particular took us all on a heck of a ride. Nobody knows for sure where the next destination will be on this rollercoaster inferno but one thing is for sure, we could all do with a moment to breathe deeply and collect our thoughts.

This is exactly what I did while my pseudonymous peers were panic selling. In fact, I had some “lessons learnt” ideas that I had been cultivating during the 2021 bull run but I suppose the severity of this recent cycleblaster was the catalyst I needed to process them all and line them up in a cohesive article.

So with that in mind, let’s see what these 10 lessons are that I’m taking home from the recent crypto crash.

Lesson 1 — ZERO is not a meme

I think we all learnt that the hard way.

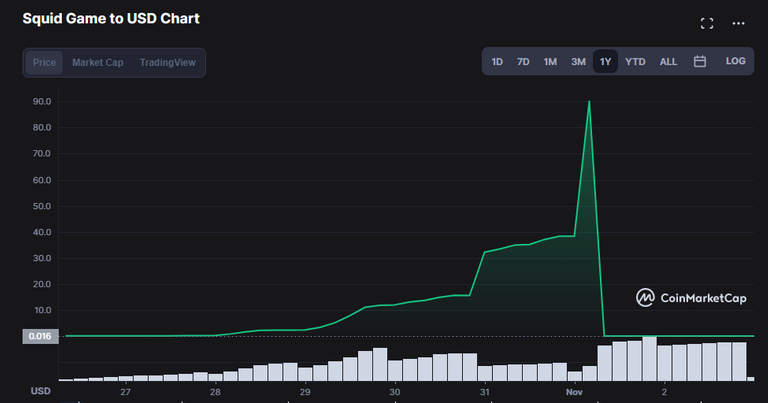

Many people will remember what happened to Squid Games a few months ago. Investors should have known better than to have gotten wrapped up in such a project:

Image source: CoinMarketCap

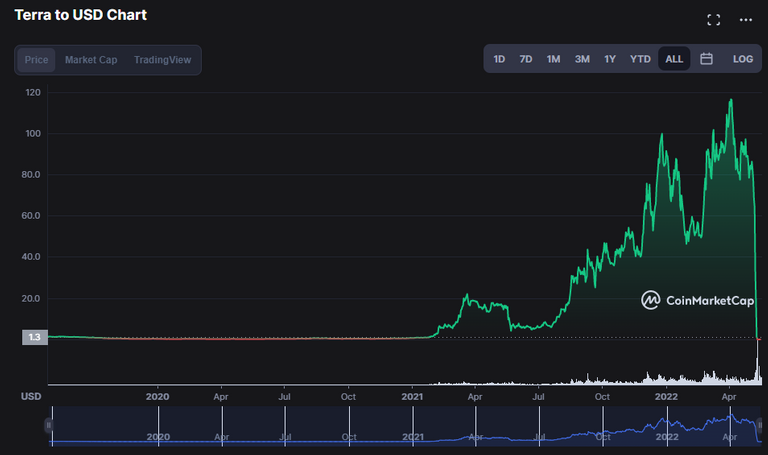

Meanwhile, “smarter” investors all across the board were piling into the Terra ecosystem. Not many people (yes, there may have been a select few) saw what was coming to Luna. The risk was still there though and boy did it show its ugly face. People treated Anchor Protocol like their savings bank account. I’ve read instances of millions worth of savings lost overnight, even rumours of suicide.

I thought ZERO was just a meme, only applicable to low-end rug pulls such as Squid Games. Seeing this chart is a brutal reminder of what a risky environment we are playing in:

Image source: CoinMarketCap

Lesson 2 — Beware of crypto cult figures

The point of this lesson is not to point fingers at particular people (founders) and question their legitimacy or intentions. There are a few names in particular I’d like to share here, but I presume most of you have the same names on your hitlist too, so let’s keep it that way for now.

What we can do as cognisant market participants is sharpen our senses. We must learn to be aware of cults forming. If you find yourself in one, then maybe it might just be time to skip town.

Wait a minute, isn’t crypto as a whole, just a giant cult? Maybe. But looking at the recent scandals and crashes we can at least use some waypoints to help guide us though this crypto culture, before becoming cultivated for someone’s exit liquidity in a subculture of this giant cult.

We need to look at the behaviour of the founders. Are they extremely charismatic and overly confident about the success of their project? Do you notice a rampant echo chamber forming around them? Is the price action of the project somewhat correlated to their social media presence?

Image source: Wikipedia

How many of you would have aped into Clark Stanley’s SnakeCoin?

Lesson 3 — Be careful who you follow…

… you might just be their exit liquidity.

This ties in nicely with the previous lesson, but is slightly different. Whereas the cult figure lesson focuses on the god-like founder figures being created in crypto today, this lesson is focused squarely at the murky underwaters of the crypto influencer cesspool.

The Wonderland Sifu scandal earlier this year brought my attention to the work of ZachXBT. I’d recommend giving him a follow on Twitter as he is a crypto detective who regularly calls out influencers posting on-chain evidence of their shenanigans. If one of your favourite follows is on his hitlist then take a good look at that character and question their motives. Remember, everyone looks like a genius calling shots in a bull market but once the prices retrace a lot of these dodgy dudes won’t think twice about bringing attention to their investments only to dump on their followers hours later. It’s happened time and time again.

He even maintains a catalogue of his investigations over at his Notion site.

Lesson 4 — Supply and demand

Did you know that it wasn’t so much the selling of LUNA that tanked its price? No, the real killer was inflation (regarding the selling, LUNA tokens were subject to a 21 day unstaking period, so spare a thought for those who were forced to sit through the death spiral).

Now, I won’t get into the nitty gritty of Terra’s UST/LUNA minting algorithm, but suffice it to say that in order for the stablecoin ecosystem to operate, it needed to be an open ended system, as tokens were constantly being burned and minted. As investors scrambled to get rid of their failing dollar wannabees, a tsunami of LUNA tokens flooded the market, destroying the supply/demand ratio of an already troubled asset.

This is one of the more important lessons I’ve learnt from this episode and something I will definitely be placing high on my checklist when reviewing current and future crypto investments. When placed side by side, I think I’d feel better investing in a project with less upside potential but more security regarding the supply, instead of a coin with high upside potential, but open to supply dilution. Or at least size the risk differently.

Lesson 5 — Pick your niche

It’s just too overwhelming to stay on top of all things in crypto. It may have been possible a few years ago, but by now there are several thousand projects and more and more vertical markets being created. You will end up spreading both your money and research too thin, not to mention your portfolio becoming less and less manageable.

Maintaining hyper focus on one main area allows you to judge risk and opportunity better, be early to investments and stay close to developments. Solid rewards, even in a less valuable vertical should still outperform scattered results as a result of overdiversification.

If you’re lost, then just try to think about what interests you personally, and see if there is a crypto use case for that particular topic. I just so happen to be interested in writing and other forms of digital media, so I’ll be going on a deep dive in this particular crypto rabbit hole while the market patches itself up.

You know what’s great about rabbit holes? They lead to interconnecting tunnels. Head down your specific niche’s rabbit hole and who knows, you might just meet another rabbit from a different tunnel with the latest underground news for you to act upon.

Lesson 6 — Not every project needs its own token

First of all blockchain doesn’t fix everything. It’s actually quite a cumbersome system that in many cases adds an unnecessary layer of complication to a solution to a problem that isn’t really a problem, nor something that needs a solution.

The fact that 99% of all projects launch their own coin or token is simply mind boggling and reeks of cash grab left, right and centre. The concept is designed to allocate wealth to founders and early investors. Their exit liquidity is you.

In most cases, the project could operate perfectly fine using one of the many other readily available cryptocurrencies on the market today.

Lesson 7 — Be tax aware

Find out what taxes are applicable in your jurisdiction and factor them into your trading behaviour. Do the work now and avoid nasty surprises in the future.

On a side note, I was listening to Tyler Reynolds on the Delphi Podcast recently and he mentioned someone who had 8 million crypto transactions to file in his tax report! I’d recommend giving this interview a listen, I always find it fascinating to listen to people who have survived and thrived through the crypto era.

Lesson 8 — Take your crypto security seriously

Earthquakes, hurricanes, floods, forest fires, robbery, civil war, Alzheimer’s, a hungry dog, an angry toddler…

Any one of these could unexpectedly come for your private keys. What’s your backup plan? Do you even have one? What’s going to happen to your crypto if you die in a car crash this afternoon? Will your children inherit your Bitcoin? Can you remember your seedphrase? Did you store it somewhere safe?

Ask yourself these difficult questions now and take action sooner rather than later. Otherwise you might just find yourself asking some even harder questions when you lock yourself out of your fortune.

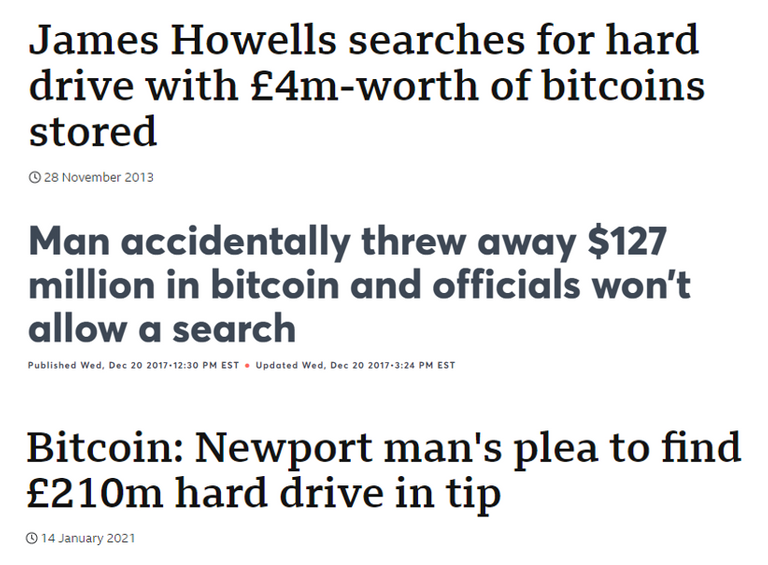

I think my favourite anecdote to this lesson is the unfortunate story of James Howell, one of the very first Bitcoin miners, who threw away the wrong hard drive back in 2013, containing the keys to 7500 BTC. I’ll just pop these headlines in here for good measure…

Lesson 9 — Take the money and run

This lesson ties in nicely with the one about picking your niche. If you are spread too thin and active across too many fronts, not only is it hard to keep focus on your investments, you also run the risk of missing a fast paced disaster unrolling and not having the reflex to take action.

Many investors seem to have incorporated an up-only laziness bias by taking the successes of previous projects into account. Don’t let this blind your better judgment. The main goal of this wild west rodeo is to protect your wealth. If there’s a scam or rug pull or something similar unfurling, then take your money and run, even at a loss. Many people got wiped out and left with nothing after the Terra fiasco. Would it not have been better to take 80% of your dollars and call it quits, rather than risk losing it all?

As a side note, be careful how much you allocate to staking. If you find yourself in a take the money and run situation, waiting 21 days for your funds to clear isn’t all that helpful, no matter what they APY was when you first signed up. Always keep some cash liquid, whether its an opportunity or a disaster.

Lesson 10 — Crypto is a business product, you are the raw material

There is a reason why Satoshi left the scene way back when. He launched Bitcoin, helped oversee its first baby steps, then skipped town. Probably the best thing he could do for the network. Nobody can or should interfere with it now, apart from the occasional patch up.

The rest of the market, as useful and promising as it is, is for the most part a multi-trillion dollar get-rich-quick marketing bonanza. It feeds upon new capital — yours. Without it, it cannot continue to grow. In order to do that, people with vested interests attract new market participants with either lucrative opportunities to earn money (“join the team”) or play into your inner softie with humanitarian idealism cloaked in future tech (“do you part”).

This may sound harsh, and somewhat contradictory coming from someone calling themselves a web3 pro, but I’m fine with calling things out for what they are, especially if they offer an improvement to the faltering status quo. In retrospect, I recognise that I was enticed into the ecosystem by both of the above mentioned narratives, but I’m still here, despite my epiphany. It still remains a space based (in principle) on fair morals while also offering the chance to earn life changing money.

If we can take a moment to reflect, see the space for it really is, then we can come back together as a team and build something together that’s even better, led by utility instead of greed. There’s still time to make this work…

So where do we go from here?

Simple, we build.

If you’re a developer, you code; if you’re a trader, you trade; if you’re an investor, you research. If you’re a web3 content creator, like me, then you simply get back to work, keep your ears to the ground and report back to the masses.

Invest in yourself, get healthy, take a break, but come back stronger and build. Now’s the time to outwork the quitters. When the markets rebound in search for new highs, your hard work, carried out during the hardest of times, will eventually pay off.

One thing is certain, if you’re in this game and never learn from experiences like these, then you better up your game, get more focused or risk falling off altogether.

You can’t make an omelette without breaking some eggs!

Signing off for now,

JaseDMF

Original content, copyright JaseDMF 2022. First published on Read.cash.

Let's connect:

Twitter | Medium | Publish0x | Read.cash | Noise.cash | Hive | Vocal

Disclaimer: some URLs may include affiliate links. These don't cost you any money, nor do they alter your web browsing experience. They do however help yours truly keep the heating on in the winter!