Dear reader,

I presume that you’ve heard about this thing called Ethereum 2.0? It’s going to save the crypto market and pump all our bags to the moon, right? It will rid us of that dreaded, yet predictable, 4 year pump and dump cycle. It will make the gamers happy again by lowering GPU prices, it will make the environmentally friendly artists happy again by reducing energy consumption and it will provide happy hodlers with the opportunity to earn yield on their investments. It’s a no brainer, right? Right? Tell me I’m right…

Well, what if I told you that there is something in particular that people aren’t telling you in the headlines? A special metric that the sophisticated tech investors have hidden up their sleeve. The other side of the digital coin that you need to take into consideration while managing your risk.

And now for a picture of a New York deli:

Jase, you’ve lost it mate!

Have I?

Hungry comedians

Let me take you on a trip back in time to 1960s New York. Theatre comedians would spend their time between shows hanging out at Lindy’s delicatessen on the corner of Broadway and 51st Street. An idea was born around this time that a comedian’s output was a constant number. The frequency in which they performed dictated the eventual shelf life of their career. This concept became to be known as “Lindy’s Law” and can be traced back to a 1964 New Republic article written by Albert Goldman.

Over time, the concept has been revisited by various academics and mathematicians up until its current framing in investment circles where the law dictates that a non-perishable good should live on in the future for as long as it has already lived in the past. Every additional measure of time added to its history doubles its overall lifespan. This phenomenon itself is known as the Lindy Effect.

Nassim Nicholas Taleb spoke about the Lindy Effect in his 2012 book Antifragile, although the technology he refers to in this case is slightly less advanced than that of a cryptocurrency network:

“If a book has been in print for forty years, I can expect it to be in print for another forty years. But, and that is the main difference, if it survives another decade, then it will be expected to be in print another fifty years. This, simply, as a rule, tells you why things that have been around for a long time are not "aging" like persons, but "aging" in reverse. Every year that passes without extinction doubles the additional life expectancy. This is an indicator of some robustness. The robustness of an item is proportional to its life!”

Taking Bitcoin into consideration, a savvy investor could look at the age of the network (13 years old as of January 2022) and consider it to have a shelf life of at least another 13 years. Why do you think a long term investor such as Michael Saylor only began to invest in the asset once it reached the double digit age bracket?

The Ethereum network launched in July 2015, so it’s rapidly coming up on its 8th birthday. With the prospect of a major network upgrade and a Lindy effect predicting at least another 8 years of activity, one could boldly make the claim that the network is going nowhere in the short-mid term due to its Lindy effect.

What's at stake

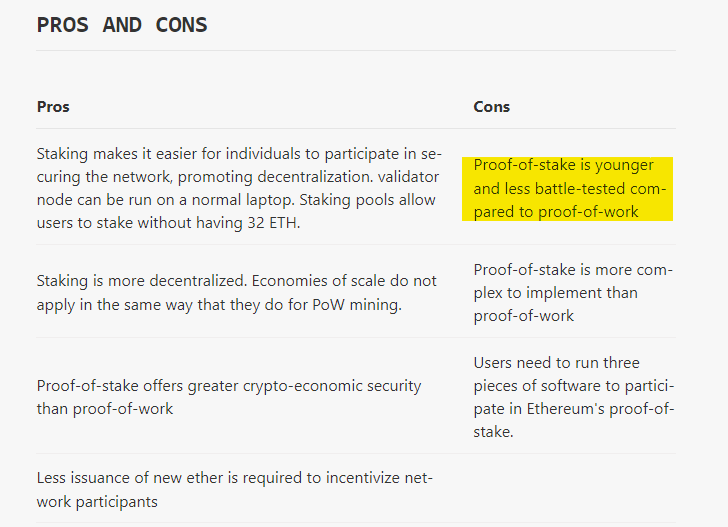

Your money, that’s what. Ethereum holders will soon(?) be given the opportunity to delegate their precious coins to network validators in return for staking rewards as the network undergoes a seismic facelift and resurfaces as Ethereum 2.0 (or the Consensus Layer, to be politically correct). The technology under the hood is also changing as the consensus mechanism switches from proof-of-work to proof-of-stake. This is the critical part to understand, the fact that the tech behind the branding is actually changing. Theoretically, this resets the network’s Lindy effect and on paper reduces the life expectancy of the protocol on a short term horizon.

On it’s website, the Ethereum foundation even goes so far as to point out the fact that:

"Proof-of-stake is younger and less battle-tested compared to proof-of-work”

There are obviously plenty of advantages arising from this transition to proof-of-stake, but the purpose of this article you’re currently reading is to inform you that the hype of transition alone does not guarantee a success story and that sophisticated investors (something I am not) use a variety of metrics to measure the risk/reward ratio of their investments. Lindy’s Law is one such metric. How to correctly apply the law and whether or not the Lindy will have been reset post Merge is a topic of discussion that could be causing some serious head scratching amongst the giga brains of “smart money” at the moment.

To the curious mathematicians out there in need of measurable expiration dates, here is the precise equation that you can run by your next degenerate deployment: E[T-t|T>t]=p.t

With all that being said, using a single metric inspired by a troupe of 1960s theatre comedians to assess the chances of survival of a 21st century cryptographic world computer protocol is a long stretch of the investor’s imagination. In fact, anyone who questions the legitimacy of Lindy’s Law need only pass by the corner of Broadway and 51st Street to see for themselves:

I guess Ronald McDonald’s Lindy was stronger.

Signing off for now,

Jase - Digital Media Freelancer

Resources:

- https://en.wikipedia.org/wiki/Lindy_effect#cite_note-6

- https://en.wikipedia.org/wiki/Lindy_effect#cite_note-8

- https://en.wikipedia.org/wiki/Lindy%27s#/media/File:Lindys_Restaurant_Broadway_and_51st_Street_New_York_City

- https://ethereum.org/en/developers/docs/consensus-mechanisms/pos/#pros-and-cons

- McDonald’s: Google Street View

Original content, copyright JaseDMF 2022. First published on read.cash.

Let's connect:

- Publish0x: Earn crypto for reading about crypto

- Read.cash: Earn Bitcoin Cash for writing

- Noise.cash: Earn Bitcoin Cash for microblogging

- Hive: Earn HIVE for your Web3 social activity (signup via Ecency)

Disclaimer: some URLs may include affiliate links. These don't cost you any money, nor do they alter your web browsing experience. They do however help yours truly keep the heating on in the winter!