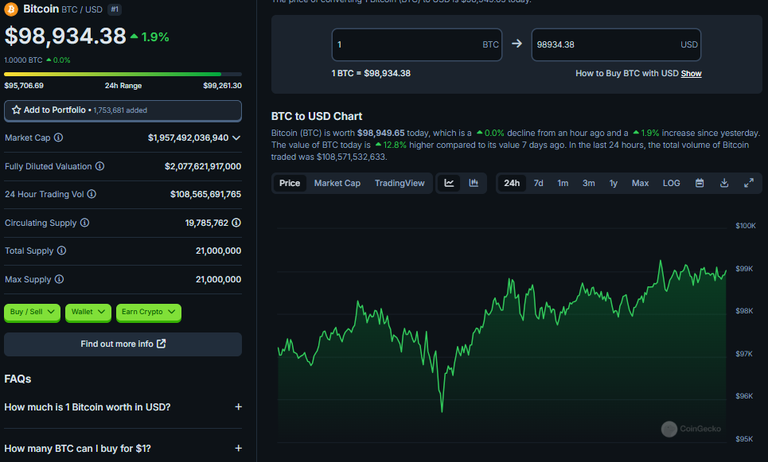

Bitcoin continues to surprise and redefine the boundaries of the digital economy. In a spectacular leap, the digital currency has surpassed the $98,802 mark, setting a new all-time high. This meteoric rise marks a crucial milestone for the global adoption of cryptocurrencies and highlights major changes in the global economic landscape.

A Remarkable Journey: From $80,000 to $95,000 to 98,802

In just a few days, Bitcoin has seen an impressive rise.

November 10: Bitcoin passes $80,000, marking a spectacular comeback after a year of volatility.

November 13: The currency hits $90,000, bolstering investor and market confidence.

November 20: Bitcoin surpasses $95,000 for the first time, paving the way for a possible psychological $100,000 threshold.

And😊 from today - Bitcoin up to 98,802....

Bitcoin’s rise is not just a fluke, it reflects growing interest from individual and institutional investors. With this record, Bitcoin has become more attractive to governments, corporations, and private investors. At $95,000, Bitcoin’s market capitalization surpasses assets like silver, cementing its position as a top financial instrument. Bitcoin’s success is forcing governments to take clearer positions on the regulation and use of cryptocurrencies.

What do you think - $100,000: Utopia or Reality?

Bitcoin’s journey has been a cinematic one, quite epic. Launched in 2009 by the mysterious Satoshi Nakamoto, the digital currency initially seemed like child’s play—a cryptographic experiment that promised to remove banks from the equation of financial transactions. Who would have thought that, a decade later, this “digital gold” would be valued at tens of thousands of dollars?

As Bitcoin grew in value and popularity, its story became more than just a technological chapter. It became a metaphor for financial freedom, a digital revolt against a centralized and sometimes abusive banking system. And in November 2024, that revolt reached its peak: the $95,000 mark wasn’t just a record; it was a signal that the financial world as we know it was about to change forever.

Historically, Bitcoin has always been a volatile asset, a risky play for many investors. But what has fueled this latest spectacular rise is a complex mix of factors

Under the Trump administration, the United States has announced ambitious plans to turn Bitcoin into a strategic asset. The creation of a national Bitcoin reserve, made up of coins confiscated by the judiciary, has sent a clear signal: this cryptocurrency is no longer a mere alternative, but a serious player in the global economy.

Large companies and investment funds have begun to see Bitcoin as a unique opportunity for diversification. Each massive purchase of the digital currency has pushed the price even higher, and demand has continued to grow.

As Bitcoin approaches the $100,000 mark, a powerful psychological effect has emerged. Investors large and small have rushed to buy, fearing that they may miss the opportunity of a lifetime.

- The $100,000 mark is now within reach, and many are wondering: what next?

Some analysts predict that Bitcoin could become a global standard, a currency that transcends national boundaries and redefines the world economy. Others, more skeptical, warn that this rise could be just a bubble waiting to burst.

The fact is that the Bitcoin story does not end here. Whether it reaches $ 100,000 or faces a correction, this cryptocurrency has already demonstrated one thing: the financial world has entered an era of irreversible digital transformation.

So what does Bitcoin represent for you? An investment vehicle, a technological revolution or simply a captivating story of our times? Regardless of the answer, one thing is certain: the future is already here, and it bears the imprint of a digital currency that continues to defy expectations.

)

)