Hi everybody, how's it going with you? I invite you back to one of my blog in the Hive Learners community, I will be giving understanding to a point known as Futures Trading, which with this idea, I get to make sense of the nuts and bolts that accompanies it.

Futures Exchanging is a sort of subsidiary agreement that permits you to trade a particular resource or security at a foreordained future date and cost. Future contracts are exchanged on futures trades and require the utilization of brokers.

As an example,

Brokers can go long(buy) to wager on a cost increment, or short(sell) to wager on a value drop and benefit by exchanging these digital forms of money against USDT.

Future trading basically, permits brokers to estimate on the future worth of a digital currency. Allow us to take apart it, to exchange prospects you really want to understand what Leverage is.

The term Leverage alludes to expanding the utilization of something. As we probably are aware that USDT is a cryptographic money that is connected to the US dollar.

Note that For this situation, the prospects markets empower you to improve your exchanging capital by standing firm on Footholds evidently worth x10 or higher of your exchanging capital and benefit from these positions.

What makes this possible?

With regards to Futures Position, We don't buy coins to keep in the prospects market as we in all actuality do in detect exchanging or the typical way you purchase bitcoin and keep it. For this case, We have positions on the lookout.

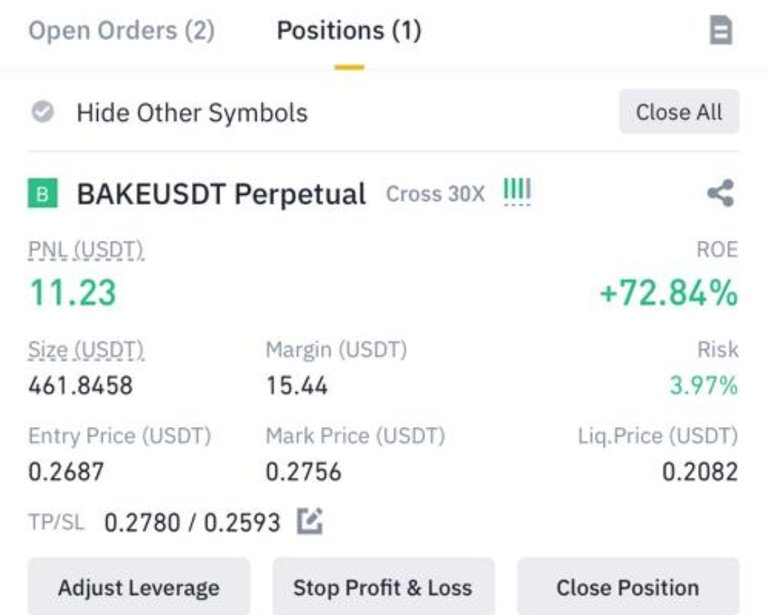

The following is an illustration of my exchanging position on Binance.

To zest things up, you can bring in cash by exchanging positions for one or the other bearing of the market.

HOW?

This essentially intends that assuming the market is unloading, you can enter a Sell position that way and on account of any other way, you can likewise benefit similarly as much as though the market is pumping.

An example is given underneath. a Sell exchanging position on the right and a Purchase on the left.

Presently, We should go on a consistent clarification.

Putting what we've found out about leverage, capital, and positions to utilize.

Think about this...

Stephen has just $500 in his future wallet and can decide to open a $5000 purchase/long situation on an exchange.

And that implies he is inferring that the market will rise

Assuming the market ascends in support of Stephen, he is qualified for any benefits made on that $5000 position.

Isn't that so astounding?

You might be asking why you shouldn't pull out all the stops and open a $10,000 or more position, yet this may be excessively unsafe, which is the reason this leads us to the following part.

- Leverage

- Margin

- POSITION SIZE

- PNL

- LIQUIDATION Cost

- RISK Management

LEVERAGE: - This is obviously how frequently your margin is increased. multiple times leverage approaches multiple times your margin.

MARGIN: - margin is basically the sum contributed when you open a position.

SIZE OF POSITION: - This is the least difficult to get a handle on, It is basically the sum in units of the pair being exchanged, it can likewise be communicated in USDT. It is additionally affected by your margin and leverage.

PNL: - This is just the benefit and misfortune you are making on an exchange.

LIQUIDATION PRICE: - Individuals are generally panicked by simply hearing this word. This is just the cost at which the complete loss of assets (capital subsidized in a record) happens while exchanging cross-isolation mode or the deficiency of margin utilized alone.

Liquidation happens when a broker's record is overleveraged and his misfortune can presently not be kept. The broker then, at that point exchanged his/her situation by involving the excess margin left in his exchanging wallet.

This is why Stephen must be careful and manage his risk in order to avoid being liquidated.

RISK MANAGEMENT: - This is just a system to guarantee that you exchange capably, expand your benefits, and don't become sold during one exchange venture.

To turn into a beneficial broker, you should have an intensive comprehension of Technical Analysis, Trading Psychology, and Risk Management. There are assets on YouTube that you can utilize, however they can take you up until some point. You'll require a coach who has related knowledge in exchange to show you these abilities.

EXCHANGES

Exchanges are frequently alluded to as Merchants, which is where you can exchange prospects on different trades, I'll list some of the best in terms of security and trading fees.

- Binance

- KuCoin

- ByBit

- FTX

- Huobi Worldwide

Here comes the conclusion on the topic of Future Exchanging, where I have made sense of all the exchanging Wordings and exercises required before one can begin future trading.

Know about liquidation, which happens when you are overleveraged and you don't manage your gamble with the executives appropriately. I trust this acts as sufficient direction for anybody plunging to put resources into futures Trading.

Many thanks to you for coming, I desire to see a lot of you sometime later.