Russia, China, Iran and Saudi Arabia are moving away from the US Dollar. It was like yesterday when the US decided to poke the bear from Russia and ignite a war in Ukraine, a proxy one of course. They were then throwing sanctions over sanctions on Russia as a country and its ex-pats in the hopes that Putin would give up on his "military action", but he didn't.

Most of the world followed suit and we found ourselves seeing oil prices skyrocketing in no time and other commodities following suit. I bet there were profits to be made from this deal, and I bet none of you plebs has profited from these. We, the plebs, are never positioned on the heaviest side of the counter.

Over one year after the war in Ukraine started and we are being faced with the situation now when the dollar's position as a reserve currency is threatened by the yuan. Yeah, who would have guessed it?! Russia, China, Saudi Arabia, and Iran teaming up in pricing oil in Chinese yuan. I guess it's not a bad idea after all. We had the dollar functioning as a reserve currency for something like 70 years now.

It's probably time we should try something else. How did the dollar become a reserve currency accepted worldwide, though? Well, thanks to the globalization of the economy and also mostly due to oil being priced in dollars, but now, that's about to change.

America has won every war it has been a part of, so far, and most of these conflicts that have been provoked and fueled by the US have taken place on foreign territories, most of them being literally destroyed and drained of resources. Iran, Iraq, Syria, Libya... These are just a few countries that will never be the same after the American invasions.

How has the dollar managed to "stay as strong and globally accepted for so long"? Well, I guess the fear of sanctions played an important role for that matter. I guess you don't want to be excluded as a so-called local economy from the global one. If you think life outside the dollarization fence is fun, ask Iran how it feels about that...

A global economy has to have a strong reserve currency and this has so far been the dollar, but the ones who profited the most from that situation were of course the FED and Wall Street, "the money printers". Individuals like you and I have not had much to gain from the dollar being in such a position except for probably cheap fuel and food(talking about regular Americans here)... Stuff that used to be relatively cheap in other properly developed economies as well.

Now we're living the times when the yuan might challenge the dollar as a reserve currency(considering that oil will still have a high demand for the years to come). Referendum on whether to make Germany's capital Berlin "climate neutral" by 2030 has failed is somehow a confirmation that fossil fuels(which are not actually fossil fuels) still have "a word to say" in the economy.

We're not there yet, living on renewable energy and other related crap... There probably will come a time when fossil fuels will no longer have much demand and by then it won't matter that much in what currencies are these going to be priced but until then...

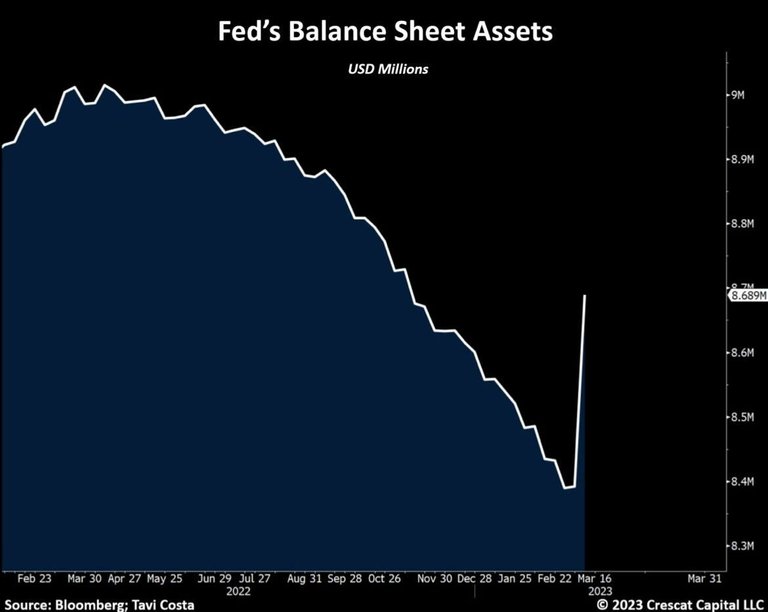

We got damn wars carried out for that matter for so long now, and almost any financial crisis that threatened the economy(in the US and abroad) got solved by "inflating the FED's balance sheet" like it pretty much happened recently with the banks such as SVB, CS and so on and so forth. The printer went BRRR and the crisis was somehow postponed for future generations to pay the price for its deviation. What will happen with all "the printed dollars" when the yuan will become the currency oil shall be priced in?

I guess the answer is pretty simple. The tide shall come back to the shore and will probably turn into a tsunami on the way back. Americans will probably get to experience their own "Weimar episode" as the Germans did after WW2. Or... the government(basically the elites behind the government) would have created the perfect crisis and get to "finally introduce the damn CBDC" that they're already pilot testing. A currency that can't practically inherit the illnesses of the dollar.

This could be the perfect storm to make CBDCs happen for sure. China will launch its own, of course, which will be internationally traded against oil and other commodities. But that will only benefit the issuers of such currencies, while we the plebs will become slaves of a system that can shut down or freeze our funds at any time based on bad behavior reasoning or whatever shit they can come up with.

So what's the escape from such a storm that seems to be artificially created? Hive and Bitcoin... and a bunch few others, but ultimately the whole purpose of alts is to buy you more sats. That simple...

Thanks for your attention,

Adrian

Posted Using LeoFinance Beta