Tax filing is a complex task for most people and this is something that we need to do once a year. No matter in what country you live in there are certain tax liabilities and you need to file your taxes accordingly and that too on time to avoid penalties etc. In India, the tax filing date is 31st July and I made sure to file my taxes for the year by this date. Sometimes I think to complete this task in May or June month but to be honest I have never done it and every year I get these tax filings done in July however I don't wait for the last date. Usually, there are many issues when the due date is closed because a lot of people do their filing and even the portal accessibility can be a problem.

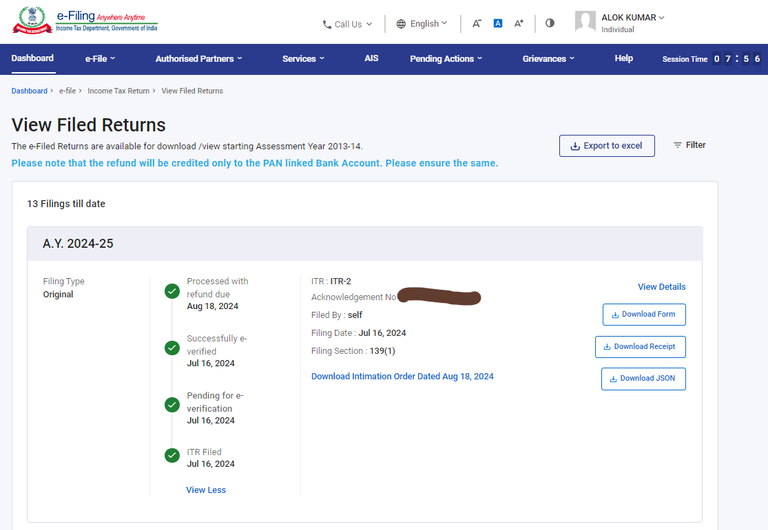

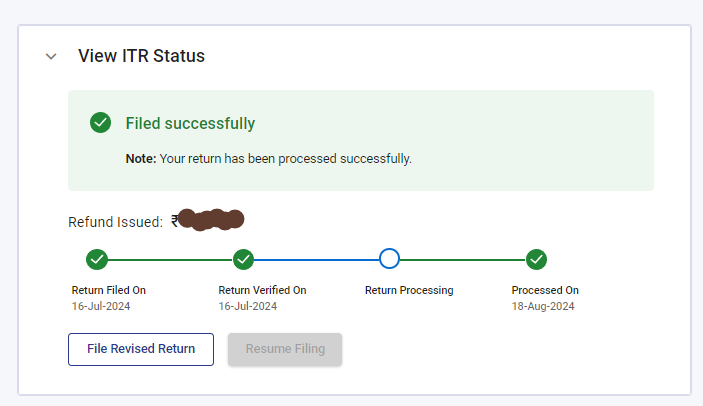

For the people who are in any organisation, they need to file the taxes once they receive their form 16 and this form is issued by the employers. Generally, most of the employers issue these forms in May month and some of them also do this in June. Even if the form is distributed in June then also we have a month to get the filing done which I think is a good amount of time and there is no reason for any delay. I did my text filing on 16th July and it was validated on 18th August.

This filing process works in such a way that we need to file our taxes according to the income and expenses we have done in the year and then the tax department verifies the information and processes it. If everything is correct and matches with the record whatever they are comparing with then it is validated and a refund is processed if any according to the filing details. If there is any discrepancy then they mark the filing as defective provide the reason as well and ask the person to submit the revised filing within a certain due date. Last year my filing was marked as defective and after the revision, it took many months for the validation.

This time also some of my friends have got the notification that their filings are not correct and they need to file a different form. The tax department is quite strict now and they are checking each and everything that which form should be filed which means if you are in crypto then you can't file ITR 1 because you are not eligible for that and you must file it 2 or 3 depending upon your eligibility. I have filed ITR 2 which is the form for people dealing in Crypto and even in the last year I did the same but there was some discrepancy as per the tax department and I had to pay some extra taxes to get the processing done. There was no refund last year but this year it was and I got my refund within a month which I think is good because now the team is working faster to process more refunds and filing in a day.

As I mentioned this year a lot of people are getting the notifications that their filings are not correct and they need to revise them. First of all, they check which form is filed and if the form is correct then they are also matching the information with other components including the income and investment numbers. Even people who claim fake investments are also notified and it is highly recommended that do not claim the fake exemption if you have not done the investment because it might put you in trouble. The government is tracking everything and claiming the false exemption can cause a lot of problems for you and you might get a notice to pay a penalty also if your case is picked up for scrutiny. Even my employer centre circular to all the employees that they have been notified by the tax department that some employees have claimed for false reduction which should not be the case and actions will be taken against them accordingly by the department.

I'm glad that my tax filing is verified and refunded processed in a month and now this activity is closed for me for the year. ITR 2 farm is a little bit complex but if you pay attention to the details it is asking then even you can do it and you don't need any assistance on this. I was thinking of getting it filed through assistance but later I changed my mind and I did it. I believe that it's good to get your things done by yourself because this way we know what is being done and if in case there is any query then also we know what to answer this is why I did my filing without any assistance and it was a good learningful experience.

Thank you

Posted Using InLeo Alpha