traV̶̤́E̴̯͗RSe - IntR̶̮̋insic Value Analysis: V̵i̶d̶e̵o̷games

Understanding Non-Fungibility Using Video Games

As a musician, I'm a huge proponent to NFTs. As someone who has conversed with friends quite frequently and written about NFTs, I've learned that it is an abstract concept for some people to grasp. Lately I've been learning investors my age and younger (millennial and down) that I speak with about NFTs, and non-fungibility in general grasp the concept well when applied to Video Games.

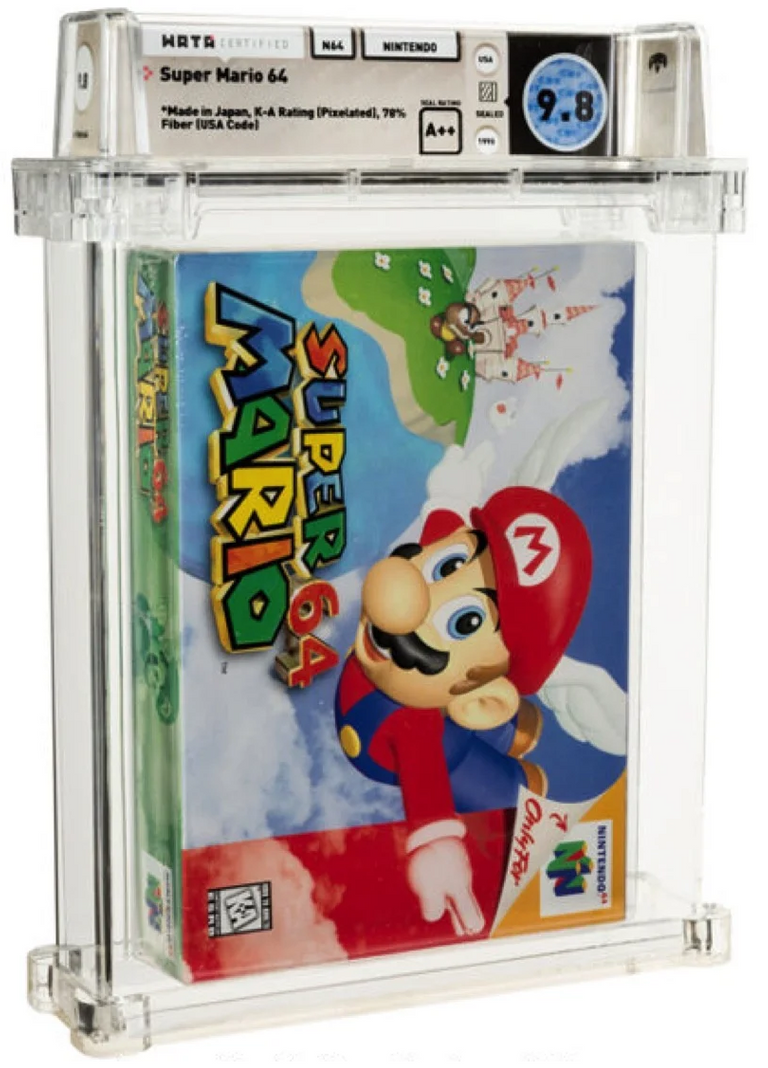

A couple years ago, pristine copies of classic in-box video games were selling for crazy amounts of money. Pictured above is a (potential scam) 9.8 rated mint copy of an early revision of Mario 64. This Video Game asset sold for $1.56m USD. Setting aside some of the questionable aspects of the sale, this is still a fantastic case study for the non-fungibility of a mint condition video game released in 1996 vs its price in 2021.

To older investors I've talked to about this, the price seems quite absurd and indeed, it is incredibly high compared to historic price trends for video game collectors. This very blog was spawned from a conversation I had with my father, and his lack of understanding about these high prices. The younger investors I've spoken with understand this price point a bit more on an intrinsic level. This could be due to the age gap of humanity, as younger generations grew up fully immersed within video-game culture. This is quite evident as a survey taken as early as 1990 stated that more children worldwide recognize Mario more than Mickey Mouse.

Intrinsic Value Analysis of Super Mario 64

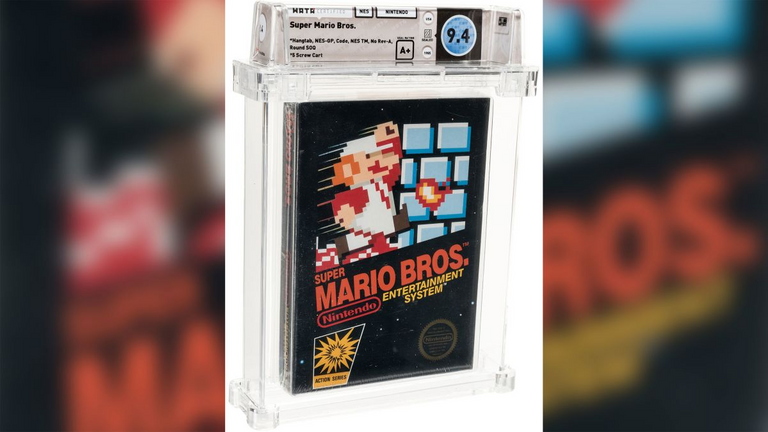

Original Mario Bros for NES sold for $660k, source.

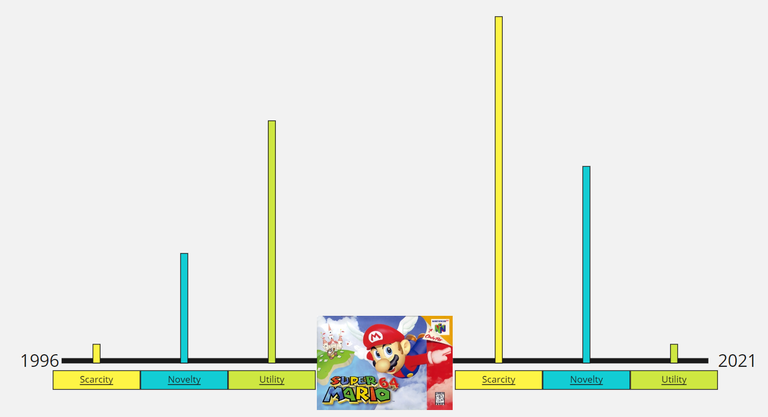

The three ideas I'd like to consider with the sale of Super Mario 64 and other video games:

- Scarcity

- Novelty

- Utility

Intrinsic value is a measure of what an asset is worth. This measure is arrived at by means of an objective calculation or complex financial model. Intrinsic value is different from the current market price of an asset. - Investopedia

Scarcity

Scarcity is the measured limit of a specific resource or asset. Demand for a resource or asset can out-pace the provided supply, whether a physical resource like gold or an asset such as a pre-production 1964½ Mustang (sidenote: gorgeous car). When demand vs supply wins in the great tug-of-war of economics, then an asset is scarce. This is the easiest of the three concepts to grasp.

In 1996, the scarcity of Mario64 was theoretically null in western markets, as production runs were still occurring. If demand outstripped supply, they could manufacture or mint more. The Mario64 that sold above was an early revision, however, making it scarce even for its time. In 2021, this is amplified by the scarcity of mint condition, complete in-box Mario64 games regardless of revision. Barely any children in 1996 would go to purchase Mario64 only to keep it pristine in box and on a shelf, as this would negate the ability to play the game (utility).

Novelty

Novelty is a term I am loosely using to encapsulate the intrinsic wealth of Mario and what he represents. As linked above, even as early as 1990 more children worldwide recognized Mario over Mickey Mouse, and that trend hasn't stopped. Mario is iconic. Mario wasn't the first video game character, but he was the first major video game character to capture the 'gestalt' of the cultural consciousness. In the gaming of the 1980s, playing "Nintendo" was akin to playing any video games. The star of the show, the front and center mascot in the homes of every Nintendo/NES owner by default, was the original Mario Brothers.

It is the novelty which is where I see a generational divide in terms of understanding, by no fault of anyone. A great way to understand it would be a comparison to older collectables. An investor can understand the value of legacy non-fungible collectables, say a rare misprint stamp, the first comicbook released containing the comics icon Superman, or to an elevated level: A Picasso piece or the famous "Sunday Afternoon" and understand the value of owning icons of cultural significance. Starry Night is in essence priceless, yet I've never been a fan of Picasso and would rather hang something else on the wall (utility), however I would absolutely love to own the original version (scarcity).

Understanding cultural significance, we can say that Superman is to comic books as Mario is to video games. The video game industry is projected to see $65b USD in 2021. There are other well known comic book heroes, especially now-a-days, just like there are many well known video game mascots. That said, Superman and Mario were the first to capture their cultural consciousness, Mario64 was the first fully 3D representation of Mario. Clearly, lets not forget he has his own theme park in the works.

Utility

Utility is the measure of something's usefulness, in other words the dynamic of interaction between owner and asset. Since this post is about financial assets as a whole, I am considering the utility of "price value growth/maturation" exterior; dynamics between scarcity, novelty and use-ability/usefulness all play into the potential for price growth.

So setting "wealth growth" aside, utility could represent many things, from buying heavy machining equipment for a new business, to buying a postage stamp to send mail via the post, to buying a form of entertainment. The original Action Comics #1 had utility for its time as it is a story that a reader can engage with for enjoyment. Nowadays, the very act of unsealing that comic from a sealed protective case sends shivers down the spines of many a comicbook collector. Physical engagement with the asset becomes lessened as the age and physical condition becomes a much higher consideration for its price point.

One definition of utility states: "Functional rather than attractive. 'Utility Clothing'" This definition made me gag as an eccentric ~/\rtist~, as attractive/creativeness is a major function of clothing for me. But I digress. Setting that definition aside, above I said I would rather hang another picture that I enjoyed over Picasso's Starry Night regardless of price; this is a function of choosing the utility of enjoyment over the novelty of cultural/historical ownership. Obviously as all three factors come into play, I'd rather own Starry Night for its wealth than some picture I merely enjoyed more. The desire to hang another piece up because I enjoy it is a subjective choice, which a lot of utility is.

The point of owning Super Mario 64 in 1996 was to play it.

In the case of Mario64's utility, one can currently buy an aftermarket open box Mario64 cartridge and play the game or use other emulated means. By todays standards the game still plays amazingly well, but there are currently many different "3D platformers" on the market in 2021. In 1996 with its ultra-tight control scheme and awesome level design, Mario64 was an incredible gaming experience and very fun in the era of gaming consoles transitioning from 2D 16-bit to 3D 32/64-bit.

In 2023, Mario64 still holds up (some argue initially setting the bar) in 3D platform gaming, but very similar experiences can be enjoyed with other many other titles. A mint condition Mario64 sealed in a case, much like the Superman comic, has a sort of built in 'negative-utility' as one can not open the case and use the cartridge without destroying its mint condition quality. The owner of this game purchased it for the sake of its condition and its rare early revision novelty, not to physically play it. It is a display piece of cultural significance. A collectable.

The point of owning a mint copy Super Mario 64 in 2023 is to own pristine cultural significance.

Please remember, for this blog I am removing "the ability for an asset to increase in relative wealth to others" as not part of what I'm calling utility. I tried to set out writing with a bit of ambiguity here to try to and define different areas of intrinsic financial wealth. It is assumed the key point of any asset overall is wealth growth, so to pinpoint what I mean by utility, I am subtracting this. Without "wealth growth", there is little utility in a physical mint copy of Mario64 in 2021, outside of carefully displaying it on a shelf.

It would be crazy to open a mint copy of Super Mario 64 now

The cultural significance element of Mario64 should not be undervalued or underestimated. Scarcity only matters if demand outstrips supply. You could have something completely untique and one of a kind but if absolutely noone wants it (including you), the value is zero. Historically the video game industry has even seen instances like this before. This again goes shows how culturally significant Mario really is.

Plus, if you haven't heard, Nintendo is working on full length animated Mario Brothers Movie starring massive voice talent including Chris Pratt as Mario. Nintendo is also creating a theme park named Nintendo World in Japan. There is no slowing down the steamroller that is Nintendo. Nintendo has shown itsself to be the dominate juggernaut gaming company in terms of branching out into different cultural spaces. A scarce mint copy of Mario64 is an encapsulation of that companies historic past, in a sense.

That's why Super Mario 64's mint condition prices aren't that crazy...(ok they are but still)

I realize this blog reads like a Nintendo fanboy post, but I'm hoping the points above:

- make sense

- are more a comment on cultural wealth phenomenon, less my subjective feelings

- wasn't boring

The idea for this blog came from my own feelings of amazing seeing these items sell for such high prices, along with a difference of opinion between me and some from older generations whom I've spoken to about it. I hope what I typed here made sense, taught you something or made you think. Thank you for reading.

on traV̶E̶R̸se tomorrow:

on: Bull-Headed Collaborations

on: Bull-Headed Collaborations is about my cousin and I being stubborn and typical Taurus zodiacs, arguing over everything and anything. From video game consoles to record studio software, we always seem to find a reason to swear allegiance to an idea and debate it to the bitter end.

This commentary piece is more about life, musical productions and working with my best friend to create lasting artwork...all while we constantly talk smack on eachother.

trA̷verse: on trA̷verse: A series of musings, memoires and mementos gathered, garnered and gleaned from exploring new digital ecosystems. Born too late to explore the seas, born to early to explore O̵u̸t̷erSpace, born just in time to explore the Metav̷e̴rse̷.

n̶̠͋Y̸̟̎m: AMP̴̛̣H̵̟̓LUX

Posted Using LeoFinance Beta