I'm a dummy, in fact it took me more than 2 years to jump into DeFi, and I still don't understand it 100% despite having read tons of articles and "DeFi for dummies" kind of guides, but I can safely say that I understand enough to write this post, so please don't take it personal, I'm not calling you dummy as an insult, but mainly because when it comes to DeFi, we are all dummies and, the simpler the concepts, the better.

There are many intricacies, corners, dark alleys and much more that you have to understand if you want to become a DeFi investor in a space where everything changes very fast, and if you actually want to make 1000x returns, you have to be a maniac, have tons of luck, and have lots of money to spare in case things go south.

But we - that means you and I - are not trying to make 1000x returns, mainly because those only happen every lunar eclipse, but also because in order to get such returns we have to be willing to lose 999 times out of 1000.

We, as Hivers, are looking for that 2x or that 5x, maybe even that 10x through sound investments - such as the Hive token, HBD staking, Leo or SPS token buys, or things like that. Which is what this post is about so, enough of introductions, this is not a Pancake recipe with a long, boring introduction, so let's skip to the good part already.

About PolyCub Farms - How do they work?

Polycub farming basically has three parts:

- The part where you benefit - You stake your tokens in a vault to farm Polycub tokens, which basically means that you get rewarded polycub depending on how much value in dollars you stake.

- The part where the market benefits - The total amount staked by all users in a specific farm, provides liquidity to that market. This means that anyone who wants to buy the token, can do so through that market without the need of a specific seller and, anyone who wants to sell that token, can do so without the need of a specific buyer.

- The part where the ecosystem benefits - There's a fee for each transaction that happens in the DeFi ecosystem, and the cool part about Polycub is that instead of that fee going to the founder's wallet, it goes back to the ecosystem in a way that helps push higher the price of Polycub.

DeFi is complicated, there are tons of terms and concepts that are hard to grasp, protocols that are complicated to understand and many risks involved. This is why investing in a project involves many risks. If you are a DeFi novice like me, these risks can be mitigated by knowing if the founder is not anonymous and has other successful projects (such as Leo Finance and Cub), knowing that the project is legit and has real economics behind, being sure that the community has a long term mindset as well as many active members who understand the mechanics and know that the smart contracts are not a scam.

All of these apply for Polycub, which is why I can safely say that I vouch for Polycub Farms as a sound investment at the moment.

How does Polycub Liquidity Pools (Farms) help the Hive Ecosystem?

The more USD total value is locked in a Farm, the more liquidity it provides to the tokens stored in the Farm, which means that the higher the amount of tokens in a farm, the higher the chance for a whale to buy-into the ecosystem in the blink of an eye. This also means that if a whale wants to sell a token and leave the ecosystem, they can do so more easily through a Liquidity Pool swap (to trade tokens) instead of doing it through a Centralized exchange such as Binance.

Think about it, if a whale wants to buy Hive through a centralized exchange, they have to deal with bots, market order fillings, price action and much more, whereas if they buy Hive through the Polycub Liquidity pool, they just set a swap and that's it. There are obviously many factors here but that's as simple as it can be explained.

The more USD total value a Farm has, the easier it is for someone to swap a token paired in that liquidity pool.

One of the main problems any Crypto ecosystem faces, is the simplicity for whales to get-in and get-out of the ecosystem. If there is no token liquidity (availability of tokens to be bought or sold), it is not likely that whales will want to jump in into an ecosystem.

Polycub aims to solve this issue

That's the main focus of the Polycub ecosystem farms, to provide liquidity so that anyone can jump into a specific Hive market without facing selling/buying issues.

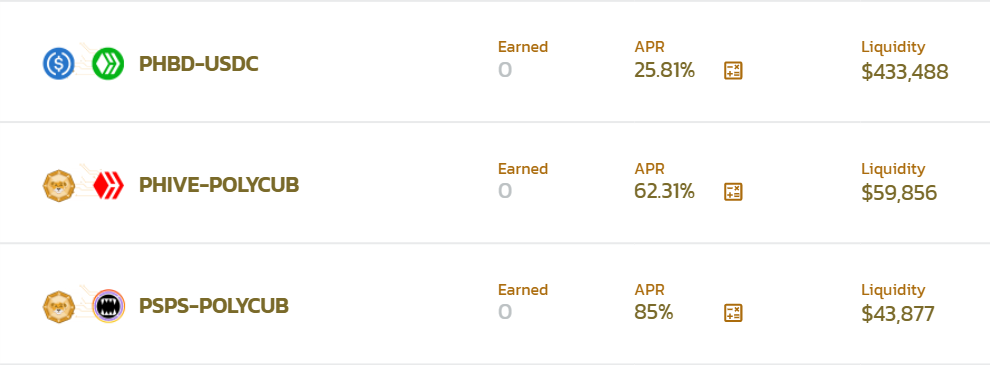

I'm talking about these markets, which use wrapped versions of the tokens you already know and are used to provide liquidity to: HBD, Hive and SPS.

The more USD value that is under the Liquidity column, the easier it will be for a whale to buy into said market, which means that...

By increasing the amount of liquidity in those farms, you are benefiting yourself and benefiting the Hive ecosystem as well.

But wait, what's that column that says APR?

well, that the sweet part. That percentage means the Return of Investment you will get in one year. This amount changes depending on the liquidity amount stored in a farm, which means that you have to check your farm regularly - yes, that's a must in DeFi - but, imagine, if you store $1,000 and the APR values didn't change, you would get $250, $620 or $850, depending on which Farm you store your tokens. The APR amount doesn't even take into account what would happen if every time you claim your farmed tokens, you stake them again in the Farm (that is called APY, which takes into account compound interest, which is to reinvest the tokens you earn). APY's are way higher than APRs, but let's stick with APRs, I think those numbers are already incredibly attractive.

That amount of APRs is why I began this post by telling you how a user greatly benefits from providing liquidity through staking their tokens in a Farm.

Is this information enough for you to consider getting into DeFi through Polycub Farms?

If you are willing to learn, and you don't want to keep missing on these APRs (which means Annual Percentage Rate, by the way), here's a step-by-step tutorial series to put your Hive ecosystem tokens to work for you and stake into Polycub Farms:

Step 1: Get a Metamask Wallet

Step 2: Buy Polycub

Step 3: Wrap your Hive Ecosystem tokens

Step 4: Stake your tokens into a Polycub Farm

Step 5: Start earning passive income!

Just don't forget to check your Farms every now and then and claim your tokens so that you can reinvest them as soon as they unlock.

Make sure to join the Leo Finance Discord server and read some of the posts about Polycub on Leo Finance's blog.

This post is informative about Polycub, meant to give more information about how to stake into Polycub's farms and to be used as a tool for those who want to participate in @leogrowth's provide Liquidity Week, it is not financial advice.

Posted Using LeoFinance Beta