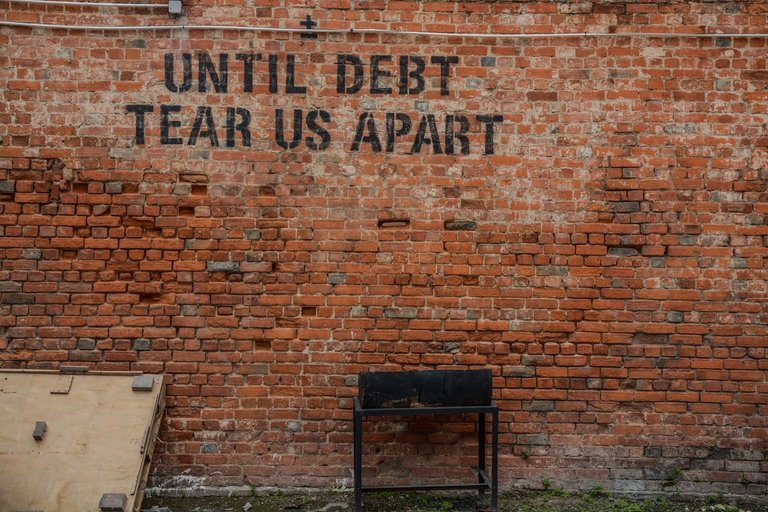

One of the first steps to becoming rich is to settle all your debts. Read any book on personal finance, or financial growth, and this statement will doubtlessly be one of the first things that come up. Debt is the slow devil that chips away at your wallet. Before we become independent, we must settle it.

- Why is debt such a No-No?

This goes hand-in-hand with the ability to acquire wealth through saving. The money that you can be putting aside for later is instead going in the pocket of someone else. Why? Why would it not go in your pocket? Through time this exponential accumulation of funds will result in possibilities. Possibilities as of then unseen with your debt.

Let's take a deeper dive into this concept, shall we?

WHAT IS DEBT

I think we are all aware of the basic concept of debt. But you would be surprised at how many people don't understand its nuance. Being indebted to the bank or a loan shark is one thing, but there are other forms of debt that people have come to accept - to their own downfall.

These forms of debt have become so ingrained into day-to-day life that people don't even see them as such. We have to break away from these trappings.

One such trap is the needless subscription. Why pay for a Spotify/Apple Music account when you can hear music for free on YouTube? But there are conveniences. Yes, the companies will do everything in their power to make a fast buck. But that doesn't mean that these services are necessities. Especially when we are struggling.

Smart money management comes from everywhere. You don't need that cable subscription if you never watch the TV. But friends might come by. Cool, I'm sure they will live without your TV. 🙂

DEBT FREE

Once debt-free the whole world is your oyster. Opportunities arise that were previously unavailable. A lot of people have a problem with coming terms that most things in life are debts. But once they do, and once they feel that weighty wallet, their suspicions are put to rest.

As an example. You could save up some money, and if you have the means, set up your own personal small gym. Then, you can work out whenever and not have to bother with the membership or travel debt. Now, I fully know this is easier said than done. I'm just using this example to spotlight how removing debt can have a positive impact on your long-term plan.

But at the end of the day, that's not the problem. People know that debt is bad, they just have a hard time noticing it. That, or they're too lazy. It's much easier to pay a sum than to do the hard work yourself. Saving money and being frugal is not for everyone. But it is the easy track for gaining wealth.

Thank you for stopping by. ❤️

Image source 1 | Image source 2

Follow me on my blog atyourservice

Posted Using LeoFinance Alpha

Posted Using InLeo Alpha