Welcome to my Not financial advice – September 2022 post!

Hi everyone!

To be totally honest, I just haven't been paying attention to the markets or anything for the last month... so I don't even know what I'm going to find in this post... hopefully something useful hey.

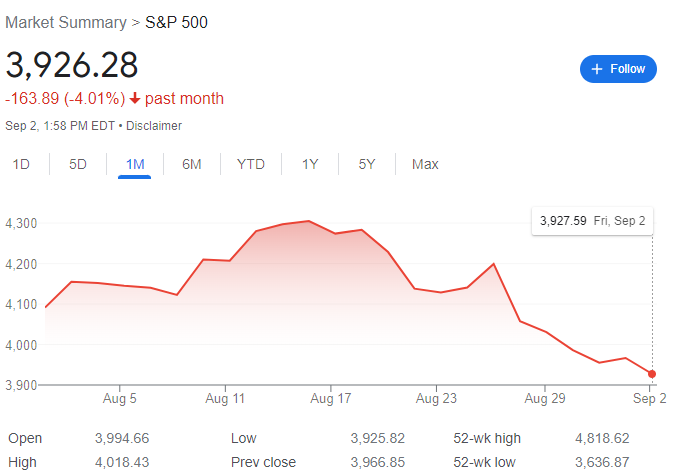

It was exciting seeing a little bump in the markets in my Not financial advice – August 2022 but I did say that was temporary... and I was not wrong.

Let's look at the S&P 500 for the last month...

It's been quite the rocky road... the US Fed usually makes an announcement on their FOMC meetings and then about 3 weeks later they release the minutes... which was August 17th. I think that was the cause of that mid-month hotness... I'm not sure what caused that spike around the 25th, but the subsequent cooling I'm sure is just the impact of higher interest rates.

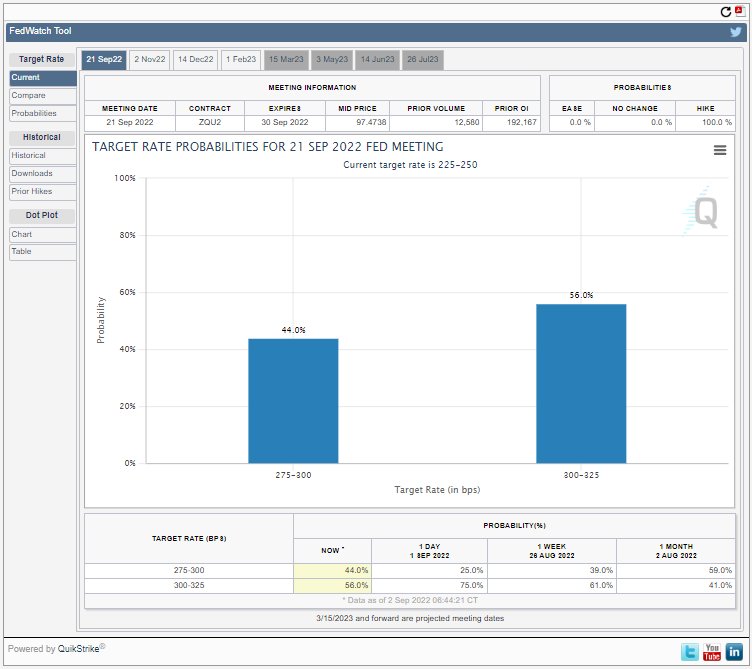

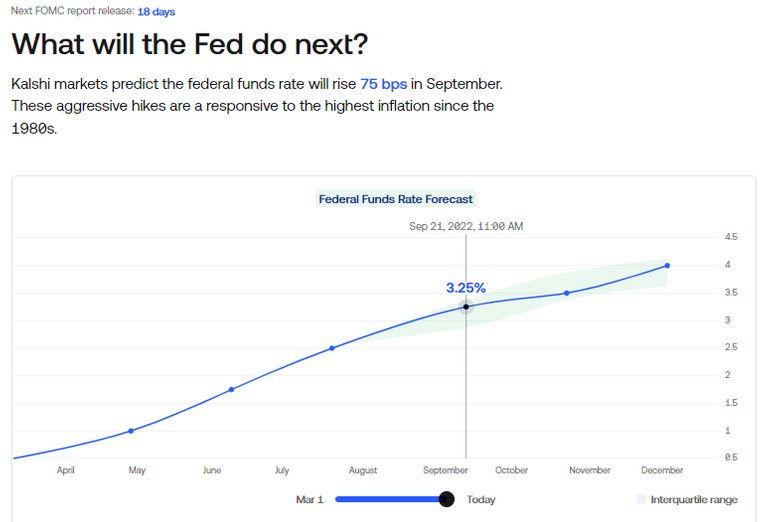

The next FOMC meeting is in 18 days, and the market is really quite split on whether interest rates are going to go up by 25 or 50 basis points...

The above data is gotten by surveying institutional investors.. however on Kalshi, people literally bet their money on market movements and they're currently predicting a much more aggressive move by the US Fed:

Be interesting to see who is right... I wish I had been tracking both this entire time...

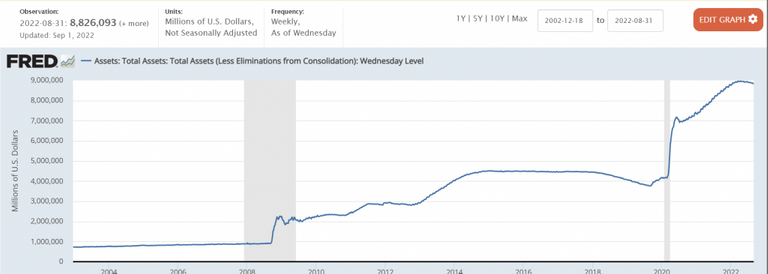

Not only are interest rates still rising but the US Fed is slowing not-renewing the assets on it's balance sheet:

It's still not actively selling, and honestly, I'm not sure that it will anytime soon. I think the markets would need to be doing extremely well for them to actively sell assets off, and I don't expect assets to do so well in the next year/18 months.

I know lots of people were talking about the Biden Administration Student Relief Plan will worsen inflation, but I just don't think that is true. Students will need to start repaying their debts on January 1st 2023, they haven't been paying since March 2020... Considering the US Government collected $70B in 2019 off student loan repayments that's a lot of money suddenly being unavailable for purchasing goods and services.

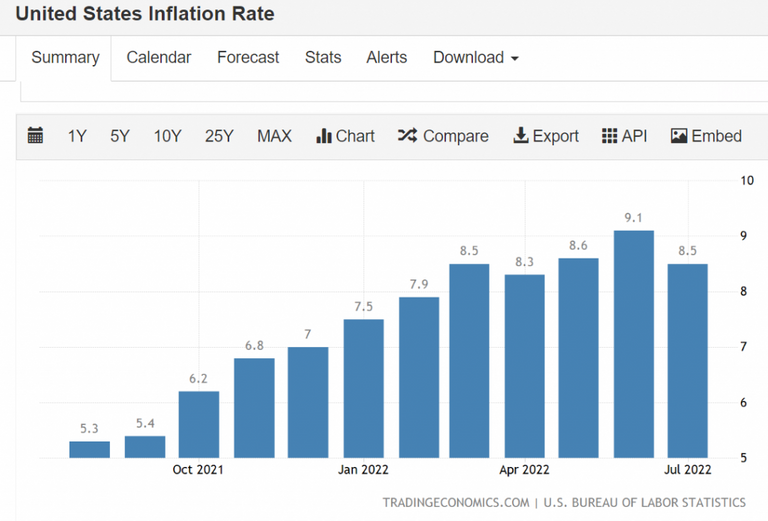

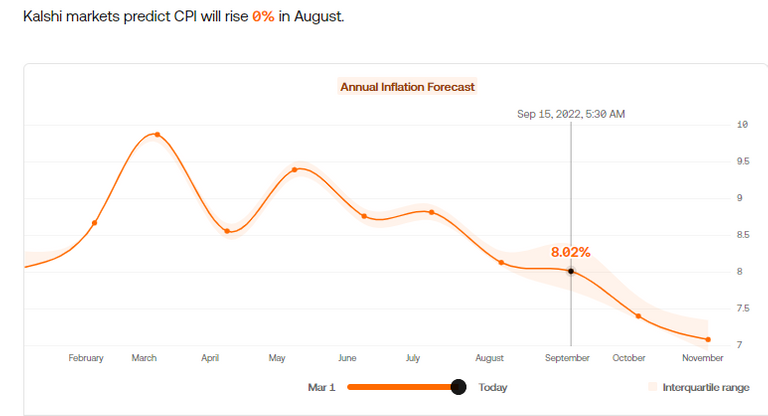

I'm still confident that inflation will be heading south...

And I'm not the only one...

I really do think that it's the higher prices of the big things (especially energy and grain) and constant talk of recession (as well as continuous expensive extreme weather events) that will bring down inflation... along with the continuous innovation by tech companies and entrepreneurs solving problems and trying desperately to reduce costs.

So what does all this mean?

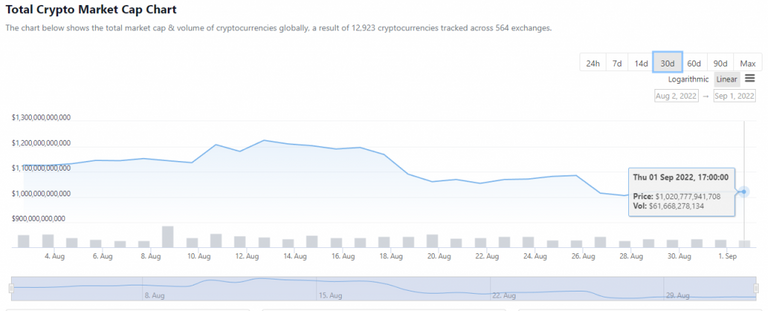

To me, it means that stocks and crypto will continue to fall in price, slowly but erratically. It's a good time to buy as long as you can avoid selling for, say, 2 years...

I do see that a few people think that the BTC bottom is in... and that might be true...

... personally, I don't think we have. I'm guessing that we'll drop lower over the next few months or just continue to bounce around the 20-22K mark...

Obviously it's possible that the ETH merge in 4 days will bring some enthusiasm back to the crypto market as a whole... but I'm guessing that'll be mostly short lived. Let's grab an ol ETH screenshot just in case I'm wildly wrong...

I do think the ETH merge and the move to Proof of Stake will be better in the long run, but I just don't think it's going to change too dramatically...

(html comment removed: wp:heading )

What am I excited about?

(html comment removed: /wp:heading )

KOINOS!

Their latest testnet looks absolutely amazing! I want to set up my own testnet this weekend... and their mainnet isn't too far away now. I'm guessing before the end of the year.

If you don't hold any KOIN yet, I would recommend getting some, even if it's just a little bit, before they hold the snapshot (no date yet). You'll need MetaMask and Uniswap to get it here:

https://info.uniswap.org/#/tokens/0x66d28cb58487a7609877550e1a34691810a6b9fc

I definitely feel like everyone is still sleeping on Koinos:

... which makes sense... they refuse to pay influencers to shill their blockchain.

To me, this means that it might remain a bit of a secret until applications really start building on it and using it. The applications will essentially (if they have stake) run blockchain transactions for free. Miners will be able to run the network using a Proof-of-Burn consensus algorithm that is unique and attempts to be way more fair and equitable than the other consensus algorithms. It's an interesting approach and I'm curious to see how it goes. I have every intention of setting up a mining rig for Koinos.

I'm also even more excited about SPLINTERLANDS!

Things have absolutely changed in the last month.

Players are no longer winning DEC in their game rewards... they are winning SplinterShards instead:

I won $0.14 from winning this particular game.

What's really interesting about the developments in the last month is that the supply of DEC is going to be reduced by 80%.

You can now only get DEC by:

(html comment removed: wp:list )

- Renting out cards

- Ranking really high on the ladder (although I think this will change)

- Being involved in the liquidity pools

The really, really clever bit is that you can swap a $1 worth of SPS for 975 DEC. What this means that if the price of 1000 DEC ever gets above $1.25, then you can burn SPS for DEC and sell DEC on the markets for a profit.

The aim is to keep 1000 DEC to be worth $1... and if 1000 DEC goes higher than $1.25 then players will start to flood the market with it (all while reducing SPS supply) to profit... bringing the price back down. I can't wait to see it in action, it all sounds really well thought out.

I am involved in the liquidity pools myself and I'm kicking myself that I didn't get in earlier... the APRs were pretty high at the start, and were still good when I got in, but they're now so popular that these are the numbers:

Hmm, that might be hard to see:

DEC-DAI - 38.33% - $429,089.50

DEC-SPS - 7.18% - $1,145,079.47

VOUCHER-SWAP.HIVE - 60.88% - $413,308.50

SPS-DEC - 43.61% - $1,153,876.89

DEC-BUSD - 30.13% - $545,939.81

SPS-BNB - 72.64% - $1,385,476.47

SPS-WETH - 87.43% - $1,151,216.70

DEC-SWAP.HIVE - 55.37% - $297,028.56

SPS-SWAP.HIVE - 70.19% - $1,433,876.07

The current provision of tokens to these pools are:

(html comment removed: wp:list )

- 1.5M SPS / Month - SPS-BNB Pool on PancakeSwap (BSC)

- 1.5M SPS / Month - SPS-ETH Pool on SushiSwap (Ethereum)

- 1.5M SPS / Month - SPS-HIVE Pool on Hive Engine (Hive)

- 750k SPS / Month - SPS-DEC Pool on Hive Engine (Hive)

- 375k SPS / Month - VOUCHER-HIVE Pool on Hive Engine (Hive)

(html comment removed: wp:list )

- 20M DEC / Month - DEC-BUSD Pool on PancakeSwap (BSC)

- 20M DEC / Month - DEC-DAI Pool on Uniswap (Ethereum)

- 20M DEC / Month - DEC-HIVE Pool on Hive Engine (Hive)

- 10M DEC / Month - SPS-DEC Pool on Hive Engine (Hive)

[Source]

So, what you're aiming for is the liquidity pools with the most amount of monthly distribution as well as the lowest total amounts (so that your percentage share would be bigger).

That is probably SPS-WETH and SPS-BNB.. and I'm not participating in either because I haven't had great experiences with PancakeSwap (I legit think they've lost my LP funds I was participating in) and I just have no experience with Sushi.

I am participating in DEC-DAI, DEC-SPS/SPS-DEC and VOUCHER-SWAP.HIVE (Thanks Matt!). I've actually been in DEC-DAI for nearly two years, so that's easy (and never had an issue with UniSwap). I do regularly take the DEC and SPS I've earnt and pump it into DEC-SPS and I never actually earn liquid HIVE so I haven't been topping up my VOUCHER-SWAP.HIVE but I love that I'm in it.

When I was originally in the Uniswap WETH-DEC liquidity pool for nearly 2 years I think I did suffer from impermanent loss over that time but with SPS, DEC, Vouchers and SWAP.HIVE I'm honestly not too worried because they're all useful to me. If one goes crazy and leaves the others behind then I'm confident that the Splinterlands company will establish some sort of burning mechanism to help stabilize, ie, introducing new packs or special cards that cost vouchers, SPS or DEC.

The roadmap is so intriguing...

I'm really excited about SPS Validators, Land and Riftwatchers... but I really hope there is a decent amount of time between Chaos Legion selling out and Rebellion being announced. I don't see why there would be... and I do think that'll affect the second-hand market price of CL packs.

Once Rebellion is launched, it will push out Untamed edition cards (and I think Riftwatchers will push out DICE edition cards) from the Modern league so it'll be interesting to see if Rebellion+Riftwatchers cards will be enough for people to hold competitive decks, or will they need CL cards to build out their decks?

If they do... CL packs might have some value on the secondary market after they're sold out... if not, well... the people who bought CL packs as an investment (traditionally card packs have sold for multiple times more on the secondary market after they've sold out) might be in for a shock. They wouldn't be able to recoup their investment... which would make them less likely to invest in Rebellion packs for resale.... decreasing demand.

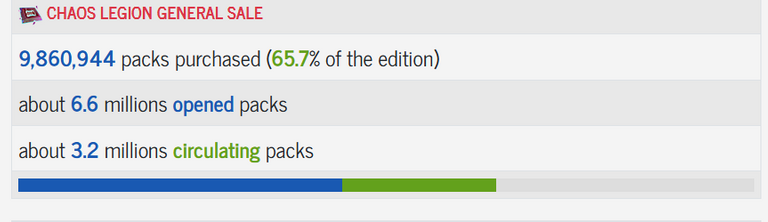

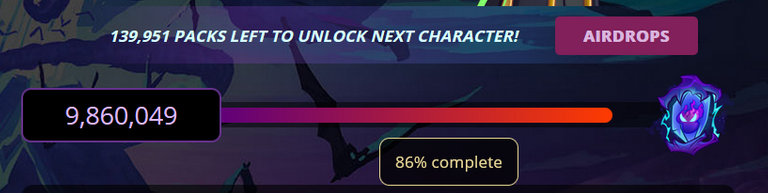

I do wonder what the demand for Rebellion will be like, especially if there are lots of people who bought CL packs hoping to take advantage of the CL airdrops and then offload them for a profit. There are currently 3.2 million unopened CL packs:

If we assume that about a third of packs remained unopened when the Chaos Legion edition sells out, then there will be 5 million packs hoping to make a profit on the secondary market. That's a lot of supply, and demand might only have eyes for the shiny Rebellion packs.

Ultimately, the playerbase of Splinterlands will have to continue to grow in order to eat up the supply. If the playerbase isn't growing at a steady clip then releasing Rebellion might do more harm than good.

I don't know what's going to happen, but I am super super curious.

Personally though, I just don't have the modern cards to be competitive... I'm waiting for CL to sell out, everyone to open their packs to get all the CL airdrops and pick up the cards I want for cheap.

As you can see below, I am currently, a wild boy:

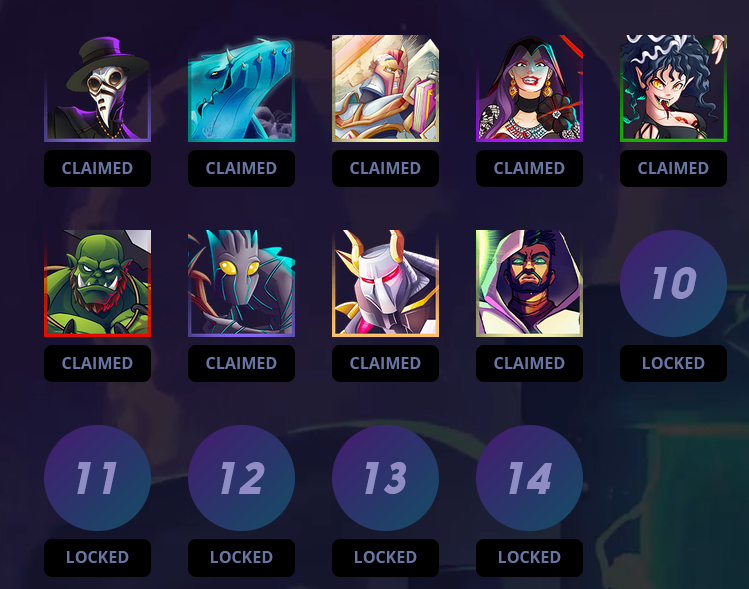

At this point we are getting super, super close to the 10th CL airdrop card being distributed:

We've hit that tricky stage where enthusiasm might kick in and they might disappear overnight, or we still might be a couple of weeks away...

I'm definitely nervous about this particular card. One of my favourite team builds is a heavy armour deck that focuses all the attacks to my tank who is being healed and re-armoured while the rest of the team does damage... and Conqueror Jacek will completely disrupt all of that. I mean, he straight up seems designed to destroy that type of build with both Piercing (treats armour like health) and Scattershot (ignores taunt) and is super, super fast. I might be in for some pain...

After this newest Conqueror Jacek airdrop, Splinterlands will officially be 2/3rds through it's Chaos Legion sale. I'm also curious to see how Riftwatchers affects pack sales too. Riftwatchers will be a small complementary edition that the Splinterlands Inc company won't make any money on... it's designed to increase enthusiasm and burn SPS and Vouchers. I'm sure there will be Riftwatchers airdropped cards that will help motivate people to burn their SPS to buy Riftwatcher packs.

I have to admit, I'm not pumped at the idea of selling my SPS, for, well, anything just at the moment.

I know, however, that I'm not going to not buy Riftwatcher packs.

Lots to be excited about!

I'd love to learn what you're pumped for! Thanks for reading my ridiculously lengthy Not financial advice – September 2022 post!

Posted Using LeoFinance Beta