Hello good people of leofinance, hope it has been going well for you as we all approach the end of the year, it has been discovered that there were major crypto crashes this year and as regards, I will be sharing some useful financial guidelines as regards crypto investment.

Useful tips for investing in crypto.

Carryout your personal research

This is the most important of all tips as it will help to understand the performance of an asset if it’s the safest time for investment or not. In this research, you need search on popular social media news site about the asset performance.

What I do is search on twitter using hash tags about recent tweet made by the crypto company and correlates it with the performance thereof.

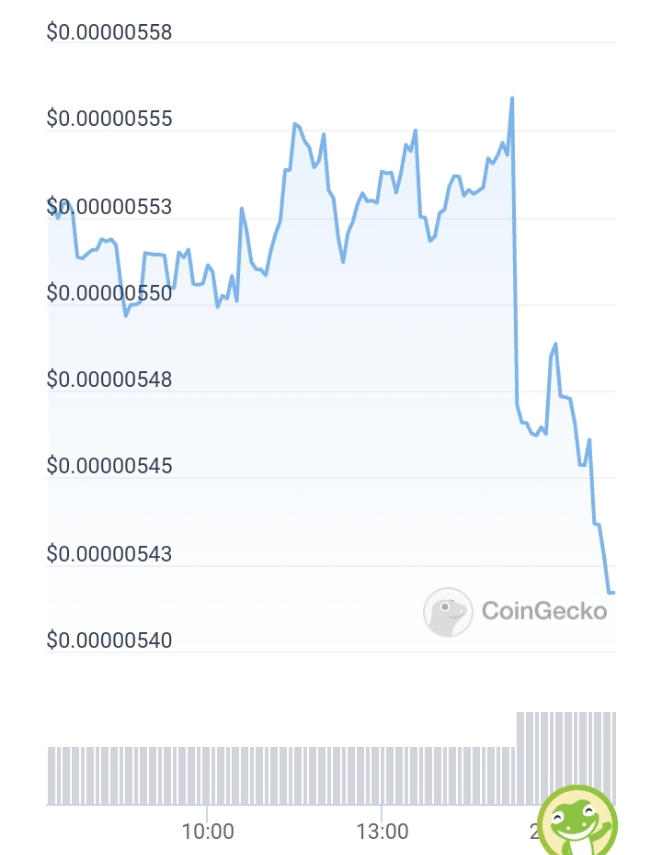

I am very careful in selecting the type of investment I choose, I am also grateful for crypto market indicators such as coin market cap of coingecko.com which keeps track record of all events which had happened on a crypto asset right from the beginning.

It is advisable to not to invest in an asset with a zig-zag graph. I will explain why. The zig-zag graph represents instability in price. Probably in the same day, the price could pump and dump at same rate. If you really want to make some good returns upon your investment check for graph with low zigzag plots.

Estimate your investment

It is necessary at this point to estimate the amount you wish to invest. I do not advice one to invest all of savings or income into a particular project because it might seem like a dream when your funds will be gone though I don’t wish even my enemy that but it is essential to invest what if you lose it wouldn’t become a burden of thought to you.

It is not advisable to invest a loan into crypto.

What you do with loans is to use for a current business you know in a short period of time will yield profitable output if you are already in it, the better it will be than starting afresh.

Do well to monitor progress on your investment

This may be quite stress full though but it is essential to keep track on your investment in order to know when to cut trade and work out liquidity. Some people may choose to the long term investment plan which involves setting a reminder about their investment in 5- 6 years’ time and they care less about the progress of their investment. It good to understand there are some times advisable to pull out from long term investment especially if the price hits a bear market.

Whilst you monitor the progress again for some time before you go back to trade.

Analyze your profit and compare to loss

In crypto trading, it is essential to analyze how much profit you have been able to make after your conviction in purchasing a particular asset. This will help you keep track record of your investment progress.

Crypto trading is one of the good ways to make income but how you get to plan your investment determines the success of it.

Thanks for reading; I wish you all a progressive day.