Greetings to you friend, how are you doing today. I trust you and your loved ones are doing very fine. I am so excited to share with you another interesting topic about finance, just as we did in our previous topic when we discussed Crypto Profit Calculator. In today topic, we will be looking at Profitability Ratios.

canvas design

Profitability Ratios are used by financial analysts, accounting gurus, Investors, traders, CEO of company crypto traders etc. to measure and evaluate the ability of a company to generate profit (income) relative to revenue, statement of financial position, shareholders funds equity and a lot more during a specific accounting period of time.

With proper understanding of profitability ratio, you can be able to measure the ability of a company to generate income. As a crypto trader, or an investor, you can use ratio to understand your business, by evaluating the performance of your business or the company you are working with.

Ratios is usually what is used to determine the growth of a company, i.e. the performance of a company. In checking the performance of a company, a higher ratio simply means the company in the performance is more efficient as it is producing profit for its shareholders, than a company with low profitability ratio.

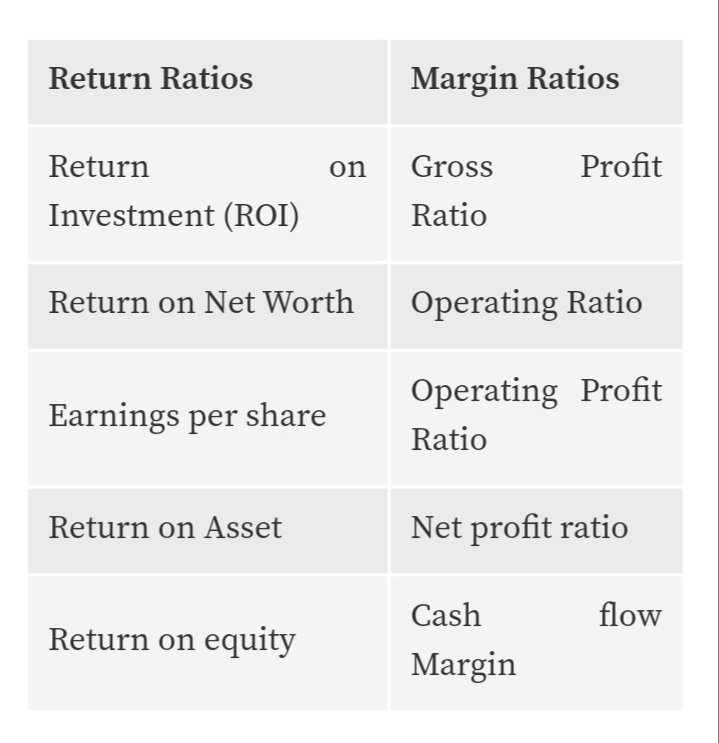

Types of Profitability Ratios

Profitability ratios are categorize in two different types and they sub-category which are use by company to measure company performance and financial well-being. Here I have categories the type of Profitability ratios used by financial analysts...

Return Ratios: This is the type of Profitability ratio that represent the ability of a company in generating profits (returns) to its shareholders. In this type of ratio you will get to see the following: return on investment, equity, assets, retained earnings and so on.

Margin Ratios: This is the type of ratio where a company has the ability to convert sales into profits in different ways. A good example of this type of ratio are gross profit margin, operating profit margin and so on.