China, love it or hate it, is the second-largest economy in the entire world. With great GDP comes great spending; China spends a lot of money every year to buy all sorts of commodities, turns them into cheap made-in-China goods, and sells them to every corner of the world. I don't have to be an economist to know that China's mercantilism is thriving; they earn profit by minimizing imports and maximizing export. They have many ways to make made-in-China products appealing to foreigners, including deliberately depreciating the value of CNY and stealing intellectual property. Whether or not it is morally right, China profits greatly from global trade.

[https://tradingeconomics.com/china/balance-of-trade]

Despite the absurd zero Covid policy lockdown and housing bubble, China's trade surplus reached an all-time high in July of this year and shows no signs of slowing down.

You don't just keep your money in the bank if you're rich. Most wealthy people diversify their wealth into many assets and security, not just cash. The same goes for China; it must spend its trade surpluses on a monthly basis and diversify them into various assets.

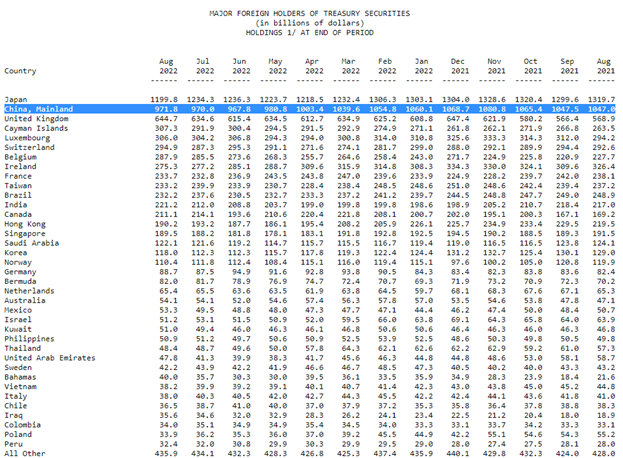

[https://ticdata.treasury.gov/Publish/mfh.txt]

China used to spend a lot of its trade surplus buying U.S. debt, but that is no longer the case because China knows the U.S. debt is subject to the control of the U.S. government. If the West can impose sanctions and freeze Russian assets, they can certainly do the same to China if it doesn't follow their rules.

The U.S. bond market has a market cap of $46 trillion. In contrast, the market cap of gold is about $10 trillion, and the stock market is about $20 trillion. Given China's desire to minimize its treasury holdings, it's not a surprise that a large portion of the treasury money will move into other asset classes, such as Bitcoin.

The Bottom Line

China is not a fan of Bitcoin, but they are now hoarding it in order to escape the U.S. Treasury. Meanwhile, China is always a buyer of gold and silver. Now imagine half a trillion dollars of treasury money outflow to other assets; a huge portion will flow into silver and gold.

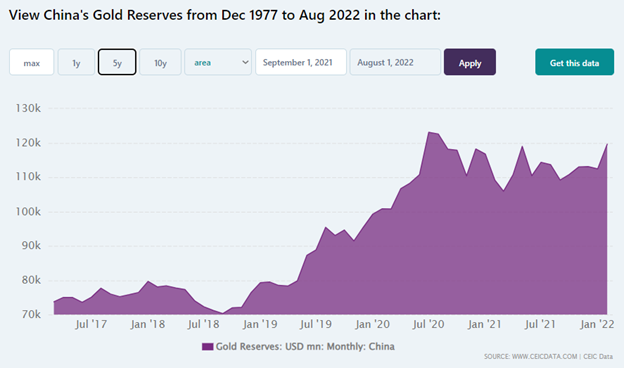

[https://www.ceicdata.com/en/indicator/china/gold-reserves]

As more of China's money leaves the U.S. Treasury, I predict that its holdings of gold will hit an ATH in the upcoming year.