[Bloomberg: Silver sentiment hits a multiyear low]

I spent a considerable amount of time discussing mean reversion. Everything in the world follows the rule of mean reversion (kinda). When a rubber band is stretched, the amount of effort required to stretch it further increases as the band is elongated, and eventually, it will bounce back. This reminds me of tolerance in the human body. The term “tolerance” refers to the human body’s reduced response to a drug or medication, which develops as a result of continuous drug use; whatever drug you give it, our body will inevitably get used to it and if you stop taking the drug, the tolerance will bounce back. I believe that the same concept applies to trading and investing as well, in which, during a bear market, we will eventually become used to the low prices of assets and the prolonged downtrend before it bounces back up again. Here’s a meme that explains the phenomenon:

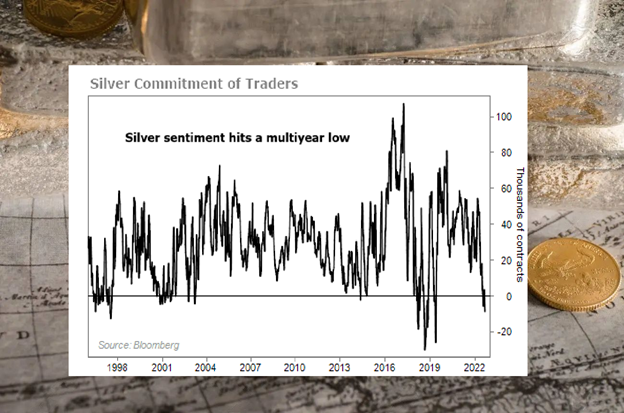

The above meme may also be explained using Bitcoin, where the majority of people bought $BTC when it was trading at 69k but have since lost interest because it is currently trading at 19k. We have become accustomed to the downward trend and extrapolate based on our most recent experiences in the market. During a bear market, investors always end up being overly pessimistic, and in the end, they give up on the idea of buying the dip. That’s why you’ll always see people buy high and sell low or sell low and buy high. Taking a step back and looking at the situation from a more holistic perspective is the prudent thing to do. What went down will someday go back up, and vice versa; this is a general rule that holds true for important natural resources with a high intrinsic value, such as silver.

I know that means reversion is kinda controversial, and many criticize that it’s unreliable; the mean reversion always works until it doesn’t. The central argument of the skeptics is that, eventually, all tradable assets will fall to $0 at some point in the future; entropy is inevitable. But trying to predict when a fundamental commodity like silver will fall to $0 is a waste of time because it is highly unlikely that this will occur during our lifetimes.