Oh, here we go again—that time of the month. #FOMC is trending on Twitter, and whatever the Fed decides will undoubtedly have an effect on the market prices of everything. The Fed will decide whether to raise interest rates by 50 bps or 75 bps in a few hours. Perhaps they will just hike the rate by 1%; in that case, the market will undoubtedly tank.

#FOMC is trending on Twitter

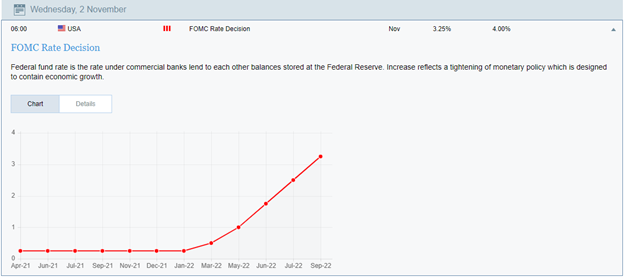

Today the Fed will announce rate decision. [Source: https://www.fxpro.com/trading-tools/forex-economic-calendar]

The markets (crypto, metals, forex, or stocks) will respond to the rate decision based on the percentage of the rate increase. The entire market will pump if the rate increase is < 0.75%. If the rate hike is > or = 0.75%, then the market is going to slump further. I’m going to predict that the Fed is going to raise the rate by at least 0.75% due to the fact that U.S. GDP grew at a 2.6% pace in Q3, which is better than expected. I sound like a broken record now, but the thought process of the market participants is very simple. Markets respond positively to loosening monetary policy and negatively to tightening monetary policy. The Fed must balance inflationary and deflationary pressure since too much of either can be harmful to the economy.

Silver Market

Currently, silver is trading just above the strong supports. Even in the worst-case scenario, I don’t believe silver will break the support this year; even a 1% rate hike shouldn’t be enough to shatter silver’s strong support in the short term. Silver is volatile, but not that volatile; I don’t think a drop of over 10% in a few days and breaking the support is a plausible scenario.

On the other hand, if the Fed, for whatever reason, decides to just increase the rate by 50 bps, silver may be set to break out further over $20. Not financial advice, but the technical analysis of silver indicates a “buy.” However, in the end, we must consider various factors, such as geopolitical and macroeconomic ones, to determine whether the bull market is near or whether silver will fall into a prolonged economic winter.