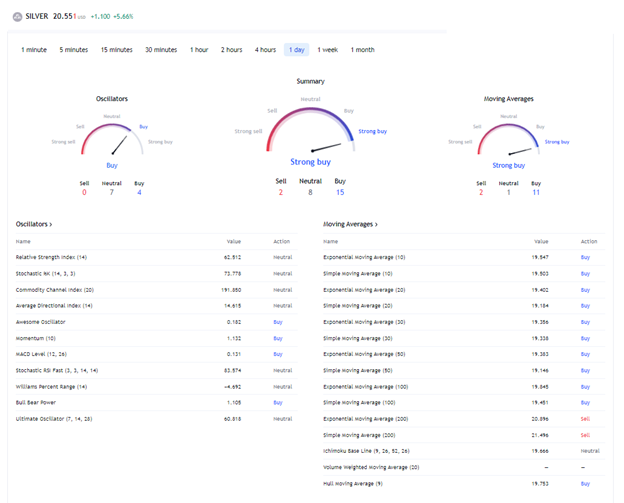

I was ready to start writing a piece about the rising unemployment rate in the U.S., but something else caught my eye. The technical analysis of silver by TradingView indicates a strong buy! What exactly does that mean?

Silver price increased by 5% today. That's a good sign, but in my opinion, silver hasn't broken out of the choppy trend yet. My prediction is that silver will "crab" between $18 and $22 until the end of this year. I'm not sure how much the midterm election will affect the pricing; I doubt it will have much of an impact. I think silver will not break out of this sideways trend in such a short amount of time unless bombshells (such as quantitative easing or escalation of the war) emerge.

[https://www.tradingview.com/symbols/TVC-SILVER/technicals/]

On the other hand, TradingView TA is super bullish on silver (daily timeframe). They determine whether an asset is a "buy" or "sell" by calculating the oscillators and moving averages of the asset. For instance, if the Relative Strength Index (RSI) of an asset is below 30, it indicates "buy." While an RSI of over 70 indicates "sell". TradingView calculates 11 oscillators and 14 moving averages; if an overwhelming majority of indicators show "buy", then they summarize that to "strong buy".

I'm sure the TradingView TA isn't perfect. I mean, the indicators used in the TradingView TA have received their fair share of criticism in the past. In general, indicators are not very good at predicting the price movement of any asset. Even TradingView made it clear that the signals from their indicators do not represent financial advice. Even so, it's intriguing to see that so many of the well-known indicators simultaneously show "buy" signals.