PolyCUB is the newest addition to the CUB Defi family. Polygon CUB extends the ecosystem from Binance Smart Chain to Polygon.

An allocation is dropped to holders of CUB over a period of 60 days. Airdrop period is quickly approaching the end. The token is currently experiencing a rapid inflation phase. Initial inflation started out at 5 PolyCUB per block (every 2 seconds) and already dropped to 1 tokens per block.

xPolyCUB is now a governance token which will control future decisions about the PolyCUB ecosystem:

Introducing xPOLYCUB Governance | First Vote: Reduce the Locked Claim "Power Down" Window.

The first governance action was to shorten the penalty period for claiming incentive tokens from 90 days to 30 days.

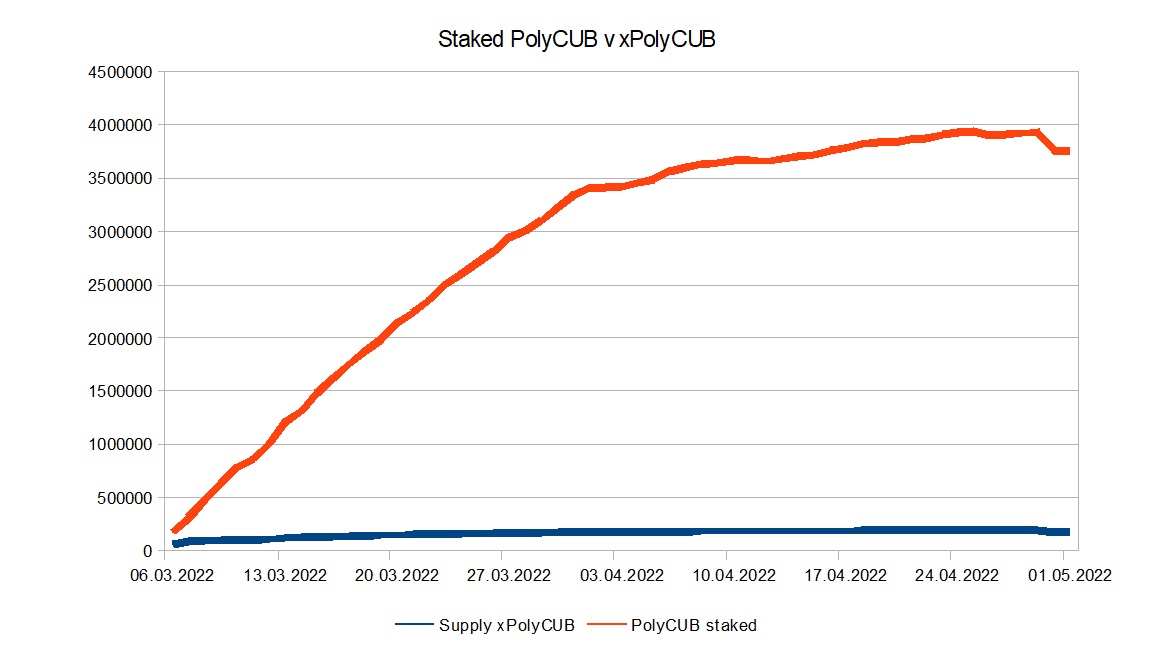

The growth of staked PolyCUB has been slowing down:

| xPolyCUB | Growth xPC | staked PolyCUB | Growth | |

|---|---|---|---|---|

| 13.03.2022 | 118039 | 1155480 | ||

| 20.03.2022 | 147146 | 125 % | 2143376 | 185 % |

| 27.03.2022 | 165587 | 113% | 2946201 | 137% |

| 03.04.2022 | 174638 | 5% | 3414844 | 16% |

| 10.04.2022 | 182071 | 4% | 3659610 | 7% |

| 17.04.2022 | 185563 | 2% | 3799559 | 4% |

| 24.04.2022 | 189549 | 2% | 3923194 | 3% |

| 01.05.2022 | 178707 | -6% | 3746506 | -5% |

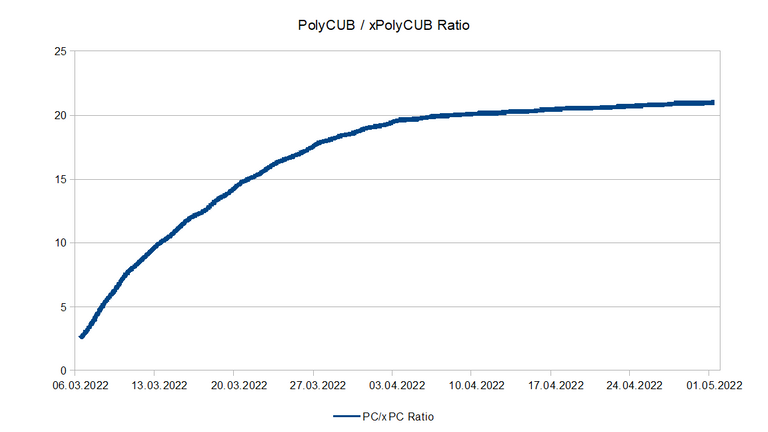

Ratio of staked PolyCUB to xPolyCUB:

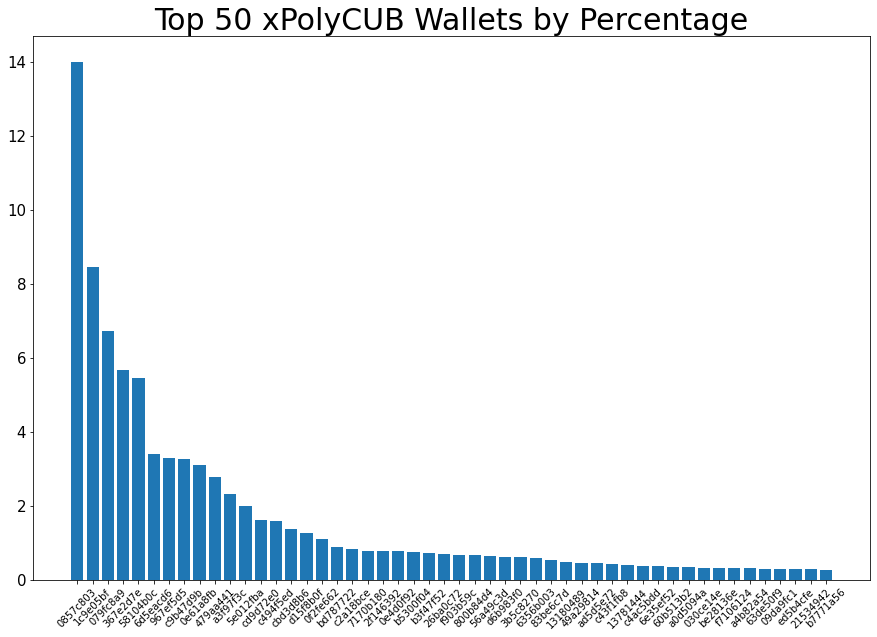

Top 50 accounts ordered by percentage:

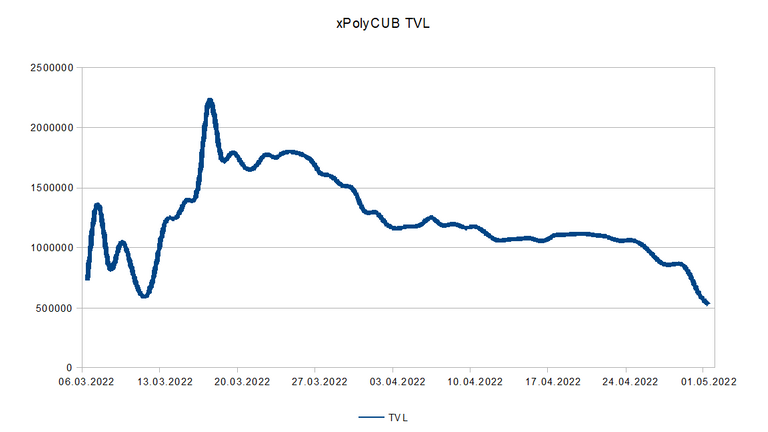

As of March 1st, total PolyCUB supply is 5'507'804. Of those, 68% is staked in the xPolyCUB vault, which is an equivalent of 524'511 Total Value Locked (TVL) in the xPolyCUB vault:

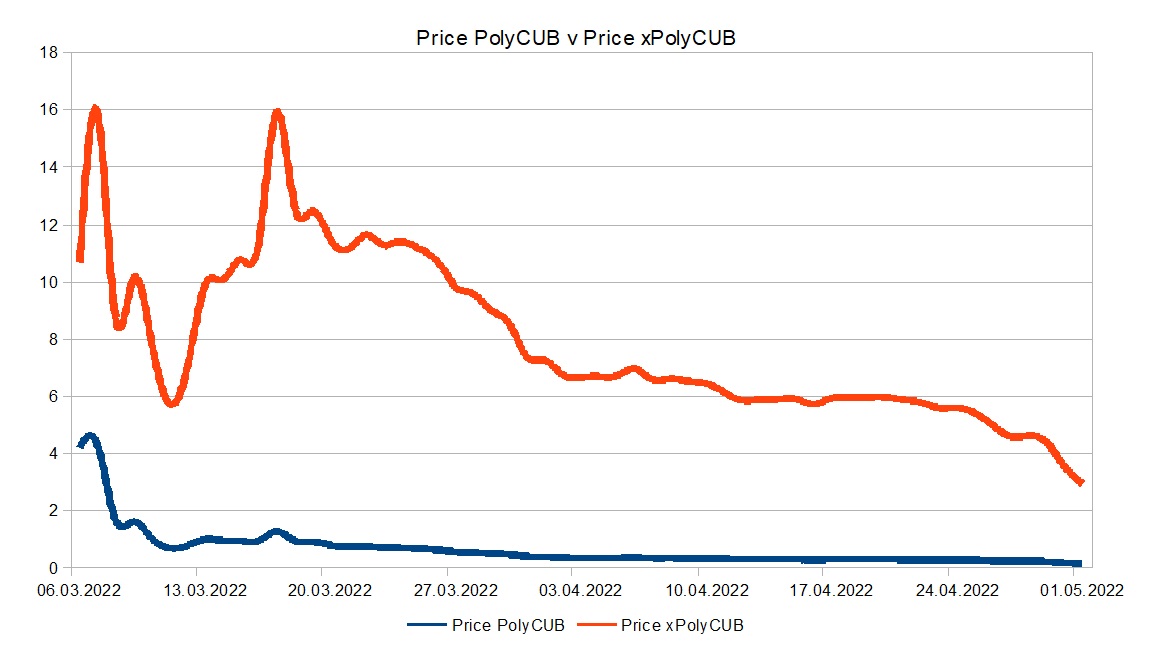

Price of PolyCUB and xPolyCUB over time:

Data taken during airdrop claims.

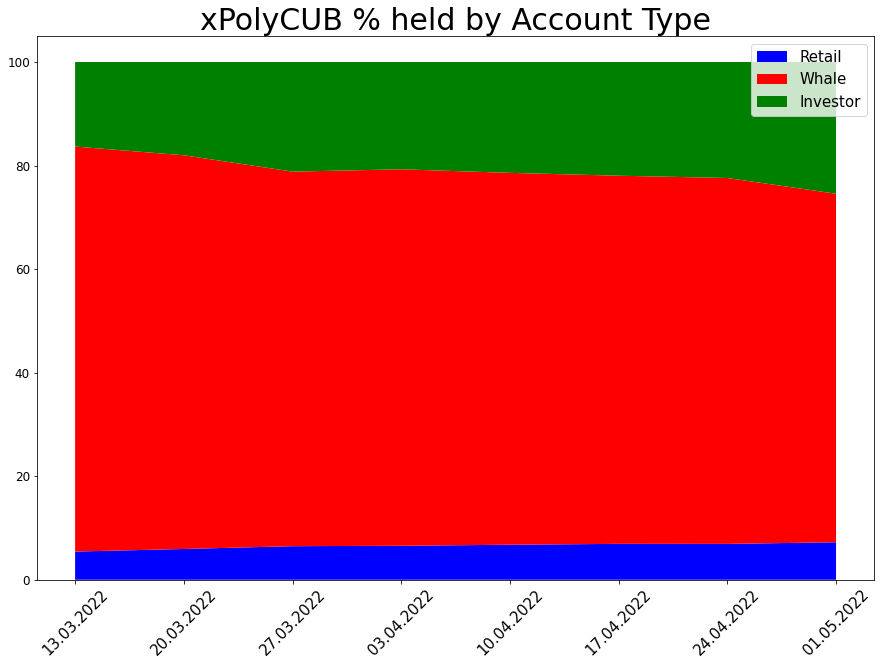

Stake Distribution

Account classification

- Whale = Accounts holding > 1% of total supply.

- Investor = Accounts holding between 0.1% to 1% of total supply.

- Retail = Accounts below 0.1% of total supply.

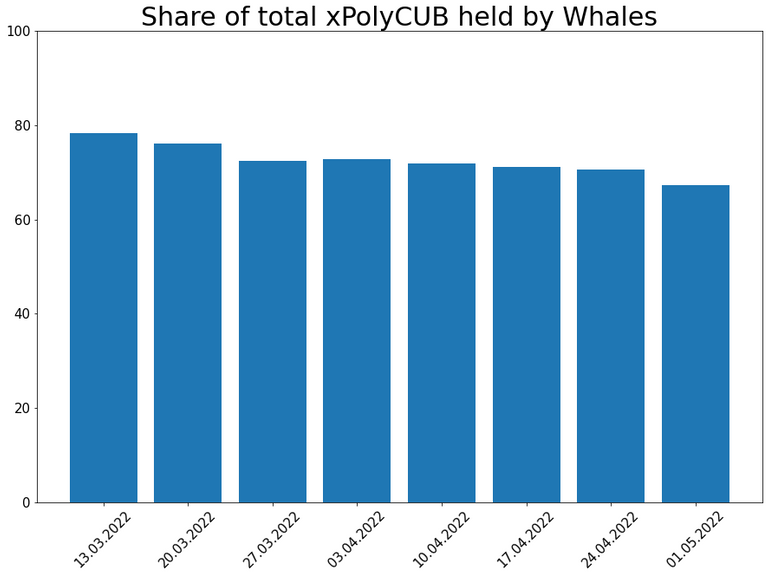

Whale Domination describes the share of tokens whales hold.

A few tokens for comparison:

| Token | Domination [%] |

|---|---|

| DASH | 4 |

| ETH | 14 |

| HIVE | 40 |

| DOGE | 45 |

| BTC | 63 |

| VET | 74 |

Distribution as of March 1st:

| Whale Domination % | Investor % | Retail % |

|---|---|---|

| 67.32 | 25.44 | 7.24 |

A whale domination percentage of 67% is extremely top heavy, but it is early times and domination has been dropping from 76%.

Stake percentage held by account type over time:

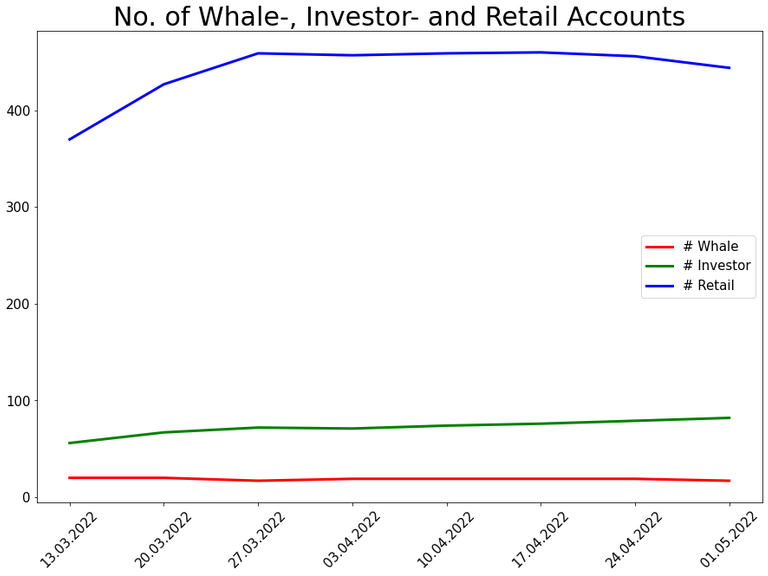

Out of a total of 543 xPolyCUB addresses there are:

| # Whales > 1900 xPolyCUB | # Investors | # Retail < 190 xPolyCUB |

|---|---|---|

| 17 | 82 | 444 |

Number of wallets holding Koin sorted by whale, investor and retail:

xPolyCUB distribution across accounts:

| Max | Mean | 3rd Quartile | Median | 1st Quartile |

|---|---|---|---|---|

| 25000.00 | 3450.56 | 104.13 | 19.66 | 4.04 |

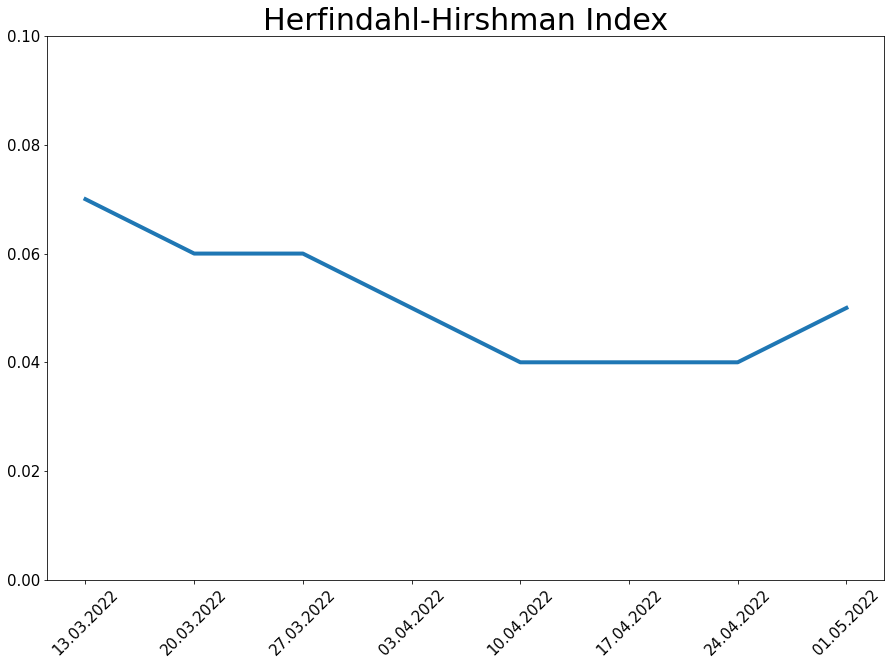

The extremely large difference between mean and median balance shows a strong concentration of assets in the top quartile. Although still very lopsided, the distribution is slowly improving, which can be observed by the Herfindahl–Hirschman Index (HHI):

The HHI is a measure of industry concentration or competitiveness. Increases in the Herfindahl index indicate a decrease in competition. The scale ranges from 0 (highly competitive) to 1 (monopoly). In practice, a value over 0.25 already signifies high concentration.

Data source: polygonscan.com

Vote for my witness: @blue-witness

Posted Using LeoFinance Beta