PolyCUB is the newest addition to the CUB Defi family. Polygon CUB extends the ecosystem from Binance Smart Chain to Polygon.

An allocation is dropped to holders of CUB over a period of 60 days. The token is currently experiencing a rapid inflation phase. Initial inflation started out at 5 PolyCUB per block (every 2 seconds) and already dropped to 1 tokens per block. Emissions will stay at 1 CUB per block for 1 more week.

Governance Vote

The latest feature is the use of xPolyCUB as governance token:

Introducing xPOLYCUB Governance | First Vote: Reduce the Locked Claim "Power Down" Window.

The first voting window is closing in a few hours.

@onealfa created a post about the state of voting yesterday:

Let your voice be heard

Voting participation at the time of his writing was still low. Only 73 votes were cast. Now there are 78 votes cast, out of a total of 554 potential voters (14%).

Looking at Numbers

One special feature is the option to stake PolyCUB in order receive xPolyCUB. xPolyCUB receives inflation and 50% of the early harvesting haricut.

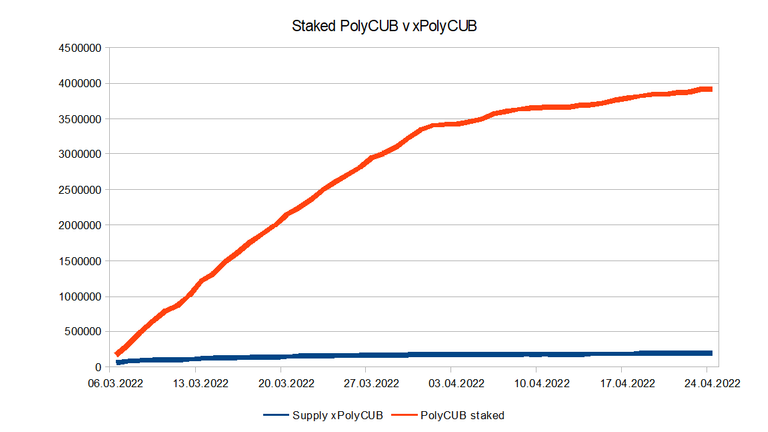

The growth of staked PolyCUB has been slowing down:

| xPolyCUB | Growth xPolyCUB | staked PolyCUB | Growth staked PolyCUB | |

|---|---|---|---|---|

| 13.03.2022 | 118039 | 1155480 | ||

| 20.03.2022 | 147146 | 125 % | 2143376 | 185 % |

| 27.03.2022 | 165587 | 113% | 2946201 | 137% |

| 03.04.2022 | 174638 | 5% | 3414844 | 16% |

| 10.04.2022 | 182071 | 4% | 3659610 | 7% |

| 17.04.2022 | 185563 | 2% | 3799559 | 4% |

| 24.04.2022 | 189549 | 2% | 3923194 | 3% |

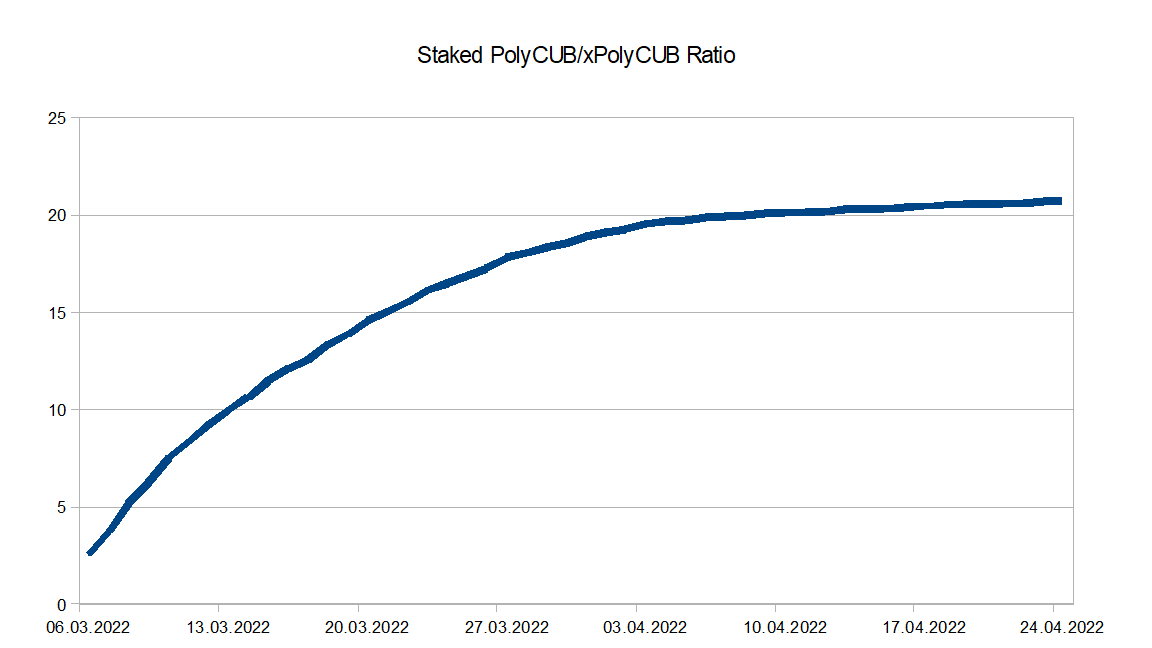

Ratio of staked PolyCUB to xPolyCUB:

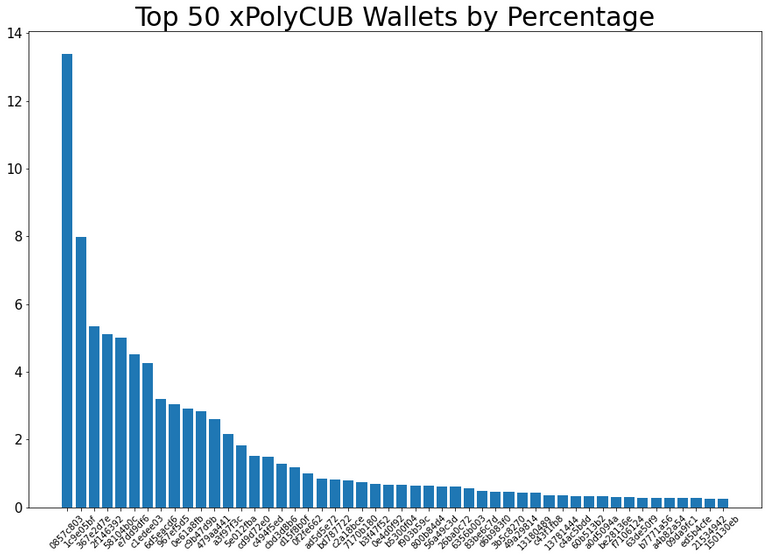

Top 50 accounts ordered by percentage:

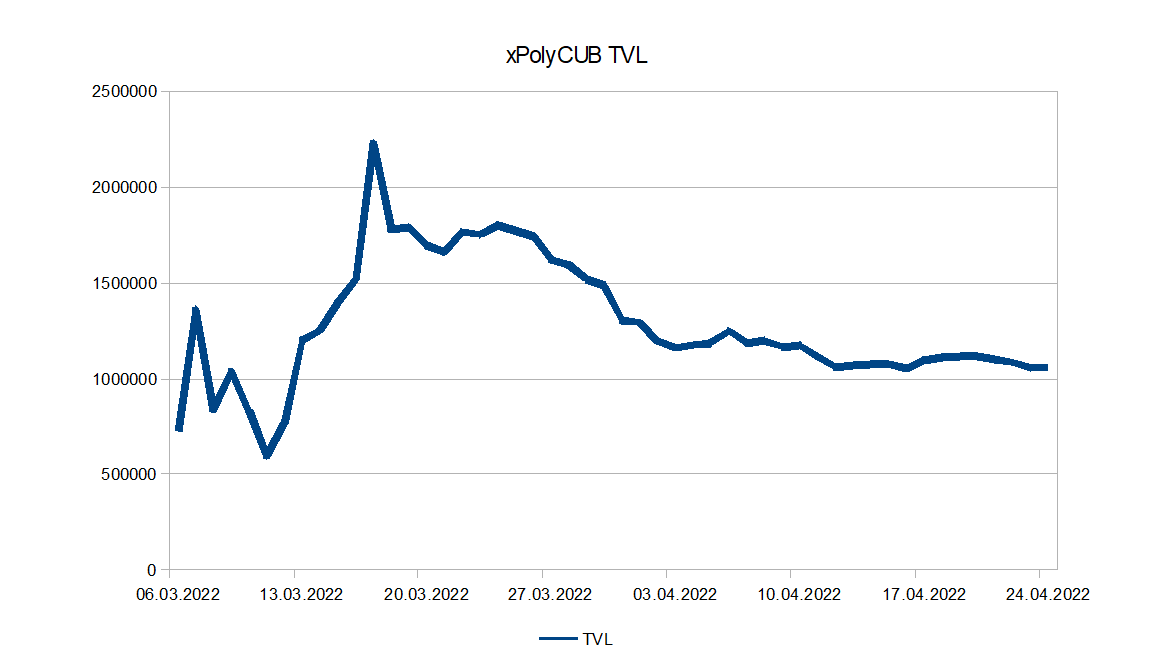

As of April 24th, total PolyCUB supply is 5'369'497. Of those, 73% is staked in the xPolyCUB vault, which is an equivalent of 1'059'262 Total Value Locked (TVL) in the xPolyCUB vault:

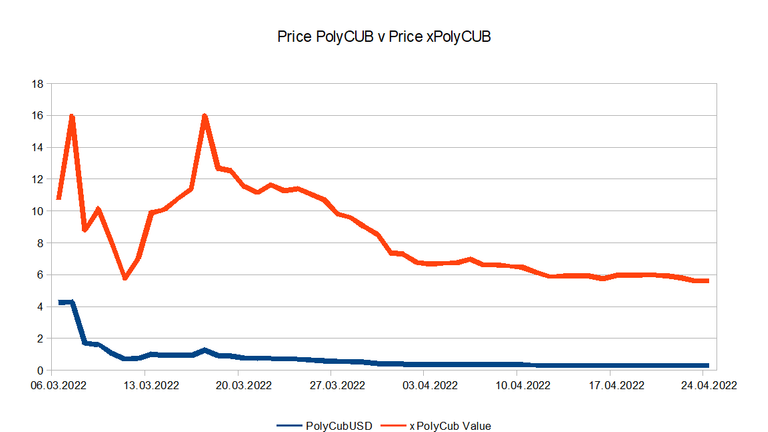

Price of PolyCUB and xPolyCUB over time:

Data taken during airdrop claims.

Stake Distribution

Account classification

- Whale = Accounts holding > 1% of total supply.

- Investor = Accounts holding between 0.1% to 1% of total supply.

- Retail = Accounts below 0.1% of total supply.

Whale Domination describes the share of tokens whales hold.

A few tokens for comparison:

| Token | Domination [%] |

|---|---|

| DASH | 4 |

| ETH | 14 |

| HIVE | 40 |

| DOGE | 45 |

| BTC | 63 |

| VET | 74 |

Distribution as of April 17th:

| Whale Domination % | Investor % | Retail % |

|---|---|---|

| 70.68 | 22.4 | 6.92 |

A whale domination percentage of 71% is extremely top heavy, but it is early times and domination has been dropping from 76%.

Out of a total of 554 xPolyCUB addresses there are:

| # Whales > 1900 xPolyCUB | # Investors | # Retail < 190 xPolyCUB |

|---|---|---|

| 19 | 79 | 456 |

xPolyCUB distribution across accounts:

| Max | Mean | 3rd Quartile | Median | 1st Quartile |

|---|---|---|---|---|

| 25378.46 | 3504.16 | 100.00 | 18.67 | 3.82 |

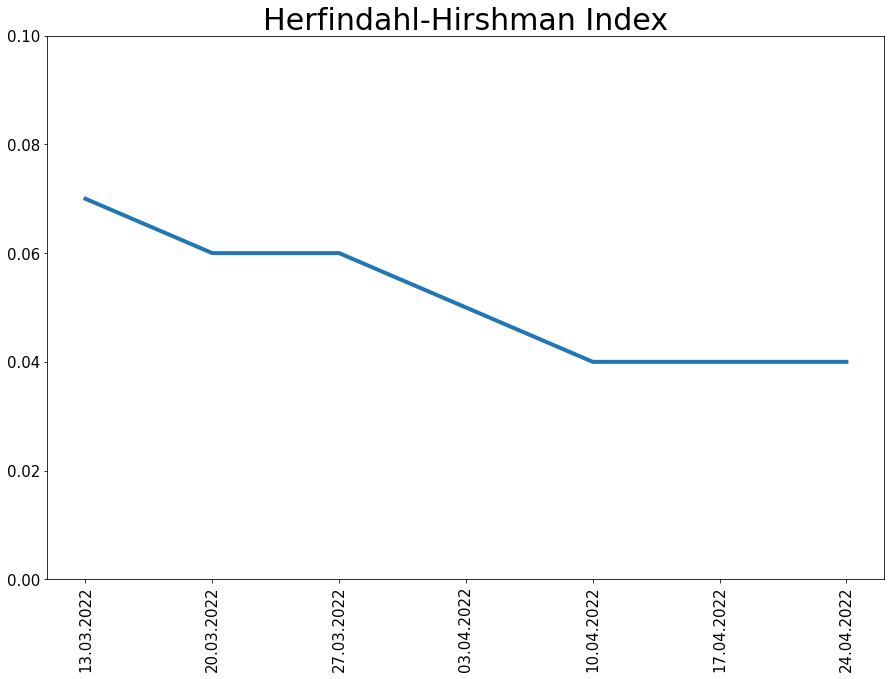

The extremely large difference between mean and median balance shows a strong concentration of assets in the top quartile. Although still very lopsided, the distribution is slowly improving, which can be observed by the Herfindahl–Hirschman Index (HHI):

The HHI is a measure of industry concentration or competitiveness. Increases in the Herfindahl index indicate a decrease in competition. The scale ranges from 0 (highly competitive) to 1 (monopoly).

Data source: polygonscan.com

Vote for my witness: @blue-witness

Posted Using LeoFinance Beta