Let's talk about Solana. The hated and loved altcoin leaves no one cold, as it keeps making headlines repeatedly. By the time of writing this post, SOL was trading at $166 and even briefly crossed the $170 level earlier. I am not taking much profit at this time as my target is still pretty far away and I strongly believe Solana will perform well during the alt season.

Interestingly enough, I find myself writing a lot about Solana topics even though I haven't got a specific favorite chain. There's just so much going on there! In my previous article I was diving into the crazy world of ever-evolving meme coins. This time I'll leave the meme coin scene alone but instead focus on a much safer, or perhaps more sensible way to use SOL tokens.

Sanctum & LSTs

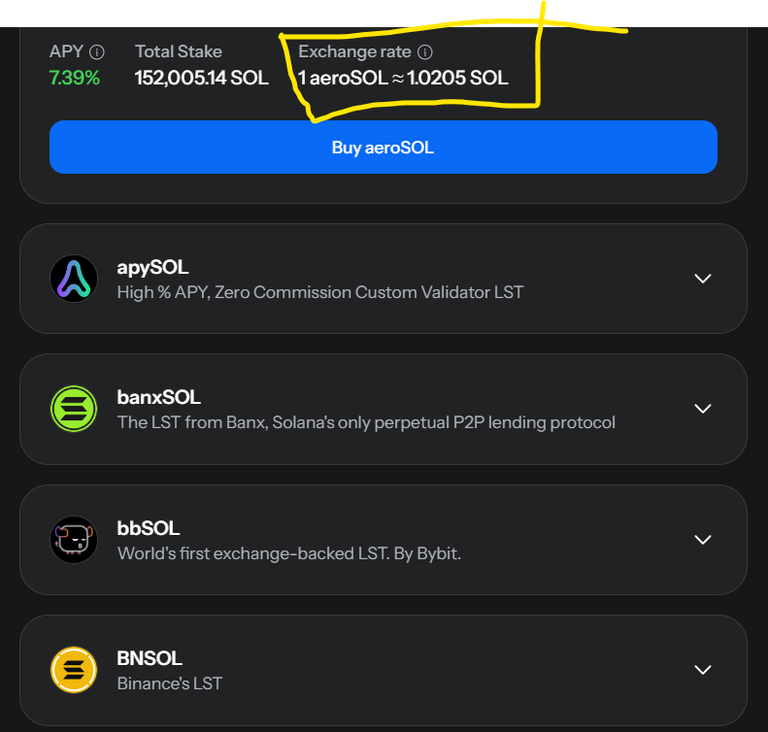

One of my absolute favorite Solana platforms is Sanctum. They are listing a large selection of Liquid Staked Tokens, or in short, LSTs. The idea of LSTs is that instead of just holding your SOL, you can easily stake it by swapping it to one of the LSTs on Sanctum. Instead of it being locked somewhere, you now hold the Liquid Staking Token in your wallet and are free to use it on other platforms as well.

Even by just holding LSTs you'll earn an APY which is typically between 6-10%. How it works is that in time, the exchange rate of LSTSs is growing so if you buy aeroSOL now, it'll be worth more SOL in six months. So no claiming is required, just holding.

I have currently parked my SOL in bbSOL which is backed by the Bybit exchange. The reason for choosing it was a huge APY standing currently at 18.83%. You can also easily swap LSTs to other LSTs on Sanctum so you are not tied to anything if you spot another interesting option.

Other Benefits

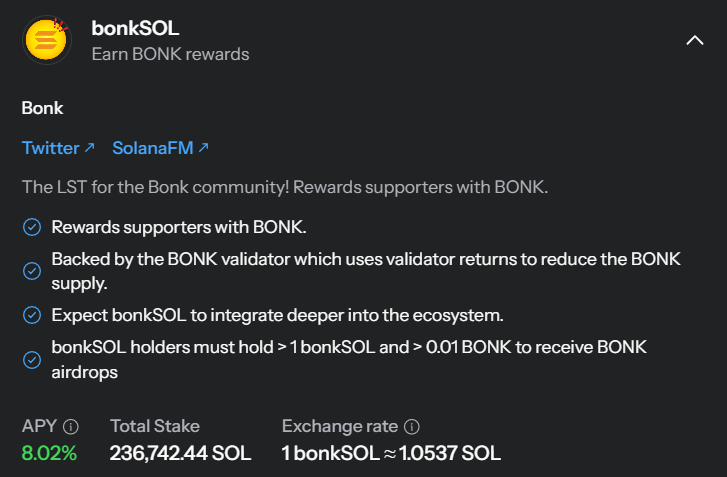

By studying different LSTs I've learned that some of them offer other incentives than just APY. For example, bonkSOL has an APY of 8% but in addition to this, holding >1 bonkSOL & some BONK, you are automatically entitled to BONK airdrops.

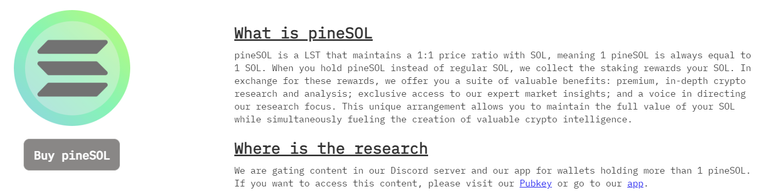

Another very interesting idea of utilizing LSTs comes from Pine Analytics.

By holding pineSOL you will not enjoy any APY rewards but as holder, you gain access to Web3 analytics services that Pine Analytics is delivering. According to their website, they are focusing on DAOs, DeFi, Tokenomics, Dapps, and on-chain events.

To me, this pretty interesting and unique idea. Instead of paying a monthly subscription fee in fiat, you are gaining access to their content by simply holding SOL in your wallet. I think there are platforms out there with similar ideas using NFTs as keys. However, the problem with NFTs is that they can easily decrease a lot in value if there is a shift in trends. Compared to that, I'd much rather be exposed to SOL, especially on the brink of an alt season.

In my opinion, the Pine Analytics model represents the direction I would like to see Web3 take. Users wouldn't need to pay in fiat(or in crypto) but instead forfeit some of their rewards for the product.

Conclusion

When the masses find their way to crypto they they want simplicity - easy-to-comprehend concepts and easy-to-use dapps. Sanctum is a good example of a platform I would be happy to introduce to some of my douchebag no-coiner friends. It's super simple to use and doesn't contain any unnecessary nonsense. My bullishness toward Solana and Sanctum is growing day by day as I keep learning more about SOL use cases.

DISCLAIMERS:

- This is NOT financial advice.

- Thumbnail image created with Canva, pics used: Pine Analytics, Sanctum

TON mini-apps I'm currently playing:

🔹 Blum - play mini-game and complete tasks to earn Blum points (pre-market trading live on Whales Market!)

🔹 Wizzwoods - cool strategy game (Berachain + Tabi)

🔹 TON Station - very simple farming game with a lot of potential

🔹 Agent 301 - perhaps the next $DOGS

🔹 Tomarket - hurry up! airdrop in October

Posted Using InLeo Alpha