Scary thought - Getting into a routine for identifying new trades and staking on CubDefi and Polycub. Do have some outstanding risk issues around liquidity in Polycub for which I do not have answers

Portfolio News

After last report seeing the pending airdrop coins go down with no cation on my side, it was good to see the numbers going up. No new staking done on CUB

Bought

Every now and then I scan charts for all the coins in my target portfolios - top 10 by market capitalisation and rising 10 for 6 months to December 2021. I am looking for reversals relative to BTC or ETH.

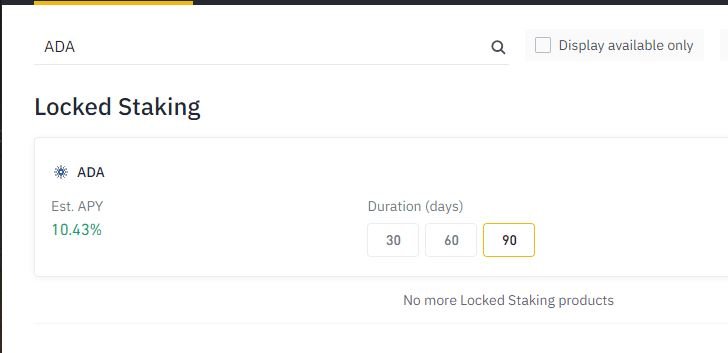

Cardano (ADABTC). Price had another go at breaking the downtrend with a firm move. I added another parcel selling BTC.

Target exit will be around the same level as my previous partial exit. Binance were promoting a staking opportunity at a solid APY of 10.43%. I staked some.

Loopring (LRCETH). Price broke the downtrend and made a higher high after the last failed effort. I added a small parcel selling ETH.

Only after the trade did I notice news item - it just goes to show you can make winning trades from charts without being clued into newsflow.

Sold

Sold BTC and ETH to fund the purchases.

Staking

Getting into a routine on staking on CubDefi. I did watch some of the weekly AMA - a progress chat with the founders and they are convinced they have designed a model that will protect the price of PolyCUB and especially xpolyCUB. They would say that.

I did also read a post by @edicted about the Liquidity pendulum operating on CUB staking. It seems that what it is doing is stripping yield out of the liquidity pools (farms) in favour of the staking kingdoms where they need the yield. This has me nervous about staking more CUB.

I do not understand it fully. Next day I read the [next post](next post) from @edicted

Welcome to my Hatchet-Job: Polycub Liquidity Pools & Sustainability Models

This has me even more confused - not sure if it is the complexity of the topic or the writing. What is clear is there are shades of the 2017 ICOs about this thing and the diamond hands have been front running it a bit. I always figured this was a risky adventure into new territory - that is why I am only allocating a small investment of what was essentially free money - ETH mined between $200 and $300. @edicted had $100,000 in - I am not at 1 ETH yet.

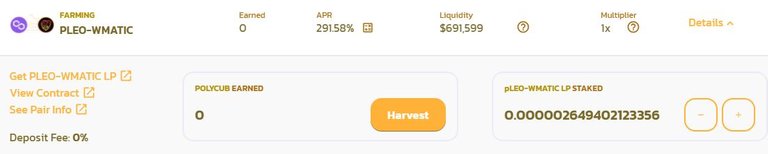

Staking PLEO Did the periodic transfer of LEO to the Polygon mainnet to stake in PLEO-WMATIC farm with APY at 291% (and dropping). Good news from my @edicted reading is he is staying in this pool.

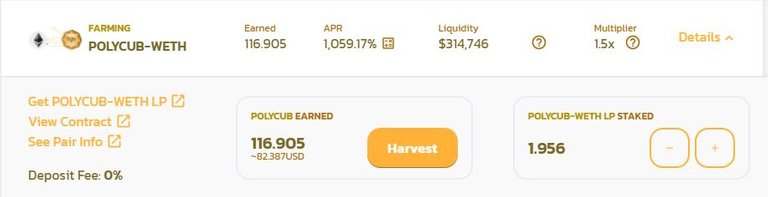

Staking PolyCUB-WETH With ETH price crossing $3,000, I took the chance to buy more PolyCUB on SushiSwap and set up a PolyCUB-WETH stake at APY of 1059% (and dropping). I am nibbling away at $100 lots =- effectively a $200 staking each time

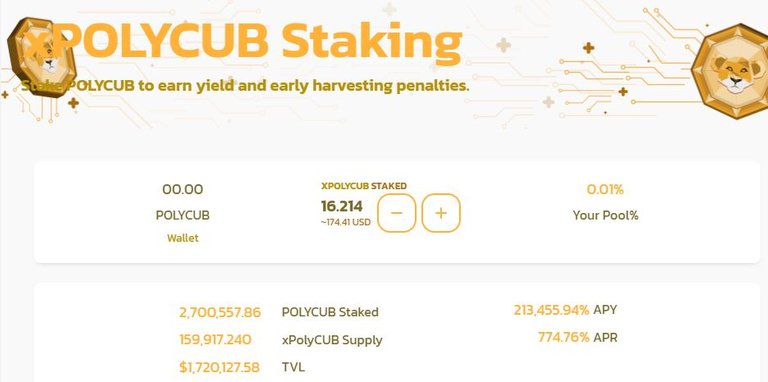

Staking PolyCUB Claimed three tranches of PolyCUB airdrop tokens (11.514 and 8.065 and 5.764) and staked them for xPolyCUB with APY standing at an outrageous number for the 2nd and 3rd ones

Small wonder the network said it was busy - the APY has 6 figures in it. Next one was even crazier.

I am going to guess this is a bug in the calcs as the confirmed staking came out at a more sensible number at 877% - not really sure what the APR and APY differences are.

Key Links

Polycub Farms For staking PLEO-WMATIC and PolyCUB-WETH https://polycub.com/farms

Claim PolyCUB Airdrop https://polycub.com/airdrop

Staking PolyCUB For staking PolyCUB to earn xPolyCUB https://polycub.com/staking

Buying PolyCUB Buy them on Sushi.Swap. This is the contract address for

POLYCUB if you have not already got it set up

0x7cc15fef543f205bf21018f038f591c6bada941c

Paraswap.io Paraswap looks for the optimal ways to swap tokens. It is worth testing periodically to see if there are better routes to those above.

Converting LEO LEO can be farmed on CubDefi and Polycub. Be sure to covert the correct form - PLEO for Polycub https://wleo.io/polygon and BLEO for CubDefi https://wleo.io/bsc. Clue P for Polygon mainnet and B for Binance Smart Chain.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: Trade/Stake image is based on royalty free photo under CCO public domain licence from piqsels.com. CubFinance logos come from CubDefi media kit. Loopring news clip is from FX Street. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades whn you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

March 23-25, 2022

Posted Using LeoFinance Beta