A volatile week was the week t be more selective especially in deciding what assigned stocks to replace. This is the time to start holding a bit more cash than normal. One new investing theme in Aged Healthcare started.

Portfolio News

In a week where S&P 500 rose 0.9% in a volatile series, my pension portfolio dropped 2.19% with the biggest drag De Grey Mining (DEG.AX) driving half the fall on its own and alternate energy stocks. The disappointing part of the week was the drop in gold and silver

The headlines tell a story of the whipsaw week - is it time to buy the dip or will this keep dropping?

There was clearly a fair amount of buy the dip stuff happening with some massive intra-day swings.

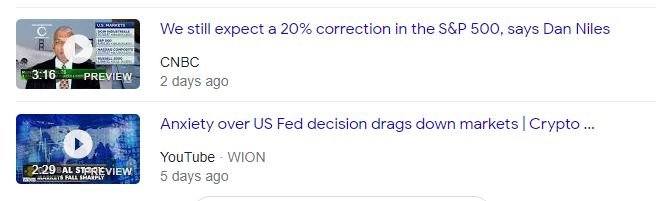

Big movers of the week were few with US Natural Gas (UNG) (+24%) and Star Bulk Carriers (SBLK) (+11.8%).

Natural Gas

Why did natural gas spike? Cold US weather? Potential for war in Ukraine? It seems that the spike was a technical event around uncovered futures expiry. A thought is the potential for war in Ukraine is putting a bid under a range of commodities beyond natural gas. See the article here

One chart to compare the US Natural Gas ETF (UNG - the bars) with Gazprom, the largest European gas producer (OGZD.L - blue line) shows that the tensions are not really playing through to Gazprom price which has not made a higher high while UNG has. I am invested in both.

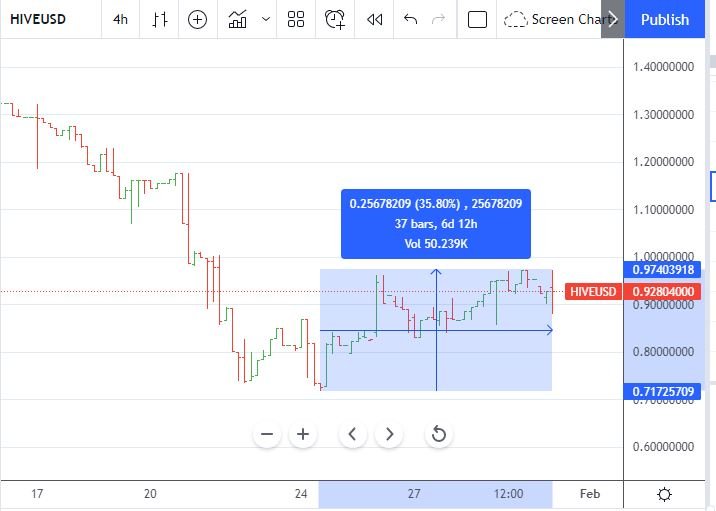

Crypto booms

Bitcoin price tested lower but reversed to finish the week 4% higher than the open with a trough to peak move of 18%. That 18% is remarkably like the move we saw the week before. Of note is the January 31 close is a higher low on the monthly chart - price may well bounce off this level

Going against the trend was Sandbox (SANDUSDT) up 56% and nicely up against BTC too.

HIVE is holding its own with a peak to trough move of 36%

Bought

GoGold Resources Inc (GGD.TO): Gold/Silver Mining. Someone commented on a Twitter post about the big silver mining moves by Stroud Resources (SDR.V) the week before telling me about this mining company which has tenements in the same location in Mexico. I went looking and find the latest drill results have better silver intersects. The close in charts suggests the market has not caught up yet - that had me buying a small parcel.

The stepped back chart to March 2020 lows shows a significant gap between GGD (the bars) and Stroud (the blue line). The gap maybe reflects the real difference in the Silver grades. Sometimes I see these as opportunity trades. Of note is the different way prices moved after drill results came out (Stroud looks like they were leaked)

https://finance.yahoo.com/news/gogold-announces-more-excellent-drilling-113000951.html

Honey Badger Silver Inc (TUF.V): Silver Mining. With rising interest rates, I continue to add to silver and gold hedges. These are not really hedges as they are still exploration opportunities but they will benefit from rising silver and gold prices. I doubled my holding to average down my entry price.

Starr Peak Mining Ltd (STE.V): Silver Mining. Averaged down entry price in another portfolio. For completeness I have added these two stocks onto the comparison chart - that suggests a bit of value hunting may be on the cards in Stroud Resources.

Fiverr International Ltd. (FVRR): Internet Services. The market has smashed growth stocks like Fiverr with inflation and rising interest rates a huge drag. Fiverr is proving to be a problem child in my portfolio - price has dropped more than 50% since I bought my first parcel. I started the process of repair by buying a parcel of stock to average down entry price and to start writing covered calls.

In another portfolio, I have a 150 strike naked put option expiring in June 2022. I rounded up my holding to 100 shares to average down and to reduce my average cost. I will be applying my new OptionsAnimal training to repair this trade. Later in the week I added another 50 shares as price keeps sliding. I will round that up too if price drops more. The chart shows the damage though there is enough time for recovery if we see price move in the same way as the last run. If that plays out, the 150 sold put might not be at such a premium.

I am a little encouraged by Motley Fool articles suggesting Fiverr might make sense as a long term holding given the growth in freelancing with Upwork suggesting more than 50% of US population could participate in freelancing by 2027. The great resignation shows this move is accelerating.

https://www.fool.com/investing/2022/01/23/buy-these-3-potential-10x-stocks-now-look-like-a-g

Walmart Inc (WMT): US Retail. I used the down days to start to build back a holding in Walmart. Its business model is working - I will nibble into a holding large enough to write covered calls and may write some naked puts at lower prices.

AMN Healthcare Services, Inc (AMN): US Healthcare. Action Alerts Plus idea to add this healthcare provider as part of an Ageing Health theme. Stock has sold off in by more than 20 percent since December 2021 making an opportune time to enter.

In another portfolio, I chose to sell a February strike 90 naked put at 3.3% premium with 10% price coverage rather than buy the stock. The charts shows the naked put (90) as a red ray - it is below the last two lows. I have put in some comparatives. AMN is double in performance since the March 2020 lows.

BASF SE (BAS.DE): Europe Chemicals. Replaced stock assigned at 0.23% premium to assigned price. Wrote a covered call at 0.9% premium with 5.2% price coverage

Crédit Agricole S.A (ACA.PA): French Bank. Replaced stock assigned in October at 8.4% premium to assigned price. Wrote a covered call at 1.2% premium with 6% price coverage. I chose to replace Credit Agricole as it is lagging the other banks I have added back (ING (INGA.AS) and ABN Amro (ABN.AS)).

The price comparative chart going back to September 2021 lows against the Amundi Europe Banks ETF (DB5.DE) shows the 3 laggards - Commerzbank (CBK.DE), Deutsche Bank (DBK.DE) and Credit Agricole. This is the way contrarian investing works.

Carrefour SA (CA.PA): French Supermarket. Replaced stock assigned at 6% premium to assigned price. Wrote a covered call at 1.7% premium with 5.7% price coverage

AXA SA (CS.PA): French Insurance. Replaced stock assigned at 3.8% premium to assigned price. Wrote a covered call at 0.7% premium with 5.5% price coverage - not the best premium here.

Yamana Gold Inc (AUY): Gold Mining. Last week's trade report showed that one of my portfolios was not as well hedged with gold and silver as the others. I added a parcel of stock and also a January 2023 4.5/5.5/3.5 call spread risk reversal. With price closing on Jan 27 at $4.06, I went one strike out-the-money and bought a January 2023 4.5/5.5 call spread. With a net premium of $0.224, this offers maximum profit potential of 346% for a 35% price move. I funded the trade fully (plus a bit) by selling the 3.5 strike put option which is 16% below the closing price. Smarter trade would have to looked for an earlier expiry for the sold put so I could narrow down the "plus a bit" - e.g., July 2022 would have worked. I might change it. Of note is trading costs are a factor in this trade.

Let's look at the chart which shows the bought call (4.5) as a blue ray and the sold call (5.5) as a red ray and the sold put (3.5) as a dotted red ray with the expiry date the dotted green line on the right margin. The key parts of the chart is price has tried once to break the downtrend. The trend line is drawn through the closes on each of those spikes. We cannot really say this is a breakout as we have not seen a higher high or a higher low yet. Price has only to get halfway to prior highs to be a winner.

Over the next few weeks I will explore a longer term trade to January 2024 with a wider target range say a 5/7 bull call spread.

Sold

Union Pacific Corporation (UNP): US Railways. Action Alerts Plus idea to trim their holding. I sold half in one portfolio for 14% blended profit since March 2021. Initial idea was a Jim Cramer AA Plus idea. In another portfolio, I closed the entire holding for 12% blended profit since March/June 2021.

Shorts

Chose not to set up any Nasdaq hedges until we see a few up days.

Cryptocurrency

No trades

Income Trades

In my pension portfolio I wrote 61 covered calls (US 51 UK 2 Europe 8) and 6 naked puts (all US). I have widened the number of stocks that I wrote covered calls at multiple strikes. This does reduce premium income but it also reduces the likelihood of going to assignment.

In my others portfolios I wrote 34 covered calls (US 28 Canada 1 Europe 5) and 8 naked puts (all US)

Naked Puts

Deere & Company (DE): US Agriculture Machinery. Action Alerts team added to their holding. I wrote a naked put at 0.96% premium with 16% price coverage.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work. Natural Gas" (CC BY-SA 2.0) by todbaker

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades whn you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

January 24-28, 2022

Posted Using LeoFinance Beta

. Keep up the fantastic work

. Keep up the fantastic work

--

--