Markets lapped up the certainty from the Federal Reserve. Became a busy week adjusting portfolios to be sure I did not get too exposed to being assigned on sold puts.

This report covers the week's transactions for all portfolios but only options expiries in my pension portfolio. There are some nasty losses in solar power but overall the 30 day trading delivered more capital profit than the pension payments made.

Portfolio News

In a week where S&P 500 rose 0.92%, my pension portfolio rose a whopping 3.13%. Big contributions came from Europe, Japan, Solar, Marijuana and the reopening trade.

Big movers of the week were Latin Resources (LRS.AX) (+35.7%), Stem Inc (STEM) (+31.7%), KraneShares CSI China Internet ETF (KWEB) (+28.7%), PayPal (PYPL) (+23%), NVIDIA (NVDA) (+19.7%), American Airlines (AAL) (+19.5%), JinkoSolar (JKS) (+18.5%), Delta Airlines (DAL) (+18.5%), Fiverr International (FVRR) (+17%), Cronos Group (CRON) (+16.8%), Adyen (ADYEN.AS) (+16.8%), Airbnb, (ABNB) (+15.1%), Canopy Growth (WEED.TO) (+15.9%), Deutsche Bank (DBK.DE) (+14.9%), Global X Social Media ETF (SOCL) (+14.6%), AMN Healthcare Services (AMN) (+13.2%), Yooma Wellness (YOOM.CN) (+13%), 3D Systems Corp (DDD) (+12.6%), Commerzbank (CBK.DE) (+12.5%), Bayhorse Silver (BHS.V) (+12.5%), Aurora Cannabis (ACB.TO) (+12.2%) ETFMG Alternative Harvest ETF (MJ) (+12.1%), Solid Power (SLDP) (+11.9%), Mitsui Engineering & Shipbuilding (7003.T) (+11.3%), American Eagle Outfitters (AEO) (+11.3%), Nokia (NOK) (+10.8%)

These moves show how the Federal Reserve took a lot of uncertainty out of markets - only one silver miner and some pops in travel and payment services. Nice moves in European Banks and marijuana may have found the floor.

The news of the week was from the Federal Reserve which raised interest rates for the first time since 2018. The rise was only 25 basis points but they did map put 6 more to come. That settled the markets big time - at least we can plan ahead.

Of note is June 2022 Eurodollar futures had that size of move already priced in ahead of the meeting. I did dig into the Bitcoin article - the strategy is to buy Bitcoin and short the 3 month futures to keep the spread - too bad that inflation is now 8%.

Covid Action

I have been watching a new documentary series called Covid Secrets which highlights the data underlying adverse reactions to the mRNA gene therapy treatments. Then I saw this tweet quoting one of the main protagonists in the documentary series.

I looked at the charts and can only say that the market is not seeing it this way. Yes price has dropped 26% since the all time high after a run of 131% from the March 2020 lows - Cominarty has been good for Pfizer.

The comparative chart with Moderna (MRNA) is even more telling - a rise of over 1400% but now only 487% ahead. More about this later.

Crypto booms

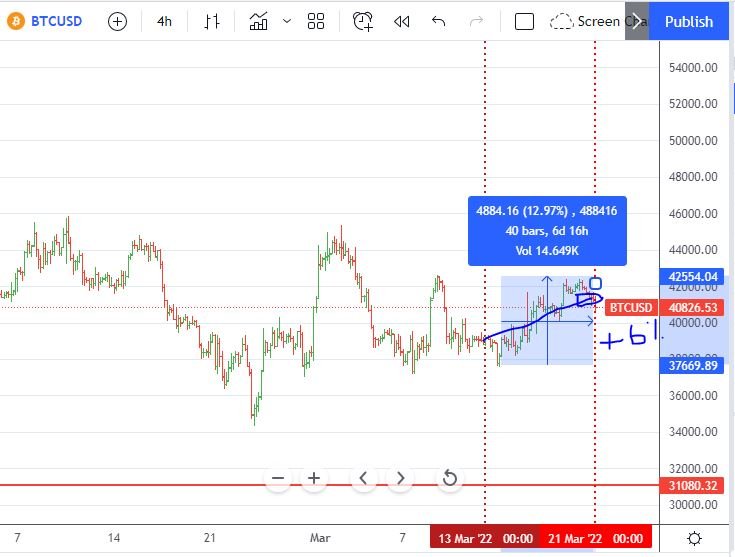

Bitcoin price drifted lower and then pushed higher finishing the week 6% higher than the open. the 13% trough to peak range was a little tighter than normal.

Ethereum pushed ahead strongly with a 10% trough to peak move relative to BTC

Move of the week in my portfolios was AAVE with a 44% trough to peak break - happily I caught that one on Friday.

Not far behind was Loopring (LRC)

Bought

ETFMG Prime Cyber Security ETF (HACK): Cybersecurity. Following the Mandiant (MNDT) takeover by Alpahabet (GOOGL), I was looking for stock to replace it. My sense is the main cybersecurity players will all be taken out by the cloud providers. An example: I noted in security reports from one of my websites that one of the hacking IP's was hosted by Oracle Cloud Services - they cannot afford to have this stuff if they are going to win. I did not have time to do the detailed research - step one - buy more of the industry ETF. I will keep digging.

Huntington Bancshares Inc (HBAN): US Reginal Bank. Following the First Horizon (FHN) takeover by Toronto-Dominion (TD), I was looking for stock to replace it. I topped up my holding of this regional bank which has been lagging the others. Dividend yield of 4.21% is appreciably higher than the SPDR Regional Banking ETF (KRE). I do have a holding in KRE and will be running both covered calls and credit swaps to drive income there

Victoria's Secret & Co (VSCO): Intimate Apparel. Assigned early on a naked put at 16% premium to $51.49 closing price. Wrote an April expiry covered call for 0.83% premium with 26% price coverage. I guess I will be keeping the premium and the stock. This was part of a 75/90/60 call spread risk reversal - price was going nowhere near the bought call. As it happens, I closed out the bought call (75) when I thought I was writing a March covered call. Would have lost all the premium as it happens.

Quick look at the chart shows a classic failed trade - at no time did price stay above the level of the bought call. It tried and failed and then headed steadily lower and found support around the $50 level. This is the trade management problem with call spread risk reversals - the trades are cash neutral (credit premium of $0.80 on this one) and do not need attention until price drops below the sold put level.

Victoria's Secret and the predecessor business (L Brands) has not been a happy place in this portfolio.

Credit Agricole (ACA.PA): French Bank. I am exposed to a March expiry 13 strike naked put. I bought a parcel of stock at €10.74 to average down the assignment price. My investing thesis is high inflation must lead to higher interest rates and improving bank margins. My holding remains below standard size - so averaging down makes sense. Wrote an April covered call for 2.8% premium with 4.3% price coverage.

Assigned at 19% premium to €10.89 closing price. This naked put was part of a 13.6/14.2/13 call spread risk reversal bought in February just as European rates started to rise. The came the ouch - the price of the war in Ukraine.

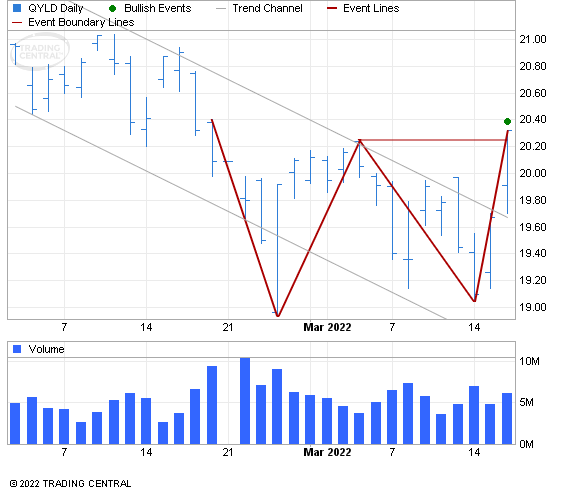

Global X NASDAQ 100 Covered Call ETF (QYLD): Nasdaq Index. Received a buy trade signal from my broker on a technical indicator.

Averaged down my small holding as a test in two portfolios. This ETF writes covered calls on Nasdaq stocks and is an income trade rather than a capital trade.

Sunpower (SPWR): Solar Power. Replaced stock likely to be assigned on covered call at 0.6% premium to assigned price. Nice to see stock move ahead 2.1% from my purchase which makes this much more cost effective than buying the call back.

Loss on assignment was 33% since November 2021.

Coeur Mining, Inc (CDE): Silver Mining. My covered calls in Hecla Mining (HL) and Pan American Silver (PAAS) will be assigned. Replaced them with Coeur Mining as it is lagging the other silver miners for some reason - best dig into the reasons before I get too carried away.

The chart shows CDE clearly lagging iShares Silver Trust (SLV) which is trading pretty much in line with PAAS. HL is the leader

The Walt Disney Company (DIS): US Media. Assigned on naked put at 3.3% premium to $140.30 closing price. The premium on the last two naked puts brings breakeven price to $140.88. Investing in Disney is a reopening trade from AAPPLus - must say it has not been a happy trade so far with income trades covering only half of the capital losses since November 2021.

Sold

Walmart Inc (WMT): US Retail. Assigned early on covered call for 1.6% blended profit since December 2021/January/February 2022. This is an Action Alerts Plus pick and I will possibly replace it as it is a solid consumer staples stock for cautious times.

Adyen N.V. (ADYEN.AS): Payment Services. Assigned on covered call for 4.7% profit since March 2022. (9 days). This tranche was supposed to average down the assignment coming at 22% premium to the €1841 closing price. Instead I banked the profits on the covered call. Breakeven €2235.27. This is a long term investing theme as online ordering systems is a key part of their value propositions

Electricité de France S.A. (EDF.PA): French Utility. Assigned on covered call for 4.8% blended loss since November 2021/February 2022. The last tranche was profitable - somehow I wrote 3 contracts rather than the 2 I wanted. Income trades have been working really well with profits recovering capital losses 5 times over.

Canadian Solar (CSIQ): Solar Power: Assigned on covered call for 13% blended loss since November 2020/February 2021. I will explore how best to add back solar power - the heady days of 2020 will come back as oil prices rocket. Income trades have covered capital losses 15 times over since August 2018 - this shows the value of writing income trades on high implied volatility stocks.

Hecla Mining Company (HL): Silver Mining. Two tranches assigned on covered calls with one tranche breaking even and one for 4.2% profit since November 2021. Average cost on remaining holdings is a bit higher than the $6.72 close.

iShares Russell 2000 (IWM): US Small Caps. Assigned on covered call for 1.5% profit since January 2021.

JinkoSolar Holding Co (JKS): Solar Power. Assigned on covered call for breakeven since December 2021.

Maxeon Solar Technologies, Ltd (MAXN): Solar Power. Assigned on covered call for 20% loss since January 2022. Disappointing as $13.40 closing is 7.2% higher than cost for this tranche though still lower than my overall average cost. Income trades have covered the capital loss on this trade by more than 12 times.

Pan American Silver Corp (PAAS): Silver Mining. Assigned on covered call for 7.1% loss since July 2021. I only started writing income trades on PAAS then and have covered nearly three times this capital loss.

Sunrun Inc (RUN): Solar Power. Assigned on covered call for 38% blended loss since August/November 2021. SunRun is facing strong challenges in its home state as California cuts back on solar subsidies and adding in rising input costs. This last exit takes capital into loss status but income trades have covered that 3 times.

Chemical & Mining Co. of Chile Inc. (SQM): Lithium. Assigned on covered call for 45% profit since December 2021.

Invesco Solar ETF (TAN): Solar Power. Assigned on covered call for 12.5% loss since January 2022. I will be exploring avenues for adding back some of the solar exposure - I do still have holdings in Canadian Solar (CSIQ), First Solar (FSLR), JinkoSolar (JKS), Maxeon Solar (MAXN), Sunpower (SPWR), SunRun (RUN) and bull call spreads on TAN.

United States Steel Corp (X): US Steel. Assigned on covered call for 27.6% profit since September 2021.

Shorts

Eurodollar Futures (GEM22): US Interest Rates. Expiry of futures contract looking for rising interest rates. Achieved the equivalent of 72.5 basis points rate rise. Contract was set up in April 2021 and there was only one rate rise - market has baked in 2 more. Profit achieved is a modest 0.72% but margin requirements for futures contracts are only 3 to 12% of face value ($250,000) - this makes the risk return on this trade around 23%

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. Closed out the remaining March expiry long put for 263% profit since January 2022. Switching this trade structure from a ratio put spread to a bear put spread worked well. Holding onto expiry helped too with price dropping another 0.75% in Thursday trade (Mar 17). Too bad this portfolio cannot hold short positions as I think with 6 rate rises coming this stock is going to fall quite a bit more. It is already below the lower strike of the April bear put spread.

Invesco QQQ Trust (QQQ): Nasdaq Index. With price opening at $338.37, sold the March expiry 315 strike put option to claw back some premium and leaving the sold 312 strike put option to expire.

Pfizer Inc (PFE): US Pharmaceuticals. Given the information presented in Portfolio News about the potential for culpability, I decided to test out some shorting ideas. The biggest challenge is guessing when the truth is going to emerge and the share price begin to take the hit. My first thought was to set up a bear put spread - I picked June and did 52.5/45 for a net debit of $1.88. With price opening at $54.38 price needs to drop 3.6% to go in-the-money. I reduced the net premium by selling a March 25, 52.5 strike put option which brings the net debit down to $1.47. In effect what I have constructed is a calendar put at 52.5 strike on top of the 52.5/45 bear put spread. More research needed to test out other models.

A quick look at the chart which shows the calendar put (52.5) as a red ray and the bear put sold put (54) as a dashed red ray and breakeven as a dashed blue ray. There is no technical support for this trade other than the sold put (45) is at the cycle low. This is a pure contrarian trade. Another idea is to buy a put option as far out in time at the same percentage drop that Moderna (MRNA) has made since its all time high

Hedging Trades

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. I have a small holding of stock with average cost of €11.87. With price closing on Friday (Mar 11) at €10.75, I am keen to put in some protection for my holding. My outlook for European Banks is long term bullish but the Ukraine war is making things look bearish in the short to medium term and it could get ugly again. I chose a calendar put spread as that gives me protection below the current price for the next 3 months - if I lose, I do not lose a lot BUT I can collect income along the way.

I put in place a March/June 8 strike 10 put calendar. I picked strike 10 as that is the low from last week's drop and I do not mind having to buy more stock if price does drop below 10. I was looking at April expiry for the sold put but figured I could grab more than 1% premium for a 5 day exposure as first cut. Net debit on trade is €0.70

The chart shows the new trade as a purple ray stretching to June expiry. The other trade showing is in a different portfolio - I will work out a plan to manage being assigned on that short 12 strike put.

ABB Ltd (ABBN.SW): Europe Industrials. With price opening at Sfr31.90, I put in place a 30 strike March/June calendar put spread to protect my holding. The spread is a net debit of SFr1.29. I am fully expecting to be able to recover this net premium with each rollover of the sold put.

Deutsche Lufthansa AG (LHA.DE): German Airline. With price opening at €7.10, sold March expiry 6.9 put option to claw back some premium on the last protective collar trade. Replaced that with a 6.4 strike April/June calendar put spread to protect my holding. The spread is a net debit of €0.33. I am fully expecting to be able to recover the balance of the net premium (€0.18) with each rollover of the sold put. First expiry is April 1.

Expiring Options

Deutsche Bank AG (DBK.DE): German Bank. With price opening at €10.64 (Mar 16), I adjusted a March expiry 11.6/14/11 call spread risk reversal by selling the 11.6 call option. This dragged back a portion of the premium and makes the net premium of the trade a credit of €0.15 which would then reduce the breakeven if the sold put gets assigned to €10.85. Closing price at €11.07 was above the sold premium - maybe better to wait another day. I was not expecting price to jump 10% in a day - it did 7.21%.

Waited another day and should have read my notes - I bought back the sold put and turned a credit trade into a small loss. I decided I did not want to buy the stock - price closed (Mar 17) at €10.90 = below the sold put strike.

iShares MSCI India ETF (INDA): India Index. With price opening at $43.76, I am exposed to being assigned on a March expiry 44/42 credit spread. I bought the spread back and opened up an April expiry 42/40 credit spread. This credit spread is part of a funding stream for a January 2023 45/55 bull call spread. The net premium of that trade increased to $1.72 which reduces maximum profit potential to 481%.

The chart shows a trade that was progressing well and then fell over but has found support. The big unknown is the geopolitical impact of the Ukraine war - India will be forced to choose sides. That is why I did not want to buy the stock at $44. As it happens Wednesday (Mar 16) and the week close was above $44.

Cryptocurrency

I started writing up crypto trades separately. I spent the front end of the week getting fully into staking CUB and PolyCUB.

Purchases made on GRTETH

and AAVEETH

These are written up in CIB3

Income Trades

In my pension portfolio, for the month wrote 50 covered calls (UK 3, US 34 Europe 13) of which 13 were assigned (US 12 Europe 1).

7 naked puts written (all US) of which 2 were assigned

Naked Puts

Pan American Silver Corp (PAAS): Silver Mining. My holdings in PAAS will be assigned. Rather than replace the stock at 6.4% premium to assigned price ($26), I sold naked puts for double size at that price for 2.9% premium to $27.67 closing price

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades whn you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

March 14-18, 2022

Posted Using LeoFinance Beta