Solar Power makes a come back and Steel surprises in my managed portfolios. A few uncomfortable naked put assignments as banking stocks get nervous around the war.

This post covers options expiries for two of my other portfolios - let's call them managed

Portfolio News

In a week where S&P 500 rose 0.92%, my managed portfolio rose a whopping 4.99% driven by solid moves in marijuana, US reopening trade, European banks, and JinkoSolar up 18.5%.

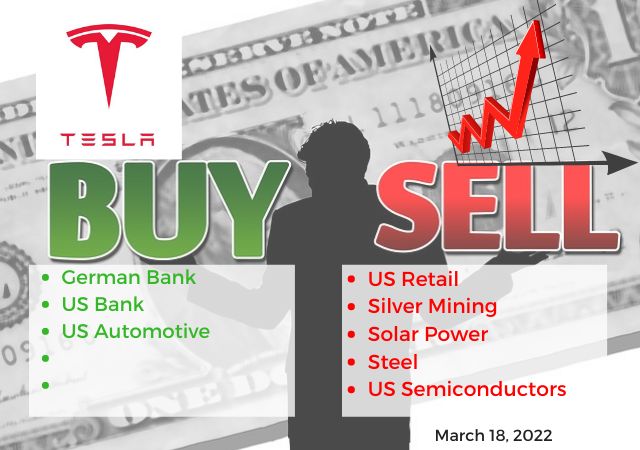

Bought

Commerzbank AG (CBK.DE): German Bank. With price closing at $7.00 assigned on naked put at 14% premium. This trade was part of a 8.8/9.2/8 call spread risk reversal that expired worthless. Breakeven on the trade is 7.95 - not accounting for trading costs. The trade was doing just fine until the war in Ukraine came along.

Citigroup (C): US Bank. Assigned on a naked put at 4.6% premium to closing price of $57.35

Sold

Canadian Solar Inc (CSIQ): Solar Power. Assigned on a covered call for 15.7% loss since June 2021. Income trades have not covered this capital loss. Solar power has been a challenge for the last 18 months - this is one to keep plugging away at for the long term - just need to find the right stocks. I am thinking that it might pay to look for leaders rather than laggards.

JinkoSolar Holding Co., Ltd (JKS): Solar Power. Assigned on a covered call for breakeven since July 2021. Averaging down and writing split strikes helped to retain some stock

Hecla Mining (HL): Silver Mining. Assigned on a covered call for 8.8% profit since September 2021. Silver mining has been a solid hedge trade with Hecla Mining being the workhorse.

Pan American Silver (PAAS): Silver Mining. Assigned on a covered call for 3.5% loss since July 2021. Income trades have covered this capital loss more than 4 times.

VanEck Vectors Steel ETF (SLX): Steel. Assigned on a covered call for 12.3% profit since November 2021. Steel has been a strong reopening trade. My instinct is US-based steel is going to be a big beneficiary of disrupted supply chains from Europe given the Ukraine war.

Walmart Inc (WMT): US Retail. Assigned on a covered call for 4.3% blended profit since December 2021/February 2022. I will add this back as Walmart is a solid consumer staples stock for uncertain times

Expiring Options

Advanced Micro Devices, Inc (AMD): US Semiconductors. With price closing at $113.46, price closed below the lower strike of 120/155 bull put spread generating an all in loss of 162% of risk capital. Proper trade management would have been to close out the trade for a smaller loss or even at breakeven when price was between the short put (120) and long put strikes (115). In my notes from last month (TIB586) , I noted that the long put should have been put below support - see TIB86

Quick look at the chart suggests that is exactly right as price turned on that support level (the lower thin red line). Next month I will set up another bull put spread with this in mind - say 110/100

Tesla (TSLA): US Automotive. With price closing at $905.39, the 790/760 bull put spread worked the way it is supposed to. Price did drop to the support where the bought put (760) was and turned and climbed solidly out-the-money.

When I signed up for the OptionsAnimal program one of my objectives was to write credit spreads at less risk than naked puts. My target was to generate enough credit spread income in a month to cover the monthly fee. This trade delivered $1,000 toward the fee with only $3000 capital at risk. Next cycle, I could double that by doing two contracts.

Income Trades

27 covered calls written (UK 1 Europe 7 US 19) of which 6 were assigned and 7 naked puts written (Europe 1 US 6) of which 2 were assigned.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades whn you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

March 18, 2022

Posted Using LeoFinance Beta