A quiet week for sitting on the cash raised in options expiry last week. Did do some work on switching to credit spreads away from naked puts especially on stocks I am interested in buying at lower prices.

Portfolio News

In a week where S&P 500 rose 1.84% to close out 2nd winning week in a row, my pension portfolio rose a more modest 1.7% with Europe softer than US.

Big movers of the week were Tilray Brands (TLRY) (+55.3%), Latin Resources (LRS.AX) (+33.3%), Aurora Cannabis (ACB.TO) (+23.4%), Canopy Growth (WEED.TO) (+20.7%), Cobalt Blue Holdings (COB.AX) (+20.6%), Harvest One Cannabis (HVT.V) (+20%), Peabody Energy (BTU) (+18.6%), Cronos Group (CRON) (+17.7%), ETFMG Alternative Harvest ETF (MJ) (+15.2%), Pilbara Minerals (PLS.AX) (+14,6%), Gemfields Group (GEM.L) (+14.5%), IGO Limited (IGO.AX) (+13.8%), United States Natural Gas Fund (UNG) (+13.2%), Telecom Italia (TIT.MI) (+11.1%), Direxion Daily 20+ Year Treasury Bear 3X ETF (TMV) (+10.4%), Mitsubishi Heavy Industries (7011.T) (+10.4%).

Two big themes - commodities and marijuana. One deal situation and rising interest rates

Markets wanted to move higher for the 2nd week

Inflation news is going to get worse with the lag between Fed rate rises and response.

The big driver is going to be food prices and oil prices. Headlines have forgotten about Covid for this week. Adding in The Mosaic Company (MOS) into credit spreads was driven from this observation

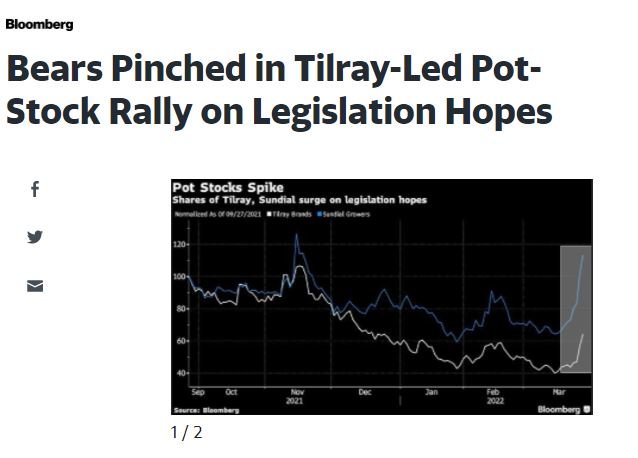

Cannabis Rebounds

Biggest moves in my portfolios were cannabis stocks

The stock gains came on news that the U.S. Congress has passed a piece of legislation supporting marijuana research, and more significantly, will be holding a floor vote on the Marijuana Opportunity, Reinvestment, and Expungement (MORE) Act next week. The House of Representatives previously passed that legislation, but it stalled in the Senate.

https://www.fool.com/investing/2022/03/25/why-tilray-and-other-cannabis-stocks-popped-friday

Crypto booms

Bitcoin price pushed higher all week with a surge late in the weekend up 15% higher than the open. It looks like it wants more - 15% volatility is about normal

Ethereum was about the same move

Cardano move was 36% - glad I caught that earlier in the week.

Next biggest move of the week in my portfolios was Chilz (CHZ) up 28% against BTC which was up 15% against USD

Hive hesitated below $1 mark and then pushed through and may well be holding. A fair bit of that was a move by one of the big PolyCUB farmers (@edicted) back to HIVE and LEO - see CIB5 for some thoughts on this.

Bought

iShares Russell 2000 (IWM): US Small Caps. Added a small parcel with a view to nibbling away to get to 100 shares to write covered calls again in this portfolio.

Skyworks Solutions, Inc (SWKS): US Semiconductors. Added another small parcel to average down entry price - will work at this steadily to get to 200 shares to write covered calls. AAPlus pick which they are happy to keep nibbling at.

ENGIE SA (ENGI.PA): French Utility. Been watching Electricité de France (EDF.PA) price motoring away since the bottom was found after the outbreak of the Ukraine war. Added a new small holding in their main competitor as EDF.PA are in the midst of a capital raise and a government bailout. Dividend yield 7.05% with ex-div date on April 27.

The comparison chart shows prices moving in tandem on this bounce - ENGIE does not have the overhead of a deeply discounted capital raising to hold it back.

Posco Holdings (PKX): Korean Steel. Steel has been a big mover since the March 2020 lows and a few of my holdings were assigned last week. Normally I step back to buying an industry ETF as step one for replacement. I did look at that and did not like the iron ore components of the ETF. I did the price comparison charts to the Van Eck Vectors Steel ETF (SLX - the bars) looking at each of the steel producers (excluding the iron ore suppliers).

US Steel (X) has grown a stunning 579%, more than double SLX. The laggard is Posco which has only grown 120%. I added a small parcel to capture any of the catch up - make up half the gap would be a 50% jump. What I like about Posco is it also has some large lithium brine tenements in Argentina = a hidden gem. Dividend yield 5.98%. Wrote a covered call

Walmart Inc (WMT): US Retail. Replaced stock assigned on covered call at 1.1% premium to assigned price.

SolarEdge Technologies, Inc (SEDG): Solar Power. Solar Power has been a drag since mid 2021. Since the Ukraine war started attention has gone back to solar with uncertainty about natural gas in Europe. A few of my holdings were assigned last week mostly at losses. I did the price comparison charts to the Invesco Solar ETF (TAN - the bars) and worked from the 2021 highs.

TAN has dropped 33% in that time. Of note is three of my current holdings have dropped more (CSIQ, SPWR and RUN) and two are a little better (FSLR and JKS). Normally I would replace assigned stock with the industry ETF (TAN) or the laggards. What struck me is the leaders (SEDG and ENPH) have not really outperformed - not like US Steel in the steel charts. They are showing that they are better placed - my thought is as solar bounces, the leaders could well open bigger gaps. I put in place Bull Put spreads on SEDG and ENPH

ChampionX Corporation (CHX): Oil Services. The sale of Weatherford warrants below got me looking again at oil services. I made a comparison chart against the Van Eck Vectors Oil Services ETF (OIH - bars) against the top holdings. I ran comparison back to December 2020 and the last cycle high

A few stocks are lagging (CHX, FTI and NOV and HP) - I picked two that I had not previously held and are not oil drillers. For Champion, ROE is a 6.79% = not the best and price to sales of 1.6. Dividend yield 1.24%

TechnipFMC plc (FTI): Oil Services. Financials for UK-based oil services provider are not the greatest, though 2021 did get back to profit after some solid cost cutting. Price is midway between 52 week high and low. Forward PE is 18.83 and ROE is a miserly 2.27% and price to sales of 0.53.

Sold

Weatherford International plc (WFTUF): Oil Services. Pending order to sell warrants partially filled for 57% blended profit since December 2019/June 2021. These warrants were issued when Weatherford emerged from Chapter 11 bankruptcy with my holding with cost base of $2347 converted to 4 warrants. I did average down in 2021 to grab some capital back - this profit recovers 23% of the capital loss.

ABB Ltd (ABBN.SW): Europe Industrials. With price opening at SFr32.74, rolled over March expiry short put (30) to April at same strike bringing net debit on strike 30 calendar put to Sfr0.95

Shorts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price opening at $131.28 (Mar 21), I set up an April 131/128 ratio put spread fully cash neutral. As the week moved on I decided to convert the ratio spread to a put spread and bought back the sold put (128). Stage one got me buying back the whole leg leaving with an open bought put (131) = 52% loss. Not to worry, I have two bear put spreads that are in-the-money to cover the loss. Stage two is maybe to sell some puts further out-the-money, say 125.

Closed out the 138/132 and 137/133 bear put spreads for 66% (Mar 7) and 84% (Feb 24) profit respectively. That leaves me with one open-ended April expiry put (131) which is now in-the-money (Mar 24). This makes four winning trades in a row - challenge is to scale up and not lose the momentum or the courage.

Quick look at the chart shows the trades that were closed out. I had thought price would start a new channel when it broke out earlier in March. It did not and went back into the channel. That will be a useful guide for April expiries.

Well I did go for stage two and sold some puts further out-the-money at 126 and 123 and back to a ratio spread. I will convert that back to a bear put spread this week. The chart wants to go down harder is my instinct.

Hedging Trades

United States Natural Gas Fund (UNG): Natural Gas. Wanted to protect my holding from price volatility. Started to set up a calendar put and bought the June expiry strike 15 for $0.76. Could not get hit on the March 25 expiry bid - changed that up to sell a 17 strike to grab $0.04 premium back - hit on one contract only and trading costs are ugly on weekly options.

Cryptocurrency

Bought ADA and LRC - see CIB5 for details

Income Trades

A slightly quiet start to next months writing with 61 covered calls written across two portfolios (UK 3 Europe 17 US 41) and 2 naked puts (US 2).

In addition to the credit spreads reported below, I set up 4 in Europe across two portfolios

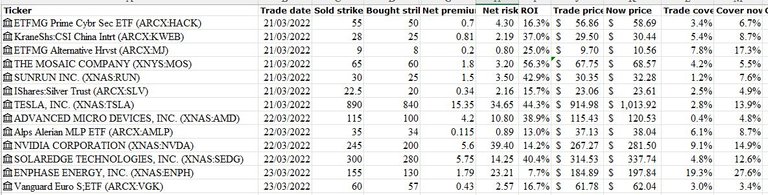

Credit Spreads

I have started to deploy bull put credit spreads rather than naked puts on stocks I am interested in but not committed to buy. Principle is to sell a put at a level below support and to buy a put at a lower strike to manage the risk. I have to say I did not really do all of that. I did tabulate all the US trades and do all the computations. The spreadsheet snapshot is below shows sold strike, bought strike, net premium and computes risk and ROI. The prices are open for trade day and the current price with the coverage ratios.

Of note is the ROI's are in a wide range from 7.7% to 56% (that is a function of how far out-the-money trades are). The average risk adjusted ROI is 26% for this tranche of trades and risk capital is a very modest $16.7k. That is what the objective of adding credit spreads was - reduce capital at risk.

Now for a few notes on rationale for each stock

- ETFMG Prime Cybersecurity ETF (HACK): Cybersecurity. Replacing Mandiant after Alphabet takeover.

- Krane Shares CSI China Internet ETF (KWEB): China Internet. ETF Trade Signal idea and averaging down as price lifts off lows.

- ETFMG Alternative Harvest (MJ): Marijuana. Averaging down as price breaks off lows.

- The Mosaic Company (MOS): Fertilizer. Agriculture and commodity boom as supplies from Ukraine and Russia come under pressure.

- Sunrun Inc. (RUN): Solar Power. Averaging down as price breaks off lows.

- iShares Silver Trust (SLV): Silver. Hedging trade

- Tesla, Inc. (TSLA): US Automotive. Been writing naked puts for months now.

- Advanced Micro Devices, Inc (AMD): US Semiconductors. AAPLus pick.

- Alerian MLP ETF (AMLP): US Oil. Close gap on oil majors as oil price rises.

- NVIDIA Corporation (NVDA): US Semiconductors. AAPLus pick.

- SolarEdge Technologies, Inc (SEDG): Solar Power. Sector leader as solar comes off lows.

- Enphase Energy, Inc (ENPH): Solar Power. Sector leader as solar comes off lows.

- Vanguard FTSE Europe Index Fund ETF (VGK): Europe Index. Was aiming to set up a bear put spread as a short hedge trade and managed to set up a bull put spread - maybe my brain is telling me markets are stagnant to bullish and not bearish as war risk feels played out.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades whn you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

March 21-25, 2022

Posted Using LeoFinance Beta