Hello, Hive community! I'm here today to share a recent venture I've delved into – forex trading. It all began when a friend introduced me to this world, and I decided to join a WhatsApp group dedicated to forex training. I'll be honest; the initial stages of the training were a bit dull, but as I delved deeper, I discovered the intricacies that make forex trading far more complex and fascinating than it first appeared. Contrary to popular belief, especially among the younger generation, I've come to realize that forex is not a quick route to wealth. It requires patience, skill, and a cool head.

One of the fundamental lessons I've picked up on is the importance of not letting emotions drive your trading decisions. At this point, I wouldn't call myself an expert by any means. I'm very much in the learning phase, and my goal is to improve with each passing day. With that said, I recently received a technical review of the EUR/USD currency pair from the WhatsApp group, and I decided to base a trade on the information provided.

EUR/USD Technical Analysis:

Taking a technical perspective on the EUR/USD pair, it appears that the recent uptrend falls short of signaling a significant upward move. The intraday rally stalled just below Friday's high, while the pair continues to trade below all its moving averages. Notably, the 20 Simple Moving Average (SMA) has been heading south below the longer ones, acting as a dynamic resistance level around 1.0570. Meanwhile, technical indicators show signs of advancement while maintaining upward slopes within negative levels.

Looking at the 4-hour chart, a similar pattern emerges. The Momentum indicator is heading north, although it remains below its 100 level, and the Relative Strength Index (RSI) indicator is steadily climbing at around 43.

Nevertheless, the advances are capped by a bearish 100 SMA, and a bearish 20 SMA is nearing the longer one. Lastly, the 200 SMA is firmly pointing south above the shorter SMAs, suggesting that the overall risk is skewed toward the downside.

Support levels: 1.0495, 1.0450, 1.0400

Resistance levels: 1.0570, 1.0610, 1.0650

Now, for setting Take Profit (TP) and Stop Loss (SL) levels, it's important to consider the support and resistance levels mentioned in the analysis:

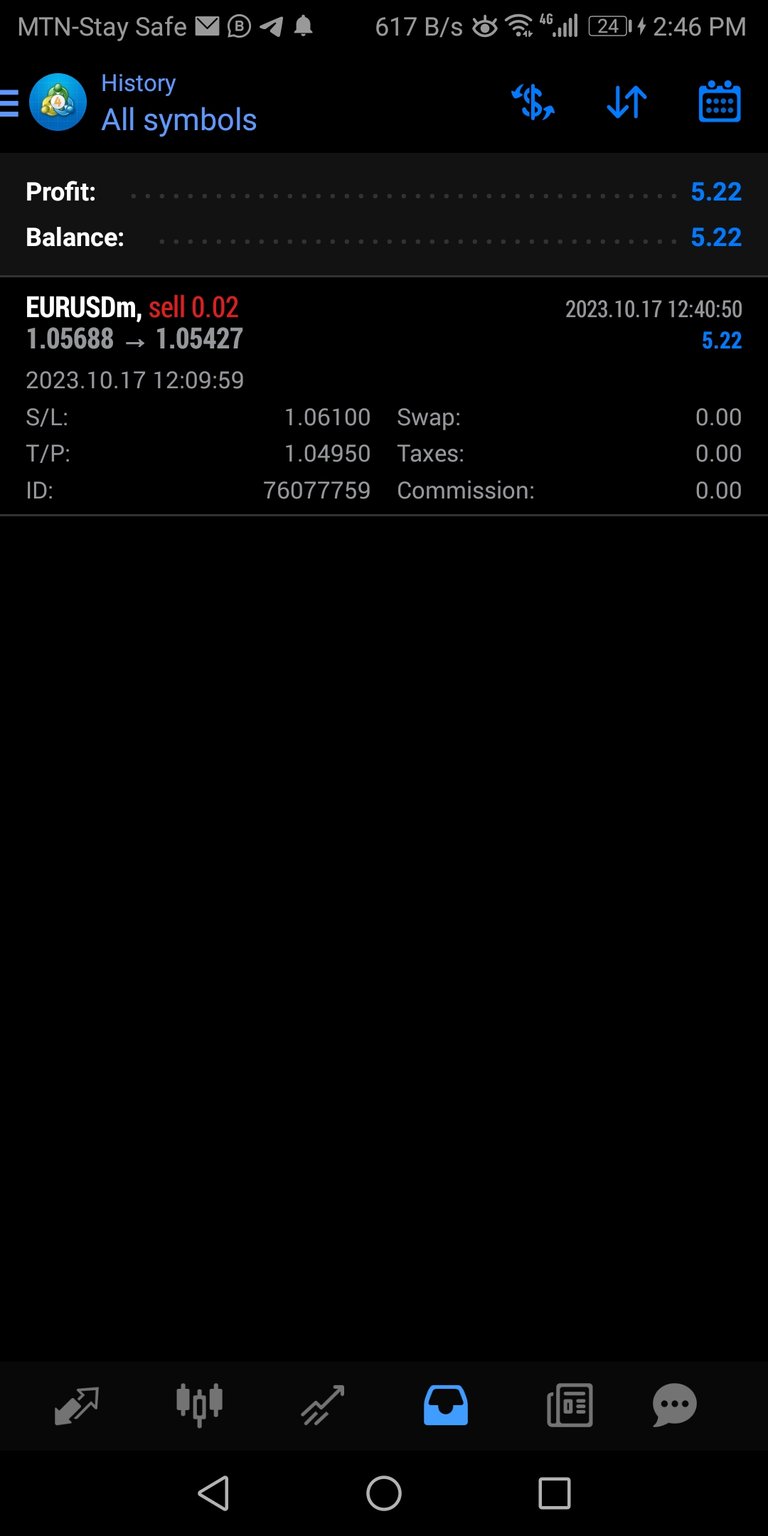

For a Stop Loss (SL) to limit potential losses, I considered placing it just at the resistance level, 1.0610. These levels can act as a safety net to exit the trade if the market goes against my position.

For Take Profit (TP) I set it at the support level, 1.04950 but I pulled out of the market before it could hit my set TP

And here's my result on the currency pair for today:

A Screenshot from my phone

As I continue to explore this intriguing world of forex trading, my initial experiences may appear modest. However, I believe in the concept of "days of small beginnings." Each day is an opportunity to learn and grow. I am excited about the journey ahead and look forward to sharing my progress and insights with you on Hive.

Thank you for joining me in this new adventure!