Stablecoins were originally created to solve the problem of getting liquidity into the bitcoin space, and the issue of having exchanges custody funds. Instead of each exchange having to create its own fiat treasury, accept fiat, and deal with the banking wires, having a stablecoin reduced that complexity.

A central body would manage all the creations and redemptions, while the funds in the system would be pegged to that treasurey. Exchanges would offshore their risk to these third parties in exchange for speed and simplicity of their operations.

Stablecoin markets

Eventually, stablecoin markets became a trading pair, instead of shitcoin to bitcoin transfers you could now go from stablecoin to shitcoin, or stablecoin to bitcoin transfers.

Instead of shitcoins having to be tethered totally to bitcoin, they now had a hedge through their stablecoin liquidity, and it allowed shitcoins to smooth out their crashes.

Shitcoins are still very much leveraged bets on bitcoin, but stablecoins do reduce the impact of that leverage and why so many shitcoins are desperate to set up pairs against stablecoins of all types.

The more dollar exposure and liquidity you can get, the more capital can flow into your ecosystem.

Stablecoins was created for a niche use case

Stablecoins were created to allow for instant settlement in various digital markets and allow for more efficient arbitrage between exchanges. But as fate would have it shitcoiners don't understand this and they think stablecoins are meant to create shoddy financial products on top of it.

Now this chase for yield is using stablecoins as an affinity scam, people understand fiat, but they don't understand risk, so they discount the one and associate safety with the other.

This helps sucker people to compromising positions many won't get out of before it's too late.

Stablecoins are digital fiat

Apart from the obvious issue, is that its a fiat currency that continues to devalue. The stablecoin has to be a centralised service to run successfully, it's an extension of the underlying asset.

Stablecoins can only be managed from a central treasury where redemptions can be managed, if you're going to try to back it with a floating asset you're going to have a bad time.

You've already seen that with the implosion of LUNA.

The failure of stablecoins

If you think UST is the only one, you would be wrong, Bean Finance blew up a few weeks earlier

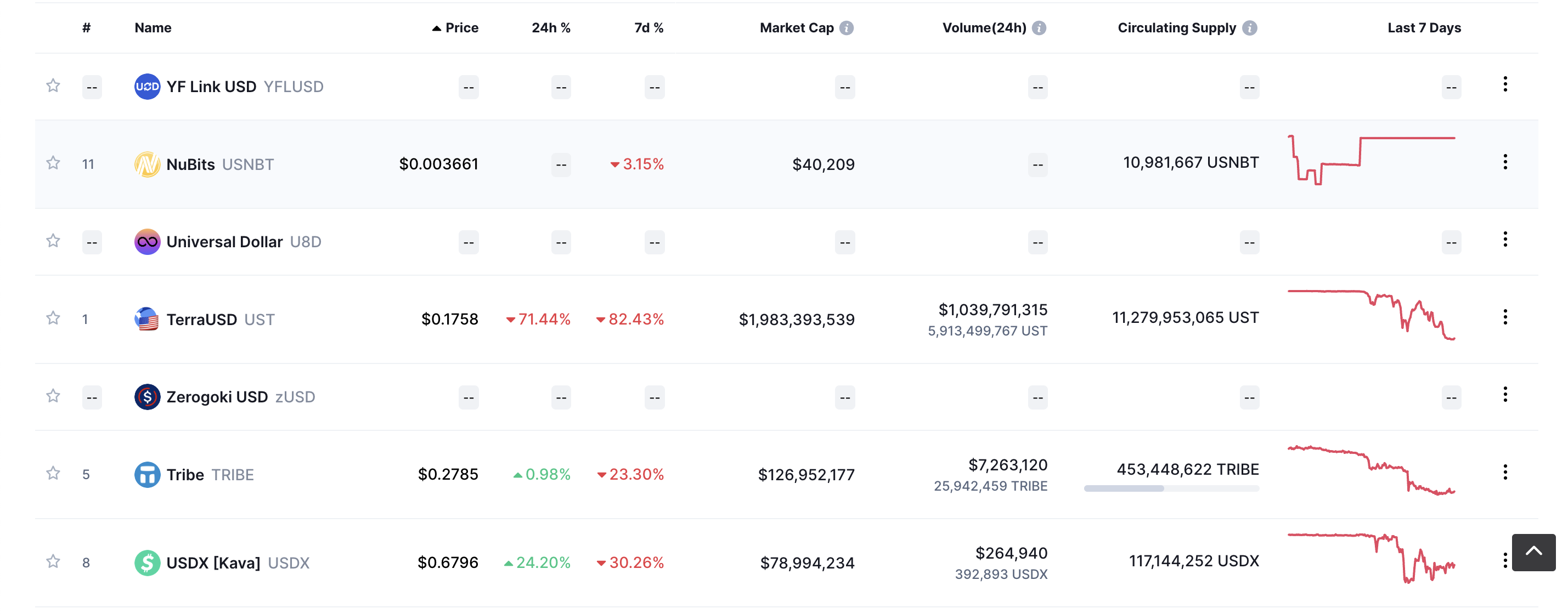

It looks like 10 stablecoins have already broken and there are 12 more that are in the same boat. If we have a look at some of the failed attempts, you can see some of them below:

The truth is algo stablecoins are a disaster waiting to happen, the collateral they are using is firstly subpar, the demand for the collateral is hardly enough, in fact, more people want the stable coin than the underlying making it a cock up in the first place.

You can maintain an algo stablecoin in certain environments where there isn't much demand for the coin so you can manage inflows and outflows to maintain the peg, but then you're doomed to be an obscure environment.

The moment you achieve any kind of scale, the obvious peg balancing will be exposed.

If anyone that tells you their algo stablecoin is different is a moron. It's only a matter of time before it fails.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Earn Free bitcoin & shop | Earn Free Bitcoin & shop | Claim Free Bitcoin & Shop |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta