In today's edition of YIYL, (You Invest, You Lose) we stick to the failures on the institutional front. It's not only exchanges and miners going tits up, but these so-called smart money. The guys who are meant to know how to deploy capital into the market, those making markets, those whale accounts on exchanges and DEFI wallets, those making the big moves and allocating to the so-called winners in the space.

That's what you're told but really these are just over funded degenerate gambling operations with fancy names, titles, and money that are so desperate for a return that they would rather go for broke than try to find real opportunities.

As the gold rush in the shitcoin market lines up a new set of suckers, it takes very few survivors in the previous set who walked into the casino thinking they could beat the odds.

No Midas touch

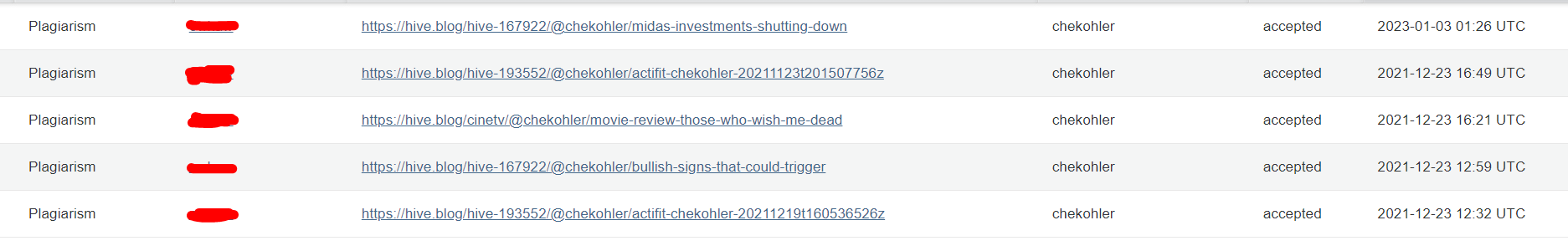

Our latest victim to wave the white flag is Midas Investments which announced suddenly that they would be shutting down their platform, which previously enabled users to deposit cryptocurrencies which would then be invested in various defi projects.

The team revealed that they had only $51.7 million in assets compared to $115 million in liabilities, while that might be a shocking admission to customers, it was also a fact they had not disclosed to most of their employees.

So only top management knew the depth of the impairment and they were trying to hold out hope for a turnaround that never came, is that really how you plan to run a business?

What happens to user funds?

Personally, I am always shocked at the number of assets people are willing to add to platforms like this, considering that the figures quoted above are probably based on depressed prices we see now, so they could have easily been managing around half a billion in assets during the heights of the bull market.

You'd think just being honest and taking your fees on withdrawals, deposits, and trades and earning some on arbitrage and market making would need you a decent return on the assets you hold but I guess, fractional reserve banking is too good to resist and now this is what you're left with, more promises than assets.

Users with assets on the platform will see a significant haircut in what they are allowed to withdraw. Midas intends to keep 55% of the Bitcoin, ETH, or stablecoins held by users in their accounts, as well as any rewards users had earned.

Not your keys, now you have no coins

Let the users be too upset that more than half of their assets no longer belong to them, if that's not comforting enough, don't worry about it. After Midas writes off all the bad debts they created for themselves but you paid for, you get to do it all again.

As an olive branch to the customers they rekt, Midas will be making up the difference in a new, valueless token that does not yet exist, but that will be associated with some future project that Midas has not described yet.

You're welcome!

Reading and covering these stories, these responses often feel like satire especially since I am not invested so I don't feel an emotional tie to any of this nonsense. It just reads like trolling but the sad thing is this is the work of so-called professionals.

These investors, these entrepreneurs, these traders, these tech bros are supposed to be so smart, so why do you keep doing such dumb shit? Lol well, I guess the answer is you can get away with it and the customer is too dumb to know that they're being taken for a ride.

Sources:

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Earn Free bitcoin & shop | Earn Free Bitcoin & shop | Claim Free Bitcoin & Shop |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta