Credit card is common now a days and every other person is having a credit card. But the problem is people thing Credit card as their extra money and thus this actually is the problem. So if anyone is having a credit card they should actually avoid these 4 common mistakes.

Overspending

People think Credit card as their extra income and thus they overspend thinking it as their money. And at the end of the month when the bill comes they don't have the money to pay the bills. People who newly get the credit card does thus mistake and buy expensive items on Credit card to regret it later.

Minimum Payment

When the bill comes there is 2 options, pay full amount or pay minimum amount due. When you pay minimum amount, the remaining amount will attract the interest of more than 30% which is quite huge. And this starts the cycle of debt trap. I have been using the credit card from last 8 years and I have always done the full payment.

Pay Bill after Due Date

A lot of people miss paying the bill on time and thus their credit score decreases as well as you have to pay the late fee also. So it's better to pay the bills on time for the financial health.

Ignoring Cashbacks

A lot of people use credit card but they don't know how to optimize the rewards. We should use the Crdit cards on such a way that it should increase our rewards. Some fo the credit card have rewards upto 7 to 8%, and thus based on our spending we should get the Credit Card.

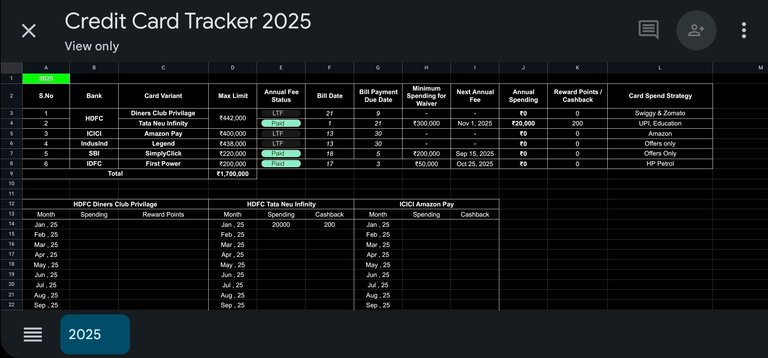

I have created a Google Sheet tracker where I can see what is the bill due date, what is the amount I have yo pay, what is the cashback I am getting and all the details. I will also get the information about how much money is remaining for the renewal fee waiver for a year and this actually helps me to track it effectively.