Whenever I meet with some friends most of our talk revolves around money, whether it's buying stocks, getting into mutual funds, cryptos or even real estate. So yesterday, I was having a conversation with one of my friends about goals, and I have told him about my goals and how I am planning to achieve those goals in the coming years.

PC: Pixabay.com

He said that he has not created any goals but would like to create one, one more thing about him is that he has recently bought a home and does not have extra savings to invest because most of his salary goes into EMI. He has asked me for suggestions, so what I said is that it's ok to be slow but steady to reach your goal.

That means even if he can invest a small amount every month and continue doing that for years, he can able to reach his goal provided his goals are realistic. I know when you have expenses and EMI's it's hard to save anything in the month, that's the problem most people have when they have quite a big loan over them. But even though if he habit of investing small amount it can be huge when the time comes.

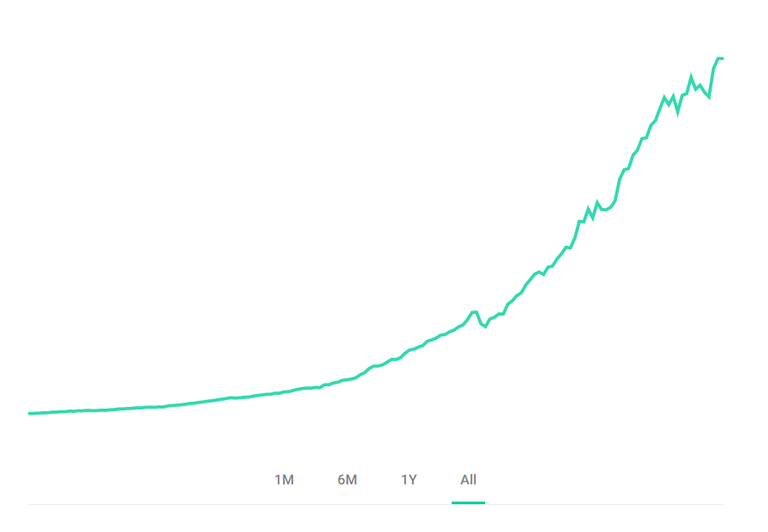

We all start somewhere and some people invest heavily whereas some people invest whatever they can. For me also I was investing a small amount initially as my salary was less and the expenses were more but eventually when the salary increased, I have started investing more and try to increase that every year as the salary increased. The below image shows how my portfolio grows over the years, as you can see I too have started from 0 but now have invested subsequent amounts and continue investing to complete the goals which I have set for myself.

Everyone knows this proverb that "Slow and Steady Win the Race", but I think even if you are slow, medium or fast if you are steady towards your goal you will achieve it, that's what consistency means. Out here when it comes to investing we are not racing against other people, but racing against ourselves themselves so now it doesn't matter how much you invest, what matters is you invest every month.

What mantra I am following is to set a goal for myself and try to invest some amount every month in that goal. Again that goes to the realistic goal that I have set as per current conditions and thus when the need for a bigger goal arises, I can change accordingly. But it's always necessary to start somewhere.

I might not have invested in a fortune but I know whatever I am investing is as per my financial conditions and thus I try to remain steady rather than have that quick rich mentality. And that's why I take the mutual fund route so that I do not have to worry about maintaining the risk that the mutual fund takes care of.

Posted Using LeoFinance Beta