I was investing in both the Power Finance Corporation and Rural Electrification Limited from long time. Though the investment amount was not high. Both of these companies are dividend paying company and gives good dividends. And my investment strategy was to get some dividends out from it.

PC: Google.com

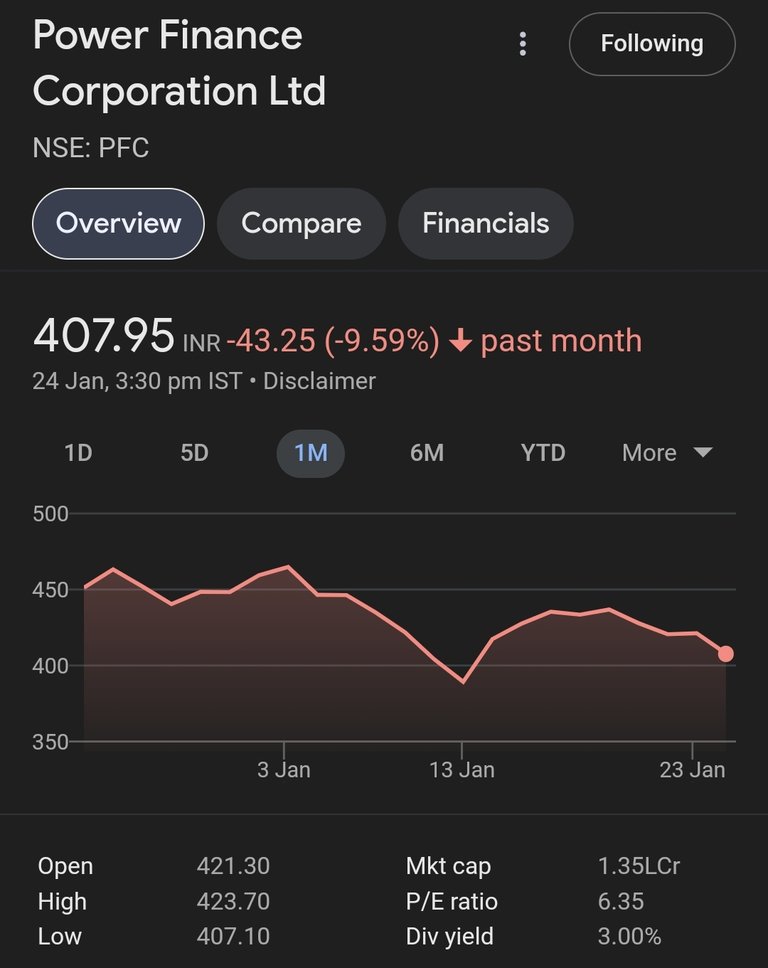

Now these both companies are the Public Sector company and both are into power. Now the problem is investing in the similar company doesn't make sense, and it doesn't support the diversification. So today I have sold all my REC and bought PFC. The price was almost similar so I have got little more of the PFC after selling my REC. As of today the market is going down and both PFC and REC have came down significantly from its all time high. So whatever is the company you are investing it will be similar only.

My point was having more investment into one shares would be much better than the less number of shares into multiple company. I wanted to have a sizeable inveatmnet into PFC so that I get more dividends and thus it can help me to create a regular income. I don't have much dividends income company I have the PFC as well as ITC, both of which gives good dividends.

As of today I am not investing any new money to any new companies. All the new money is going in the index fund itself because I feel index funds is much better option in the volatile marlet rather than individual shares. When the marlet improves, I will buy those companies share. But eventually I will try to move everything to index only and don't worry about the individual share investing as I have seen its very hard to beat the index so why spend time on it.