While the crypto market tanked the last week, the GambleFi coins managed as always to hold their ground and they continued to provide solid dividends which I'm now using to buy the dip.

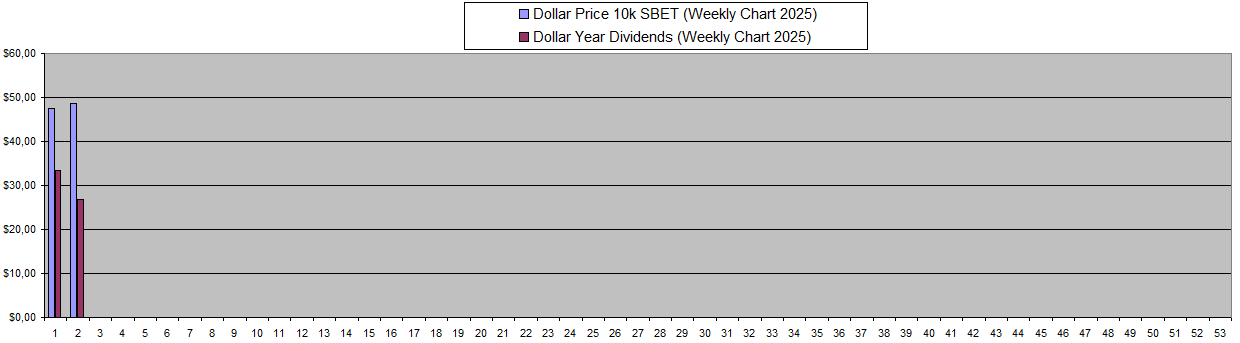

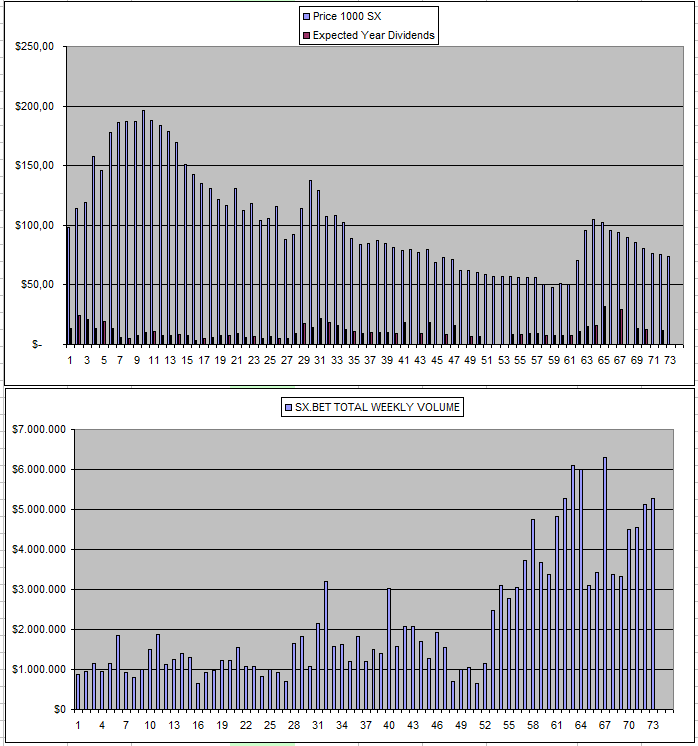

Sportbet.one (SBET)

I had an interaction with the support team this week as I did an USDT withdraw to Binance while they send the native USDT instead of the real ones which obviously were not credited. However, after some mails they did properly refund me the money again showing good reliability which they have done for many years now. So I'm still happy with my investment and will continue to just hold while raking in the benefits each week

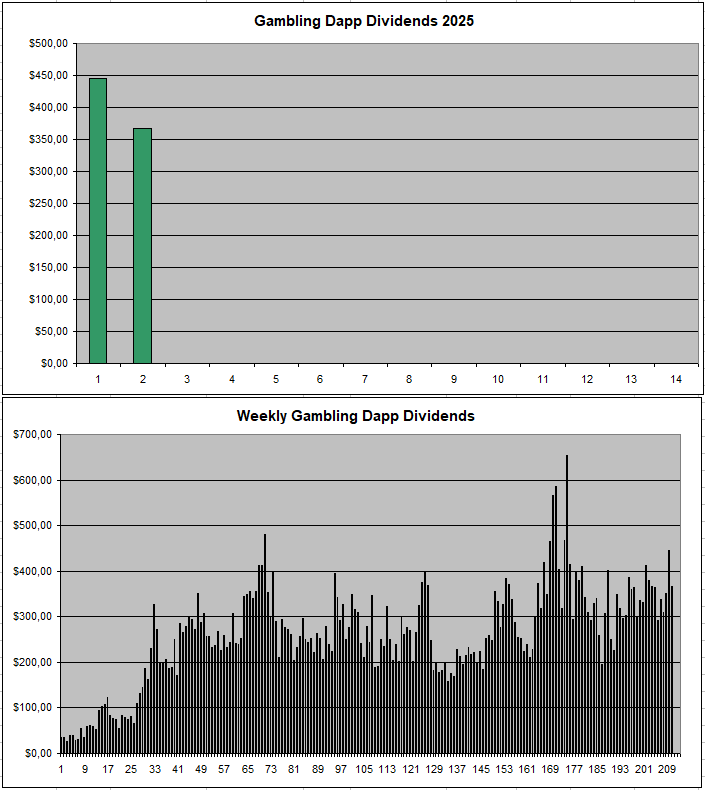

The price of SBET also went up a bit and dividends once again were quite strong. I started a new chart for 2025 so it's going to be interesting to see it fill up over time.

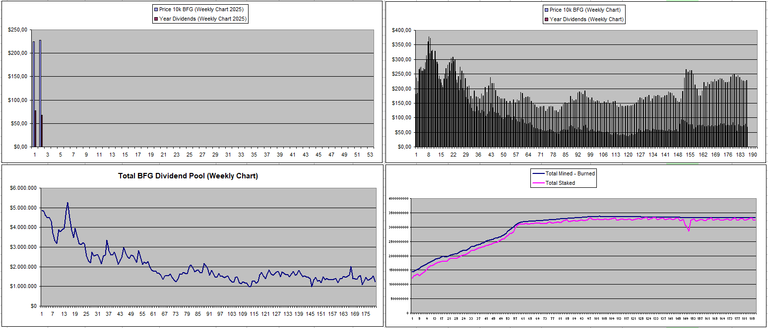

Betfury.io (BFG)

Just another regular week for Betfurty which was rather disappointing as the dividend pool went down again.

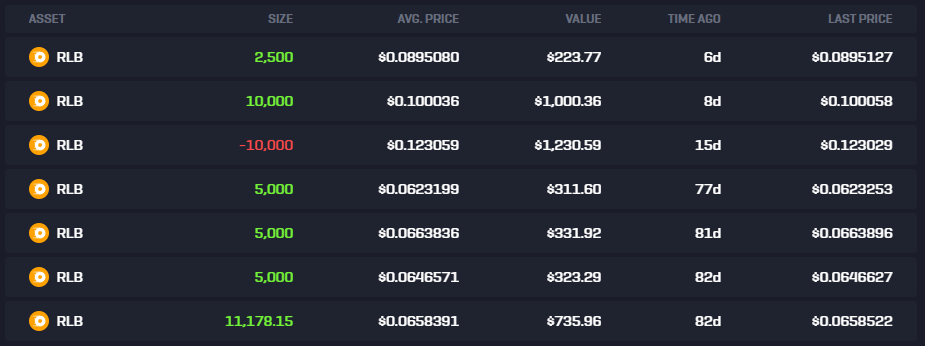

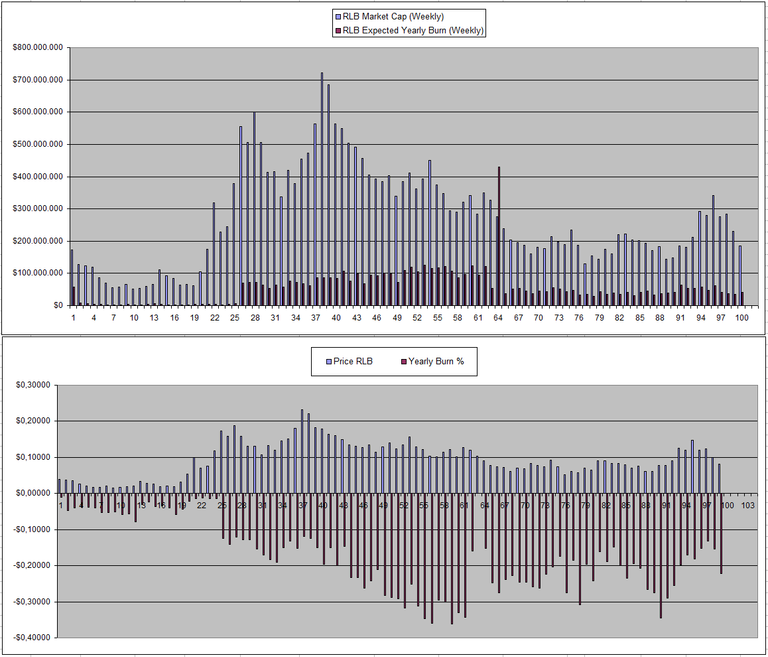

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

I fully bought back the RLB which I previously sold the moment the burn went below 15% and managed to buy 2500 more than I sold (25%). Last week because of the dip it's now back at 22%+ which kind of makes me want to buy more.

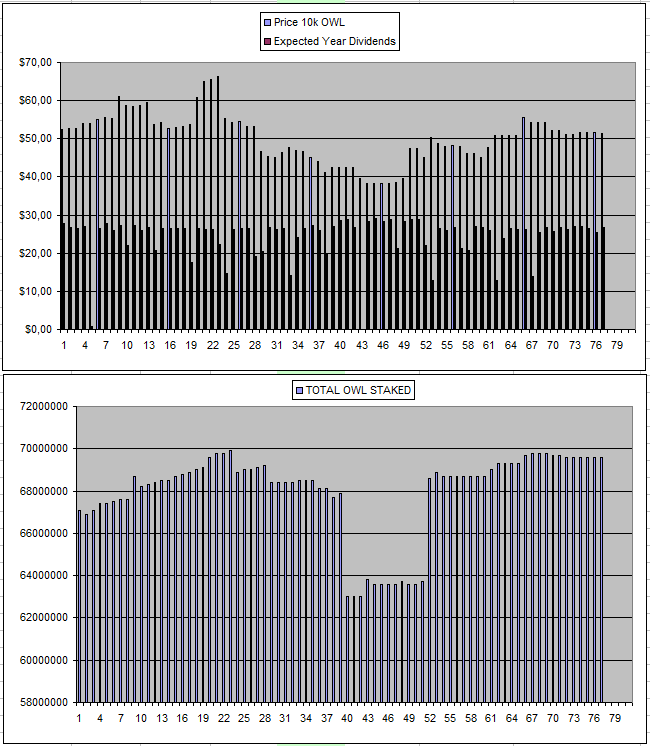

Owl.Games (OWL)

Another week and another ~30$ dividends from OWL which after 78 weeks now paid back around 65% of my initial investment.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

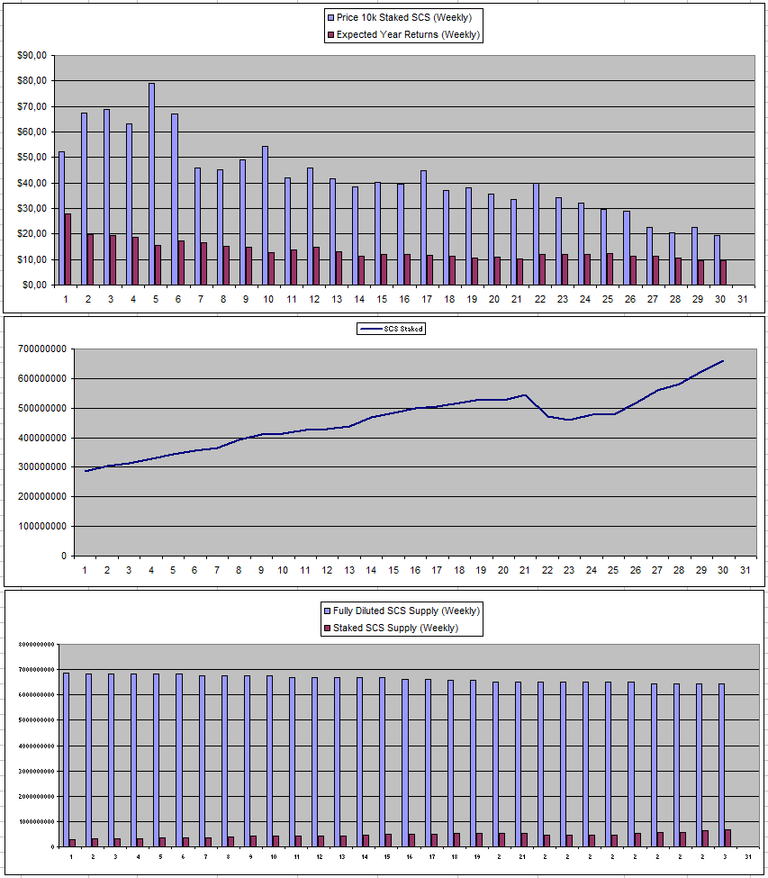

Solcasino.io (SCS)

Week after week more SCS is getting staked as last week another +5.81% was added while still only 10.28% of the max supply is staked. The last 3 weeks for having 500k SCS staked, the received dividends were 10.05$ / 9.01$ / 9.09$ so they are holding up. I am tempted to continue to cost-average some more SCS and stake it with an eye on the long run building the income stream but at the same time I feel there is more sell pressure ahead.

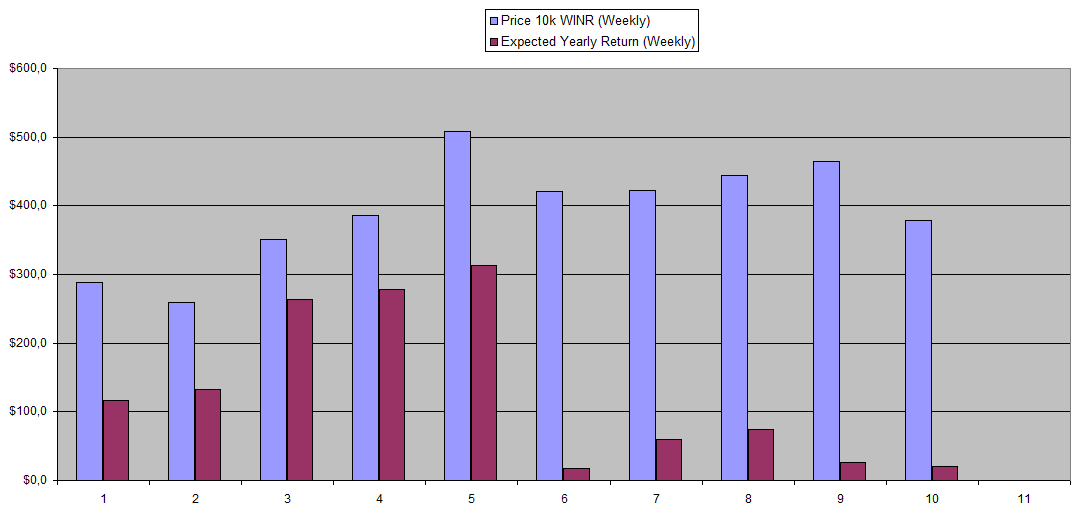

It looks like WINR is just back to 5% APY after somewhat of a hype phase. While there is a lot to like about the project I really hate how they handled the vWINR migration as for almost half a year they kept saying 'keep it staked and we will handle the merge' while all the ones who didn't take the risk to lock got very high dividends. Now after all this time they come with a statement that you need to vest (unlock) which takes 180 days and afterwards you can bridge to the WINR chain. They also said that there will be some compensation but I doubt it will come anywhere close to the punishment that the most loyal investors had. I only put part of my WINR into vWINR so I'm quite fine with it also because the price went up. At the same time there is the Brett pool which I heard nothing about more aside from the site saying 'back soon'.

So Yeah, it's quite frustrating also because the dividends are way down compared to where they used to be a month or so ago. I don't rule out for WINR to see a correction down in price.

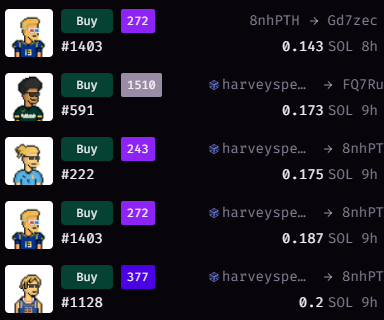

vBookie (NFTs)

Still not so much going on with vBookie were the floor price on the NFTs still looks really low. It remains a high risk high reward project

| Last Week | This Week |

|---|---|

|  |

Sx.Bet (SX)

This was the 2nd time that there were no dividends so I will need to go ask on their discord what is up with that

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +55% APY |

| Betfury.io (BFG) | +30% APY |

| Owl.Games (OWL) | +52% APY |

| Sx.Bet (SX) | +0% APY |

| WINR Protocol (WINR) | +5% APY |

| Solcasino (SCS) | +48% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

I received exactly 366.52$ in passive GambleFi Earnings last week for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 27.4k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using InLeo Alpha

Posted Using INLEO