It was a pretty regular week for GambleFi as it pretty much goes it's own way as a business that has real customers and revenue which slowly but surely is growing over time as more people get into crypto. If anything this is really a marathon over multiple cycles re-investing some of the dividends which helps to grow the passive earnings. Give it enough time and it really starts to add up. By now it's been over 5 years since I bought my first gamblefi coin to build some reliable passive income and it has been a fun ride without anything crazy.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

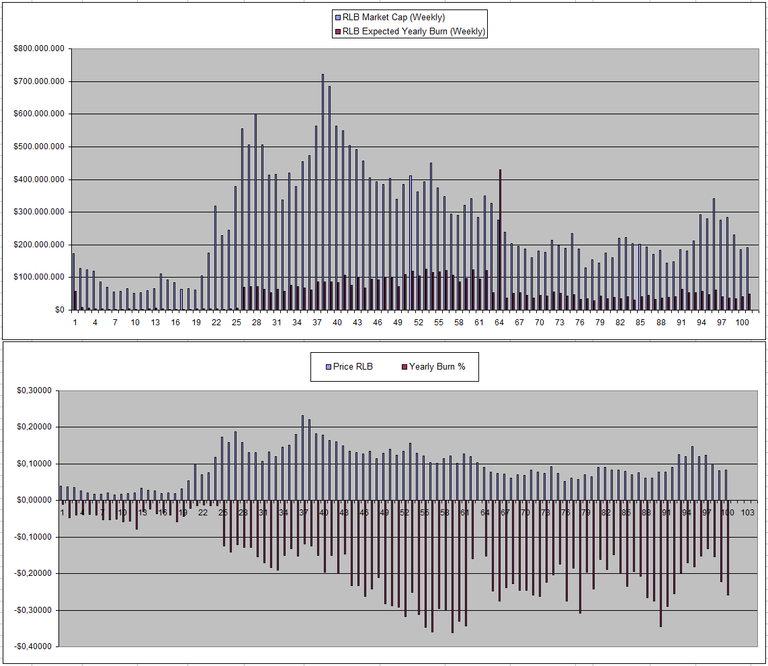

RLB for me is now back in a zone where it feels like it's a great buy, with the price having come down but the revenue still flowing in, more coins get burned so it's a matter of time before the price has to go up (unless Rollbit is scamming everyone or if revenue all of a sudden would go down a lot). With Trump back in charge, the new narrative seems to be US based coins so I guess money flowing into those is one of the reasons why the RLB Price went down to where it is now.

Looking at the numbers though, last week the expected yearly burn was at a whopping 25.931% so it's tempting for me to buy some more but at the same time I don't really have the spare funds to do so properly. Generally when both the price goes down and the Burn Up it makes a possible temporary reversal

The chart also looks like it's in sideways mode after the initial pump and retracement.

Sportbet.one (SBET)

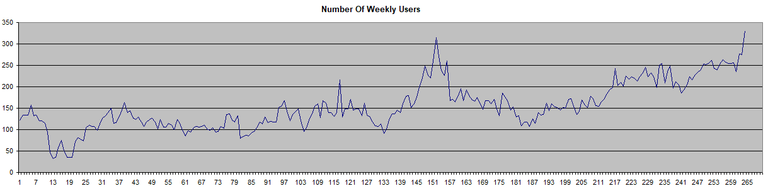

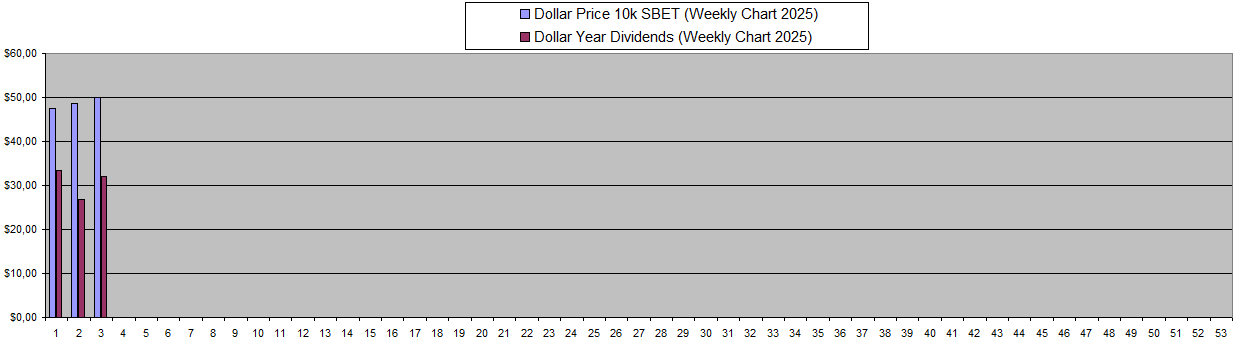

Sportbet last week saw an all-time high of individual users that placed at least 1 bet on the platform. While this is still very low at just 331 accounts, it's nice to see the previous record which was set during the world cup broken. The dividends were also quite good at 300$ for staking 5 Million SBET which equals about 64% as an SBET Price which increased by a couple Percent.

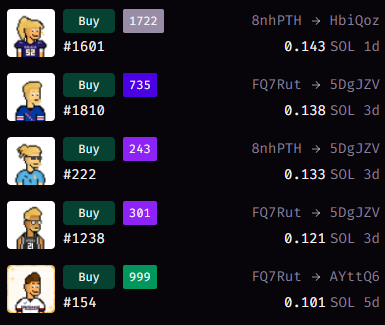

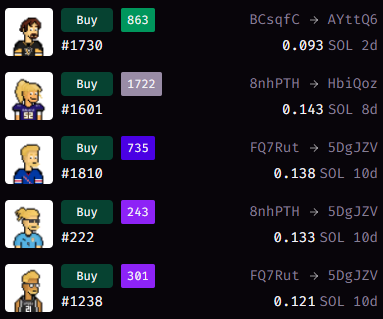

I'm hoping this trend continues this year even though I doubt that it will go crazy since it remains a product that is run on a small chain. however it's easy to use now for Solana users as SOL is one of the accepted Deposit options which doesn't get converted to dollars but stays in SOL. With the price increase of Solana because of the Trump coin, I so far earned 435$ in SOL from Dividends which is pretty nice.

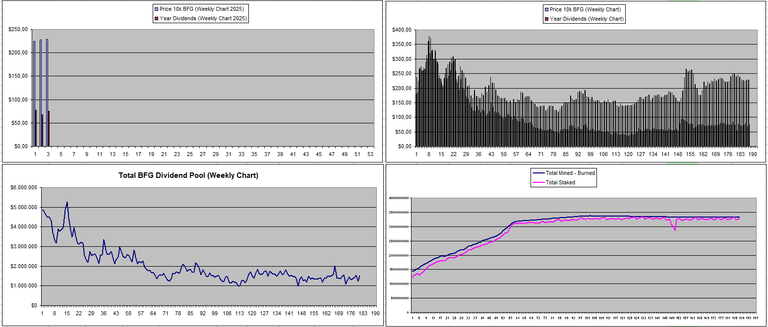

Betfury.io (BFG)

The dividend pool went up again last week from 1.2 Million to 1.515 Million which is nice. The main thing they really lack right now is Solana integration which really would make it so much more accessible to more users since a lot of the action now is there.

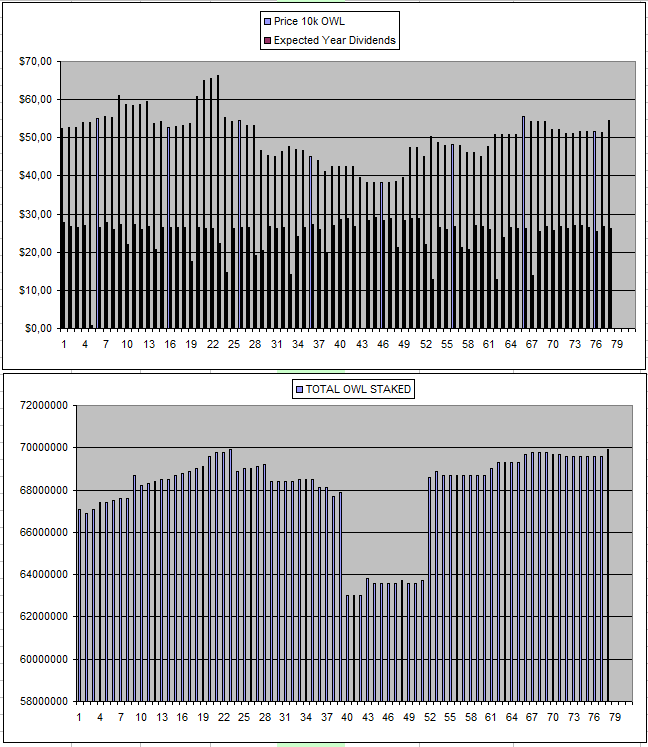

Owl.Games (OWL)

The same pattern continues for OWLDao and you have to give it out to them that it has actually been a nice GambleFi investment despite the feeling that the project doesn't really live with some orange flags along the way and the high taxes to buy, stake and unstake. They seem to have fixed the Dividend pool delay which always took quite some away from the dividends which I really appreciate now.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

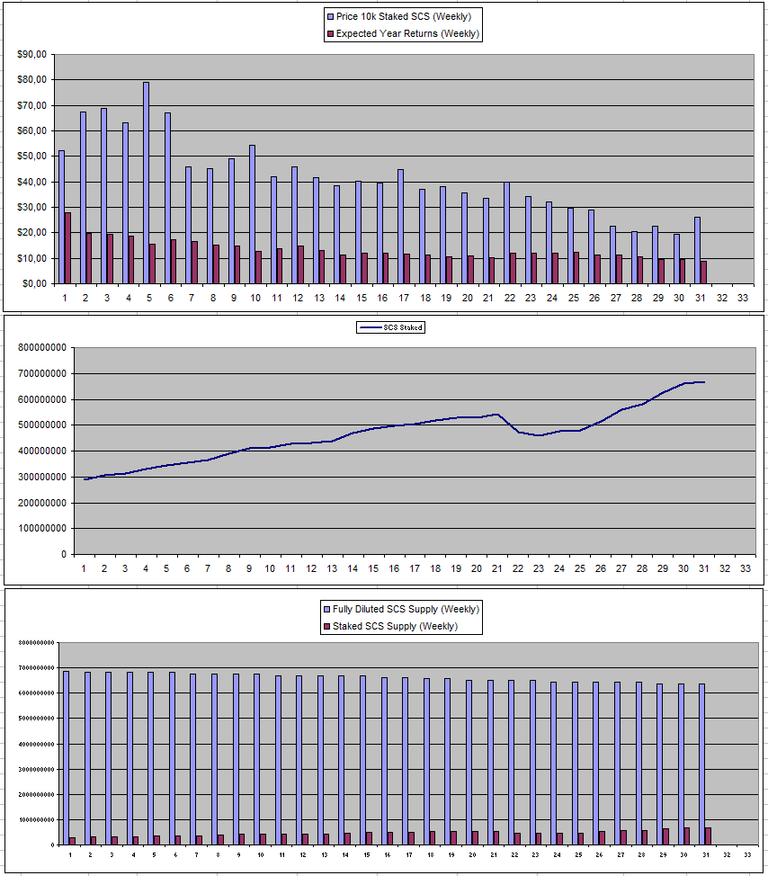

Solcasino.io (SCS)

So the price of SCS pumped with 33.53% while at the same time the dividends that I received for having 500k SCS staked dropped from 9.09$ to 8.62$ which is not really something that I'm looking for to accumulate more. The reality is that SCS is in token distribution mode where more get released each week which is bound to put pressure on the price. Unless they increase the USDC Dividend pool which never really is talked about I expect this one to get dumped back down

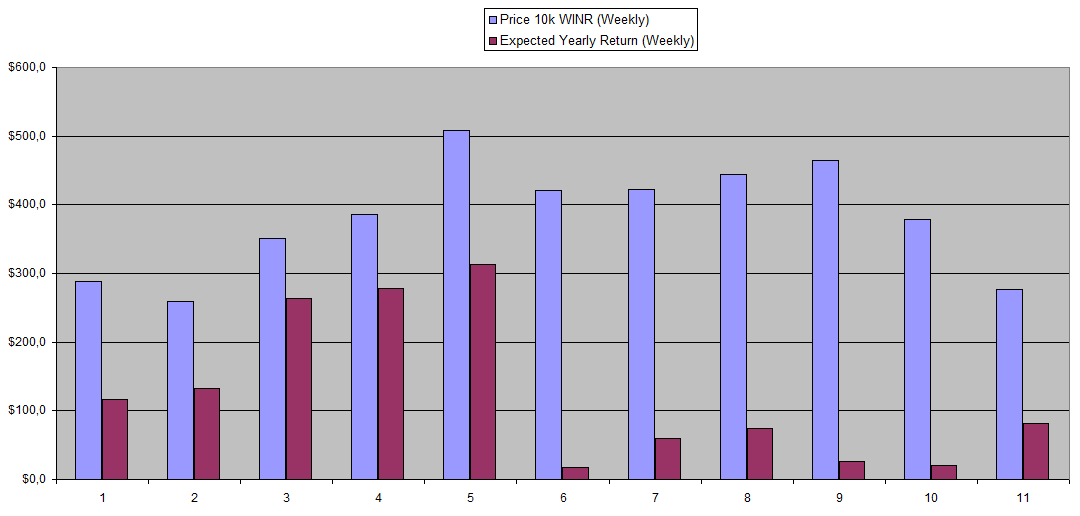

The dividends were better again last week but the price of WINR got quite a big hit from 0.03782$ to now 0.02772$ and it's getting in a zone where I'm starting to consider buying 50k extra as I still believe in the long-term success of this project. However, the profit so far this week overall is just around 30k so not really that high.

They did also come out with some kind of AI Agent gimmick which I don't really understand and feel like it's just tapping into the hype with something that isn't needed and will go nowhere

The overall volume is also down way too much so I'm hoping the price goes lower for an even better buying opportunity. I did receive a total of 15.62$ in dividends last week which equals 29.3%.

For now there is no sign yet of the Brett pool coming back but at the same time the price of Brett has been on a decline so it stings less to have the feeling to have lost 10k BRETT even though they claim it will be put back at some point.

They also showed the 'roadmap' for the coming months

vBookie (NFTs)

While the floor price of NFTs is up, there was only 1 sale in the last week which was quite a bit lower. At this point it's again a matter of waiting for the January Results hoping that they are positive.

| Last Week | This Week |

|---|---|

|  |

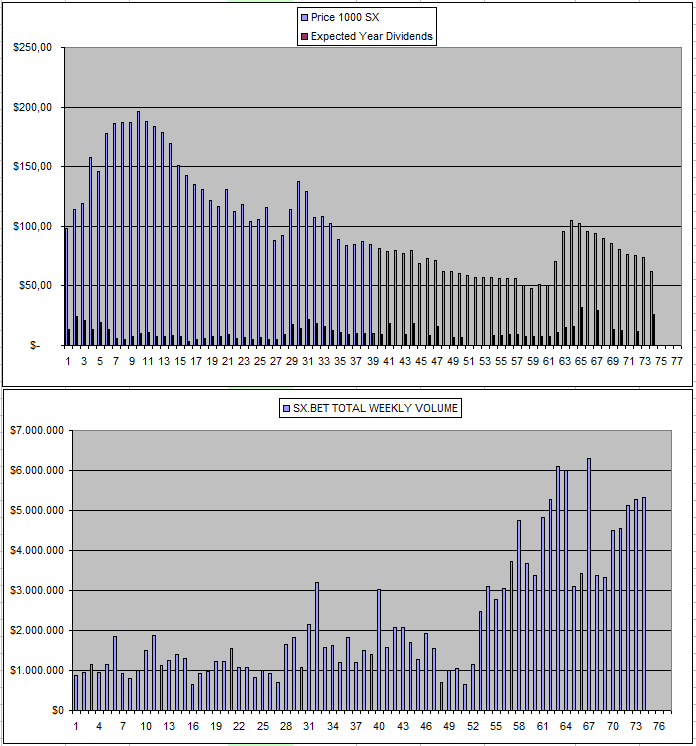

Sx.Bet (SX)

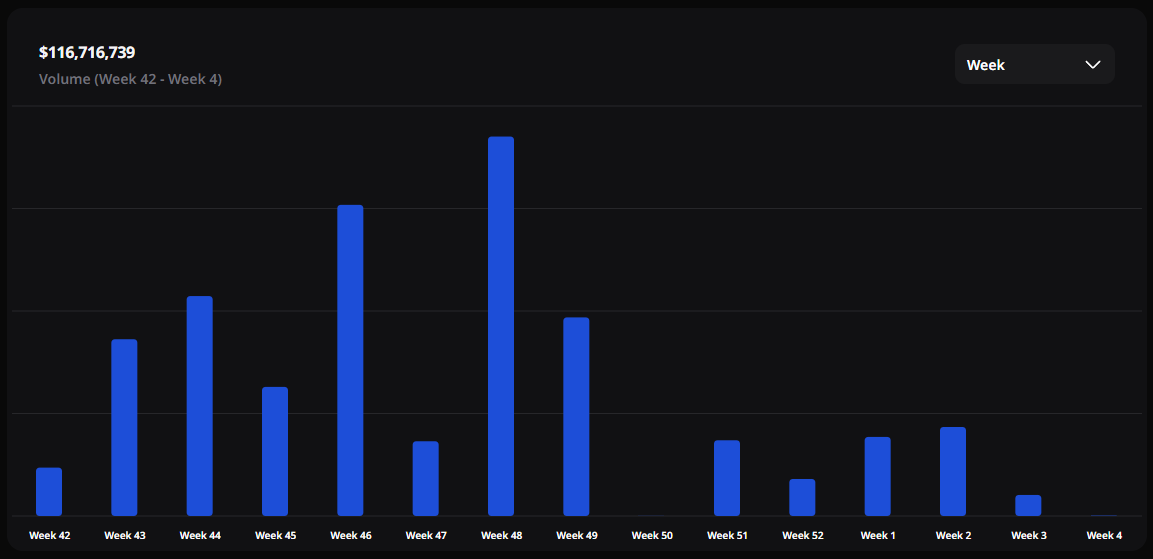

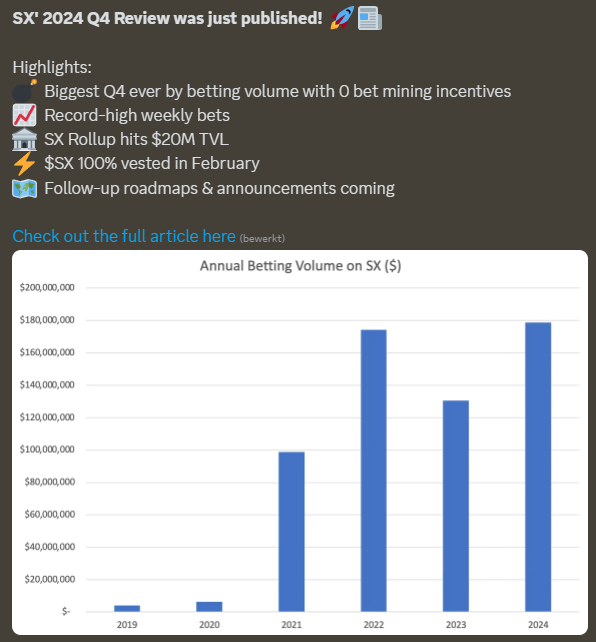

There was a new Quarterly Report (Link) which showed the highest numbers so far and this without bet mining incentives which is nice to see.

They also talked about that the supply is almost fully unlocked but dividends are still fully paid out by inflation and there isn't really something where sx makes money from at the moment. This week, the dividends were more than double as there were some weeks without any.

I did restake the dividends I accumulated for some time which ups my bag from 27400 SX to 28000 SX.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +64% APY |

| Betfury.io (BFG) | +33% APY |

| Owl.Games (OWL) | +48% APY |

| Sx.Bet (SX) | +42% APY |

| WINR Protocol (WINR) | +29% APY |

| Solcasino (SCS) | +34% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

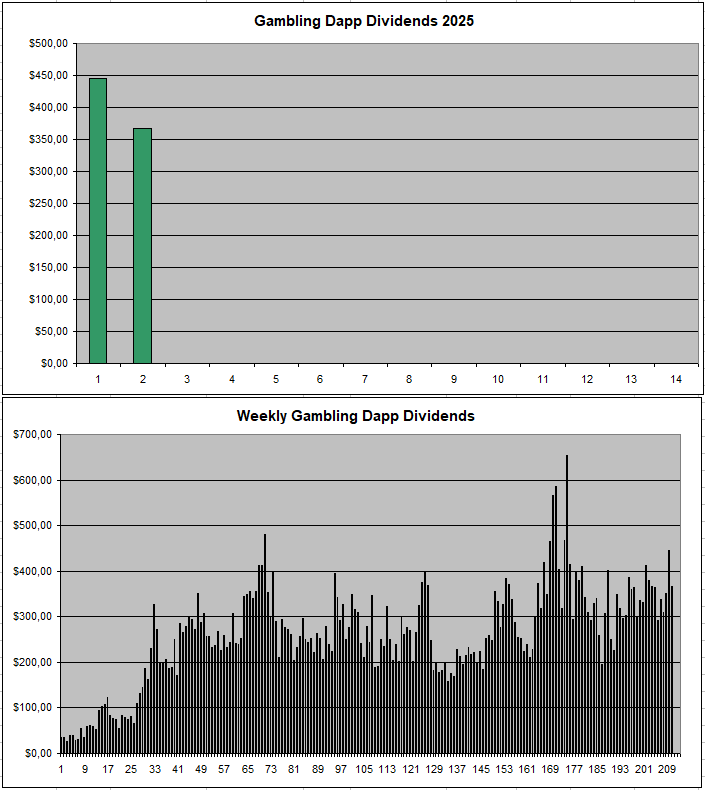

Personal Gambling Dapp Portfolio

I received a solid 447.61$ in passive GambleFi Earnings last week for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using INLEO