It was another good week for my Gamblefi portfolio while the main narrative in the market right now are all the scams that are going on with a lot of frustration on Crypto Twitter about this bull market. This along with the idea that there will never be an altseason again. During all this noise, the crypto gambling site just remain operational with people using them to place bets which continues to make money for the house and the tokenholders who get dividends from it.

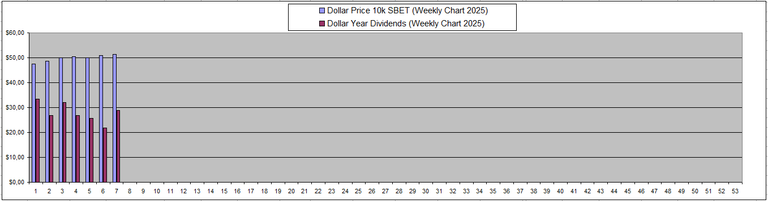

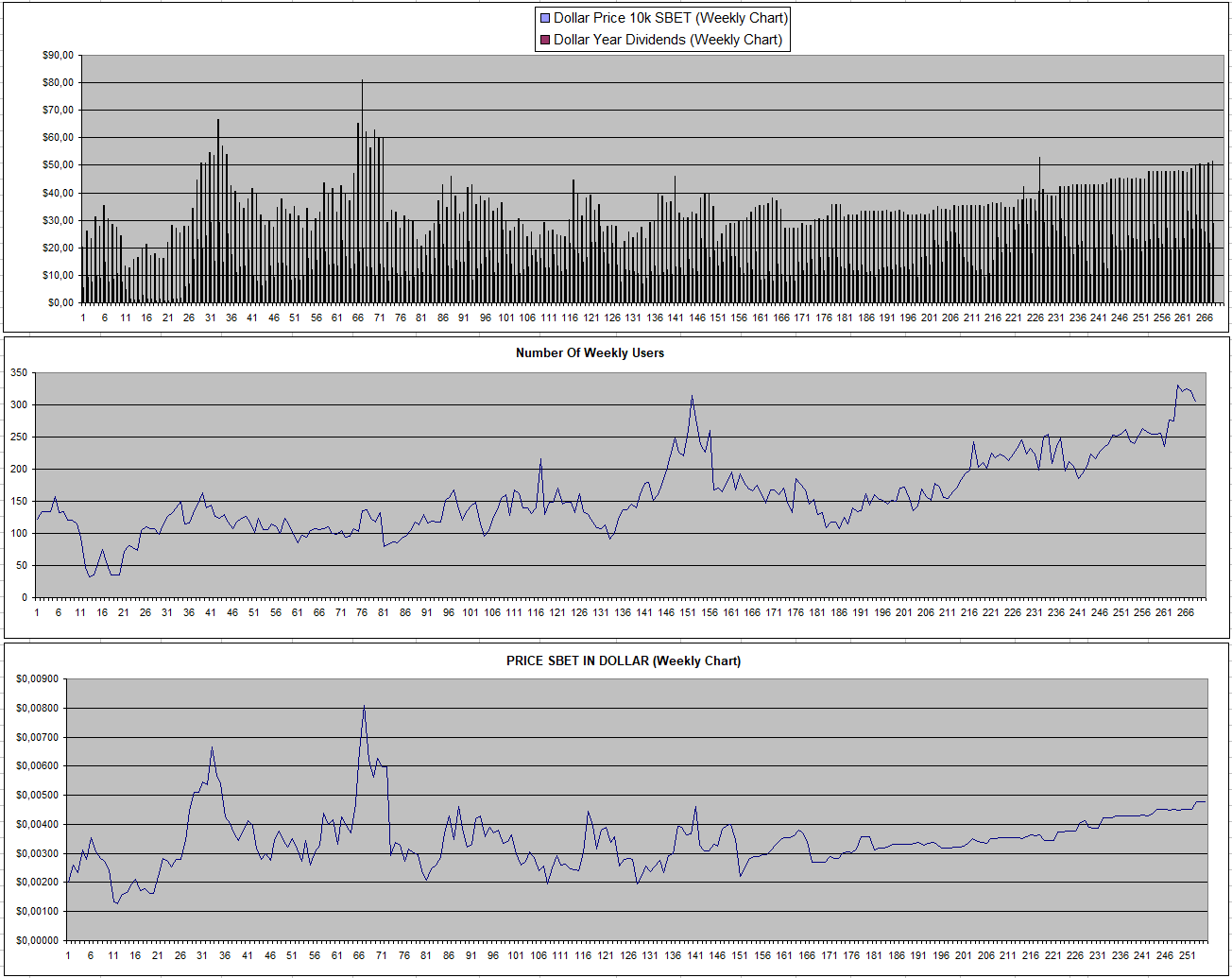

Sportbet.one (SBET)

SBET remains the star of the show as it seems to be in an slow upward price move. This because everyone who holds SBET and stakes it (98% of circulating supply is staked) gets good dividends around 1%+ in the last 8+ weeks on average. This while there is not much liquidity on the exchange which makes the price go up a bit each time there is a new buyer.

I still think it's undervalued based on what it has been giving for 5+ years now but at the same time it already is my biggest holding so while I want to buy more I'm holding off as you never know what will happen.

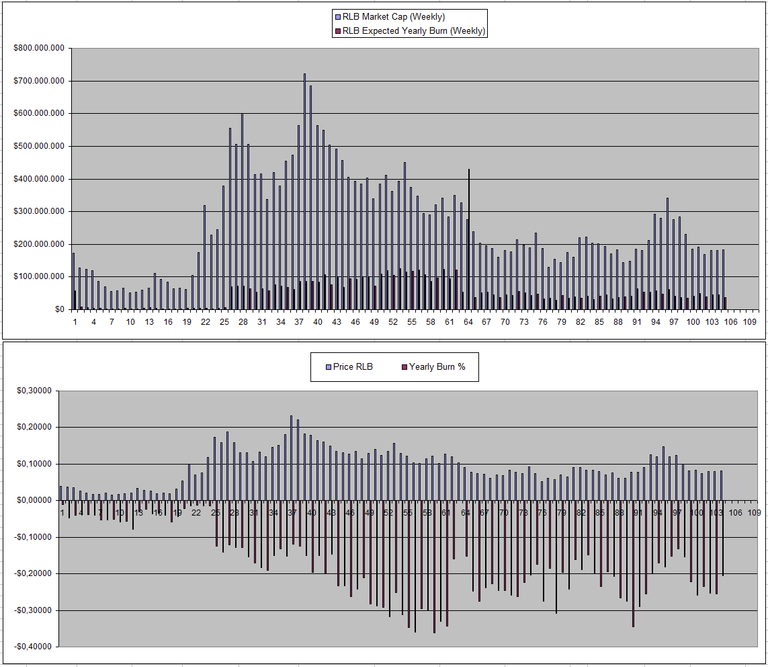

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB is also holding up quite ok as there is the burn every couple of hours of coins that are supposed to be bought back from the market with part of the profit that the site makes. Despite the fact that RLB went below 0.08$ for a while this week, the burn was lower compared to last week at 'only' an expected 20%. This is still above my 15% target where below I might consider to sell a bit again. Now I'm mainly looking at the numbers with an option to buy some more.

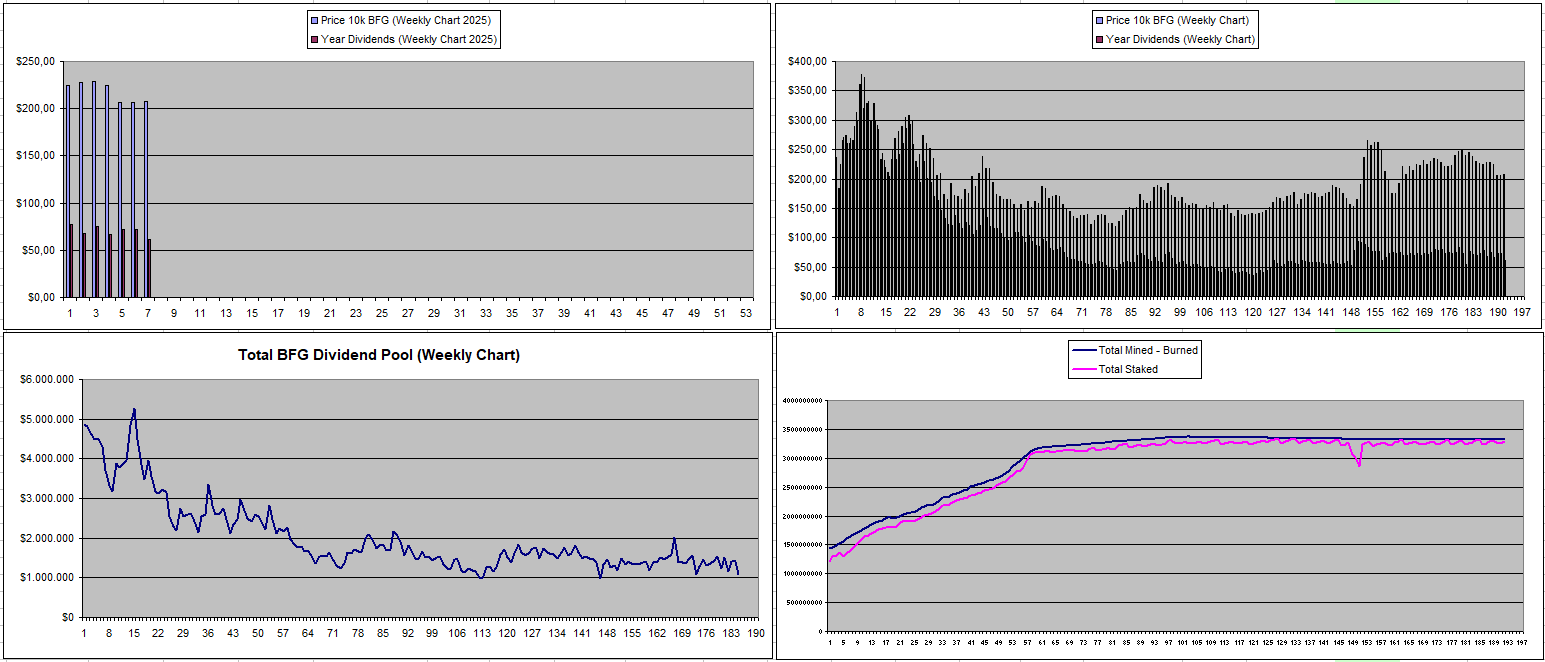

Betfury.io (BFG)

For the first time in 11 weeks, the Weekly BFG dividends for staking 500k SBET went below 60$ which was kind of a disappointment. However, the price remains around the same range at a realistic level around 30% APY.

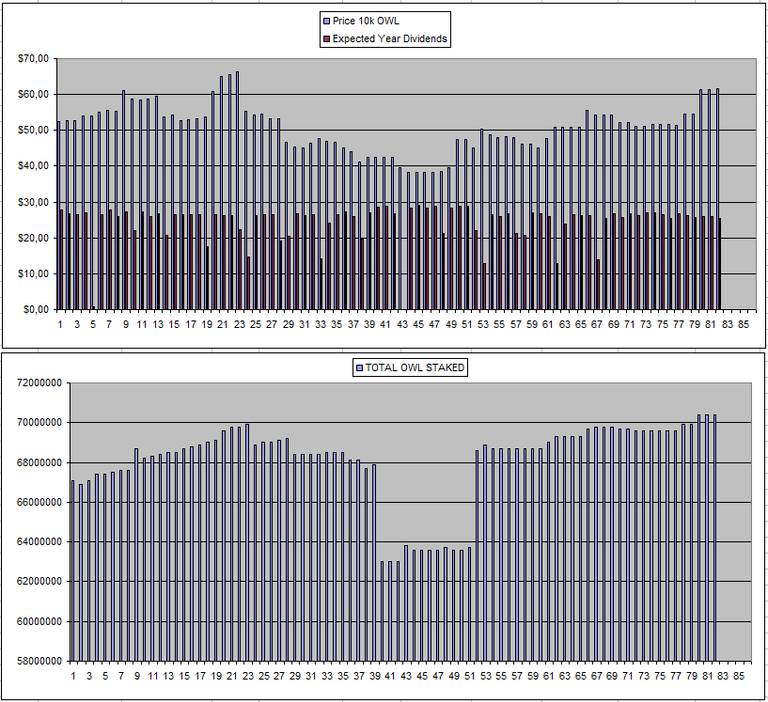

Owl.Games (OWL)

Another week and again 30$ of dividends from OWL. I also did another successful withdrawal of dividends that added up from the past months and I'm now building again toward the next withdraw. This is one of those coins where if I would have known it would go this way I would have invested much more. However, there were just too many red flags initially. So far Own has proven to be extremely reliable as a revenue-generating coin.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

| 28/01/2025 | 600k | 3179$ | 2887$ | 29.58$ | 2112.43 | 66.45% | +1820$ |

| 04/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2142.50$ | 67.39% | +2212$ |

| 11/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2172.57^ | 68.34% | +2242$ |

| 18/02/2025 | 600k | 3179$ | 3271$ | 29.37$ | 2201.94$ | 69.26% | +2294$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

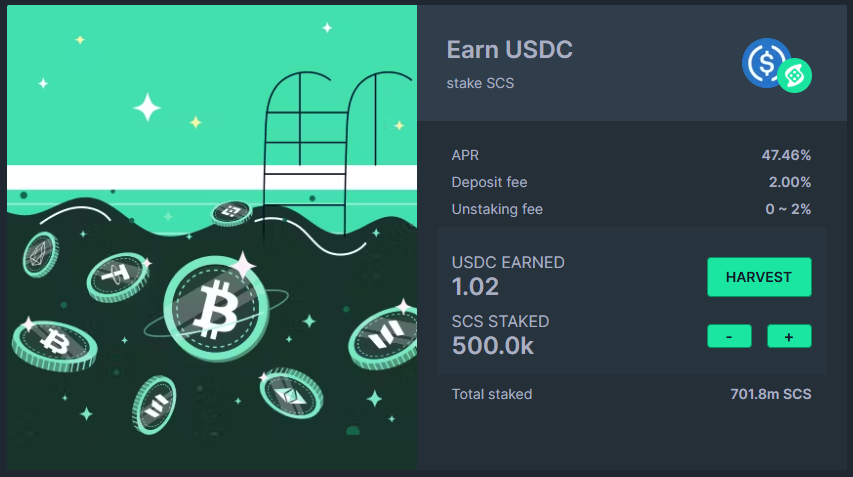

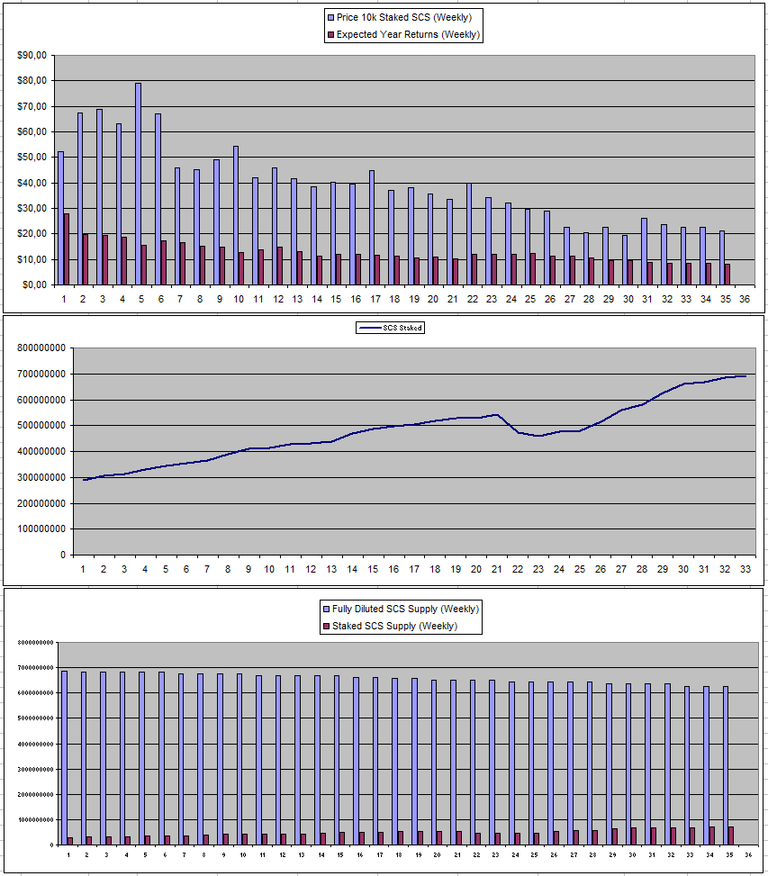

Solcasino.io (SCS)

The expected scenario is playing out for SCS as the USDC Pool does not really seem to increase while more SCS is inflated into the market toward NFT holders of which part get dumped and part get staked putting pressure on the dividends and the price. The 10$ I received weekly for staking 500k SCS 8 weeks ago by now has dropped to 7.79$ while the price is starting to adjust to the downside.

At a current price of 0.00186$ the return shows to be 47.46% but with only 11.17% of the SCS supply staked more price downside could be ahead. Around 1 days on 500k SCS staked gives a bit over 1$ now and I am tempted to slowly scale in more into SCS as I do see it as a project that can survive. The only real thing they need right now is for the USDC pool to go up and for there to be more transparency around it.

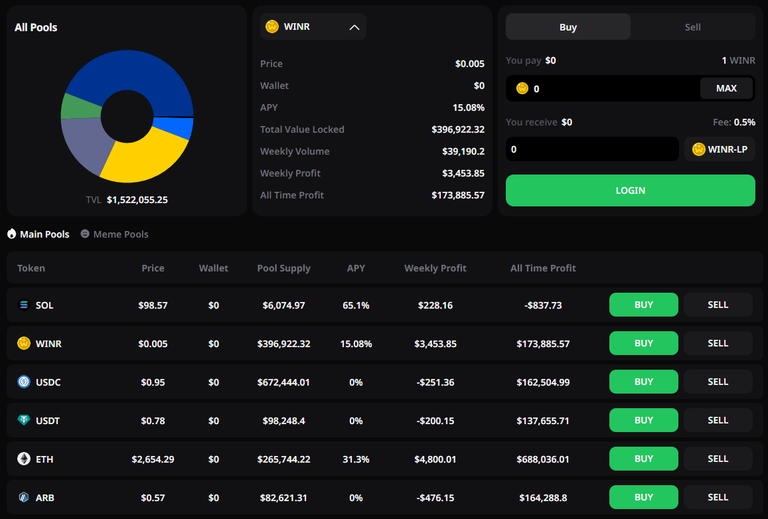

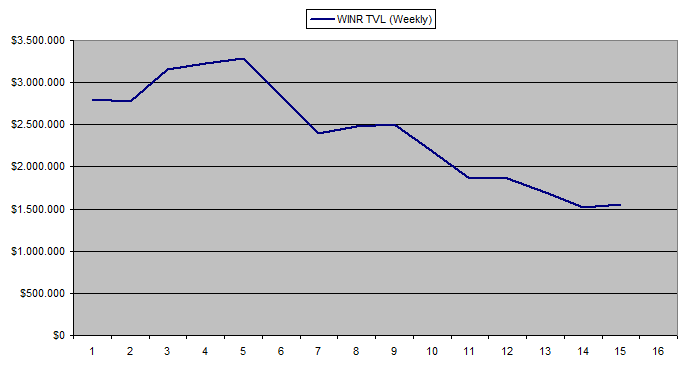

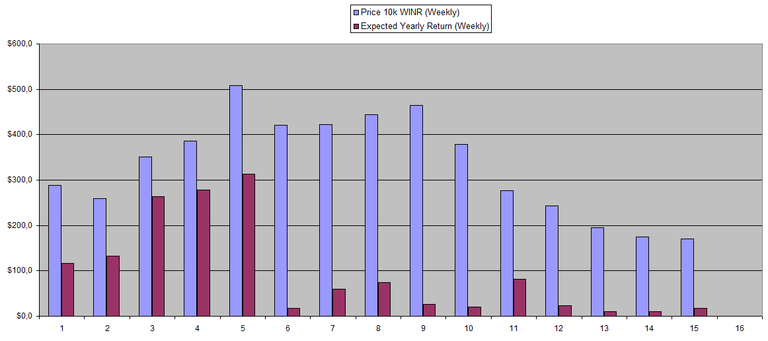

WINR has gone down in price quite a bit and it is at 0.01675$ almost half of my average buy price. I still see this one as a project with the potential to do well long-term and I'm looking to add to my bag. Ideally I want to have 1 monthly stake which I renew each 6 months so every time a month ends I have the option to sell some WINR in case things would go wild. At the same time, the price feels like it's just linked to actual revenue now which makes it harder for it to pump based on future speculation. This is what the price used to be based on.

Last week had a slight increase in dividends to 10.52% APY. One of the main issues I see is that only a 20% revenue share for providing liquidity just is too low for the risk that is involved. The TVL

I will continue to monitor the numbers and act accordingly. They are also getting their gambling licence which will allow them to start advertising.

vBookie (NFTs)

I haven't really caught up with what's going on with the Vbookie project and I mainly just wait for the report each month which so far always were underwhelming. This also shows in the activity as no NFT has been traded in the last 7 days.

| Last Week | This Week |

|---|---|

|  |

Sx.Bet (SX)

There was another week without dividends and I'm not the only one as others are asking about it in their discord. There remains some ok volume and according to the weekly WINR news it says "SX Casino is nearing launch—final API integrations with their sportsbook are in progress." So it mainly remains a waiting game.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +56% APY |

| Betfury.io (BFG) | +29% APY |

| Owl.Games (OWL) | +41% APY |

| Sx.Bet (SX) | +0% APY |

| WINR Protocol (WINR) | +10% APY |

| Solcasino (SCS) | +38% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

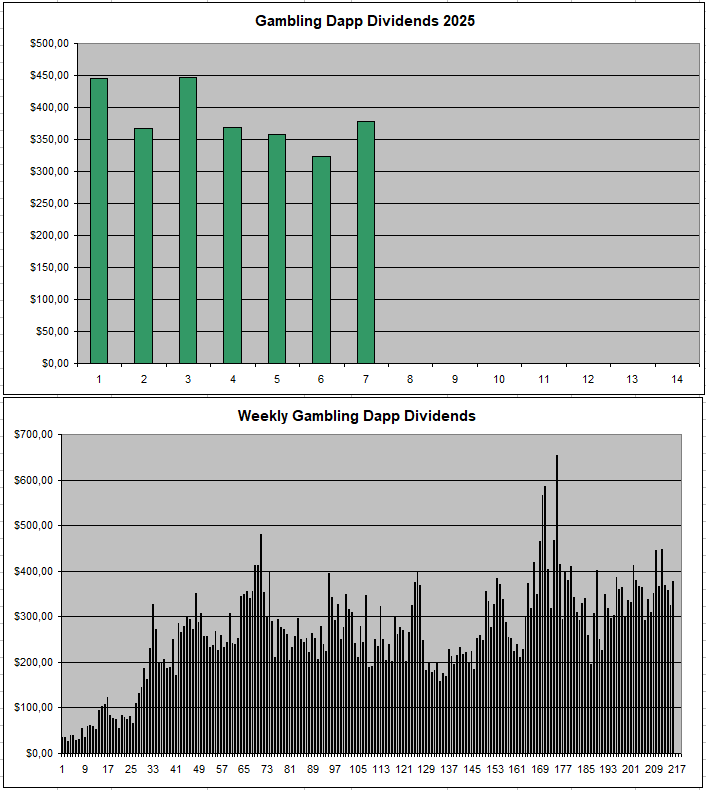

Last week, I passively earned a solid 377$ for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using INLEO