Price Dynamics

When it comes down to the prices of assets it's pretty straightforward. The price goes down the moment that there are more people selling than buying and the price goes up when there are more buyers. Especially for games, this tends to be a matter of new players having to come in to support or increase prices which is a model that inevitably will fail as a peak eventually is reached and players tend to get bored looking for other places to have fun. In that regard, It's not the best sign that for the Genesis League Goals a new token was released and not everything that the team does going forward will fall under the SPS window. Also if too much value goes to asset holders, the devs always will have the power to make sure it goes to them one way or another.

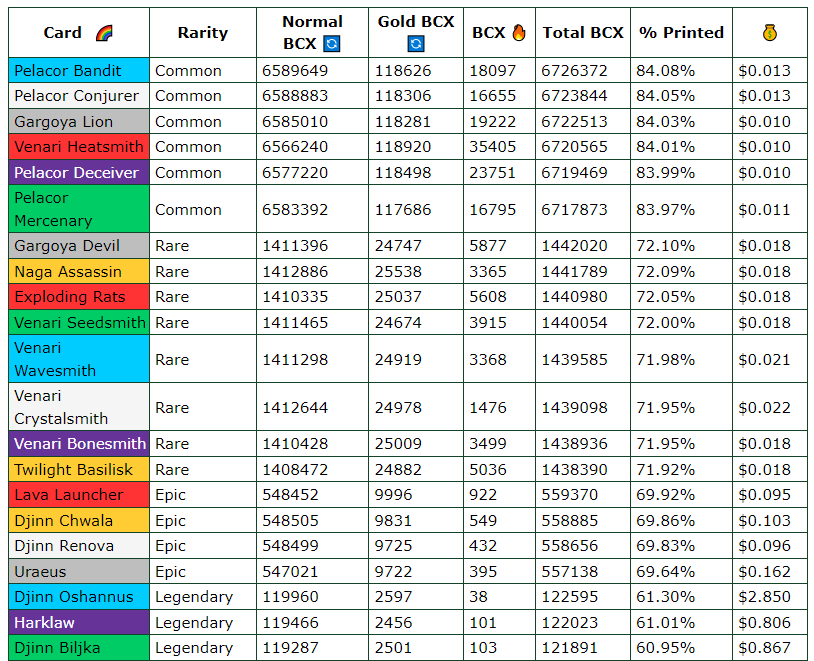

Card Prices

The card prices and especially those from the older cards have been butchered compared to the top they reached before Chaos Legion was released. For the newer sets where packs are available, the average prices on the market always range below what it costs to buy packs, otherwise, there is a hedging opportunity that the market makes use of. With the average price of a chaos Legion pack around 1.9$, it's safe to say that should be around the average value when opening most likely with potions.

Reward Cards that have an insanely high print rate remains the best way to get cheap collection power at the price of 1$ for 1000CP just based on the epic cards. There used to be a time with 15k Collection power that was needed to play in Silver 1 costing 700$+

At this point, it's safe to say that cards are intended to be somewhat affordable and aren't supposed to get insanely valuable with the value coming from being able to play the game and get rewards that way. The pace at which they are printed is just way too fast based on the actual player base and it's just impossible for most players to keep up.

Prediction: Land will likely be a big supply shock for cards and it is said that there will be a 3-month period between Chaos Legion being sold out (/burned) and Rebellion coming out which might act as a period where prices might pump a bit again creating a selling opportunity for those that want out. For now, I see the current downtrend slowly continuing unless there somehow is another crazy hype and onboarding of many new players.

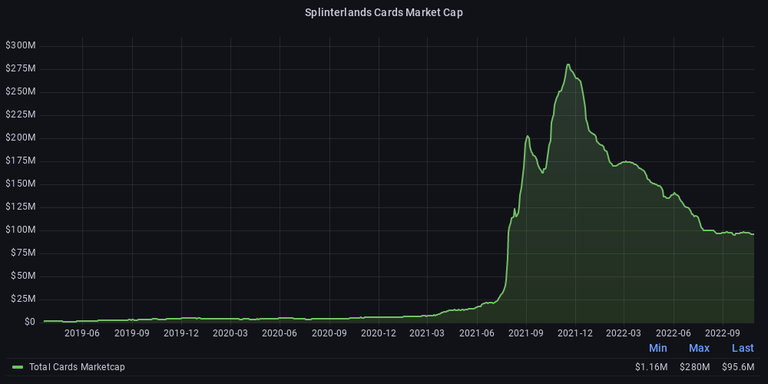

SPS Price

SPS based on the fully diluted market cap right now is valued at 178 Million Dollars which isn't that small or unrealistic just looking at the game in the state it is now. It is a Real Yield asset as it generates Vouchers when staked that players need while there are also burn mechanics. The devs also have full intention to do what they can to support the price and make it increase over time. Right now the supply and dilution of tokens being given out from rewards in all sorts of ways is not really absorbed by the market demand. More future use cases for sure will be needed and they will in one way or another have to take part of the revenue from the company which they also need in order to maintain their 140+ Employees.

The good thing however is that the lower it goes, the more tokens are needed to purchase Riftwacther packs and those get locked into the DAO.

Prediction: In the short term I would not be surprised to see SPS going lower as selling pressure likely is bigger than the demand since so much of the supply now is being put in circulation. Long-Term however I see it at a good buying zone offering good value and real yield. My personal aim remains to have 100k SPS Staked and take profit from there on out. Right now I'm at 84k and I likely will buy some more at the current price range. If there is another bull run, prices might go extreme again and I don't really see how the total market cap would be justified to go above 1 Billion which is the range where I will potentially take profit on some of my stack.

Dark Energy Crystals (DEC) Price

DEC is currently trading at 0.64$ for 1000 DEC which is 36% below where it is supposed to be pegged at. While DEC was the main reward token a lot of it got printed which was not enough during the crazy adoption and expansion phase where it traded well above the peg. Right now there is still too much of it printed for the price to be closer to the peg. At least it's quite stable around the current price and each time it goes below that, the cost of using it to buy Chaos Legion packs gets to a point where you can buy packs, use earned potions and sell the cards at least at an expected break-even price.

Prediction: I guess it will take quite a long time before DEC really goes back to what it is supposed to be pegged at while there also is a limited downward selling pressure since many will want to pick it up if it goes too low. With the new mechanics of being able to mint DEC for burning SPS, it is almost impossible for it to go above 1$ for 1000 DEC as the upside value will all flow into SPS.

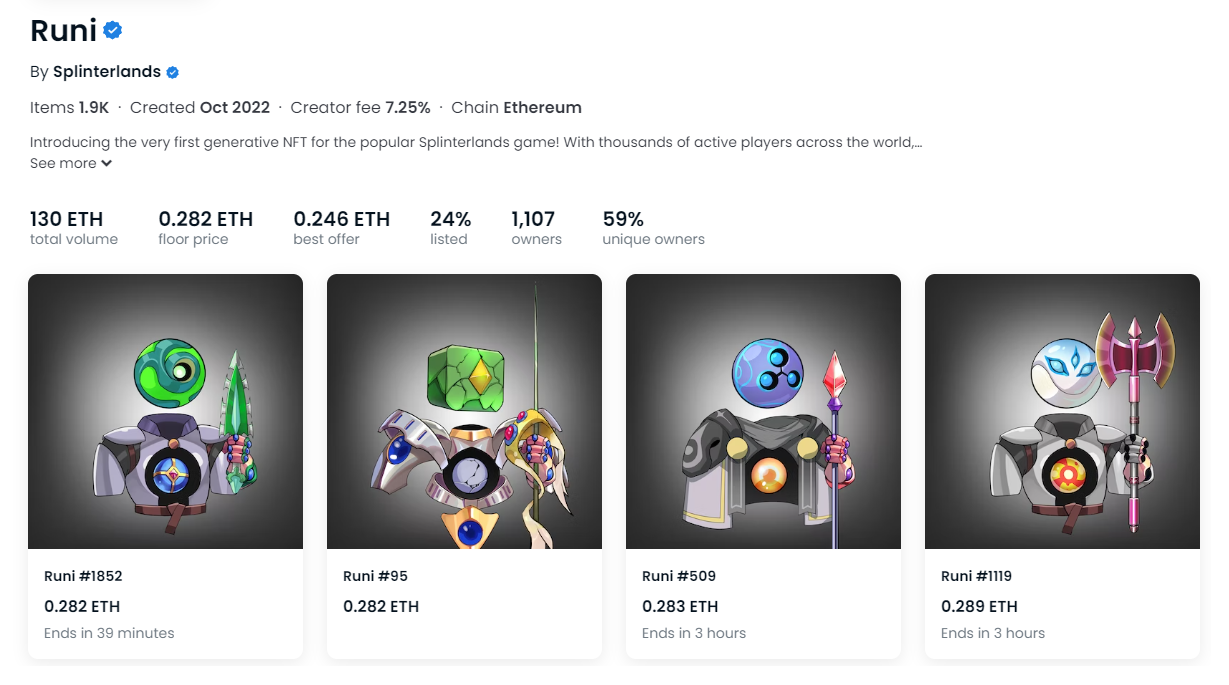

Runis

Right now there is some hype around the Runis with the floor price at around 380$ and the public 500$ mint still to come. I personally didn't get one as I'm simply not willing to spend that amount of money on something I don't really care so much about. Most players are also unable to use the max level of this card and quite a lot of them are printed (for a max level version). Also, I don't know what will be done with the profit generated from that PFP project which surely will add up. While I do think some (big) players could be onboarded because of it, I don't like this idea of just turning on the printer and diluting the existing card supply with another card that deliberately is made Overpowered giving another Pay2Win advantage.

Prediction: I see a slight decrease in price once the hype of the Runis dies down and limited onboarding because of them but lots of funds flow to the devs from the sale.

Land Plots

Land plots went for as high as 700$+ in the past and are now going for around 200$ ever since the SPS rewards were activated for holding them. Land has been a case where the devs earned all the money from them upfront which made it less urgent causing a delay of years. My guess also would be that they are going to use land as a way to burn a lot of DEC and lock up cards, especially older ones which will make it so that owning land plots will only be a small fraction of what it will cost to actually mint the spells & Items. On top, many that got an entire region were in an all-or-nothing situation as individual plots could not be sold yet. Once that is possible there will most likely be a lot more selling pressure created. It also remains to be seen how fun the introduction of Spells & Items will be as they likely will increase the Pay2Win factor of Splinterlands to even more extreme levels.

Prediction: My prediction is that the hype of Land if it's about to be released will both create some demand but also sell pressure from players that got entire regions that previously they were unable to sell individual plots. I'm also expecting the requirements in order to mint items and spells likely will be very heavy reducing the actual value of the land itself. With The current SPS rewards, I'm happy to just hold on to my 12 plots and I might sell 2 in case there is some hype that pumps the prices.

Vouchers

I think it is 20k Vouchers that are printed each day which is way more than the actual demand. This translates in the price going down after a pump at the time when the Riftwatchers pre-sale was done. New ways need to be found to give vouchers use cases which is one of those things that inevitably have to come at the cost of company revenue. I assume that they also will have to require them for Rebellion packs. Changing the print rate might increase the price but it won't really increase the returns that SPS investors get since they will receive less of them. At the current price, a buy & hold likely is something that over time will give a good return. Everything is in the hands of the devs when it comes down to these vouchers as decreasing the supply and increasing the use-case will pump the price.

Prediction: I can see vouchers continue to go down followed by the devs announcing new ways for them to be used on a more regular basis and an eventual pump at some point when these things are put in place. I currently am just holding on to the ones that I earn. If price goes a lot lower I might stack up on some more of them in anticipation.

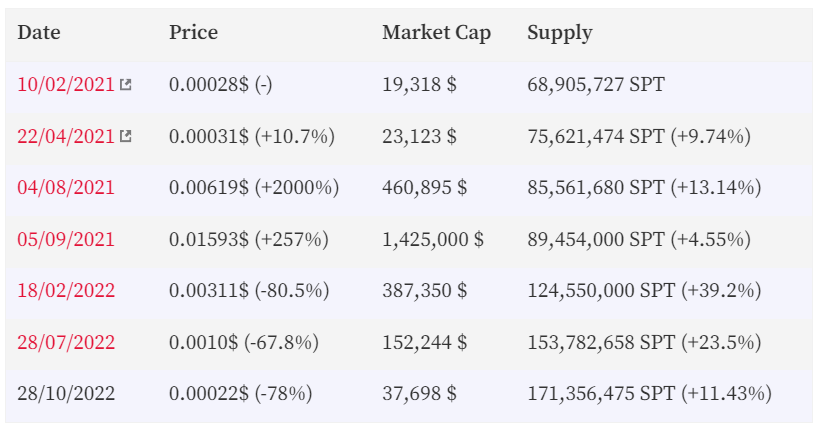

SPT (Splintertalk Tokens)

Way back before the SPS airdrop, I was speculatively bullish on the SPT token anticipating them to get a use-case which made me cost-average 2 Million tokens at prices slightly below where it is at now. I staked those having them delegated to @monster-curator which has been given me daily passive returns which I have been taking profit on ever since. I also managed to get a lot of SPS to the point where I already got a lot more out of the investment than it costed me even if SPT would go to 0 tomorrow. So despite not dumping it at the top which would have been more optimal financially, I'm quite pleased how it all played out.

This is the price evolution since I have been tracking it.

Right now SPT has no real use case and it is a Splinterlands asset that mainly is speculative in the hope that the devs will once again support it in one way or another. The inflation rate remains quite heavy and the current market cap of all tokens sits below 40k Dollars.

Prediction: I honestly would not be surprised if no extra use case was created for SPT tokens looking at how the PAL tribe token which comes from the same Devs is basically completely dead right now. The price is mainly supported by people that speculate on it getting another use case while right now there is no indication for that. I will just continue to hold onto my 2 Million SPT which served me well so far. I might get another batch but only if there are some clear hints from the devs that they will do something for it.

Conclusion

When it comes down to the prices of assets in Splinterlands, it all comes down to how many new players come in, combined with how much of the profit that the devs are making they are willing to give up. It's safe to say that this will never be more than what is needed. There are so many different assets and tokens in the ecosystem that they all can't be supported and I do believe that the time when it was possible to get rich from all of it is behind us. That being said, I do still see a good future for the ecosystem and trust the devs to do what they can to at least not crush everyone that is invested giving them ok returns.

Play2Earn Games I'm Currently Playing...

|  |  |

|---|

|

|

|

Posted Using LeoFinance Beta