A beginner's guide to Hive Backed Dollars (HBD). Answering what are Hive Backed Dollars, Hive’s trustless, algorithmic stablecoin.

Hive Backed Dollars (HBD) are the Hive Blockchain’s algorithmic stablecoin.

Supported by the Hive blockchain’s ability to convert 1 HBD into $1 USD worth of HIVE crypto at any time, they provide a novel solution to the (at least soon to be) highly regulated stablecoin space.

Rather than being backed by USD in a bank account, the Hive network’s conversion mechanism has instead pegged 1 HBD at or over $1 USD by ensuring that it can always be exchanged.

While other collateralised stablecoins such as Tether (USDT) and USDC are supposedly backed by an equal amount of USD or equivalent assets held in escrow, HBD uses a completely different, algorithmic stablecoin model.

By not actually storing any USD in a bank account, this keeps the US regulator’s greasy mitts away from Hive’s stablecoin.

Because quite simply, there is nothing there for them to regulate!

With the ability to earn 20% interest on a stablecoin by placing HBD into the savings section of your wallet, gaining exposure is a no brainer.

Click the get started button at the top right hand corner of this page and create a free Hive crypto account.

What is HBD?

Introducing Hive Backed Dollars (HBD), Hive’s very own trustless, algorithmic stablecoin.

Hive Backed Dollars (HBD) is the sleeping giant of not only the Hive blockchain, but of the entire financial space.

A permissionless, censorship-resistant algorithmic stablecoin that sits completely outside of the regulatory control of governments, HBD has the ability to grant access to financial services to anyone in need.

As long as the Hive blockchain is up and running and HIVE retains even a semblance of value, anyone can convert HIVE to HBD and vice versa.

Technically, HBD can be seen as a debt instrument of Hive.

In order to prevent a catastrophic death spiral the likes of which we saw happen to UST, restrictions on how much HBD can be created are enforced by the blockchain.

The HBD market cap for example, must be below 30% of the HIVE market cap.

This is what’s known as the debt limit and a live view can be viewed here on Hive Witness ausbitbank’s website.

More on this later in the guide.

Hive Backed Dollar Interest Rate

Perhaps one of the most underrated aspects of Hive Backed Dollars (HBD), is the fact that you’re able to earn interest on your saving balance.

Any HBD stored in a Hive savings account, earns a variable interest rate currently set at 10%.

The elected Hive witnesses are able to move this value up and down at their discretion, setting the interest rate based on their median vote.

While not quite at the famous 20% interest level offered by Terra’s UST when staked on Anchor, 10% is still streets ahead of interest rates offered on USD balances by traditional banks.

All accessible on the wallet page of your Hive account, accessed via the Hive front-end of your choice.

The Hive Backed Dollar Price:

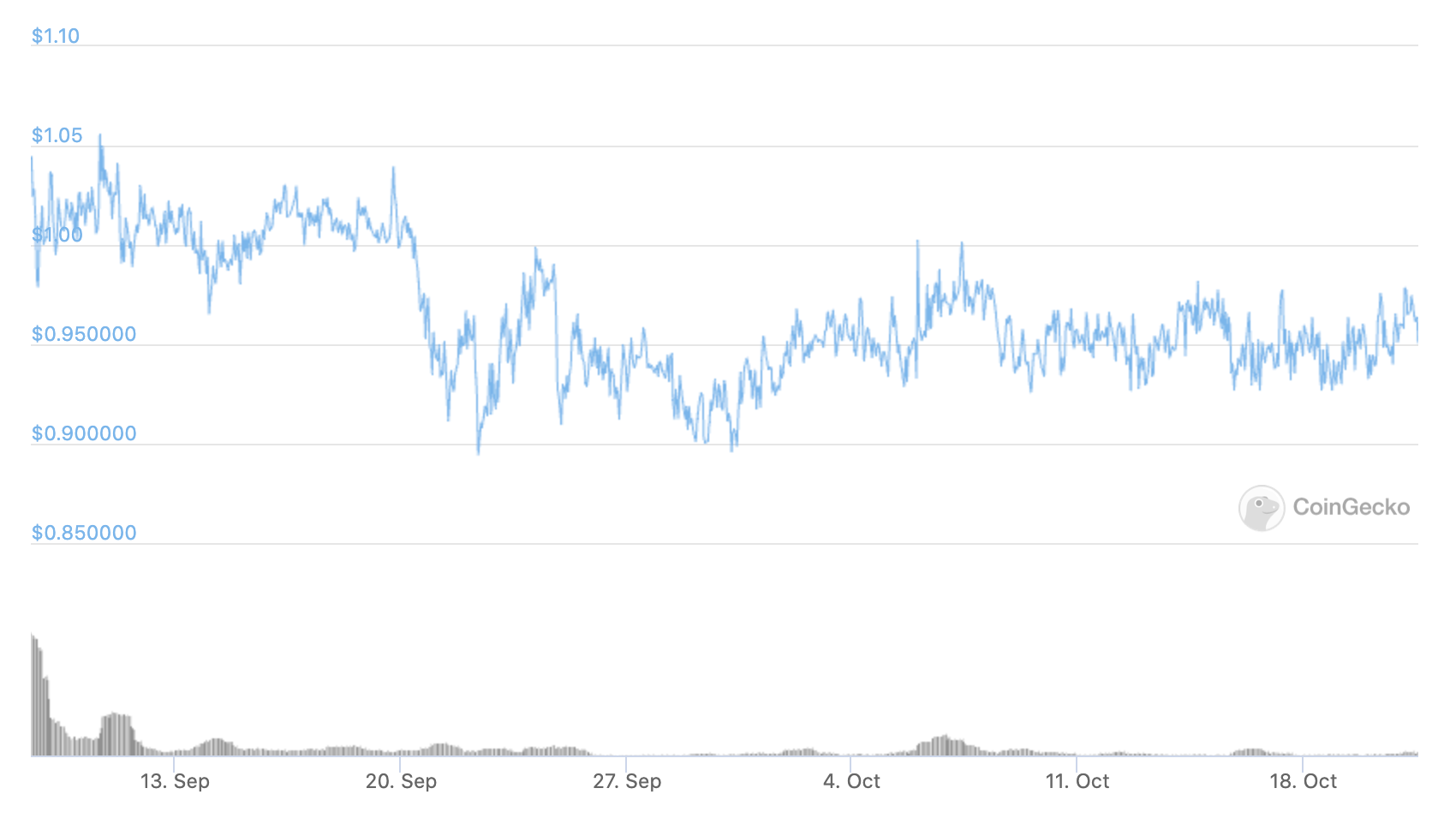

While the short term stability of Hive Backed Dollars $1 USD price peg is somewhat questionable, steps have been put in place to address this issue over the long term.

Since the HBD Stabiliser mechanism has been put in place, you can see on the following CoinGecko chart that price has been trading in the 95c - $1.05 range.

While Bittrex remains the only mainstream crypto exchange to offer a HBD trading pair on their platform, Hive account holders are able to use Hive’s internal market to permissionlessly buy, sell and trade between HIVE and HBD.

In the current regulatory environment, it would be unwise to sleep on the current working solution which Hive Backed Dollars (HBD) offers to the stablecoin market.

This guide to Hive Backed Dollars (HBD) is here to make sure that it’s not lost within the discussion.

How do Hive Backed Dollars (HBD) work?

A look at how Hive Backed Dollars (HBD) work and the mechanisms unique to the stablecoin.

Long overlooked by not only the Hive community, but also the crypto community as a whole, Hive Backed Dollars are finally starting to garner the attention they deserve.

In this section of our Hive Backed Dollars (HBD) guide, we investigate how Hive’s very own algorithmic stablecoins works.

To further our investigation, we will also examine the following three mechanisms used by the system to control Hive inflation and to maintain the peg:

- The HBD debt limit

- The HBD stabiliser

- The haircut rule

How do Hive Backed Dollars work?

As we’ve already spoken about above, Hive Backed Dollars (HBD) are decentralised stablecoins pegged to the United States Dollar (generally 1 HBD = $1 USD).

HBD is one of the native tokens existing on the Hive blockchain.

While the HBD is pegged to the United States Dollar, it is not backed by that fiat currency and the use of the USD is merely a valuation mechanism for the token.

The HBD is backed by $1 worth of HIVE.

HBD is actually backed by the code on the blockchain that converts it into HIVE.

We therefore have a stablecoin that has the function of being convertible into HIVE, backed by the code on the blockchain.

To fully understand how HBD works, it is necessary to first explain where HBD comes from.

HBD is the product of the regular inflation of the HIVE token.

Part of this regular HIVE inflation is an allocation from posting rewards that are partially paid in HBD.

Another portion of HBD comes from the Decentralised Hive Fund, which likewise receives some of the HIVE inflation.

By operation of the mechanisms utilised to maintain the peg, HBD is added to and removed from the overall HBD supply.

There are two smart contracts that come into play when the price of HBD deviates from its peg of $1.

These two smart contracts are:

- Converting from HBD to HIVE: A holder of HBD can gain access to the collateral backing their HBD by using this contract. When the holder executes this contract after 84 hours they receive the dollar numerical amount of HBD converted in Hive tokens. The exchange rate for conversion is fixed by calculating the median price of HIVE over the same 84 hour period. The Hive blockchain witnesses act as oracles to set the HIVE price for conversion.

- Converting from HIVE to HBD: A holder of the HIVE token can use this smart contract to immediately receive HBD. To use this contract, the holder must post collateral in an amount equal to 2x the HBD value calculated on the lowest HBD price listed in the past 3.5 days, as well as an additional 5% fee. The collateral is deducted from the holders account immediately and the HBD amount is likewise credited. After a period of 84 hours, the HIVE is returned to the holder less the value of the HBD and the 5% fee.

When the price of HBD is below $1, market makers can enter and convert HBD to HIVE.

This has the effect of reducing the market supply of HBD, with the goal of causing an increase in price.

Should the price of HBD be above $1, market makers can enter converting Hive to HBD with the effect of increasing the market supply of HBD.

On the contrary, with the goal of causing a decrease in price.

These conversion mechanisms operate to restore the HBD price to its loose peg of $1 over a period of time.

It’s also worth noting that this restoration process is not instantaneous.

It’s reliable to bring the HBD price back to the peg eventually given time.

However, there are times when the price deviation is too substantial and has been sustained for an inordinate period of time that other price restorative mechanisms must be relied upon.

These being:

The HBD stabiliser

The HBD stabiliser is an automated trading mechanism funded by the Decentralised Hive Fund (DHF).

This mechanism exists to maintain a tighter peg upon the HBD token.

The DHF is a self funded DAO that exists on the Hive blockchain, that stakeholders allocate by using their stake to vote on proposals.

The HBD peg is maintained by the DHF through the utilisation of one of two mechanisms:

- If the price of HBD falls below $0.97, the HDB stabiliser executes the smart contract to convert from HIVE to HBD. Once executed, after 3.5 days, HIVE is utilised to purchase HBD from the market, thereby reducing the supply of HBD and causing an increase in price. It should be noted that the margin of $0.97 should suffice to permit the DHF to earn a profit on the transaction. This profit is not guaranteed but should occur more often than not.

- If the price of HBD rises above $1, the DHF sells HBD on the native Hive Decentralised Exchange. In effect, this immediately adds HBD to the market supply driving the price of HBD lower. Likewise, this action yields an immediate profit to the DHF. The HIVE received by the DHF in this transaction is instantly converted back to HBD and held by the DAO.

By operating this HBD stabiliser, an incentive is provided to the market makers as they need less capital for the provision of liquidity.

Thereby keeping the price of HBD closer to its $1 peg.

The HBD debt limit

From a technical standpoint, HBD is a debt instrument.

One of the hardcoded ways HBD becomes available, is via the percentage of HBD to Hive allowed by the blockchain.

Within this code, is constraints to aid in keeping the Hive economy healthy.

Being a debt instrument, there must be some system assurances that the debt-to-equity ratio does not get too high.

Accordingly, one of these system constraints is the HBD debt limit.

The market cap of HBD must be below 10% of the HIVE market cap.

If and in the event the total value of HBD exceeds 10% of the total value of HIVE, the blockchain automatically halts the production of HBD.

The 50/50 reward option for posting payouts in this circumstance would begin paying liquid HIVE in lieu of the HBD component.

The system will automatically continue these modified payments until such time as the below 10% threshold ratio is restored.

Likewise, if the debt-to-equity ratio exceeds 10% and a holder of the HIVE token attempts to convert HIVE to HBD, the system will automatically reject the transaction as the system is hard coded not to create HBD.

Anyone interested in the Hive blockchain and HBD may monitor the market value of Hive and HBD as well as its debt-to-equity status in real-time.

The haircut rule

One of the ways HBD enters the Hive ecosystem is through the 50/50 reward option for posting payouts.

There are three ways that this 50/50 reward may be paid dependent upon the debt-to-equity ratio of HBD to HIVE.

These are:

- Ratio < 9% payout is HP and HBD;

- Ratio between 9% and 10 % payout is HP, HBD, and HIVE;

- Ratio > 10% payout is HP and HIVE.

It is the period where HP, HBD, and liquid HIVE is paid (ratio between 9% and 10%) that is referred to as The Haircut Rule.

During this period, HBD is issued based on the following formula:

HBD Print Rate = 100% x (10 - current debt ratio)

The result is that once the debt ratio exceeds 9%, as that ratio moves upward to 10%, less HBD is issued and is replaced by liquid HIVE.

The rationale behind the debt ratio logic

Should the debt-to-equity ratio rise too high, the entire system of a blockchain native currency can become unstable.

The conversion of system debt can greatly increase the supply of tokens in the system.

An inflated token amount that if sold, would put undue stress upon price.

Continued conversion of debt to equity adds even more tokens to the system, a procedure that if left unchecked, leads to a collapse of the system currency leaving in its wake worthless equity and a mountain of debt.

To prevent this scenario from occurring, the Hive blockchain has put the debt ratio logic discussed above into play to assure that the debt-to-equity ratio never exceeds 10%.

Final thoughts on how Hive Backed Dollars (HBD) work

At first glance, the mechanics behind HBD and the three debt ratio mechanisms may seem cumbersome or overly complicated.

But if you consider the same in terms of basic supply and demand economics, plus its effects on price, the picture becomes much clearer.

At their heart, these items are present in the system to provide stability and to protect everything from falling victim to the contingency of runaway debt.

As well as all of the consequences that come from that.

The system is getting closer to possessing the ability to maintain its peg and provide a true stablecoin.

But the same is made much more difficult due to the present lack of market depth.

As the system continues upon a path of growth, peg stability should become easier to maintain.

What are Hive Backed Dollars (HBD) used for?

A look at why stablecoins are needed in place of ‘real’ US dollars and what popular stablecoins like HBD are used for.

In volatile cryptocurrency markets, having access to USD pegged stablecoins is invaluable.

By keeping the price of stablecoins pegged to government-issued fiat currencies, the ultimate advantage comes in the form of a secure price floor.

If you’re still valuing your assets in USD, then stablecoins offer a risk-free alternative to cash, without having to actually cash out of the crypto ecosystem.

This section of our Hive Backed Dollars (HBD) guide further covers why we need stablecoins and why crypto investors would use HBD over other currently more popular choices.

Why use stablecoins instead of USD?

The biggest reason to use stablecoins instead of traditional US dollars is that they offer the safety of holding your money in cash, while still keeping it within the crypto ecosystem.

You can view stablecoins as doing the exact same job as fiat currencies do in the traditional investment realm.

But instead of, for example an equities trader moving out of stocks and into cash, a cryptocurrency trader might move out of Bitcoin and into a stablecoin.

When traders look to take profits or move between different cryptocurrency investment instruments, stablecoins offer the same safety and utility of a domestic cash market.

As you can see, stablecoins allow you to lock in profits or protect yourself from downside risk, without having to actually cash out.

As long as assets are valued in USD terms, stablecoins will be a necessity within cryptocurrency markets.

What are Hive Backed Dollars (HBD) used for?

But as you’ve already discovered in this guide to Hive Backed Dollars (HBD), not all stablecoins are created equal.

Collateralised stablecoins that hold fiat USD in a bank account will always have US regulators looking over their shoulder.

With stablecoins such as Tether, the risk of the entire market being blown up by a regulator will trigger what will essentially be a digital run on the bank.

In our opinion, this scenario is inevitable and when it plays out, your stablecoin exposure is going to want to be in an algorithmic alternative such as Hive Banked Dollars (HBD).

Instead of being pegged to the value of USD via bank deposits that are easy prey for the regulator, Hive Backed Dollars are instead backed by the value of HIVE crypto.

This Hive network backing is administered by an on-chain conversion operation that allows holders to at any time convert 1 HBD to an equivalent of $1 USD worth of HIVE.

Of course the same is true in the opposite direction.

As a result of this conversion mechanism, the price of HBD is tied to the price of the USD, though no USD is actually held as collateral or transacted in the currency.

Final thoughts on why we need to use stablecoins like HBD

As you can see, we don’t just need stablecoins.

What we really need is algorithmic stablecoins such as Hive Backed Dollars (HBD), that are out of reach of governments and regulatory bodies.

Make no mistake, US regulators have come and will continue to keep coming for collateralised stablecoins.

With a current market cap of just under $70 billion, all that money tied up in Tether is sooner or later going to have to move to an algorithmic stablecoin alternative.

When it comes to stablecoins of this nature that run on truly decentralised, permissionless networks, there aren’t many options besides Hive Backed Dollars (HBD).

Hive Backed Dollars (HBD) vs Tether (USDT)

A head to head look at Hive Backed Dollars (HBD) vs Tether (USDT).

In this section of our Hive Backed Dollars (HBD) guide, we are going to compare the unique features of two completely different stablecoins:

- Hive Backed Dollars (HBD)

- Tether (USDT)

This guide is designed to show you an unbiased feature set comparison of these two stablecoins.

The table below shows you the comparison points between the two projects.

Hive Backed Dollars vs Tether comparison table

| Hive Backed Dollars (HBD) | Tether (USDT) | |

|---|---|---|

| Hive Backed Dollars aka HBD was released as a stablecoin on the Hive blockchain, in March 2020. | Tether (USDT) was first released in 2014 as Realcoin using the Omni Platform on top of Bitcoin's blockchain. Later it was released onto multiple blockchains like Ethereum, EOS, Tron and Algorand. | |

| As per the HBD monitor, the Market Supply of HBD is $20,651,557.959 (HBD stays below 10% of HIVE’s market supply) | Tether (USDT) has a circulating supply of 69,043,109,914 USDT coins & no max. supply specified. | |

| HBD is designed by a decentralised group of community members. It is not externally funded or regulated by any government. | Tether (USDT) is a centralised stablecoin that has a centralised setup & also it has been backed legally by a few regions. Due to lack of compliance however, it has been restricted in many regions. | |

| HBD, being the stablecoin of the Hive blockchain, makes use of a delegated proof of stake consensus algorithm. | Tether (USDT) makes use of a Proof of Work & Proof of Stake consensus algorithm. | |

| HBD is built on Graphene 2.0 based blockchain which makes use of C++ as its native programming language. | Tether (USDT) makes use of the blockchain native language on which it is deployed as a stablecoin infrastructure. e.g. Tether on Ethereum would use Solidity while on TRON it may use respective SDK languages. | |

| HBD is traded on the Bittrex exchange. Though HIVE is accepted in multiple exchanges, HBD doesn't have many takers as of now. | Tether (USDT) has much wider acceptance & is often paired with other cryptos on multiple exchanges. | |

| HBD has the HBD stabiliser used to help return its value pegged to the dollar. Its value appears to fluctuate a lot above & below the dollar price (0.95 to 1.5). | Tether is assured to be pegged to the US dollar value. It does not appear to show larger fluctuation below or above the dollar value. | |

| HBD & HIVE are governed by a community of stake elected members known as witnesses. | Tether is privately managed, governed and externally audited for government regulation and compliance. | |

| HBD is being accepted in various dApps, games and NFT shops, primarily built on the Hive blockchain. | Tether is being accepted in various payment gateways of dApps, games & NFTs that accept the USD-Tether based on the Ethereum & TRON blockchains. | |

| HBD currently allows a savings rate of 10% in a HIVE wallet. | Tether does not have any such system. Except for external financial systems like Celsius, NEXO etc that offer similar services. |

Final verdict: Hive Backed Dollars (HBD) or Tether (USDT)

Tether seems to have managed to release its stablecoin on multiple cryptocurrency blockchains (Eth, Tron, EOS, Algorand & more).

This makes its trading and acceptance a lot easier.

Tether is widely accepted as a stablecoin on various exchanges and is paired with many other cryptos for trading.

Hive Backed Dollars at their current state is much more limited to their involvement on the Hive blockchain.

This pretty much leans the complete comparison one-sided in favour of Tether as the number of users on and off exchanges make use of Tether as a stablecoin over HBD.

However, the algorithmic nature of Hive Backed Dollars makes them completely untouchable by the US regulator who at any time, can crumble Tether to the ground.

For this reason alone, Hive Backed Dollars (HBD) is the only viable long term stablecoin option.

The best algorithmic stablecoins - HBD an underrated gem

A look at 3 of the best algorithmic stablecoins with a focus on the highly underappreciated Hive Backed Dollars (HBD).

Stablecoins have undoubtedly evolved beyond Tether and their collateralised USDT product offering.

Tether’s business model has always been to guarantee that for every USDT minted, there is an equal US dollar sitting in a bank to be redeemed at any time.

Essentially they’ve become one giant, retail bank that operates outside of regulatory oversight.

But with a whole raft of questions around trust that quite frankly shouldn’t be there in the crypto space, not to mention the US regulator chasing harder than ever before, algorithmic stablecoins are now the clear better choice.

You see, algorithmic stablecoins don’t actually have any associated collateral behind them.

Acting less like a retail bank and more like a central bank, algorithmic stablecoins don’t have any depositors and aren’t redeemable in the traditional sense.

Instead, non-collateralised stablecoins offer capital efficiency and price stability using other means such as controlling supply/demand via smart contracts.

In this section of our Hive Backed Dollars (HBD) guide, we outline 3 of the best algorithmic stablecoins before offering a final verdict.

1. HBD - Hive Backed Dollars

First on our list of best algorithmic stablecoins, we have the underrated gem that is Hive Backed Dollars (HBD).

Hive Backed Dollars (HBD) are actually a unique variation on trustless, algorithmic stablecoins.

While pegged to the USD, they are actually backed by the value of HIVE crypto and the network itself.

This backing is provided by an on-chain conversion operation that allows holders to at any time convert 1 HBD to an equivalent of $1 USD worth of HIVE and vice versa.

Through this conversion mechanism, the price of HBD is pegged to the price of the USD without ever actually holding any USD in collateral or transacting in the currency.

As long as the Hive network exists and HIVE has value, then HBD works exactly the same.

Currently, holders who store their HBD in the savings section of their Hive wallet can earn an extremely competitive stablecoin interest of 10%.

2. UST - TerraUSD

Second on our list of best algorithmic stablecoins, you will find Terra (LUNA)’s premier stablecoin, UST.

TerraUSD (UST) is the decentralised, USD-pegged algorithmic stablecoin of the Terra blockchain.

A yield-bearing coin that is pegged to the dollar, UST is collateralised by the blockchain’s native token called LUNA.

The value of UST fluctuates because it’s driven by supply and demand for both LUNA and the USD value.

When UST trades above $1, LUNA holders are able to sell their UST at a premium for LUNA.

The opposite is true when UST trades below $1, with LUNA holders able to buy back cheap UST with LUNA that is subsequently burned.

What this mechanism does is ensure the price of UST is always returned to the equilibrium level of $1 USD.

As you can see, the Terra protocol acts somewhat as a market maker for UST, restocking by inflating the native LUNA supply if the stablecoin system runs out of assets.

Via the Anchor Protocol, UST also offers the highest stablecoin interest rate currently available at 20%.

When traditional banks are serving ads promoting 1.5% interest rates as something special, this is a game changer.

FEI - FEI Protocol

The third and final algorithmic stablecoin on our best of list, is FEI.

Its aim is to be more capital efficient than its rival algorithmic stablecoins in the space by using the value that it controls to provide liquid secondary markets.

By defending its peg directly in the market, FEI is another project that operates much more like a central bank than a classic retail bank.

Using the Ethereum-based DEX Uniswap for all of its trading activity, FEI applies a strategy they dub reweighting to perform all required trades.

FEI also offers direct incentives as another type of capital control to keep price pegged and stable.

Ultimately however, the effect is exactly the same as what we just spoke about with UST, where the FEI protocol trades on the open market with the sole goal of pushing price back to its peg.

One aspect of FEI that’s worth noting is that its not meaningfully overcollateralised and most of its assets are in crypto.

This means that in a black swan event, the assets being FEI could drop substantially below their liabilities and leave the protocol unable to defend its peg.

Final verdict on HBD’s place amongst the best algorithmic stablecoins

As you can see, Hive Backed Dollars (HBD) more than holds its own when it comes to the best algorithmic stablecoins currently on the market.

In a subsection of the crypto market that is about to be regulated into oblivion, there is honestly no point even talking about fiat-collateralised stablecoins such as Tether.

The technology has moved past them and just like the regulators who are for some reason still hell-bent on going after them, need to adapt or die.

Speaking of regulatory dinosaurs, algorithmic stablecoins such as HBD have meant that the game has well and truly changed.

As the stablecoins in this list continue to mature and in the case of HBD, further stabilise, users will continue to shift across.

Even at this point in the game, there is really no need to open yourself up to the centralised risks that will always plague Tether.

Regulators would surely be much better served by going down the path of embracing the tech and truly supporting the citizens they’re tasked with protecting via education.

But for now, they continue to chase shadows by going after collateralised stablecoins to ensure a set of irrelevant KPIs are hit.

Hive Backed Dollars (HBD) pros and cons

A discussion around the pros and cons of Hive Backed Dollars (HBD).

By now, we know that Hive Backed Dollars are the algorithmic stablecoin of the Hive Blockchain.

They’re a gem right now known by few, but via guides such as this, word about Hive’s best kept secret is finally starting to emerge.

In this section of our guide to Hive Backed Dollars (HBD), we take a look into the pros and cons of the stablecoin.

Pros of Hive Backed Dollars (HBD)

One of the biggest challenges faced by cryptocurrency investors when it comes to interacting with stablecoins, are potential regulatory attacks on stables.

Coins that are pegged to a 1:1 ratio with the US dollar, stand the risk of being shut down by regulators in that country.

This however is not the case for Hive Backed Dollars who holds no USD in escrow.

Instead, 1 HBD is always redeemable for $1 worth of HIVE.

Another major HBD pro is that investors holding HBD in the savings section of your Hive wallet, pays interest at 10%.

This is a great way to earn a passive return on a stablecoin, away from the fluctuations of the cryptocurrency market.

Unlike with other stablecoins, the decision on HBD is not taken by a single entity but by selected witnesses, and decisions are made through public voting.

One of the democratic advantages of Blockchain governance.

Finally, conversion of HBD to Hive is completed on the Hive network, meaning that liquidity for the trade won't ever be a problem.

Cons of Hive Backed Dollars (HBD)

Hive Backed Dollars (HBD) available for external purchase or trading, is primarily done on only a handful of exchanges.

Bittrex and has only one pair with BTC, while Upbit’s HBD markets are available only to Korean clients who complete their KYC identification.

This is a huge challenge for investors who may likely want to buy and hold the stable outside the Hive network.

Addressing the issue of external exchange listings must be a priority if Hive Backed Dollars wants to better market itself.

Do the Hive Backed Dollars pros outweigh the cons?

In conclusion, you can see that holding Hive Backed Dollars (HBD) is very desirable.

While the 10% interest that comes from HBD placed in your Hive wallet’s savings account is extremely competitive, the biggest advantage is the stablecoin’s inability to be touched by US regulators.

In the not too distant future, this may be all that matters.

Should I buy Hive Backed Dollars (HBD) in 2022?

A final verdict on whether you should buy or use Hive Backed Dollars (HBD) as your stablecoin of choice in 2022.

Buying cryptocurrency right now can be one of the most profitable things you can do.

Either your cryptocurrency investment can go up, or you’re able to profit from staking.

In the current crypto climate, there are more than 12,900 cryptocurrencies and many more are added daily.

Each having different uses like value storage coins, blockchain gas coins, gaming coins, shitcoins, memes coins and finally stablecoins such as Hive Backed Dollars (HBD).

Passing or neglecting this opportunity to buy cryptocurrencies could be fatal, but when looking at so many coins it is difficult to think about which one is the best to invest in.

Experts often recommend buying BTC, ETH and BNB as they are very important coins, with extremely clear use cases.

But when it comes to buying stablecoins that are anchored to the value of USD, stablecoins should at least be on your radar.

The stablecoins market is huge, featuring USDT, BUSD, USDC, UST, among others.

When it comes to Hive Backed Dollars (HBD), besides offering stability and ample financial security, it also offers you to earn interest on your savings balance without actually having to stake on an external platform.

This is a huge advantage HBD has over its competitors in the stablecoin space.

Should I be using Hive Backed Dollars (HBD) as a stablecoin in 2022?

The short answer this question is yes, you should be using Hive Backed Dollars (HBD) as a stablecoin in 2022.

With all of the regulatory risks surrounding Tether, you would be mad to not at least consider using an algorithmic stablecoin such as HBD going forward.

The long answer is that HBD is a very useful currency for many reasons, but mainly because it is a currency that does not face the same problem that others like the Tether do.

The HBD is not backed by any physical dollars in an account.

Rather, as its name suggests, HBD is backed by an equivalent value in HIVE, the native token of the Hive blockchain.

This is an extremely unique type of stablecoin solution that not many can truly compete with from a decentralisation standpoint.

Thanks to this important function, HBD will always remain out of reach of US regulators.

The same can’t be said for almost every other stablecoin on the market.

Another benefit of having HBD saved within your Hive wallet is that it offers you an interest rate of 10% per year.

That is to say, that if you have 10K HBD in your wallet, in one year’s time you will have 11K.

In today’s climate of super low interest rates in the traditional banking world, this is a potential game-changer for risk-averse investors.

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Hive Backed Dollars (HBD)? All comments that add something to the discussion will be upvoted.

This Hive Backed Dollars (HBD) guide is exclusive to leofinance.io.

Posted Using LeoFinance Beta