A beginner's guide to Cosmos (ATOM), the decentralised network of independent parallel blockchains.

ATOM is the native cryptocurrency of the proof of stake (PoS) blockchain known as Cosmos.

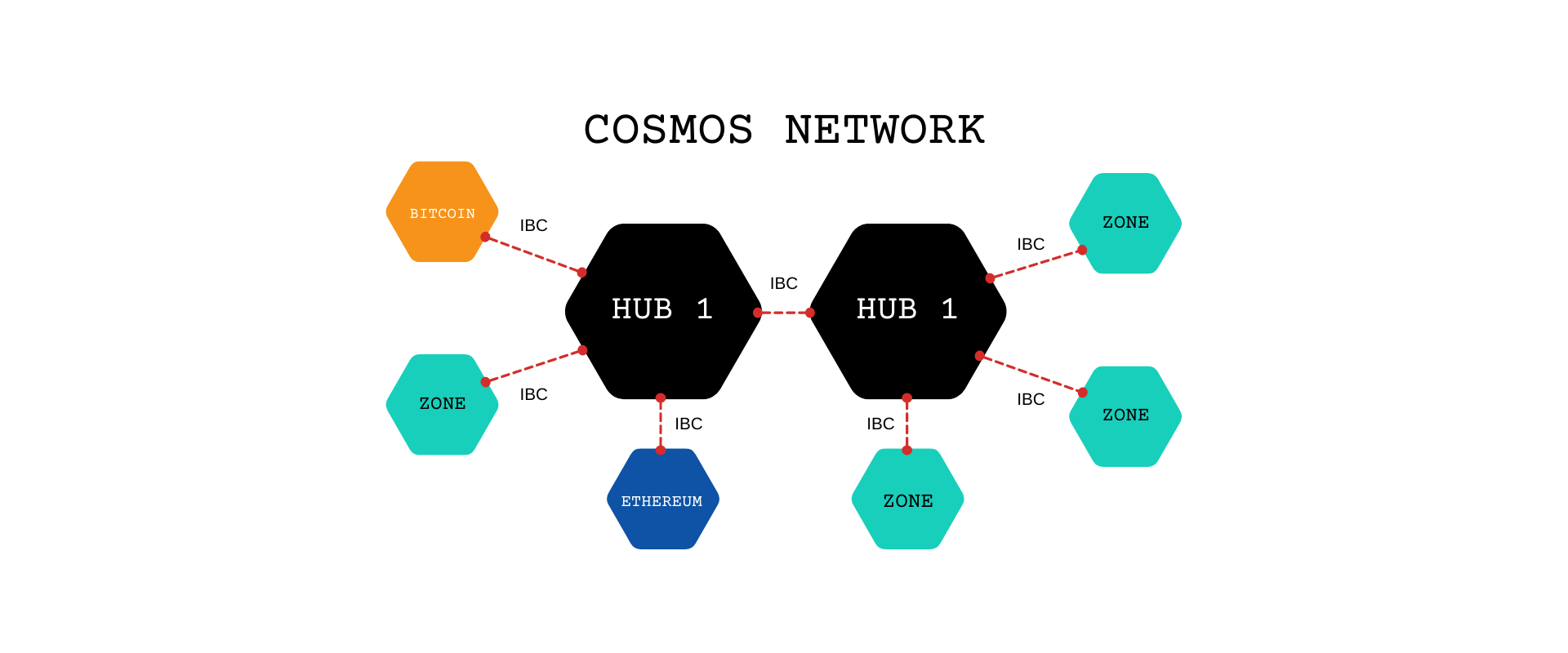

Cosmos is a decentralised network or ecosystem of blockchains that are all linked back to a central hub and acts as an intermediary.

While each running independently of one another, each blockchain (or zone as they are known) is tethered back to the Cosmos Hub where an overall record of their state is maintained.

In the team’s own words, the goal of Cosmos (ATOM) is to “create an Internet of Blockchains, a network of blockchains able to communicate with each other in a decentralised way.”

This is achieved by cultivating and supporting the Cosmos ecosystem of blockchains, allowing them to all share data and easily transfer tokens throughout the network.

For an in-depth look at the project, we’d encourage you to check out the Cosmos whitepaper, but let’s now jump into our own high-level Cosmos (ATOM) guide to discuss how it works, what it's used for and a whole lot more.

Introduction to Cosmos (ATOM)

An introduction to Cosmos (ATOM), the decentralised network of independent parallel blockchains.

Cosmos is powered by the consensus protocol called Tendermint, allowing developers to create proof-of-stake blockchains that are fast, scalable and most importantly secure.

Founded by developers Jae Kwon, Ethan Buchman and Zarko Milosevic in 2014, Tendermint went on to form the base required for Cosmos 2019.

It’s important to stress that it was the project’s Tendermint roots that has allowed Cosmos to flourish into the thriving blockchain ecosystem that we see today.

As we head deeper into our guide to Cosmos (ATOM) from here, you’ll see that Cosmos is really not a project of its own in the same way that you’re used to thinking.

Rather, it’s the base hub for an entire ecosystem of interconnected, independent blockchains and Cosmos makes interoperability a breeze.

By building on a modular set of tools, developers that choose to work within the Cosmos ecosystem have everything they need to start making the dream of a decentralised internet, a reality.

How does Cosmos (ATOM) work?

With the ATOM token at the heart of everything, we take a look at how the Cosmos blockchain works.

The Cosmos (ATOM) network is a decentralised network of interoperable and scalable blockchains that run in parallel, without losing their sovereignty.

It solves the problem of blockchain isolation and creates a more connected ecosystem.

Cosmos uses the Inter-Blockchain Communication (IBC) protocol to enable inter-blockchain communication.

Put simply, IBC lets blockchains talk to each other.

This protocol can be used and implemented by other blockchains and app developers to solve the problem of interoperability.

In this section of our Cosmos (ATOM) guide, we are going to go over the different components that make up the Cosmos Network and learn how they work.

Cosmos Architecture

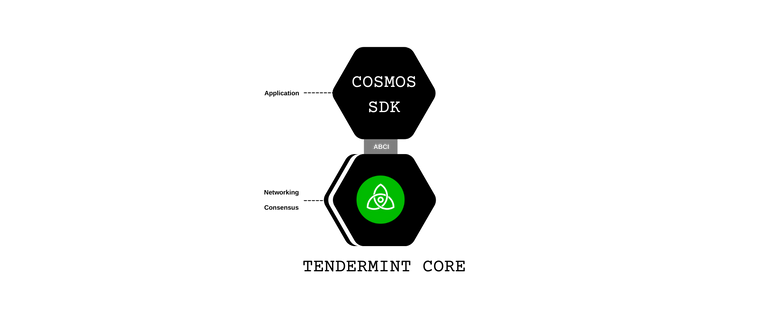

The Cosmos Network consists of three layers, with each of them having a different function required to support the network.

The blockchain on Cosmos can be divided into these layers to help in the completion of transactions and reaching consensus.

The three layers of the Cosmos network are:

1. The Consensus Layer

Blockchains in the Cosmos network use the Tendermint consensus algorithm, which helps nodes agree on the current state of the network.

Using the Tendermint BFT engine, developers can build their own customised blockchains without going to the effort of coding from scratch.

It packs the Networking and Consensus layer into a generic engine so that devs can focus only on the development of the application layer.

The algorithm is Byzantine Fault-Tolerant and uses Proof of Stake to secure the network.

Validators are the nodes that produce blocks and help the network achieve consensus.

They receive fees and block rewards for doing this job round the clock.

The system randomly selects validators and two-thirds of these nodes are required to confirm the transaction.

2. The Networking Layer

In order to reach a consensus, nodes must be interconnected with each other.

They pass on transactional data and consensus-related messages via the Networking Layer.

A node does not have to validate blocks in order to send data to other nodes, meaning that everyone sees the most recent data.

3. The Application Layer

In order to validate transactions on the consensus layer, we first need to have a set of transactions.

The application layer defines and submits these transactions to get committed by the consensus layer.

Once this is done, it then updates the current state of the blockchain.

Cosmos SDK

The Cosmos SDK (Software Development Kit) is used to develop the applications on top of Tendermint BFT.

The Tendermint BFT engine is connected to the application layer by a socket protocol called the Application Blockchain Interface (ABCI).

Through Cosmos SDK anyone can build their own ABCI App without compromising the security.

The major feature of Cosmos SDK is that it allows anyone to add application-specific modules that can be used by other developers to save on development time of their own application layer.

This feature will come in handy once the Cosmos developer community gets bigger.

There will be enough modules to build more complicated solutions to real-life problems.

For example, any existing blockchain code written in Golang can be moved into a Cosmos SDK module.

Ethermint is a project that replicates the EVM (Ethereum Virtual Machine) into an SDK module that works exactly like Ethereum.

Developers can easily create Cosmos-based modules of their existing Ethereum smart contracts without additional work.

Ethermint also benefits from all the properties of Tendermint BFT.

Developing on Cosmos gives more flexibility, security, performance, and sovereignty over Ethereum.

Inter Blockchain Communication (IBC)

The main goal of Cosmos is to allow developers to create bridges between various blockchains built on it and outside of Cosmos.

For example, full grade interoperability.

Inter Blockchain Communication protocol is used to achieve this important feature that creates the Internet of Blockchains.

After creating custom blockchains for their dApps using Cosmos SDK, devs can connect them with other blockchains allowing the transfer of tokens and data.

IBC also allows seamless bridges between private and public blockchains, making it the most powerful interoperability protocol out there.

Let's take an example to see how IBC works via an escrow account transfer to avoid loss of funds during a transaction failure.

Let's suppose an account on Chain 1 wants to send 1 ATOM token to an account on Chain 2:

- Tracking: Chain 2 will receive headers of Chain 1 and vice versa. This establishes the connection between the two chains because they start running a virtual copy of each other to track the transactions.

- Bonding: Once the connection is established, 1 ATOM will be bonded on Chain 1.

- Proof Relay: A proof of bonding will be propagated (relayed) to Chain 2.

- Validation: Once the proof is validated, bonded ATOM on Chain 1 gets a representation on Chain 2. Chain 1 will keep those ATOM bonded until their representative ATOMs on Chain 2 are sent back.

Cosmos Hub and Zones

Cosmos follows a modular architecture (known as Hub and Spoke topology), to create a network of heterogeneous blockchains.

Zones are the application-specific blockchains that are connected directly to a Hub.

Each Hub is connected to other Hubs and subsequently, then to multiple zones.

Hubs are only made to connect other Hubs and Zones.

Each zone has an indirect connection to all the other zones connected to the main Hub.

This reduces the number of connections made as the network expands to thousands of blockchains.

Anyone is free to create hubs and zones.

The first Hub created on Cosmos is called the Cosmos Hub and can be forked by anyone to create other Tier 1 and Tier 2 Hubs.

What Is A Peg Zone?

The Cosmos Hub and Zone model, as well as IBC collectively, comes together to provide interoperability among all Comsos Blockchains.

But what about non-Tendermint blockchains like Bitcoin and Ethereum that follow a Proof of Work (PoW) consensus?

Well, these external blockchains can be connected via a proxy chain known as a Peg Zone.

They simply track and copy the current state of other networks.

For example, by using a Peg Zone created and customized for the Ethereum blockchain, we can send tokens from Cosmos to Ethereum and vice versa.

Wrapping up how Costmos (ATOM) works

Cosmos (ATOM) makes blockchain development easy, providing flexibility, scalability and interoperability, without compromising security.

You should now have a basic understanding of how Cosmos (ATOM) works.

Is Cosmos layer 1?

Cosmos (ATOM) is a layer 1 blockchain solution designed to compete for market share with Ethereum.

As the industry matures, the biggest issue facing almost all blockchains is their ability to scale.

We especially see this on layer 1 blockchains such as Ethereum, when increased network demand puts pressure on fees and transaction speeds.

If you’ve used tried to use the Ethereum network during a period of such demand such as the height of the Crypto Kitties craze, you’ll know how painful it can be.

While Ethereum already has a number of layer 2 blockchain solutions such as Polygon, questions around this Ethereum light style project truly has the ability to penetrate the market.

So back we circle to layer 1 blockchains that can truly and potentially one day replace Ethereum as the best layer 1 blockchain solution available.

Cosmos is one such example of a layer 1 blockchain that has thrown its hat in the ring and this section of our Cosmos (ATOM) guide will help make its case.

First came layer 2 solutions

The rapid adoption of DeFi, NFT and gaming applications on Ethereum continues to cause bottlenecks on the network.

By design, Ethereum’s solution is to push network fees through the roof, thus rendering the chain almost useless for anyone other than mega whales.

They don’t call Ethereum a playground for the rich, for nothing.

Not so long ago, layer-2 solutions such as Polygon were all the rage.

Moving Ethereum based dApps to Polygon for example, allow users to escape the issue of high fees on Ethereum, but still remain within the overall Ethereum ecosystem.

However, that right there is the issue.

Polygon users are never going to truly jump ship from Ethereum and the network will forever be viewed as nothing more than a temporary solution until Ethereum sorts itself out.

Ethereum’s shift to Proof of Stake (PoS) uses sharding to try and provide the chain a scalability solution on its own layer 1.

Sharding allows the network to work on transactions in parallel rather than sequentially.

With the idea that network speed and efficiency will improve.

But Ethereum’s sheer size has meant the transition won’t solve these problems overnight and with hardware and staking requirements increasing have opened up a new set of questions around decentralisation.

The aura surrounding Ethereum remains for now, but Ethereum compatible, competing layer 1 networks such as Cosmos, have now well and truly arrived.

Now layer 1 solutions like Cosmos are back in vogue

It’s time for Ethereum compatible layer 1 blockchains such as Cosmos to take their rightful place at the head of the table.

By bringing interoperable bridges to Ethereum, while most importantly offering the ability to scale in their own right, could the future in fact be layer 1?

Currently, the leading Ethereum compatible, layer 1 blockchains include:

- Cosmos (ATOM)

- Polkadot (DOT)

- Avalanche (AVAX)

Each with their own network of blockchains and dApps that do everything Ethereum does, both faster and cheaper.

In saying that however, these particular layer 1 solutions such as Cosmos, do bring their own set of issues.

Namely surrounding a lack of decentralisation and the security risks that are opened up at scale.

We haven’t even included other the popular layer 1 blockchains Solana and Binance Smart Chain, simply because they may as well be inefficient databases.

They’re certainly not decentralised enough to compete with Ethereum when mass adoption takes hold.

Cosmos is layer 1, but will that be enough?

So the final question that remains is will Cosmos (ATOM)’s position as a layer 1 blockchain be enough to truly compete with Ethereum long term?

The biggest downside of layer 1 blockchains like Cosmos is decentralisation because when push comes to shove, being truly untouchable is all that will matter.

Achieved by a vast token distribution and a network of unconnected validators, across numerous jurisdictions.

This guide to Cosmos (ATOM) has shown the chain has all the technical hallmarks to compete with Ethereum.

But ultimately, it will be up to the market to decide which layer 1 solution reigns supreme.

What is Cosmos (ATOM) used for?

Cosmos is a decentralised network that allows for the exchange of data among different independent blockchains.

To kick things off, the ATOM token is the native utility token of the Cosmos Network and serves several important functions within the ecosystem.

After an Initial Coin Offering (ICO) in 2017 culminating in a project launch two years later, Cosmos can be seen as the elite 'Internet of Blockchains'.

They achieve this by providing a resolution to issues surrounding blockchain interoperability and scalability.

In this subsection of our Cosmos (ATOM) guide, we investigate what the ATOM token is used for, within the overall Cosmos Network.

ATOM is used for operations on the Cosmos blockchain

As we briefly mentioned above, ATOM is the native utility token of the Cosmos Blockchain.

As such, the ATOM token is necessary for the execution and completion of smart contracts within the Cosmos Hub.

Additionally, the Cosmos Network Validators are rewarded in newly minted ATOM tokens on each block approval.

In the same vein, the ATOM token may be utilised as a spam-prevention mechanism.

From the official Cosmos FAQ:

"As a spam prevention mechanism, ATOM are used to pay fees. The fee may be proportional to the amount of computation required by the transaction, similar to Ethereum’s concept of 'gas'."

ATOM is used for security and governance on Cosmos

When it comes to providing security and contributing to the functioning of governance, the ATOM token is also used.

First, the Cosmos Network is a Proof of Stake (PoS) network requiring validators and nodes to verify and approve blocks within the chain.

Validators act within the ecosystem to validate transactions and approve blocks within the chain.

One key to this system are the node validators, who in the case of Cosmos, are the top 100 stakers of ATOM tokens in the system.

This lock up of node validator tokens acts to insure that validators work properly within the purview of their duties and users earn rewards when they stake their tokens.

The Cosmos Network uses the Tendermint Byzantine Fault Tolerance (BFT) protocol for its consensus system.

It is this system which provides security for the blockchain and permits the various nodes to maintain a current state.

Finally, by owning and staking ATOM, users gain a vote that is proportional to the amount stoked, for network upgrades.

ATOM is also a speculative asset

It’s worth also noting that the ATOM token can also be viewed purely as a speculative asset like any other investment.

The ATOM token is readily available for investors wishing to take a position in the project.

If you believe that various developers will rush to the Cosmos blockchain to launch new independent blockchains, ATOM may be a project to consider.

There is, however, a caveat to this investment option you must be made aware of.

ATOM is a hyper-inflationary token.

As such, rewards in the Cosmos chain are made by the minting of new tokens.

Investors should be aware that ATOM does not have any limitations on how many new tokens can be created.

Instead, tokens are created based on ATOM staked, not the number of tokens created.

This means we see an annual inflation rate of anywhere between 7% and 20%.

The effect of this is a depreciation in the value of each ATOM token issued as a result of the inflation caused by the increase in total supply.

This value depreciation is intended to be countered through the staking of the ATOM tokens held and those who do not stake are in essence punished by not staking.

This punishment is a result of not receiving the staking reward and having the value of your tokens diluted by the percentage increase in total supply from the rewards issued.

However, if you do stake your holdings, you will be growing your proportionate interest in the project and hopefully adding to the potential of token price appreciation.

Note:

This staking option is often confused. Many believe that staking tokens will yield them a passive return of 15 to 20% for doing nothing more than staking.

This is not the case as the staking of a proof of stake (POS) token merely rewards an investor with a greater return than its inflationary increase.

The staking rewards are not intended as a vehicle to provide an investor with a positive income stream, but rather, are intended to increase the investor's relative share in the project.

Cosmos (ATOM) vs Polkadot (DOT)

A head to head comparison between Cosmos (ATOM) and Polkadot (DOT).

In this section of our Cosmos (ATOM) guide, we are going to compare two blockchains:

- Polkadot (DOT)

- Cosmos (ATOM)

This section is designed to present an unbiased feature set comparison of each blockchain in the discussion.

Are Cosmos and Polkadot competitors?

Yes, Cosmos and Polkadot can be seen as competitors.

Both blockchains are working in the same space of "internet of blockchains" and appear to be competitors in developing a mainnet using a structure of parachains.

In saying that however, internal operations show that the Cosmos blockchain is much more usable for key industry use-cases than Polkadot.

Cosmos vs Polkadot comparison table

The following table shows you the key comparison points worth considering when it comes to Cosmos (ATOM) and Polkadot (DOT).

| Cosmos (ATOM) | Polkadot (DOT) | |

|---|---|---|

| Cosmos launched its first token sale in 2017 and then the future upgrades were released from that point onwards. | Polkadot started as a concept of web3 in 2016 and in 2020 its mainnet was launched under a community governance model. | |

| Cosmos has 260,906,513 ATOM tokens whereas 203,121,910 were in circulation as of now. | Polkadot has around 1.11 Billion DOT and a total circulating supply of 1 Billion DOT. | |

| Cosmos is based on the Tendermint Core protocol which is a proof of stake consensus mechanism. | Polkadot makes use of the Nominated Proof of Stake (BABE/GRANDPA) consensus algorithm on its network. | |

| Cosmos makes use of the multiple SDKs with access to different programming languages so there is no fixed language preference for developers. | Polkadot makes use of Rust as its primary language for the development of dApps, smart contracts and other development on blockchain. | |

| Cosmos makes use of the modular structure for connecting with different blockchains in a model of hub & zones. They collectively connect with its main relay chain. | Polkadot on the other hand allows multiple parachains connected to the main relay chain in the slot reserve fashion. This way it handles the traffic and scalability problems. | |

| Cosmos has Tendermint in its base blockchain which allows the smart contract feature in its chain and the connected subchains too. | Polkadot's main relay chain does not have support for smart contracts as of now but it does allow such functionality under its parachain feature. | |

| Cosmos has been speculated to touch around 40,000 TPS. | Polkadot has so far tested the speed of around 1000 TPs. | |

| Cosmos makes use of the hub & zone independent security structure for securing blockchain in and out of transactions. | Polkadot makes use of the local & global shared pool security and the reserved slots to handle the blockchain security issues. | |

| Cosmos makes use of the "hub and zone" model to connect with heterogeneous blockchains within its network. | Polkadot has community governed slots that are being used for communication with other parachain or parachain to relay chain communication. | |

| Cosmos supports various blockchain SDKs and allows scalable interoperability as a bridge in and out of its blockchain. | Polkadot can be used as a bridge between Ethereum and other blockchains using the parachain feature. | |

| Cosmos can be staked and the economical consensus can be maintained. There are validators who are rewarded for handling consumer staking. | Polkadot on the other hand also uses a community governance model to handle economical consensus and staking on the validator pools is possible. | |

| Cosmos can be used for smart contracts, inter and off-chain bridges, wallets, stablecoin and dApps Defi as well. | Polkadot is mostly used for the interoperable blockchain usage scenario but the moonstake network has been working on other features like wallet, staking, stablecoin and other use cases too. |

Is Cosmos better than Polkadot?

From the perspective of a developer, Cosmos offers more ways to integrate various blockchain solutions thanks to Cosmos SDK and Tendermint BFT.

Based on some of the above points, you can see how Cosmos appears more powerful and immediately usable for developers.

Polkadot on the other hand, has yet to use its functionalities for use-cases in the same way that Cosmos has.

As a result, we are yet to see the depth with which Polkadot can show its true capabilities.

Cosmos appears more open for a new blockchain, whereas the Polkadot puts up a barrier in order to avoid any rogue blockchain making use of its network resources.

When it comes to inter blockchain operability, Polkadot probably edges it by appearing more modular, secure and easier to use than the Cosmos chain.

Should I buy ATOM or DOT?

For investors looking to buy either ATOM or DOT, the above comparison table should help you make a final call.

For developers on the other hand, the development structure of each blockchain needs to be considered before a decision on which blockchain will better solve your particular use-case.

Cosmos is definitely the popular choice for development and also from the investment context, ATOM appears to have a certain edge over DOT.

Cosmos (ATOM) pros and cons

Before buying Cosmos (ATOM), take a look at this list of pros and cons.

The internet of blockchains project known as Cosmos (ATOM), has a number of pros and cons.

This section of our Cosmos (ATOM) guide takes a look at the pros and cons, before offering an opinion on which side is more overwhelming.

Cosmos (ATOM) pros

The 3 best things about the Cosmos blockchain and its native ATOM cryptocurrency are as follows:

1. The Cosmos project is fully open-source.

The framework that it uses to allow others to build multi-asset public Proof of Stake (POS) blockchains known as the Cosmos-SDK brings everything together.

What we end up with is a raft of seamlessly integrated blockchains that have no issues speaking to one another.

One of the biggest pros is that this doesn’t matter whether chains are Tendermint-based blockchains that have been created through Cosmos-SDK, or not.

Ultimately ensuring that blockchain standards through the Inter-blockchain communication protocol are adhered to.

2. Blockchains created through Cosmos-SDK remain fully independent.

Taking advantage of Cosmos-SDK to create new blockchains doesn’t technically restrict you from moving forward.

Your independent work and sovereignty remain at all times.

All this, while taking advantage of the security and interoperability that being based on Cosmos affords.

Building on Cosmos can potentially offer new projects the best of both worlds.

3. Easier staking than DeFi on other chains.

The ATOM token can be easily staked to receive interest.

When it comes to ATOM in the case of the Cosmos Hub, staking is the process of locking up your coins to provide economic security for the blockchain.

As a reward for providing this service, you’re able to earn interest on your staked tokens.

Depending on which validators of the Cosmos Hub you choose, you’re looking at around 10%.

Cosmos (ATOM) cons

On the other hand, here’s a look at 2 of the negatives when it comes to Cosmos and the ATOM token:

1. Staked ATOM is locked away for a relatively long period.

If you choose to delegate your ATOM stake to earn interest, your tokens are frozen and therefore unable to be liquidated for any reason.

If you want to undelegate the ATOM tokens you have delegated to a validator, they will be subject to a 21 day lockup period.

This lockup period is enforced by the network for added security, in order to prevent attacks being carried out against Cosmos.

2. Overwhelming competition in the space.

As we’ve already compared in this guide above, Polkadot is the biggest competitor to Cosmos and lightyears ahead when it comes to brand awareness.

Not to mention the fact that Cosmos is just one of a handful of competitors trying to eclipse Ethereum.

A blockchain that for all its flaws, continues to streak ahead of competitors with bigger brand names and more use-cases than Cosmos.

Do the pros of Cosmos (ATOM) outweigh the cons?

Ultimately, the Cosmos (ATOM) pros, far outweigh the cons.

There’s just no denying the fact that the Cosmos blockchain has huge potential.

Competition is everywhere in the highly innovative blockchain space, especially the Ethereum killing, multichain sector.

Not to mention the fact that lockup times on staked tokens serve a security function that we here on the Hive blockchain should understand better than anyone (shoutout to J-Sun!).

Hopefully, this section of our guide to Cosmos (ATOM) has put you one step closer to making a call on whether the project is for you.

Next we move onto the final section, helping you decide whether ATOM is a good investment in 2021.

Deeper we go...

Should I buy Cosmos (ATOM) in 2023?

We finish our guide to Cosmos (ATOM) by answering whether the token is a buy in 2023.

We know that the Cosmos (ATOM) project is an ecosystem of independent blockchains with an intent to make them interoperable and to scale.

The team behind Cosmos desires to create an 'Internet of Blockchains', or in other words, a network of interoperable blockchains operating in a decentralised fashion.

Indeed, a very ambitious undertaking.

In this section of our guide to Cosmos (ATOM), we investigate whether or not ATOM is an asset you should be buying in 2023.

Why you should buy ATOM

- Cosmos (ATOM) was launched in 2017, so in cryptocurrency standards, it is an established project with staying power.

- Cosmos is one of the most sought after cryptocurrency projects when considering blockchain interoperability.

- ATOM ranks among the top 50 digital assets based on the metric of market capitalisation.

- Being one of the most popular blockchains for interoperability, ATOM enjoys wide liquidity across many cryptocurrency exchanges.

- Cosmos can boast having 248 available applications available for use in its ecosystem, with over $70 billion in user assets under management.

- Cosmos has first-mover status in the interoperability space.

- ATOM demonstrates a healthy high daily trading volume.

- The ecosystem of Cosmos is sufficiently healthy so as to support both decentralised autonomous organisations as well as decentralised gaming projects.

- Likewise, DeFi projects continue to be added to the Cosmos blockchain.

- In February of 2021, Cosmos launched STARGATE, which enhanced the performance of blockchain connections with its SDK (Software Development Kit), thereby increasing interoperability capabilities.

- Cosmos has impressive credible use cases in that Crypto.com, ThorChain, Terra, and Binance have all used the resources provided by Cosmos in the construction of their respective projects.

- Due to the relatively low price of ATOM as compared to comparable blockchains, ATOM is undervalued. This situation provides the opportunity for institutional investors to buy ATOM when they are looking for projects with historical credibility and strong use cases. The entry of institutional investors would drive the price of ATOM higher benefiting current investors.

- Cosmos has a very strong team backing the project. The core team is well versed in blockchain technology and operations as well as decentralised finance. It is through the team’s efforts that Cosmos has developed into a continuously improving third-generation technology.

- One of the three important technologies within Cosmos is its SDK (Software Development Kit) which permits developers to add their projects to the Cosmos blockchain easily and seamlessly. The simplicity of the Cosmos SDK should drive additional projects to the Cosmos ecosystem.

- It is within Cosmos’ future plans to introduce an 'opt-in shared security model' within its network zones to provide incentives for developers to choose the Cosmos ecosystem for their project.

- Cosmos will be launching its 'Gravity Bridge', which will be an efficient bridge between EVMs and Cosmos SDK compatible blockchains. This bridge will permit transfers from ETH to ATOM and ATOM to ETH by locking tokens on the Ethereum side of the transfer and minting equivalent tokens in the Cosmos ecosystem. The launch of the Gravity Bridge will bring added liquidity and value to the Cosmos blockchain as well as to the other assets running within its ecosystem.

- In January 2021, Grayscale even took the first steps toward creating a Cosmos Single-Asset Trust.

Why you might avoid buying ATOM

- There exists some possible regulatory concerns surrounding the initial ATOM token sale in 2017. Although there has been no direct action by the SEC against Cosmos, these regulatory concerns (i.e. Ripple) could potentially either affect the price of ATOM.

- Cosmos' IBC (Inter-Blockchain Communication) feature has stiff competition. Competitors include Akash Network, Crypto.com, IRISnet, CELO, and Polkadot. The result being Cosmos will face additional competition from blockchains in the mainstream (Cardano, Ethereum, EOSIO, and basically any IBC capable chain) which could divide the available market among these competitors.

- As of July 2021, there were less than 300 applications available on Cosmos which is difficult to comprehend in light of its easy to use SDK available to developers. During the same period, only 40 zones were available for use on Cosmos with only 2 being used. Further to this, Cosmos ranked just 14th among its competitors in terms of Development Activity per Sanbase.

Final verdict on buying Cosmos (ATOM) in 2023

Our guide to Cosmos (ATOM) has now provided you with the key elements to consider in reaching a final decision.

The final verdict on buying Cosmos (ATOM) in 2023 will now be left to you.

Best of probabilities to you.

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Cosmos (ATOM)? All comments that add something to the discussion will be upvoted.

This Cosmos (ATOM) guide is exclusive to leofinance.io.

Posted Using LeoFinance Beta