A beginner's guide to Fantom (FTM), the highly scalable blockchain platform for DeFi, crypto dApps, and enterprise applications.

Fantom is a high-performance, scalable, and secure smart-contract platform.

It is designed as a next generation blockchain solution to overcome the limitations of previous platforms such as Ethereum.

Fantom is therefore permissionless, decentralised, and most importantly open-source.

Thanks to its revolutionary aBFT consensus mechanism, Lachsis, Fantom is much faster, cheaper, and more secure than older technologies.

The craze for smart contracts and Defi is giving birth to more and more of the so-called "Ethereum killers", making this a very competitive market.

Our Fantom (FTM) guide will discuss what the project is and whether the network can actually deliver.

Introduction to Fantom (FTM)

We introduce the origins behind Fantom before taking a brief look at the technology and FTM token itself.

The rise of Decentralised Finance (DeFi) in the last couple of years has definitely drawn a lot of attention to smart contract platforms that could be the next big thing.

As crucial to that development as Ethereum was (and still is), most investors are aware of the affordability and scalability issues that are inherent to that network.

Therefore a lot of new projects are being launched, all looking to be the next Ethereum by solving the aforementioned problems.

Fantom is certainly no exception.

Describing themselves as a fast, high-throughput open-source smart contract platform for digital assets and dApps, their motto of "performance matters" really introduces them well.

Origins of Fantom

Fantom was created by Dr. Ahn Byung Ik, a computer scientist with a background in the food industry.

He eventually stepped away from the project and the CIO, Michael Kong, became CEO.

Their full team consists of more than 20 people, including the DeFi Architect, Andre Cronje, who is a known name in the world of DeFi as also being the founder of Yearn.Finance.

Despite becoming more known to the general public in the last few months, Fantom has been around for a while.

Their mainnet actually went live as far back as December 2019.

The technology behind Fantom

As previously mentioned, Fantom aims to be a fast, affordable and scalable platform.

In order to achieve this goal, they rely mainly on two core technologies:

- The Lachesis Protocol

- The Opera layer.

Lachesis is their consensus protocol which, according to them, is faster, more secure and more scalable than classical algorithms.

This is why Fantom is considered a fast platform, with transactions being confirmed in 1-2 seconds.

Opera is their open-source development environment to build decentralised applications.

It's fully compatible with the Ethereum Virtual Machine and provides full smart contracts support through Solidity.

The FTM token

FTM is the native token of the Fantom network.

It's used for securing the network via a Proof-of-Stake system, on-chain governance, to pay for network fees and can also be used for sending or receiving payments with fees as low as $0.0000001.

The total FTM supply is 3.175 billion tokens, of which 2.1 billion are currently in circulation.

The rest are reserved for staking rewards.

At the moment, FTM is available as a native mainnet token, as ERC-20 token, and as a BEP-20 token.

As for the FTM price, take a look at how the market is finally starting to take notice of Fantom on the following CoinGecko chart:

How does Fantom (FTM) work?

An overview of the different components of the Fantom Blockchain and how they work together.

Fantom (FTM) is an open-source and decentralised blockchain network for building decentralised applications (dApps) via smart contracts.

It leverages its speed and fast finality, while being perfect for applications due to no risk of congestion or long confirmation times.

Fantom consists of two main layers and both of them have different functions and features to support the network.

Working upon an Asynchronous Byzantine Fault Tolerant (aBFT), Proof-of-Stake (PoS) consensus, this provides the network with lightning-fast transaction speeds and finality.

To put things into perspective, the payments made on the Fantom network cost near zero ($0.0000001) and take around 1 second to complete.

The Fantom mainnet is also fully compatible with the Ethereum Virtual Machine (EVM) and anyone can easily port their existing Ethereum DApps to the network.

In this section of our Fantom (FTM) guide, we’re going to see the different components of Fantam Opera Blockchain and how they work together.

What is Lachesis?

The Fantom network uses a leaderless consensus algorithm called Lachesis.

It follows an Asynchronous BFT (aBFT) consensus algorithm, which ensures high transaction speeds and security on the network.

Lachesis also makes Fantom cheaper than generation two blockchains and much more eco-friendly too.

It allows nodes to process transactions at different times and can work with up to one-third of malicious or faulty nodes.

How Does Lachesis Work?

Each Lachesis node stores a local data structure called acyclic directed graph (DAG), containing finalised event blocks.

DAG is simply used to finalise the order of these events.

Each event block contains a set of multiple transactions and is divided into confirmed and unconfirmed event blocks.

DAGs are also divided into separate sub-DAGs which are called Epochs.

As per Fantom's whitepaper, each epoch is sealed when one of these conditions is satisfied:

- The epoch reaches a defined number of blocks.

- The epoch lasts for a specified time.

- At least one cheater is confirmed in the block.

Each event in an epoch contains a reference to the previous epoch which sets the order of these events.

New events of sealed epochs are not considered for the consensus.

With one consensus message, multiple event blocks (in batches) are confirmed at the same time on each node independently.

This will result in the creation of the chain.

Each batch of events is called a block.

A syncing process among nodes happens periodically to align the events on each node to reflect the latest state of the chain.

The newly generated event blocks are always unconfirmed and they are used to vote for the previously generated even blocks on 2nd or 3rd position at the same time.

Multiple elections end up happening at the same time, leading to fast finality with a minimum number of consensus messages being generated.

Each validator node needs to hold a minimum of 1 million FTM tokens to be eligible for block production.

Others can also stake their FTM to earn epoch rewards and delegate them to other validator nodes in order to earn a share from fees.

This ultimately creates a more decentralised and secure network.

What Is the Opera Mainnet?

The Opera Mainnet is an open-source environment used to develop and host Decentralised Applications (dApps), powered by Lachesis.

It has smart contract functionality like Ethereum, but with the added advantage of having near-zero fees and faster transaction times.

The blockchain is fully compatible with the Ethereum Virtual Machine (EVM) and hence, it is easier for existing Ethereum dApps to port over to Fantom.

On Opera, Fantom is creating a decentralised blockchain ecosystem alongside a next generation blockchain technology stack that will ultimately help developers and users participate in the new economy.

It solves the famous blockchain trilemma by providing an unseen balance between scalability, security, and decentralisation.

What Is Fantom DeFi?

Fantom provides an all-in-one DeFi (Decentralised Finance) solution for its EVM-compatible blockchain.

The following products are included in the DeFi suite:

- Liquid Staking: Users can lock or delegate their FTM tokens to get sFTM tokens at a 1:1 ratio. These tokens are liquid and users can use them across various other products within the Fantom Ecosystem. Minting and converting sFTM back to FTM is feeless.

- fMint: Users can lock FTM as collateral to mint synthetic assets on Fantom like crypto, pegged currencies, and commodities. For example, you can mint fUSD (a stablecoin on Fantom) by locking up FTM, or synthetic assets by locking fUSD.

- fLend: Users can use their liquid sFTM tokens in Fantom’s borrowing and lending protocols without risking their FTM token stake.

- fTrade: fTrade is the automated market maker (AMM) and decentralised exchange (DEX) built on Fantom. Users can exchange between different Fantom tokens within the wallet.

All these offerings native to the Fantom Network make it a fully functional DeFi ecosystem that is fast, scalable and decentralised as compared to Ethereum and other blockchains.

How to stake FTM - What you need

Learn how to download a Fantom wallet and then how to stake FTM tokens on the network.

But what about how Fantom (FTM) staking works?

As Fantom uses a Proof of Stake (PoS) algorithm to reach a consensus, you can stake FTM to earn staking rewards and earn a share of fees generated via network transactions.

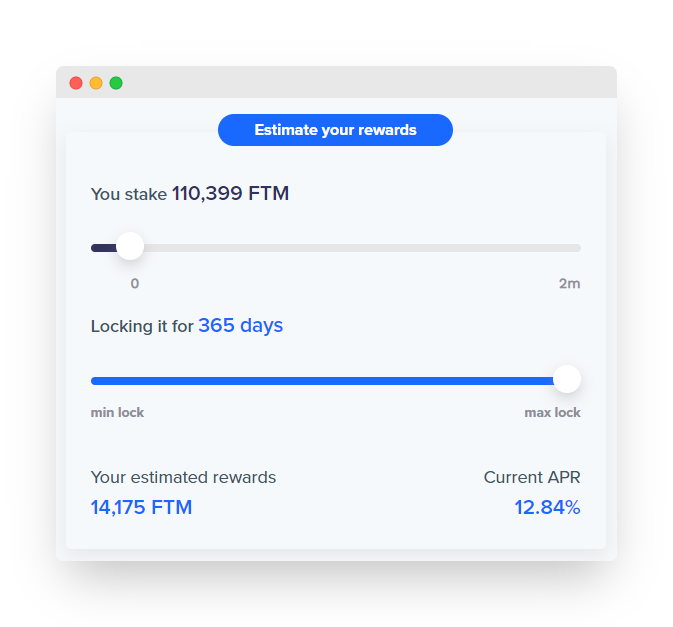

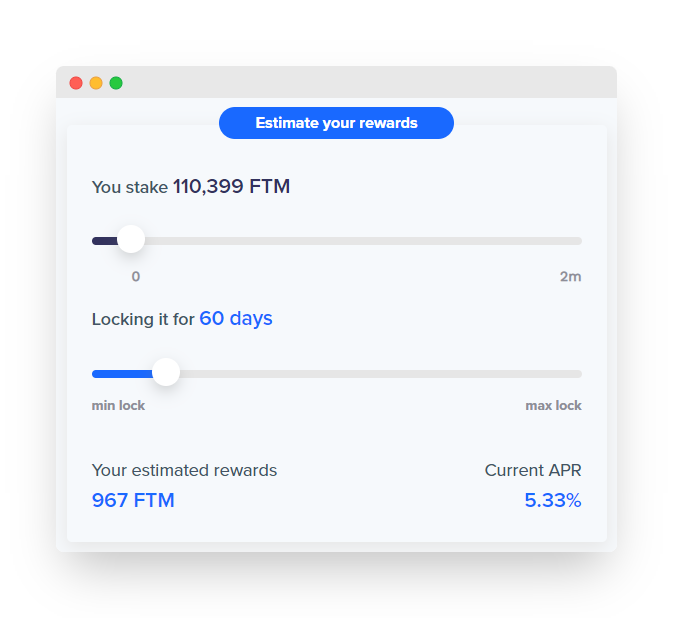

Currently, staking rewards are fixed at 12.84% and change depending upon the lock period.

A minimum lock period is 14 days and a maximum lock period is 365 days.

In this section of our guide to Fantom, we are going to explore how to stake FTM, as well as going over what is required.

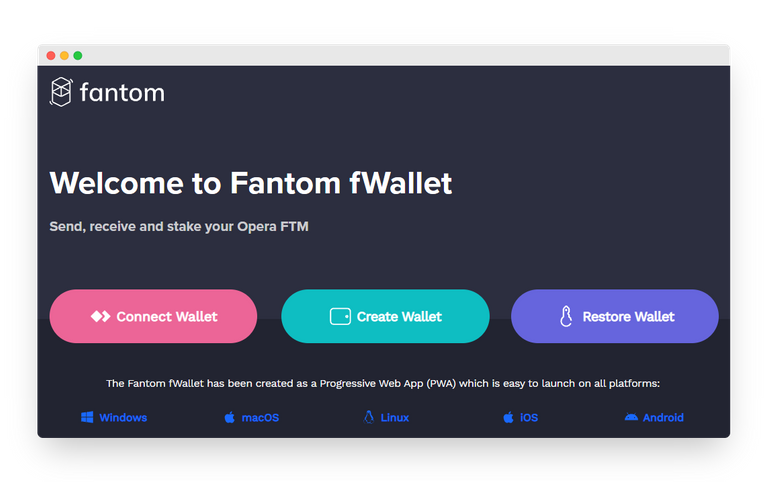

How To Download fWallet

Fantom's homegrown wallet is called fWallet.

You can access fWallet here, with it available for the most common operating systems, as well as on both desktop and mobile.

Simply click on Create Wallet and follow the instructions.

Please ensure you save your seed phrase offline, written on a piece of paper with no one having direct access to it but you!

How To Stake FTM

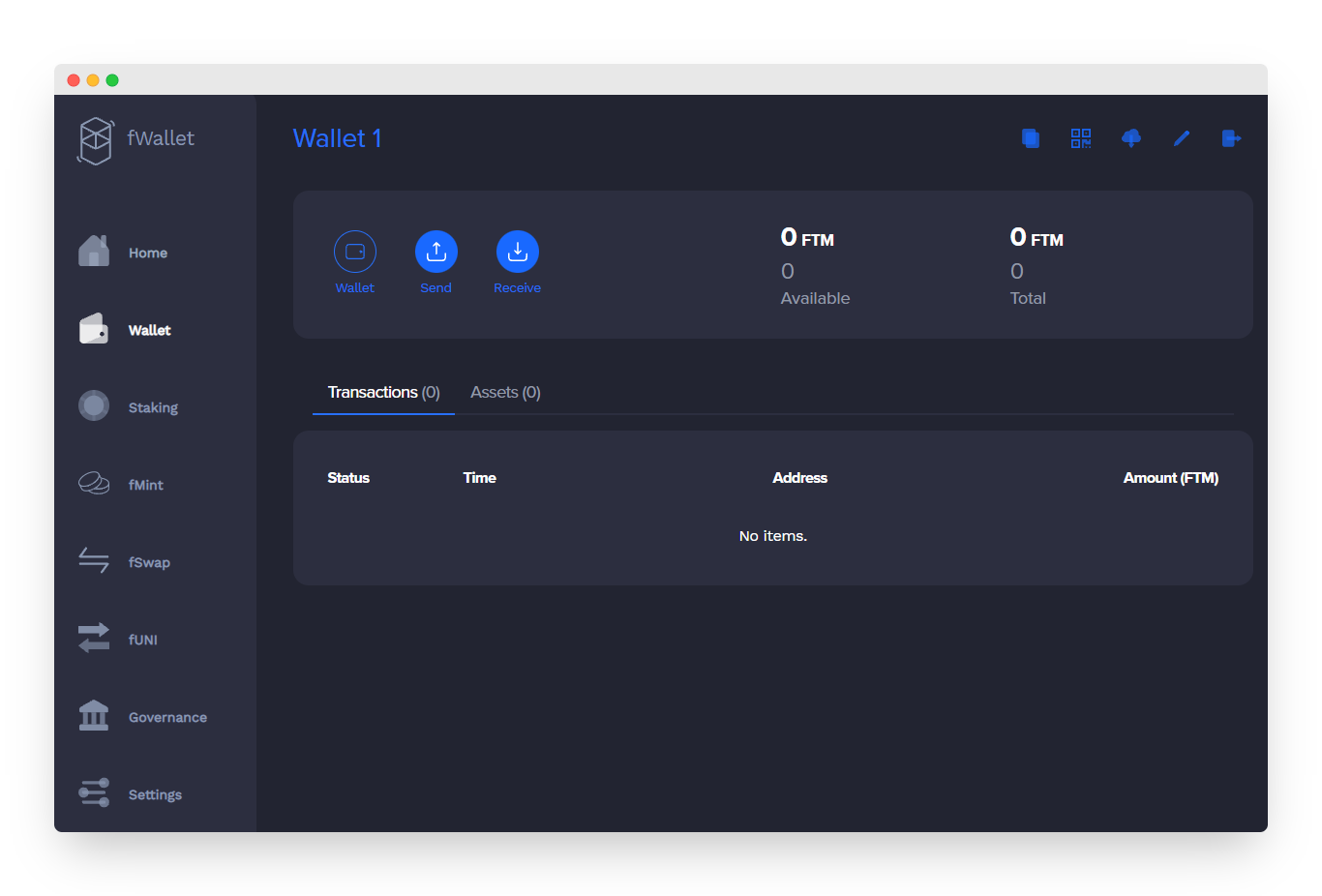

Fantom Opera wallet is an all-in-one DeFi service provider.

You can stake, mint, trade and lend, all within the single wallet that we walked through downloading above.

Once you have logged into your wallet using your MetaMask account, please click on the "Wallet" from the navigation panel on the left side of the window.

In order to stake your FTM, you first need to transfer FTM from Ethereum or Binance Smart Chain (BSC).

Click on "Receive" and you will get an address for your Fantom Wallet on the Fantom Mainnet.

Remember, you can only send FTM mainnet tokens to this particular address.

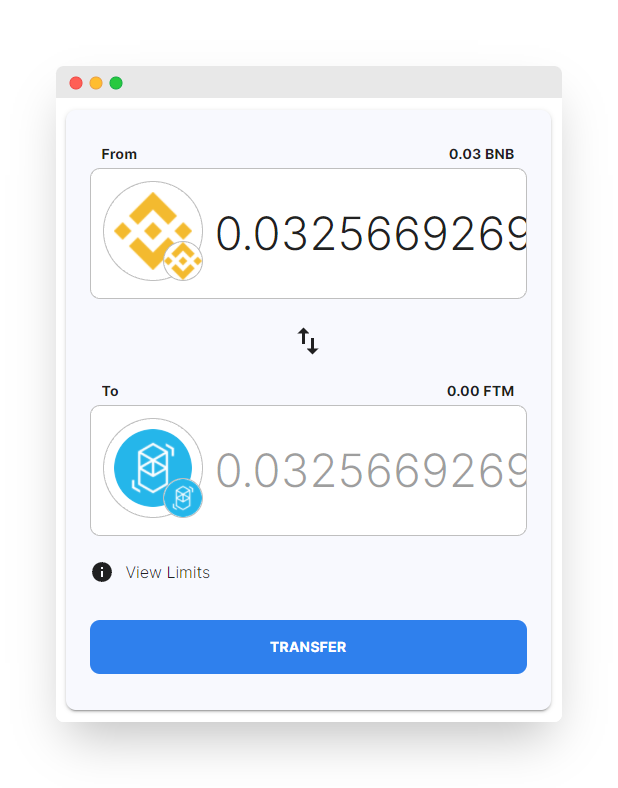

If you get stuck, you’re able to receive FTM from Ethereum or Binance Chain, using multichain.xyx.

Using this service, you can easily swap any token on ETH or BSC to FTM on the Fantom Network using MetaMask.

In the example below, we are swapping BNB on BSC to FTM on Fantom:

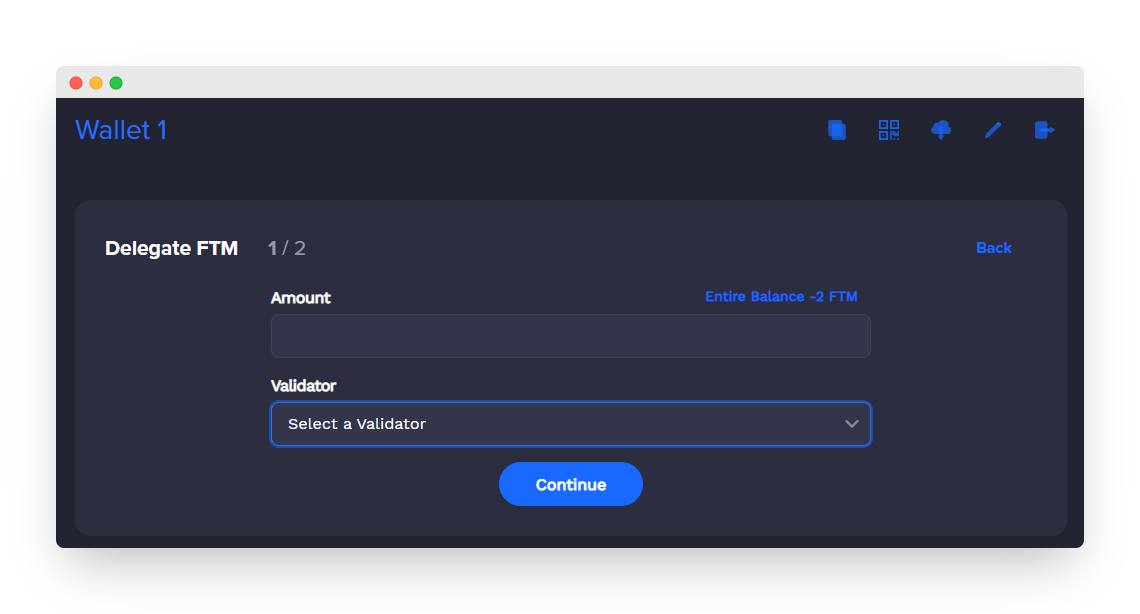

Once you receive your Fantom in fWallet, you can then click on the "Staking" tab from the navigation panel.

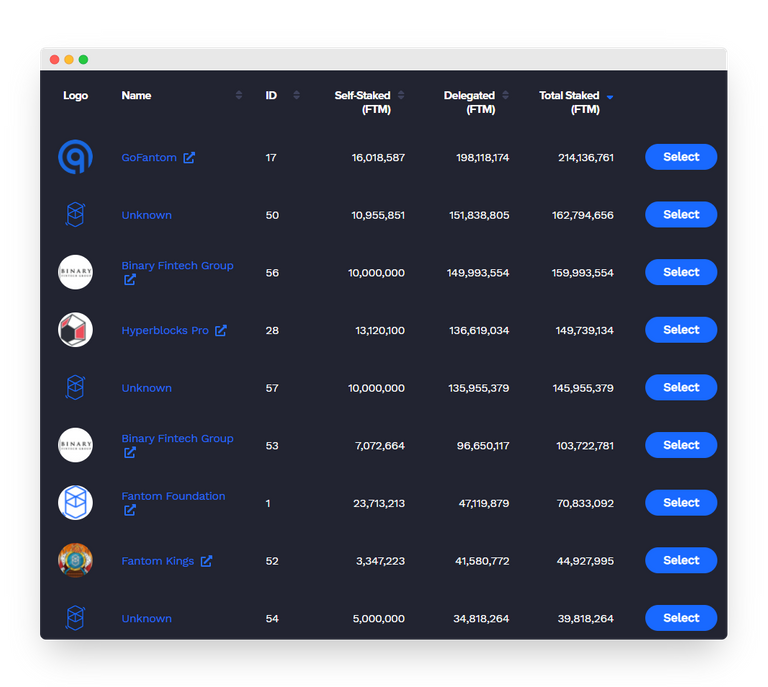

Enter the amount of FTM you would like to stake and click on the "Choose Validator" dropdown to open the list of validators currently available on the Fantom Network.

The choice of which you select is entirely up to you.

Click on the "Continue" button to delegate your FTM to your selected validator.

You will have to enter your wallet password to complete the transaction and once it is confirmed, you will get a notification as shown below:

After staking FTM, you will now start passively earning FTM, but please note that staking rewards have to be claimed manually.

On the Fantom Foundation website, you can get an estimate of your returns depending upon your staking period.

The general rule being that if you stake for a longer period of time, then you will receive higher returns.

Warning:

We’d just add a small warning for people that want to try FTM staking.

Sometimes the interface becomes broken and you can't undelegate your staked FTM, even if the delegation period has expired.

fUSD rates can also fluctuate wildly and the peg is broken almost constantly.

Does Fantom burn coins?

Fantom’s FTM token does not burn enough tokens to be considered deflationary.

For some reason, Fantom (FTM) seems to have a reputation for burning coins and therefore being deflationary.

In reality however, this is a myth.

FTM is in fact an inflationary token that will see its supply continue to increase as time passes.

With the FTM being so much more than a simple store of value and actually required to facilitate the Fantom network, a level of inflation is required to fund both its health and maintenance.

While mainstream crypto users seem to have it in their heads that inflationary tokenomics are a bad thing, this actually couldn’t be further from the truth when it comes to networks with use cases such as Fantom’s.

In this latest section of our Fantom (FTM) guide, we debunk the myth that Fantom burns enough coins to be considered deflationary.

Fantom (FTM) is actually inflationary

As per the Fantom whitepaper, there are 3.175 billion FTM tokens.

In order to expand the Fantom ecosystem, an inflationary model is adopted.

Initially, this is set at a 5% annual inflation rate.

Where the FTM inflation goes:

- 20% of the total inflation is used to reward notes.

- 80% of the total inflation is used to incentivise Fantom users.

Keep in mind that this 5% inflation rate is expected to decrease over time, as more users join the network.

Fantom Governance does burn coins

Within the Fantom governance system, token holders have the opportunity to propose ways to improve the ecosystem, as well as vote on pending proposals.

Each FTM token you have staked, carries one vote and voting costs a mere fraction of 1 FTM.

Fantom proposal submissions cost 100 FTM, which is burned in the process.

So while the Governance system on Fantom technically burns 100 FTM every time a proposal is submitted, this is a mere drop in the inflationary ocean.

As you can see, any decision carried out on the network must first be approved by participants with stake.

Fantom’s governance system is completely permissionless and depending on how you view a token with a pre-mine going to founders and early investors, completely decentralised.

The future roadmap for the Fantom network is in the hands of FTM stakers with skin in the game.

Final thoughts on Fantom burning coins

While Fantom burns coins during governance proposals and as discussed in earlier sections of this guide to Fantom (FTM), in some cases when unstaked prematurely, FTM is an inflationary token.

With Ethereum trying hard to push its own deflationary narrative, there’s always going to be interest in this aspect of the tokenomics of competitors.

With Fantom pushing to etch its place as one of the leading Ethereum killers, comparisons and questions are only natural.

But ultimately the answer to this question is no.

Fantom doesn’t burn enough coins to be considered deflationary.

What is Fantom (FTM) used for?

Fantom (FTM) is the native cryptocurrency of the Fantom blockchain platform.

The native cryptocurrency of the Fantom network has a number of use cases.

Means of exchange

As such, FTM is used as a means of exchange and value transfer within the network.

Users can send and receive FTM for various purposes, such as paying transaction fees, participating in staking, and contributing to network governance.

One of the primary use cases for FTM is to pay for transaction fees on the Fantom network.

Just like with other blockchain platforms, every time a user wants to execute a transaction on the Fantom network, they need to pay a fee to incentivise validators to process the transaction.

These fees are denominated in FTM, so users need to hold and use FTM to access the network's functionalities.

Staking

In addition to transaction fees, FTM is also used for staking on the Fantom network.

Staking involves locking up a certain amount of FTM as collateral to participate in network consensus and earn rewards for validating transactions.

Stakers also have a say in network governance by voting on proposals and decisions that affect the network's development or direction.

Payment for goods and services

Another potential use case for FTM is as a means of payment for goods and services.

While the Fantom network is still in its early stages, there is potential for developers to build decentralised applications (dApps) that accept FTM as a form of payment.

As the network grows and more people start using it, FTM could become a widely accepted means of payment for digital goods and services.

Fantom (FTM) vs Ethereum (ETH)

A side by side comparison of Fantom and Ethereum.

This section of our Fantom (FTM) guide offers an unbiased comparison between the following:

- Fantom (FTM)

- Ethereum (ETH)

Fantom vs Ethereum comparison table

The comparison table below shows you the main points between each of the blockchains.

| Fantom (FTM) | Ethereum (ETH) | |

|---|---|---|

| The Fantom blockchain was first released in 2018 by the Fantom Foundation and released their token in 2019 on its mainnet called OPERA. | Ethereum was launched in 2013 within a conceptual paper and then its mainnet was released in 2015. | |

| Fantom has around $5,322,424,245 USD worth of market supply with a circulating supply of 2,545,006,273 FTM coins. | Ethereum has 117,046,619 coins in circulation and so far $365,186,415,050 coins in supply. | |

| Fantom is based on the Lachesis which is Fantom’s aBFT consensus algorithm, making it a lot more reliable and faster than the Ethereum blockchain. | Ethereum's current infrastructure is based on Proof of Work but in the near future, it will be rolling out its Proof of Stake consensus algorithm. | |

| Fantom is completely open-source and community-driven though they do have a core team handling major upgrades. | Ethereum has its own foundation and has an open-source and community model, but it too does have a core team handling major upgrades. | |

| Fantom has support for Vyper, Ethereum Virtual machine and even Cosmos SDK support for the development of smart contracts and dApps. | Ethereum has Solidity as its primary language for developing smart contracts and dApps. | |

| Fantom has a comparatively lower cost of transactions when compared to Ethereum. | Ethereum, due to its Proof of Work model, has a low cost of transactions. | |

| Fantom's current transactions per second is around 50,000 TPS which surpasses even the much hyped Solana. | Ethereum's current TPS is around 50. So comparison wise ETH is slower than both Solana and Fantom. | |

| Fantom's native token FTM can be staked, lent and also traded on exchanges. | Ethereum's native token ETH can be staked, lent and also traded with other pairs the same. | |

| Fantom is intended to compete in the same space as Cardano, Polkadot, Solana and Ethereum due to its features and ability to scale. | Ethereum is in the same space as base blockchains which can be extended like Cosmos, Solana, Fantom and Polkadot. | |

| Fantom does allow the development of dApps, smart contract, DeFi and other cross-chain bridges. | Ethereum's own infrastructure allows layer 2 tokens, dApps, smart contracts and DeFi on its chain. |

Fantom or Ethereum - The final verdict

Ethereum is experiencing a number of scalability issues that have increased transaction fees and general costs associated with using the network.

This has forced many projects to cross over to other competing blockchains.

Fantom is cashing in on the opportunity to fill gaps where Ethereum fails to perform.

It not only offers faster transactions, but they’re also a lot cheaper.

Performance wise however, Fantom has yet to take on any big project which can demonstrate it can scale under the high pressure and load of the real world.

In the near future, it won't be surprising to see many projects choosing the Fantom blockchain and investors shifting towards the FTM token over ETH.

If you are a developer who wants to build dApps or smart contracts, both blockchains are useful for you. On the other hand, If you are an investor staying invested in both chains is a much better choice.

Is Fantom faster than Solana?

Both Fantom and Solana (SOL) are known for their fast transaction speeds and high throughput capabilities.

But it is difficult to say definitively which one is faster as it can depend on several factors, such as network congestion, node count, and hardware performance.

That being said, Fantom and Solana take slightly different approaches to achieving fast transaction speeds.

Solana uses a proof-of-history (PoH) consensus mechanism, which creates a verifiable record of time for each transaction, enabling fast and parallel processing of transactions.

On the other hand, Fantom uses a variant of Directed Acyclic Graph (DAG) called the Lachesis Protocol, which enables near-instant finality and confirmation of transactions.

In terms of raw transaction speeds, both networks have achieved impressive results.

For example, Solana claims to have achieved up to 65,000 transactions per second (TPS) in internal testing, while Fantom has reportedly reached speeds of up to 300,000 TPS in testing.

Ultimately, the speed of any blockchain network can be affected by various factors.

It's important to note that both Fantom and Solana are highly performant networks that offer fast transaction speeds and high throughput capabilities.

Fantom (FTM) pros and cons

Like any cryptocurrency, Fantom (FTM) has its share of pros and cons.

In this section, we'll take a closer look at some of the pros and cons of Fantom to help you make an informed decision about whether it's the right cryptocurrency for your needs.

5 Fantom pros

- High Transaction Speeds: Fantom is known for its fast transaction speeds, thanks to its use of the Lachesis Protocol, which enables near-instant finality and confirmation of transactions. This makes it an attractive option for applications that require quick and efficient transaction processing.

- Low Transaction Fees: Compared to other blockchain platforms, Fantom has relatively low transaction fees. This is due to its high throughput capabilities and efficient consensus mechanism, which allows it to process a large number of transactions per second without incurring high fees.

- Scalability: The Fantom network is designed to be highly scalable, with the ability to handle thousands of transactions per second. This makes it a viable option for applications that require high throughput and fast transaction processing.

- Interoperability: Fantom is designed to be interoperable with other blockchain platforms, enabling seamless transfer of assets and data across different networks. This could make it a useful tool for businesses and developers who need to integrate with multiple blockchain platforms.

- Community Support: Fantom has a growing and enthusiastic community of developers, supporters, and users who are actively working to improve and expand the network. This could help to drive adoption and growth over time.

5 Fantom cons

- Volatility: Like many cryptocurrencies, the value of FTM can be highly volatile, which could make it a risky investment for some individuals.

- Centralization: Some critics have raised concerns about centralization in the Fantom network, particularly around the control of validator nodes. This could potentially pose a risk to the network's security and decentralisation.

- Limited Adoption: While Fantom has been gaining traction in recent years, it still has limited adoption compared to more established blockchain platforms. This could make it more challenging for developers and businesses to build and launch applications on the network.

- Regulation: As with any cryptocurrency, Fantom may face regulatory challenges in different jurisdictions around the world. This could potentially impact its growth and adoption in certain markets.

- Technical Complexity: While Fantom is designed to be user-friendly and accessible, it still requires a certain level of technical expertise to use and develop on. This could make it more challenging for some individuals and businesses to get involved with the network.

Should I buy Fantom (FTM) in 2023?

In conclusion, Fantom (FTM) is an innovative cryptocurrency platform that offers fast transaction speeds, low fees, scalability, and interoperability.

These features make it a potentially attractive option for businesses and developers who need to process large volumes of transactions quickly and efficiently.

However, like any emerging technology, there are also potential drawbacks to consider, including volatility, centralization, and technical complexity.

If you're considering buying FTM in 2023, it's important to do your own research and carefully consider your investment goals and risk tolerance.

Cryptocurrency investments can be highly volatile, and there are no guarantees of returns.

As with any investment, it's essential to diversify your portfolio and avoid investing more than you can afford to lose.

Overall, Fantom is a promising project with a dedicated community and growing adoption.

Whether or not you choose to invest in FTM will ultimately depend on your personal investment goals, risk tolerance, and confidence in the platform's long-term prospects.

As with any investment, it's important to carefully weigh the pros and cons before making a decision.

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Fantom (FTM)? All comments that add something to the discussion will be upvoted.

This Fantom (FTM) guide is exclusive to leofinance.io.

Posted Using LeoFinance Beta