Now is not the me to be buying GCOTI unless you see it gaining significant value over and above what COTI will do later in this cycle. The maths does not add up and I will explain why.

I do think that making the right decisions regarding your crypto investments is not always that obvious and why you need to sometimes let the figures speak for themselves. This would also change depending where we are in the cycle as we kind of know we have approximately 12 -17 months remaining of this one we are currently in.

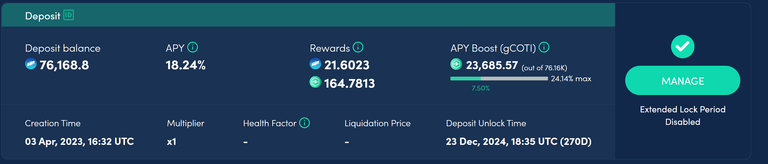

COTI has two tokens being COTI and GCOTI which is a Governance token and also an APR booster. The boost it offers to the rewards it generates is substantial enough to question which token is the smartest buy right now. COTI is currently sitting at $0.112 and GCOTI at $0.063 so a $200 investment would get you 1785 COTI or 3164 GCOTI.

200 GCOTI equates to around 0.08% on my larger staked pools so 3200 GCOTI only boosts my rewards by 1.2%.

Doing some quick calculations using the current stake in the COTI Treasury the 3164 GCOTI would generate an extra 1.2% APR which equates to an extra 2 COTI earned daily. Knowing the cycle is ending late next year or we presume it will because history tells us it will the maximum return it would earn in that time would be 365 plus the 160 days remaining this year giving us 525 days as a maximum number before the ATH's or peak of this cycle.

If we multiply that number by the 2 extra COTI earned daily that only gives us 1050 COTI compared to 1785 plus the roughly 6% APR you earn anyway bringing it closer to 1900. The plan is to sell for profit and buy back later so the obvious answer is to have the extra 850 COTI to maximise your profit.

The other benefit is when the swap out happens in Q4 later this year it will be done on the COTI you have staked and not on GCOTI so there is the potential for another 200-400 tokens up for grabs. Again this would be different if we had 3 or more years to run in this cycle and why it is important to evaluate what is the best option. This may be more about common sense, but having seen some others mention they were purchasing GCOTI instead of COTI I thought I may have missed something.

I have been working and accumulating my COTI stake for nearly 30 months now and trust me on this if you are selling when we see the market peak then buy more COTI and not GCOTI right now. In 2026 you can buy back COTI and add more GCOTI, but now is not the time. The figures do not make sense as you need more than 2 years (27-28 months) to recoup your GCOTI investment and we do not have 2 years.

Posted Using InLeo Alpha