Today @gungunkrishu did a post regarding their investment with VET & VTHO and thought it was worth another revisit to see what is taking place. From all the research I have done over the last few years this project is all pointing towards 2026 and not before. Maybe a few months prior, but that I will explain further on in this post. If you know the potential you have in any investment it changes the way you act and think which gives you an advantage over those who have no idea due to just seeing it as just another crypto which is a big mistake. Research is where you find the future profits and why this is a constant time factor required in any investment. This is about trying to remove any form of luck by guaranteeing you significant returns.

Many may be wondering why would @gungunkrishu invest in VET and VTHO of all the crypto's available. The project looks dead and has been going nowhere for years is what many would presume, but they are very wrong and I will explain why in this post.

Why 2026?

I am not talking about the price action from the Bull Cycle, but more from it's use cases where I see the real value being unlocked. I think many investors have forgotten that crypto should have a real use case for long term value and that the majority have nothing to offer yet they still invest. This is why doing research is so vitally important because you are looking way beyond green and red candles.

I say 2026 for the reason that in January 2026 CBAM is implemented which is the Carbo Border Adjustment Mechanism for Europe with regard to trade in and out. This is a new taxation levelled at manufacturers around the world who have taken no notice with regard to carbon emissions. Europe has bee affected negatively up till now when competing on price as they have to abide by regulations. CBAM is going to level the playing field where countries like China, Brazil and India will now pay a heavier taxation for any imports landing in Europe.

The Really Important Part

The way that the EU will know who is creating what carbon emissions is through using the VeChain which has now been regarded as the gold standard for tracking these carbo emissions. This is why AWS teamed up with VeChain a few years back already and why VeChain moved it's Head Office to San Marino in Europe. Having a Chinese connected company controlling this would not go down very well and why the VeChain is now very much an EU entity. The Chinese version of VeChain is called NanoJClean and yes they are part and parcel the same company cloaking their identity for political reasons in order to be accepted by the West. This had to be the deal the EU did with VeChain as no company would change their entire business if there was no pot at the end of the rainbow. The pot of gold is VeChain running CBAM and is worth the wait.

The $$$$$ Value Signals

I say 2026, but we could see the blockchain activity on VeChain increasing 6 months before. This will most likely be lost on most because the Bull cycle will or should be pumping prices at the same time. Unless anyone is checking the VeChain stats this will be lost on them and why I keep checking every few weeks.

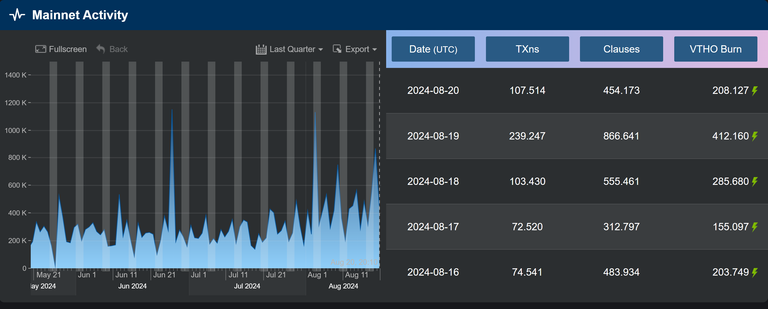

What I have noticed is that the number of clauses has risen over the last few weeks which a clause is multiple transactions counting as one transaction with one cost. The transaction cost is paid in VTHO (gas token) and a large portion is burned with the small portion paid to the validator node. This is how the VeChain works so the numbers are everything as transactions increasing means more VTHO burned adding value to both VET and VTHO.

If we compare 2022, 2023 and 2024 at similar dates there are 2 x as many transactions today than back in 2022. The umbers this year are up another 40-50% and this is not just Walmart getting ready for the Festive Season. I only expect their numbers starting to spike from the end of this month because I am in logistics and know the lead times they all use.

As you can see the VTHO burn is linked to the number of transactions (clauses) which has seen a steady rise since mid July. Bear in mind the VeChain needs to burn 36 million VTHO daily as that is the number created daily through the number of VET. The numbers tell us we need to see a 120x increase in transactions before we hit the required numbers and make VTHO deflationary. CBAM will do that when you have every company in the EU and outside of the EU transacting on the VeChain. They may not see this via the frontend when using another platform, but they will be indirectly. The numbers are huge and why it is important to pay attention because this is why crypto was developed as a use case for the real world.

Posted Using InLeo Alpha