Right after having some relief in the crypto market, and some gains, Tesla news is on its way to short that greenery in the market. As of the 21st of July, according to the Bloomberg report, Tesla Inc. has sold 75% of its Bitcoin holdings which is estimated to be worth around $936 Million at the time of selling, and this is not just verified from the Bloomberg report but also Tesla CEO Elon Musk has confirmed this selling off through the sarcastic tweet as well as the Balance Sheet of the company clearly shows the removal of Bitcoin. Now the question is how the crypto market is taking this event and what will be happening in the upcoming days.

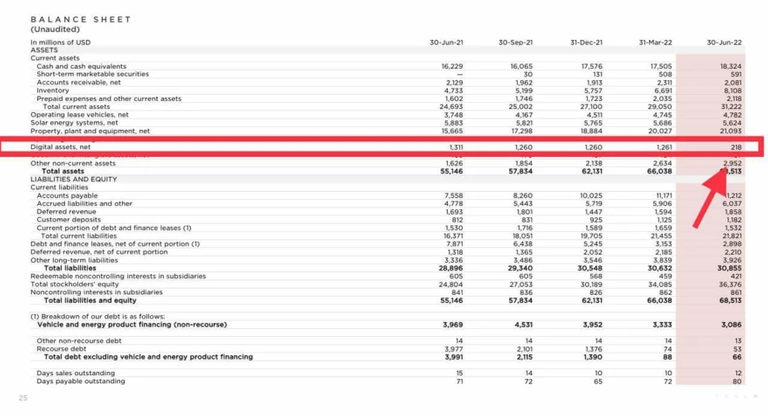

Tesla's Balance Sheet

The balance sheet is a statement of the assets, and liabilities of the company over a period of time. Companies have to show their detailed view of income and expenditure over a certain period of time. And that is why it becomes a very important aspect to look into it while researching the company as we can get an in-depth understanding of the particular company's cash flow and outstanding assets and liabilities.

Above is the balance sheet of Tesla which you can clearly see in the highlighted section labeled as 'Digital assets, net' which we can interpret as Bitcoin holdings of Tesla. As you can see in the highlighted row, on the previous release of the balance sheet on the 31st of March 2022 Tesla was holding 1,261 Bitcoins, and according to the latest updated release on the 30th of June 2022 Tesla only had 218 Bitcoin in their bag. And if we do the simple maths then we can see roughly Tesla has only 17% of Bitcoin compared to what they had in the March of 2022, that's the cut-off of 82% of Bitcoin.

Market Reaction To This News

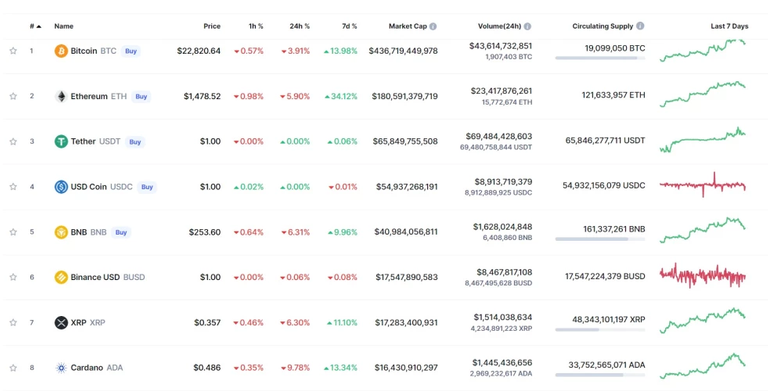

Before this news came into the public domain we had an optimistic rally going for Bitcoin and other altcoins. Bitcoin had broken a well-built barrier at $21k and was trading above $24k but right after the news about Tesla selling Bitcoin came into the market, people especially retail traders started to get panic. A panic sell button got triggered and selling pressure started to build which took Bitcoin down to around $22,700 in just a matter of hours. But Bitcoin was just on the tip of the coins that got seriously affected, altcoins including Ethereum, Solana, Cardano, and many others got hit because of this news. Currently, Ethereum is down by ~6%, Cardano (ADA) by ~9.11%, and Solana (SOL) is down by more than 11% in a twenty-four-hour time frame. These are solid projects in the crypto space, if they are getting hit like that then you can imagine what will be the condition of the other small-cap crypto coins.

You can see in the above picture, that not only stablecoins have suffered the dropdown but every other cryptocurrency has suffered little or more compared to others because of the news. After all, it is true in the crypto space, "News gets traded!"

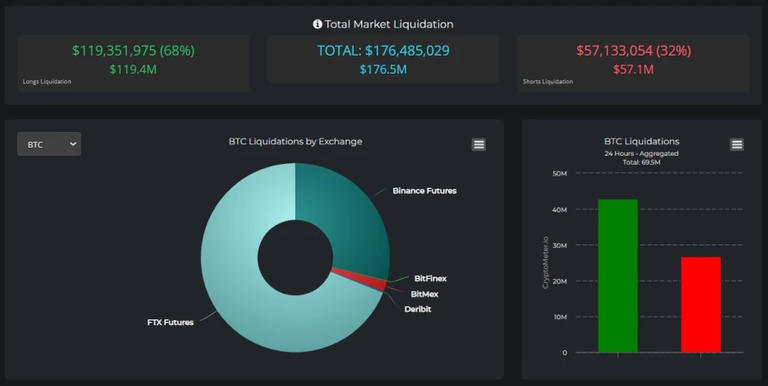

It is not just the spot market that got hit, the futures and leveraged markets suffered more than spot traders. As I already mentioned at the start of the post we were in a relief rally before the news which is good enough to say that there were many long leveraged positions but after this news and how the market reacted to its liquidations of over-leveraged and poorly risk managed positions was inevitable. In the last twenty-four hours there were $119 Million worth of long positions have been liquidated and $57 Million in short positions, collectively the market has faced the liquidation of a total of $176.5 Million in the last twenty-four hours.

Conclusion

Currently, the market situation is not in a very good position and this is not just for the crypto market but for the global economy is under stress. Even if you see some relief rallies that we saw a few days ago, it is important to understand that you do not get flowed in the emotions and trade emotionally. And if you are thinking of opening positions, especially leveraged positions then make sure to be extra cautious and always have a stop loss and do avoid high leverages.

Now the question is how long this will affect the market? In my opinion, the market will get over this in a couple of days until and unless we don't get any other bad news coming on its way because it is easy to get over with single huge bad news compared to a series of bad news.

Hope you find this article informative, do check my previous articles and if you like to tune in with me then do follow me.

Thanks for Your Time!

Posted Using LeoFinance Beta