This week's Glassnode data do not differ from those seen last Tuesday.

Therefore, in order not to weigh down the reading, I omit the repetition of the same things said on Tuesday and focus on one specific aspect, which is the flow of coin that is leaving the exchanges and going into investors' personal wallets.

On the day when the European Commission celebrates the understanding reached to regulate the exchanges, this flow of money fleeing just from the exchanges seems almost like an implicit comment from investors, although no cause-and-effect relationship can be established between the two...

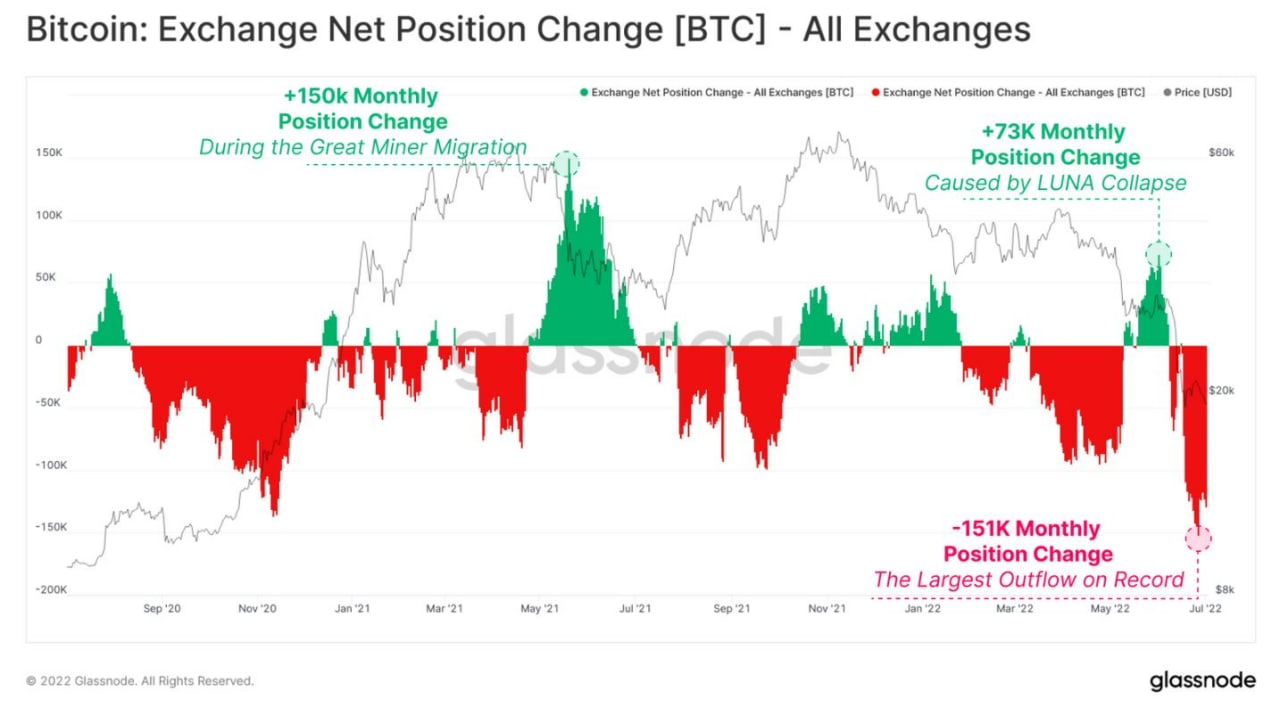

This is the graph that precisely shows the flight of capital from the exchanges, which has reached the highs, surpassing the previous bear market.

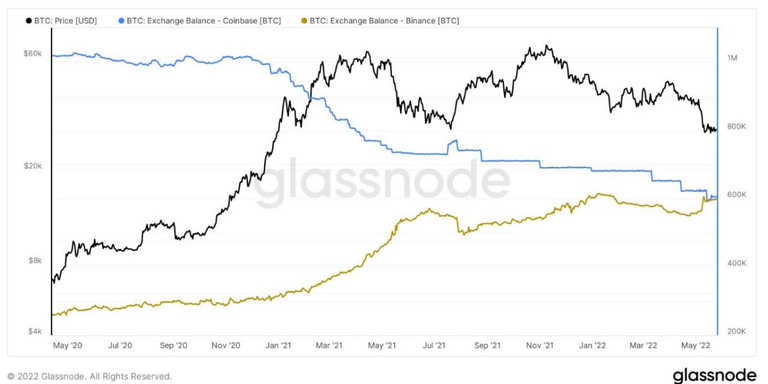

Interestingly, the outflow is not about all exchanges, though.

For example, Binance is having an inflow, while Coinbase is losing reserves.

Glassnode's hypothesis is that Coinbase is losing large (perhaps institutional) investors who prefer to park capital in their personal wallets.

Binance, on the other hand, is not a dedicated exchange for institutional investors and is probably chosen because of the ease of trading with derivatives and leverage, but also because it does not appear to be at risk of default as Coinbase is.

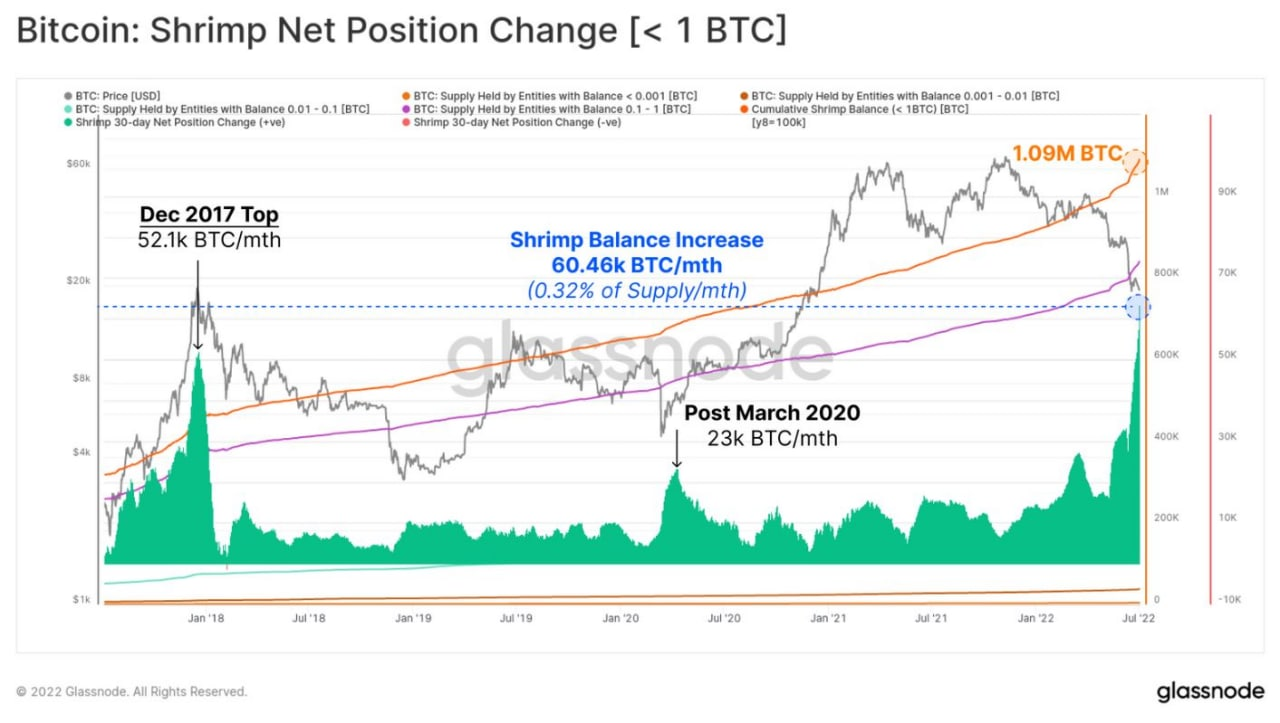

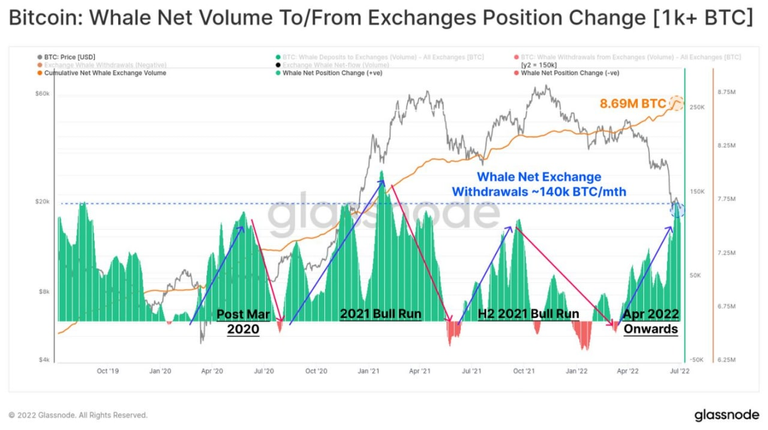

The next graphs show where these coins diverted from exchanges are going:

The first group of accumulators is the wallets with less than 1 btc.

The second and final group is the "whales," which are the wallets with more than 1,000 btc.

These are probably the ones that are draining the coins out of Coinbase and other similar exchanges.

To summarize: in the absolute vacuum of crypto transactions and usage, the only movements involve the sheer accumulation of coins moved from exchanges to personal wallets, presumably to protect against exchange defaults.

The key players in this accumulation are both institutional investors and new investors (or old investors who are opening new wallets, perhaps to prepare for the passage of new European laws on exchanges).

Nothing new, on the other hand, from the point of view of btc's cyclical trend, which has always been strongly attested to support between $17,000 and $20,000.

Recall that, historically speaking, this support should hold, since it corresponds to the high of the previous cycle.

SOURCES

https://insights.glassnode.com/the-week-onchain-week-27-2022/

Posted Using LeoFinance Beta