On June 15, the Federal Reserve Chairman delivered a speech whose extreme open-mindedness was evident even in his final answers to questions from reporters present at the press conference.

This unusual "sincerity" on Powell's part made it possible for everyone to know the full plan that the central bank intends to implement in the coming months.

It is a plan that, for the first time in history, renounces (at least for a time) the Fed's statutory goals of financial stability and employment protection; rather, it deliberately seeks to bring these two variables to their breaking point in order to achieve a higher goal.

What objective is this?

In Powell's official words, such a supreme objective would be to beat inflation.But in evaluating the economic data and the Fed's real options for maneuvering well, we need to better define that objective...

Indeed, it is not a matter of simply beating inflation by raising interest rates, as the Fed wanted us to believe until the day before yesterday.

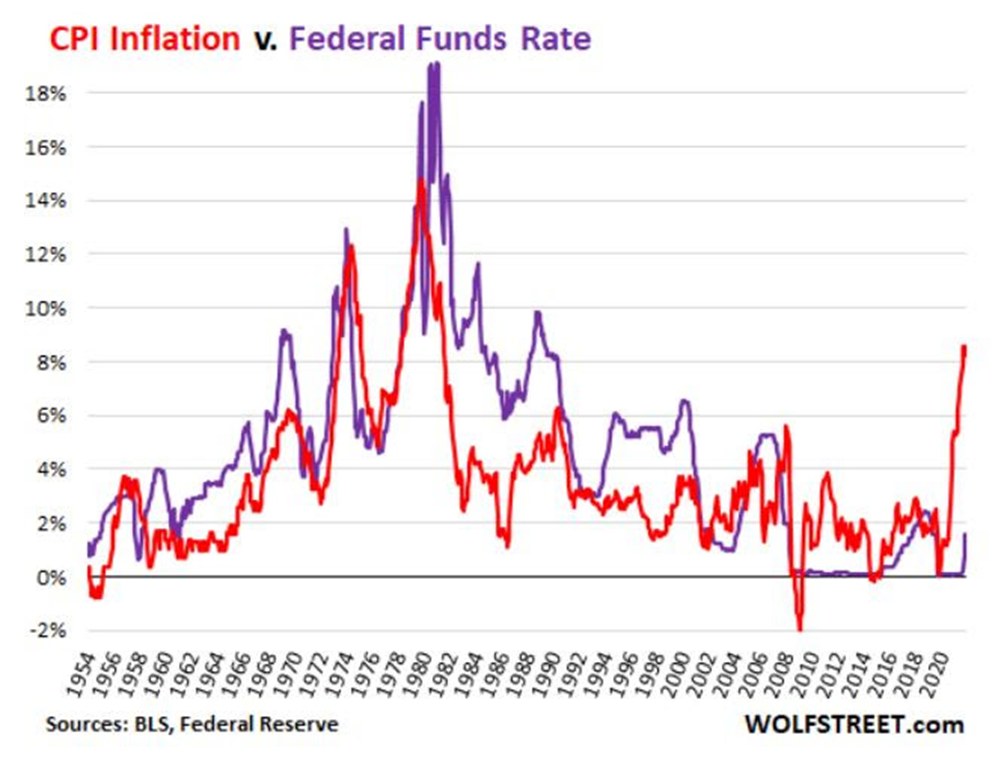

To understand this, we need only look at this graph:

In red we have the inflation curve, while in purple we have the curve showing the rate increases pursued by the Fed.

It doesn't take a genius to figure out that if the Fed really wanted to kill inflation with rate hikes, it would have to make huge hikes, such that they would at least equal the height of the red curve.

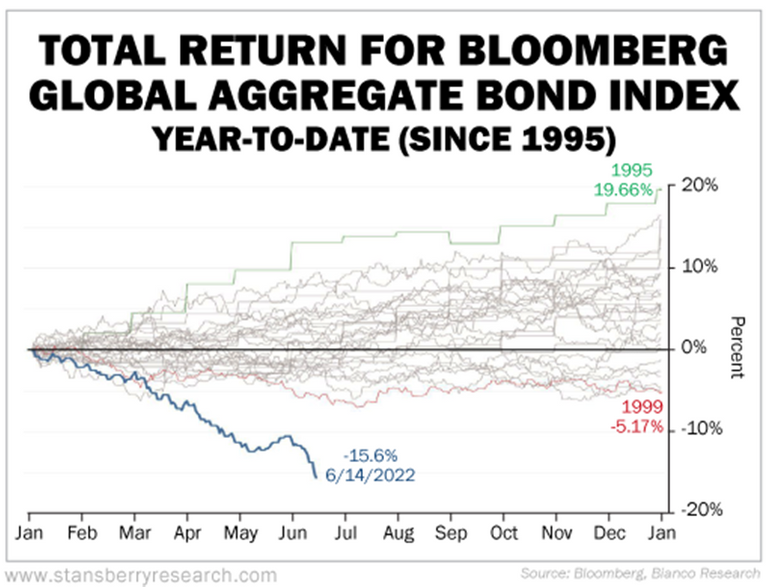

Clearly, the Fed cannot do this without destroying the government bond market. A market that is already showing signs of stress unseen in recent history:

This chart, for example, shows us that everyone in the world is disinvesting in government bonds (in fact, the blue curve at the bottom is hugely detached in its extreme downward slope from the other curves for previous years from 1995 to the present).

For now, the markets that have suffered most are Japanese government bonds and European government bonds, but it is only a matter of time before the crisis infects U.S. treasuries, and an uncontrolled rate hike by the Fed would accelerate that process...

So what did the Fed think to do?

Knowing that it could not beat inflation with a huge rate hike, the Fed thought it would let the real economy and stock markets do the dirty work (i.e., lower inflation).

In fact, Powell said that: "the Fed is unlikely to get inflation back to 2 percent without deliberately slowing the economy and increasing unemployment."

In fact, according to the central bank president, "an increase in unemployment would end the labor shortage plaguing U.S. firms and untangle some of the inflationary and supply-chain problems that come with it."

So it is a matter of provoking a (hopefully) "controlled" economic tsunami that can cool the concauses of inflation (job growth, supply chains, etc.) while preventing the Fed from embarking on the risk of raising rates above a watchdog threshold that would destroy the U.S. government bond market...

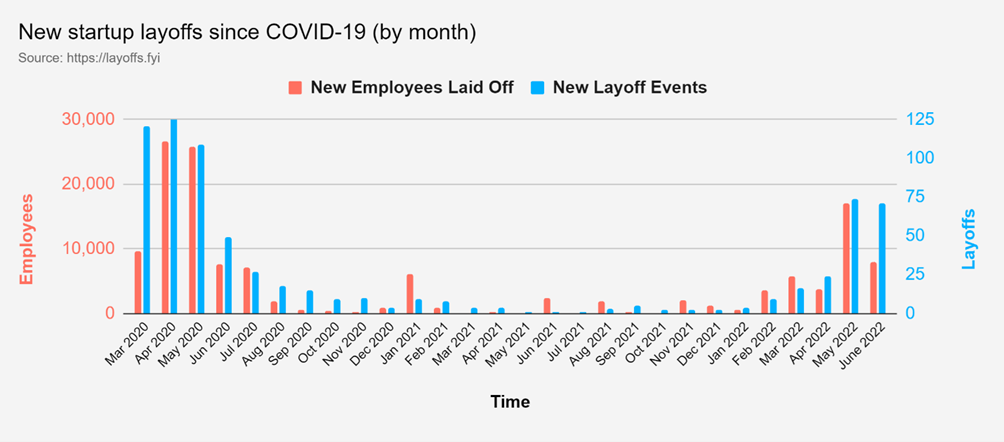

Now, at least from the point of view of employment, the tsunami is close...

This interpretation is not a conspiracy hypothesis spun out of thin air, but is based on arguments from macroeconomics.

For example, the graph below shows the rate of employed people suspended from work. We can see that in 2022, even before Powell's words, the blue and orange bands were already catching up in height with the bands for the first months after the pandemic outbreak (March-April-May 2020):

In essence, the Fed is trying to accelerate this trend, to the point of replicating the "good times" of 2020, when an unprecedented labor and consumption crisis nullified as if by magic all pressure on prices...

The "controlled" declines in the stock markets and crypto thus were just the appetizer for a generalized default that will involve all the economic fundamentals that the Fed has decided to let go to their fate.

Is this a surprisingly cynical program? It certainly is.

Is it an unscrupulous plan that does not take into account possible tragic side effects unknown to us? Of course it is, and Powell himself repeatedly said so between the lines at the press conference....

But on the other hand, it is at least a clear plan, one that has been perfectly understood by the bond market, which reacted yesterday by lowering real U.S. government bond rates.

Now, if rates go down, it means that the big funds may have resumed buying these bonds.

Let us reflect on this apparent oddity: until yesterday these funds were disinvesting in U.S. government bonds (as shown by the rise in rates indicated by the red arrow below):

Why then, after Powell's speech, would a pension fund (to give an example) do the opposite, resuming loading into clients' portfolios these securities that yield less than inflation and thus guarantee a sure loss of value of the invested capital?

The reason is that these funds have decided to "see" Powell's bet (what other choice do they have, after all?), that is, they are betting that these aggressive rate increases by the Fed are actually a way to avoid far worse increases in the future.

They are all really hoping that the Fed, with a few aggressive hikes in the short term, will be able to trigger a nice 2020-style economic default (but this time it will be a "controlled" default...) that will magically bring inflation back on track, giving the Fed the ability to lower interest rates again soon after...

So, in essence, the bond market, by lowering rates in the market (green arrow on the chart), has anticipated any future rate cuts by the Fed. An eventuality far enough in the future that it cannot happen without a prior destruction of the real economy and stock markets.

But it is not certain that this trend will continue over time. As of June 15, the US 10-year rate has been in free fall.

Should fears of side effects on the economy and on the US government bond market itself prevail, real rates could start to rise again, until they cross that 4 percent threshold that we had established (in a previous article) as a guard level beyond which treasuries could spiral out of control, in spite of Powell's bet...

In short, there are two alternatives:

Powell's bet succeeds and treasuries will be saved at the expense of the stock markets and the real economy;

the treasuries will spiral out of control and thus the destruction of the stock markets and economy will prove to be an unnecessary sacrifice.

Let me point out that, historically, recession and falling rates go hand in hand:

- in the 2007-2009 recession, the 10-year fell 300 basis points;

- in 2000-01 and 1990-91 it fell about 225 basis points;

- in 1981-82 it fell 500 basis points;

- in 1980 it reached 250 basis points;

On average then, yields tend to fall by more than 200 basis points during recessions.

This, in the end, is the general pattern of events as predicted by the Fed. Nothing more and nothing less....

As absurd as it sounds, there is no doubt about it: it is Powell himself who made this clear in yesterday's press conference.

I do not believe that Powell is improvising a crazy, out-of-control program, but is merely applying patterns of intervention widely predicted by economics textbooks.

By raising interest rates and not buying back government bonds, Powell expects to achieve the so-called "wealth effect," which is to deprive consumers of the resources to continue spending, thus achieving a squeeze on consumption that will eventually "cool" the economy and with it inflationary trends.

I will elaborate on this topic in future posts.

Posted Using LeoFinance Beta