Today I have to share an important piece of news that is not only about cryptocurrencies, but is a sign of an agreement taken at high levels by financial elites about the euro and its survival.

The tsunami triggered by Powell evidently accelerated some necessary developments that the elites agreed upon to ensure the transition from the current system, which is in an obvious terminal phase, to the economic system of the future.

So here it is that for the first time in America (not in Europe) they have decided to give birth to a euro stablecoin that will have the same characteristics of transparency, coverage and officialdom as the famous USDC, the dollar stablecoin that has now been adopted by the elites in the same way as the digital dollar that the Federal Reserve is still unable to create because of obvious technological and cultural lags.

Circle, the company that, along with others, manages and finances USDC and has brought this currency to the levels of a central bank-issued currency, announced the late June release of EUROC, USDC's euro twin.

EUROC will also be backed by cash and ECB government bonds. This means that U.S. banks that now have the task of managing USDC's hedging reserves in the form of U.S. government bonds will now also have to have reserves in ECB government bonds to cover EUROC issues.

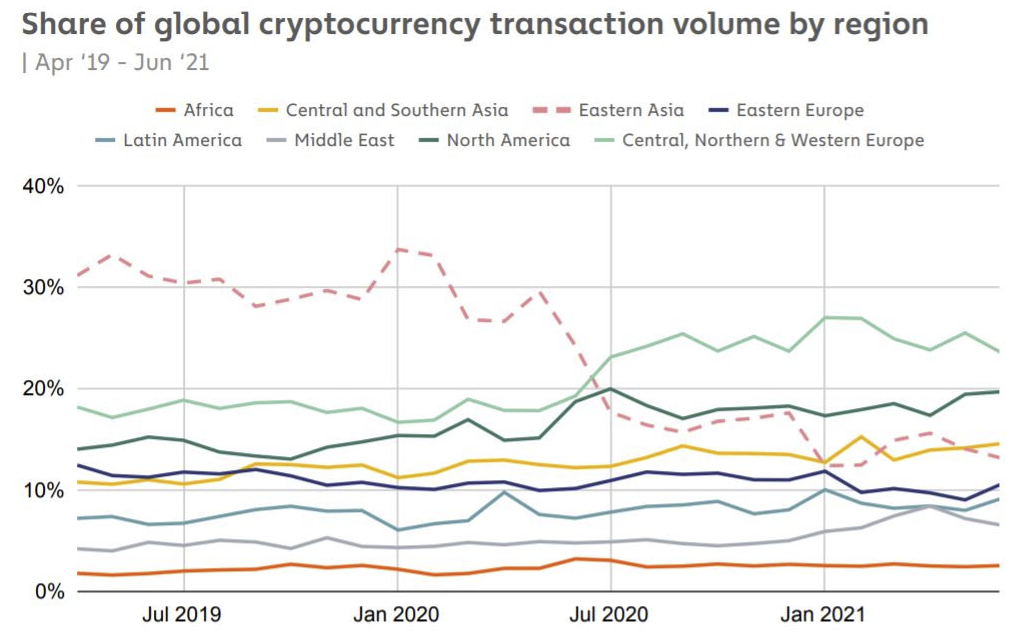

The new euro stablecoin goes to cover a geographic and demographic area, Europe, which over time has become a priority as a number of transactions, compared to the U.S. and Asia, as the chart below shows:

source: Chainalysis

Whereas previously this area was monopolized by USDC and USDT, the most widely used dollar stablecoins, EUROC will now have to make way for it as well.

Until now, European cryptocurrency investors who wanted to secure their returns during bearish cycles had no choice but to turn them into USDC or USDT, often even receiving good monthly passive returns on them on different platforms (the few existing euro stablecoins have nowhere near the same appeal and guarantees as dollar stablecoins, and rightly so, they are used by four cats).

So in essence, thanks to the dominance of stablecoins in that currency, the dollar was like the "bank that always wins," a kind of collector of last resort for a lot of capital originally coming from different currencies and invested in crypto.

The fact that the Americans have decided to give up this monopoly says a lot about the critical situation the euro is going through.

The announcement of the birth of EUROC appears in the media two days after the famous emergency meeting called by the ECB in which it was in fact decided to suspend the restrictive measures on the euro that seemed so imminent.

The project of a euro stablecoin born in the same rooms that gave birth to USDC indicates in no uncertain terms that there has been an agreement at the highest levels to rebalance the foreign exchange reserves of the U.S. lending and trading platforms and especially the banks that support their liquidity. A rebalancing aimed at increasing the stocks of European government bonds as opposed to the almost exclusive prevalence of U.S. government bonds.

This project is probably part of a more complex design by which American and European financial elites have decided to come to the rescue of the euro.

And it is also yet another dress rehearsal of that future system in which the official digital currencies of the American and European central banks will have to coexist, of which these are practically the closest prototype to the final model.

The economic importance of EUROC thus far eclipses the practical consequence, though important for us investors, of finally having a euro stablecoin available as well, on which perhaps platforms will also begin to offer attractive returns, as is already the case with dollar stablecoins.

Posted Using LeoFinance Beta