Bitcoin fell below $25,000, which is lower than the price on any day of 2021

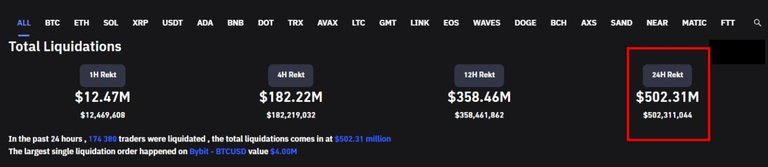

Forced liquidations of traders' positions exceeded $500 million in 24 hours!

The maximum one-time liquidation amount is $4 million (on the Bybit exchange)

On Saturday, June 11, trading on the crypto market ended with a decrease in the BTC/USDt pair. Bitcoin fell 2.29% against the US dollar to $28,424. It depreciates more slowly due to the demand for it in pairs with alts. Investors run from alts to stables, or to cue ball. The share of bitcoin increased to 47.7%, while that of ether, on the contrary, fell to 16%. Since the beginning of the week, market capitalization has decreased by $121 billion, to $1.108 billion. With this attitude, we will soon break through $1 trillion.

On Friday, I was thinking about the fact that the sellers broke through the intermediate levels (see the chart above, the channels are on the corrective movement). According to the cycles on the daily TF, I have no changes. The zone for an upward correction remained between May 30 and June 6. Due to the external negative background from other markets, warming is delayed for X days. According to TA, the daily and weekly TFs indicate a market crash and abnormal freezes compared to 2018. The second zone for growth is July 13-19.

On Wednesday, the US Federal Reserve will meet on monetary policy. Let's see if J. Powell will calm investors and change the mood in global markets. The regulator will announce the decision on June 15 at 21:00 GMT + 3, the press conference of the head of the Fed will be held at 21:30 GMT + 3.

On June 12, the BTC rate fell to $27,190. On the daily TF, I put target levels for sellers: $25676, $23189 and $20941. If prices are rounded up, we get $25,500, $23,000 and $21,000. After drawing additional lines on the chart, clusters formed from the levels: $24650-25650 and $19100-20850. In my humble opinion, it is they who are now in the crosshairs of the sellers. Worst-case scenario for buyers, market crash to $8,500. After such a collapse and having lost billions, hardly anyone will return to the market.

So it remains to hope for Powell that he will cause a crypto-spring in the market under the reversal of cycles, otherwise the market will plunge into a deep sleep from the cold. And with low activity of buyers and empty stock order books, alts will tend to zero in search of a new bottom, repeating the fate of the Moon.

If Mr. Powell succeeds in calming the financial markets, and the media stops reinforcing the bearish trend with horror stories, then the cue ball may form a double bottom with lows in the $25,000-26,700 zone. After the meeting, it will be possible to see the whole situation more clearly

Posted Using LeoFinance Beta