It's the holiday season and we're approaching nearly 2M in CUB bought and burned by the CUB DAO.

This is pretty incredible to witness. We're on the cusp of something with CUB. The growth has been consistent and as you can see in the Monthly Burn Reports on @leofinance, we're seeing more and more CUB bought and burned each month.

In the month of November, 52% of the CUB inflation was bought back and burned.

That's truly astonishing... Let that sink in.

52% of the CUB inflation.

Just 4 months ago, we were only burning about 0.05% of the CUB inflation on a monthly basis.

Now it's 52%.

What happens when it surpasses 100%?

You guessed it: CUB goes deflationary. Deflationary means that CUB DAO is buying and burning more CUB each month than it is dishing out in LP Incentives.

Once this happens, I suspect the price of CUB will start to rise incrementally. The rise in price will lead to higher APYs for people to pool bHBD and bHIVE which will lead to more bridge revenue which will lead to more buybacks which will lead to more price growth and so the pinwheel goes.

Is CUB Tracking the HIVE Price?

CUB is down slightly since our last report. HIVE is down over 15% from $0.32 to under $0.29 now.

Being that the bHIVE-CUB pool is now our largest liquidity pool, this has had a negative impact on CUB. Down about 8%.

That being said, this impact is lessened by the other liquidity pools - bHBD-CUB, BNB-CUB, BUSD-CUB - which offset some of the negative downtrend from HIVE.

When HIVE does trend up again, it will also drag CUB up with it.

This price volatility is good business for the Multi-Token Bridge. So even though the price may drop short-term, volatility = more bridge fees = bigger buybacks in December.

Follow along as I report daily on @cubdaily 🙏🏽

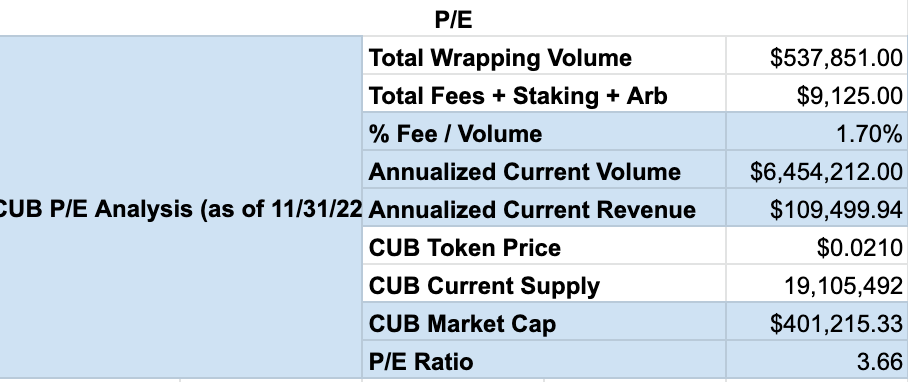

P/E Analysis of CUB

Here's a new section I'm trying out. I decided to run a P/E analysis of CUB using data from each Monthly Burn Report posted by @leofinance. Check out the second analysis I ran and leave a comment below with your thoughts.

Keep in mind that a low P/E ratio is good. It means that the revenue that CUB is generating each month is increasing faster than the CUB price is increasing (more revenues earned per share of CUB).

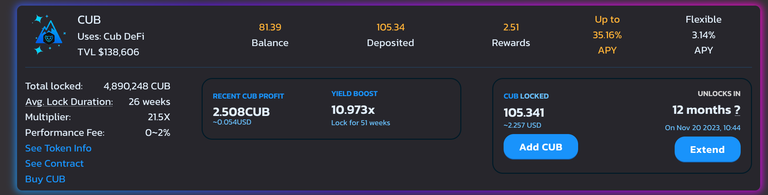

Locked CUB

A new section! The new CUB Kingdom is now live and we can track the amount of CUB locked and how long it is locked for.

- CUB Locked: 5,129,933

- Avg. Lock Duration: 31 Weeks

CUB Token

- Price: $0.01924

- Total CUB Supply: 19,372,903

- Total CUB Burned: 1,837,277

- Total Market Cap: $373,086

- Total Value Locked: $1,188,113.98

Multi-Token Bridge Stats

- bHBD-bHIVE: $132k

- bHBD-BUSD: $276k

- bHBD-CUB: $122k

- bHIVE-CUB: $126k

- Total: $656k

HIVE has dropped about 15% in price since the last @cubdaily report. Despite this, the TVL figures have grown slightly - in terms of tokens held on the bridge.

We're seeing constant - albeit slow and steady - growth.

CUB Burns

.png)

It's the holiday season and we're quickly approaching 2M CUB bought and burned! Remember that this figure was only 500k before MTB launched in August, 2022.

So that's 1.5M CUB burned in just the past ~4 months! We're on pace to flip deflationary in the sooniverse!

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: https://leofinance.io/@leofinance/cub-monthly-report-or-november-2022-50-of-cub-inflation-bought-and-burned-tvl-continues-to-grow-and-arb-bot-2-0

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.

Posted Using LeoFinance Beta